Apple Stock Forecast: Analyzing Key Levels Before Q2 Earnings Release

Table of Contents

Current Market Sentiment and Apple's Recent Performance

Analyzing Apple's recent performance is crucial for any accurate Apple Stock Forecast. The tech giant's stock price has seen its share of ups and downs recently, reflecting both positive and negative influences on market sentiment. Understanding these trends is vital for anticipating potential future movements.

- Recent price highs and lows: Tracking recent peaks and troughs provides insights into short-term momentum and potential support/resistance areas. For example, a consistent bounce from a particular price point suggests a strong support level.

- Trading volume analysis: Examining trading volume alongside price movements reveals the strength of those movements. High volume during a price increase suggests strong buying pressure, while high volume during a decline indicates significant selling.

- Key market indicators affecting Apple: The overall performance of the technology sector, broader market trends (e.g., interest rate changes, inflation), and global economic conditions all impact Apple's stock price. A downturn in the tech sector will likely negatively affect Apple's stock forecast.

- Impact of recent product launches/announcements: New product releases, successful marketing campaigns, or significant partnerships can greatly influence investor sentiment and, therefore, the Apple stock price. Conversely, product delays or negative news regarding new releases can lead to downward pressure.

Technical Analysis of Key Support and Resistance Levels

Technical analysis is a powerful tool for generating an Apple Stock Forecast. By identifying key support and resistance levels, we can gain valuable insights into potential price movements. This involves studying historical price charts and using technical indicators.

- Key support levels and their significance: Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further declines. Breaks below these levels often signal a bearish trend.

- Key resistance levels and their significance: Resistance levels are price points where selling pressure is anticipated to overcome buying pressure, halting price increases. Breaks above these levels usually suggest a bullish trend.

- Potential breakout scenarios: A successful break above a resistance level can lead to significant price increases, while a break below a support level might trigger further declines. The volume accompanying such a breakout is crucial in assessing its validity.

- Technical indicators used (e.g., RSI, MACD): Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are valuable tools for confirming potential trend changes and identifying overbought or oversold conditions. These can significantly influence the short-term Apple Stock Forecast.

Fundamental Analysis of Apple's Q2 Earnings Expectations

While technical analysis is crucial, fundamental analysis forms the bedrock of a robust Apple Stock Forecast. This involves assessing Apple's financial health and future prospects to determine its intrinsic value.

- Consensus EPS estimates: Analysts' consensus earnings per share (EPS) estimates provide a benchmark for comparing Apple's actual results. A beat or miss of these estimates can significantly impact the stock price.

- Revenue growth expectations: Analysts predict revenue growth based on factors like iPhone sales, Services revenue, and other key product lines. Meeting or exceeding these expectations is crucial for a positive market reaction.

- Key factors influencing earnings (e.g., iPhone sales, Services revenue, supply chain): Analyzing these factors helps understand potential risks and opportunities affecting Apple's Q2 performance. Supply chain disruptions or weaker-than-expected iPhone sales, for instance, can negatively impact the Apple Stock Forecast.

- Potential surprises or disappointments: Unexpected positive or negative news, such as a new product announcement or a regulatory challenge, can significantly impact investor sentiment and lead to price fluctuations.

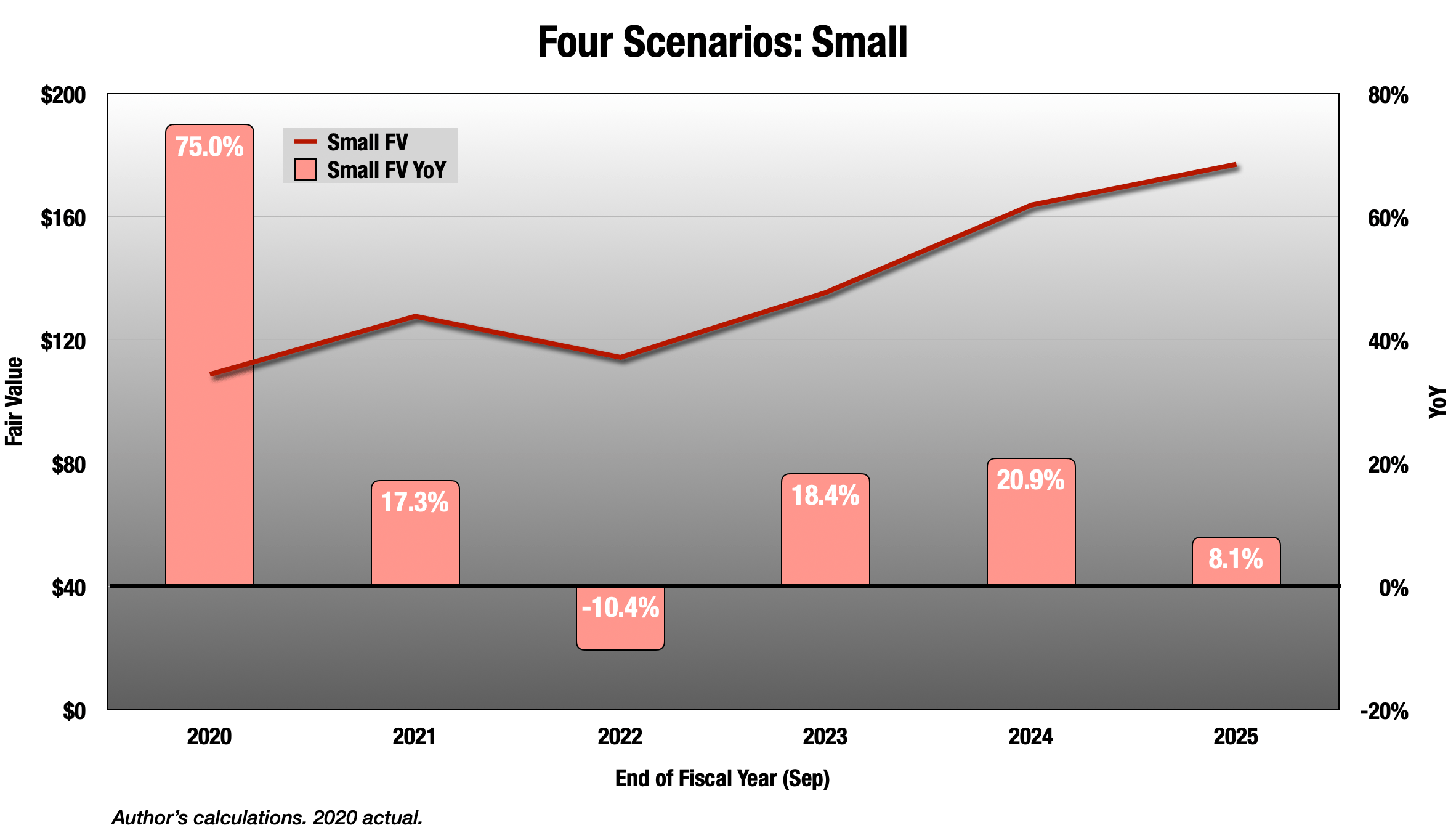

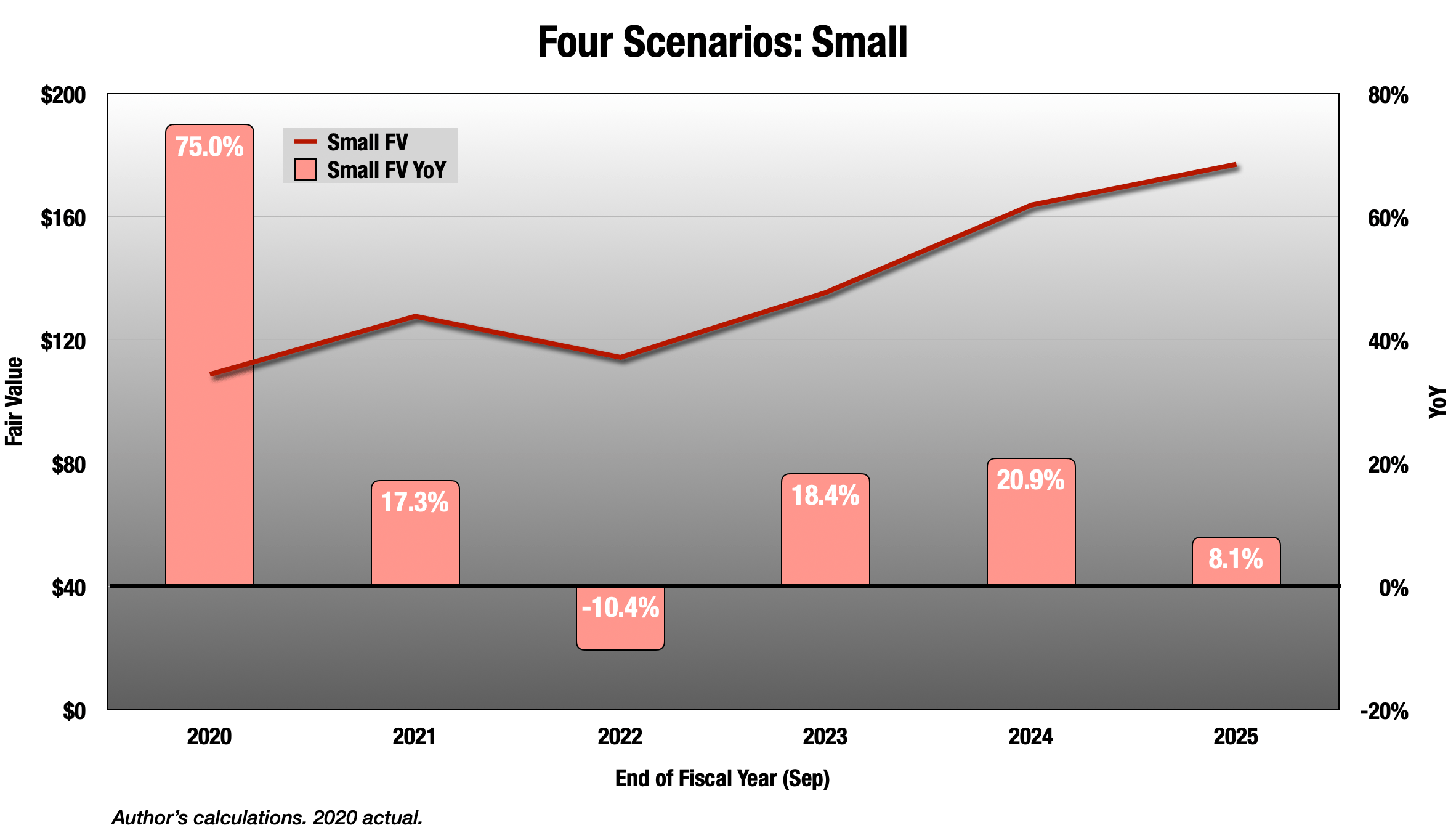

Risk Assessment and Potential Scenarios

A comprehensive Apple Stock Forecast must consider potential risks and various scenarios. Factors such as economic downturns, increased competition, and geopolitical events can all impact Apple's stock price.

- Upsides and downsides of each scenario: Consider scenarios like a positive earnings surprise (stock price surge), a negative surprise (significant decline), or results in line with expectations (moderate price movement). Each scenario has its own implications for investors.

- Strategies for managing risk: Investors can manage risk through diversification, stop-loss orders, and hedging strategies. Understanding potential risks is crucial for developing a sound investment strategy.

- Potential impact of unexpected events: Unforeseen events, such as major global crises or regulatory changes, can drastically alter the Apple Stock Forecast.

Conclusion: Apple Stock Forecast: Key Takeaways and Call to Action

This analysis highlights the importance of considering both technical and fundamental factors when formulating an Apple Stock Forecast. Key support and resistance levels, along with analyst expectations for Q2 earnings, paint a picture of potential price movements. However, unexpected events and market sentiment shifts can significantly influence the outcome.

Remember to conduct your own thorough research before investing in Apple stock. Regularly monitor the Apple stock forecast, key levels, and market news leading up to and following the Q2 earnings release. Utilize resources like financial news websites, analyst reports, and charting tools to stay informed and make sound investment decisions. Develop your own comprehensive Apple stock forecast and remember that this analysis is for informational purposes only and not financial advice.

Featured Posts

-

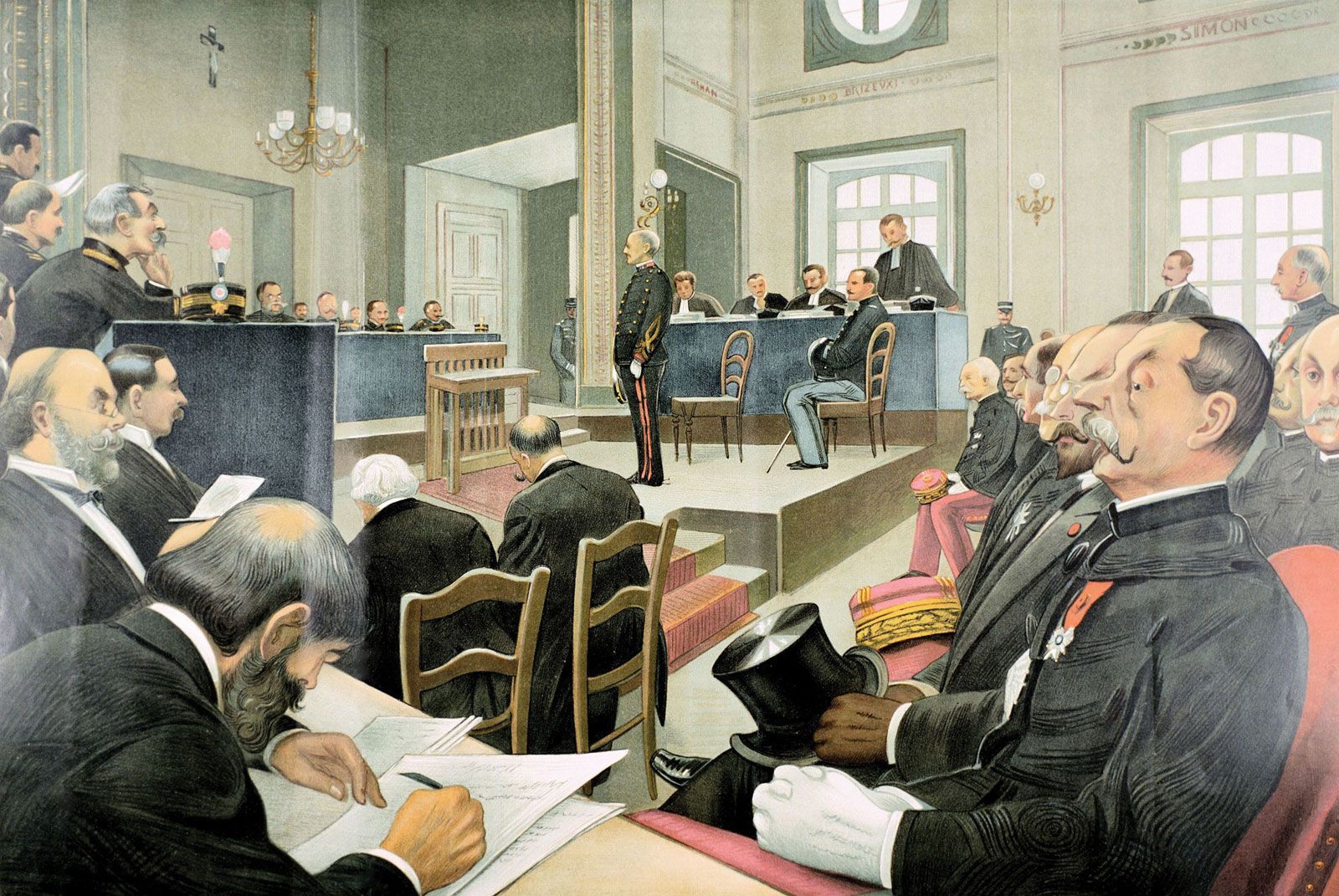

France Revisits Dreyfus Affair Lawmakers Advocate For Promotion

May 24, 2025

France Revisits Dreyfus Affair Lawmakers Advocate For Promotion

May 24, 2025 -

What Is Net Asset Value Nav And How Does It Affect My Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

What Is Net Asset Value Nav And How Does It Affect My Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Bbc Radio 1 Big Weekend Confirmed Acts Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Bbc Radio 1 Big Weekend Confirmed Acts Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025 -

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025 -

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 24, 2025

Latest Posts

-

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Menu

May 24, 2025

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Menu

May 24, 2025 -

Odd Burger Expands Reach Vegan Meals Now At 7 Eleven Canada

May 24, 2025

Odd Burger Expands Reach Vegan Meals Now At 7 Eleven Canada

May 24, 2025 -

Burclar Ve Zeka Bir Iliski Var Mi

May 24, 2025

Burclar Ve Zeka Bir Iliski Var Mi

May 24, 2025 -

Londons Odd Burger Vegan Meals Coming To 7 Eleven Across Canada

May 24, 2025

Londons Odd Burger Vegan Meals Coming To 7 Eleven Across Canada

May 24, 2025 -

En Akilli Burclar Zeka Duezeyleri Ve Oezellikleri

May 24, 2025

En Akilli Burclar Zeka Duezeyleri Ve Oezellikleri

May 24, 2025