Apple Stock (AAPL) Price Action: Analysis Of Significant Levels

Table of Contents

Identifying Key Support Levels for AAPL

Support levels represent price points where buying pressure is typically strong enough to prevent further price declines. These levels are formed by a confluence of factors, and identifying them is a cornerstone of technical analysis. For AAPL, several key support levels have historically proven significant:

-

$150: This level has acted as a robust support in the past, often rebounding the stock after significant dips. This price point coincides with several periods of increased investor confidence and buying interest. Analyzing the price charts from late 2022 and early 2023 clearly shows the effectiveness of this support.

-

$130: A lower support level, $130 represents a more significant potential downside. Breaching this level would likely signal a more substantial bearish trend. However, historically, this level has also proven capable of stemming major declines.

-

Moving Averages: In addition to specific price points, moving averages (like the 50-day and 200-day) can also act as dynamic support levels. These indicators smooth out price fluctuations, providing a clearer picture of the underlying trend. A price drop below the 200-day moving average often signals a potential bear market.

[Insert chart/graph visually illustrating these support levels and moving averages here.]

Several factors influence these support levels:

- Earnings Reports: Strong earnings reports tend to bolster support levels, while disappointing results can weaken them.

- Market Sentiment: General market trends and investor sentiment greatly influence the strength of support. During periods of overall market optimism, support levels tend to hold better.

- Technological Advancements: Announcements of new products or innovative technologies often strengthen support, while delays or setbacks can negatively impact them.

Analyzing Key Resistance Levels for AAPL

Resistance levels represent price points where selling pressure typically outweighs buying pressure, hindering further price increases. Identifying these levels is just as crucial as recognizing support for successful trading. Historically, AAPL has encountered strong resistance around:

-

$180: This level has repeatedly capped AAPL's upward momentum. Several attempts to break above this level have resulted in temporary pullbacks.

-

$200: This represents a more significant resistance level, acting as a psychological barrier for many investors. Breaking through this level could signal a major bullish trend.

-

Trendlines: Connecting swing highs on a price chart creates a trendline, which can act as dynamic resistance. A price rejection from this trendline often indicates that the upward momentum is weakening.

[Insert chart/graph visually illustrating these resistance levels and trendlines here.]

Factors influencing AAPL's resistance levels include:

- Competitor Performance: Strong performance from competitors can put pressure on AAPL's price, creating resistance.

- Economic Factors: Macroeconomic factors such as inflation and interest rates can influence investor sentiment and thus impact resistance levels.

- Product Cycle: The release of new products often helps to overcome resistance, while the end of a product cycle may cause resistance to strengthen.

Trading Strategies Based on AAPL Price Action and Levels

Understanding support and resistance levels can inform various trading strategies:

-

Buy near support, sell near resistance: A classic strategy involves buying when the price approaches a support level, anticipating a bounce, and selling when it nears resistance.

-

Breakout trading: This involves waiting for a decisive break above a resistance level (bullish breakout) or below a support level (bearish breakout) to enter a position, riding the subsequent trend.

Effective risk management is crucial:

- Stop-loss orders: These automatically sell your position if the price drops to a predetermined level, limiting potential losses.

- Position sizing: This involves carefully determining the amount to invest in each trade, minimizing risk exposure.

Different trading styles can utilize AAPL price action:

- Swing trading: Holding positions for a few days to several weeks, capitalizing on price swings.

- Day trading: Holding positions for only a few hours, taking advantage of short-term price fluctuations.

Disclaimer: Relying solely on technical analysis is risky. Fundamental analysis – examining the company's financials, competitive landscape, and future prospects – is equally important.

Factors Influencing AAPL Price Action Beyond Support and Resistance

While support and resistance are vital, other factors significantly influence AAPL’s price:

- Macroeconomic factors: Interest rate changes, inflation, and overall economic growth directly impact investor sentiment and stock prices.

- Company-specific news: Product launches, financial reports, and any significant announcements can cause substantial price fluctuations. For example, positive news regarding the release of a new iPhone model can result in an immediate price jump.

- Investor sentiment: Market mood and investor confidence play a huge role. Pessimistic sentiment can drive prices down, even if fundamental factors are strong.

Conclusion: Mastering Apple Stock (AAPL) Price Action Analysis

Understanding Apple stock (AAPL) price action, specifically identifying key support and resistance levels ($130, $150, $180, $200, and dynamic levels like moving averages and trendlines), is crucial for making informed investment decisions. However, remember that a holistic approach combining technical analysis with thorough fundamental research is vital. Continuously monitoring AAPL's price action, staying updated on relevant news and market trends, and practicing sound risk management techniques will greatly enhance your chances of success in the volatile world of Apple stock trading. Share your experiences and strategies in the comments below – let's learn from each other!

Featured Posts

-

Apple Stock I Phone Sales Boost Q2 Financial Results

May 25, 2025

Apple Stock I Phone Sales Boost Q2 Financial Results

May 25, 2025 -

Jazda Porsche Cayenne Gts Coupe Realistyczna Ocena

May 25, 2025

Jazda Porsche Cayenne Gts Coupe Realistyczna Ocena

May 25, 2025 -

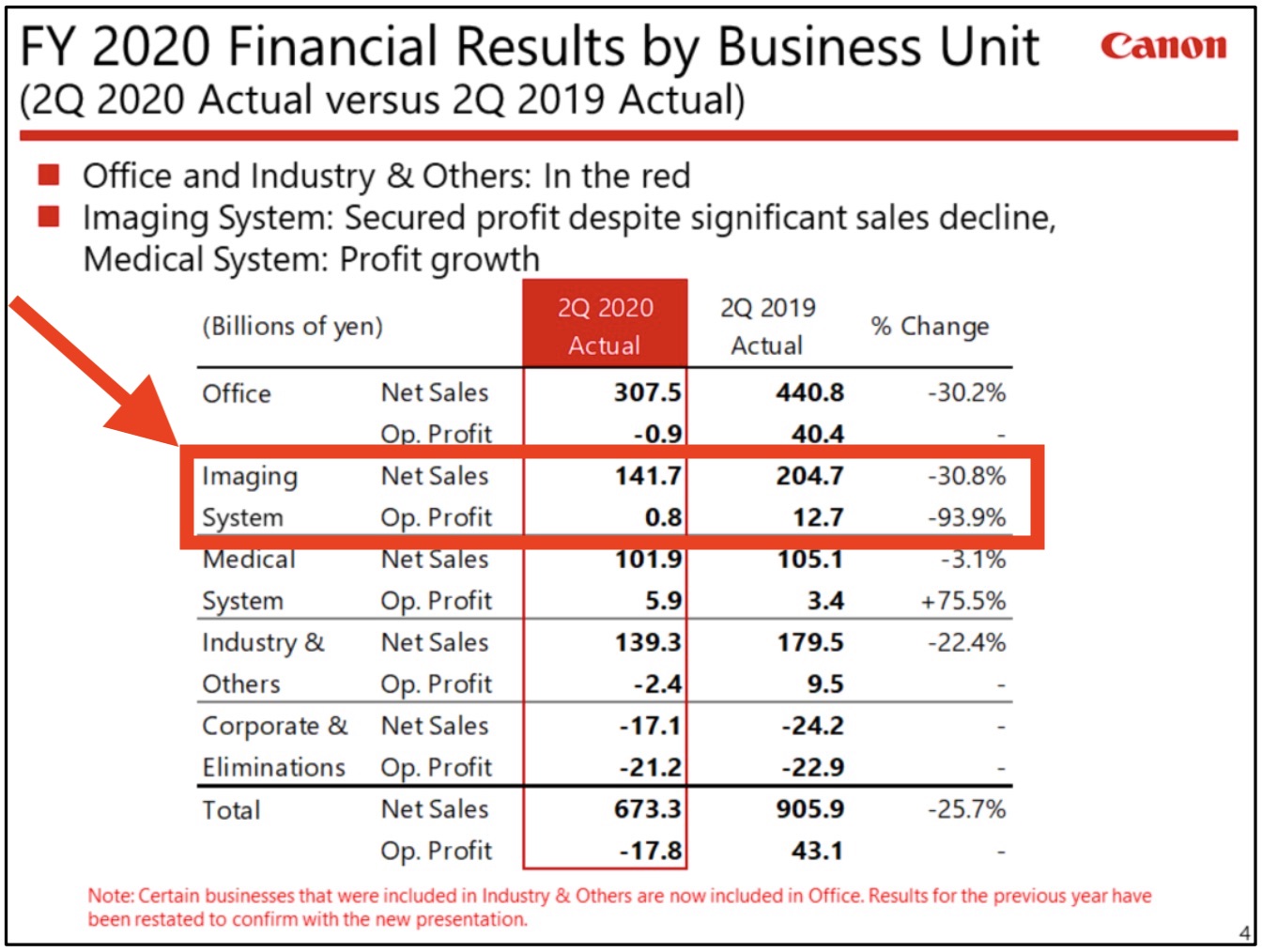

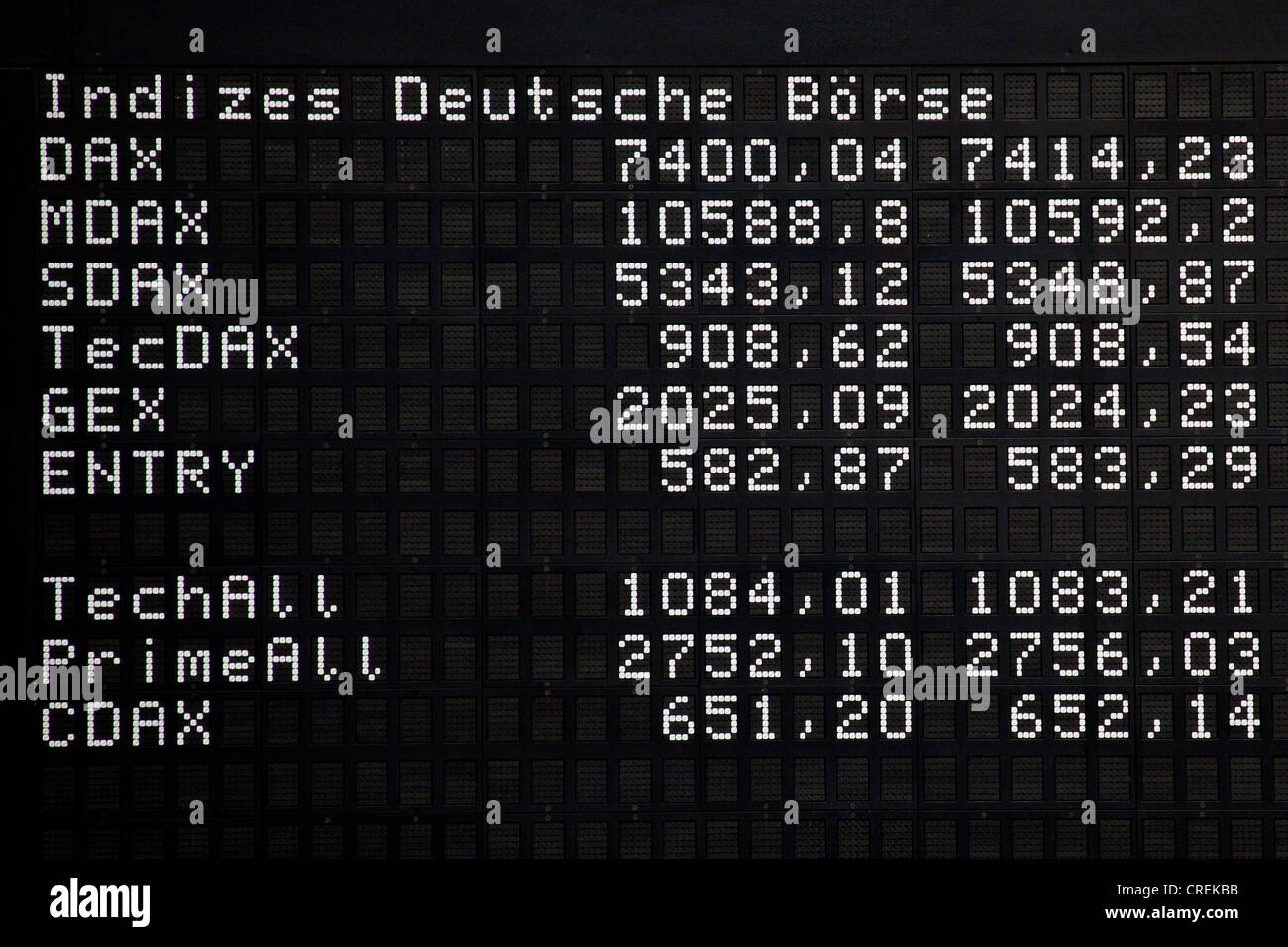

Frankfurt Stock Exchange Dax Ends Trading Below 24 000

May 25, 2025

Frankfurt Stock Exchange Dax Ends Trading Below 24 000

May 25, 2025 -

Eurovision Village 2025 Conchita Wurst And Jjs Joint Performance

May 25, 2025

Eurovision Village 2025 Conchita Wurst And Jjs Joint Performance

May 25, 2025 -

The Impact Of Canada Posts Performance On The Canadian Delivery Landscape

May 25, 2025

The Impact Of Canada Posts Performance On The Canadian Delivery Landscape

May 25, 2025

Latest Posts

-

Severe Storms Bring Flood Advisory To Miami Valley Residents

May 25, 2025

Severe Storms Bring Flood Advisory To Miami Valley Residents

May 25, 2025 -

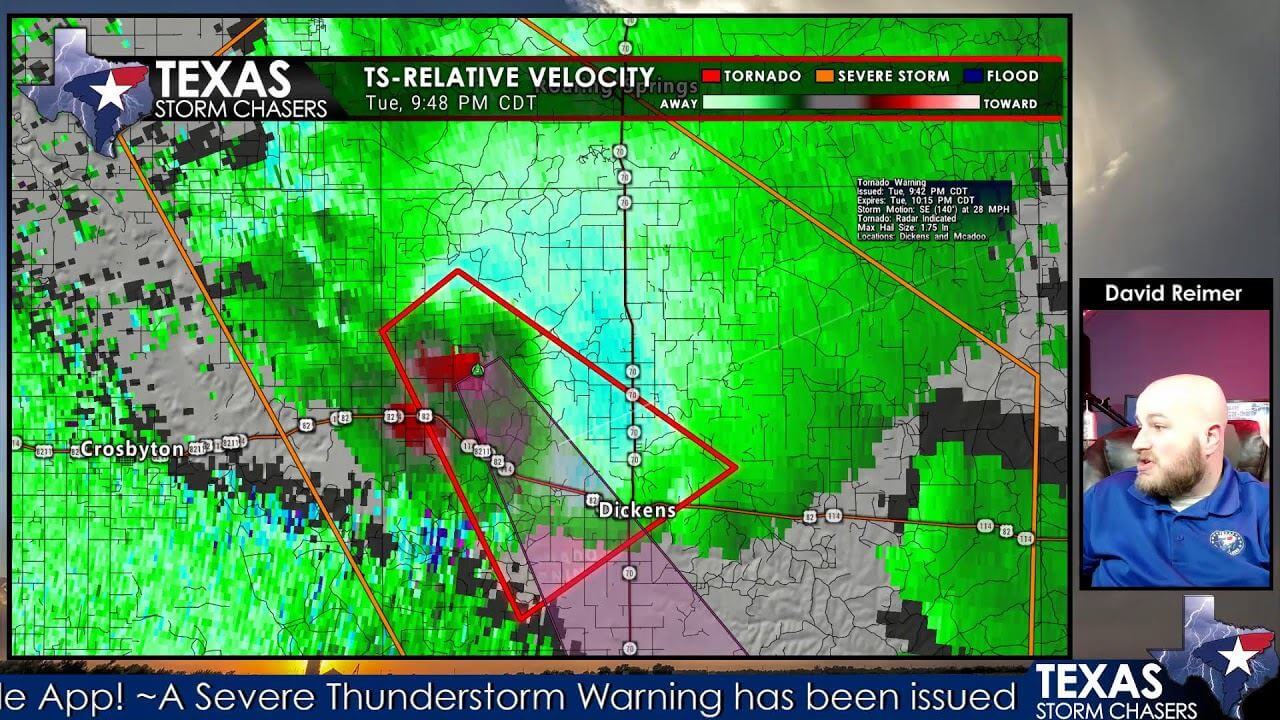

Texas Under Flash Flood Warning Heavy Rainfall And Storm Impacts

May 25, 2025

Texas Under Flash Flood Warning Heavy Rainfall And Storm Impacts

May 25, 2025 -

Severe Weather Alert Flash Flood Warning Issued For Parts Of Texas

May 25, 2025

Severe Weather Alert Flash Flood Warning Issued For Parts Of Texas

May 25, 2025 -

Flood Advisories Issued For Miami Valley Due To Severe Storms

May 25, 2025

Flood Advisories Issued For Miami Valley Due To Severe Storms

May 25, 2025 -

Flash Flood Emergency In Texas Severe Weather Prompts Urgent Warnings

May 25, 2025

Flash Flood Emergency In Texas Severe Weather Prompts Urgent Warnings

May 25, 2025