Apple Stock (AAPL): Important Price Levels And Technical Analysis

Table of Contents

Key Support and Resistance Levels for Apple Stock (AAPL)

Support and resistance levels are critical in technical analysis, representing price points where buying or selling pressure is expected to be significant. Understanding these levels for AAPL can significantly improve your trading strategies.

Identifying Major Support Levels

Support levels are price points where the downward trend of a stock is expected to find a "floor," due to increased buying pressure. For AAPL, historical support levels have often corresponded with previous significant lows or psychological barriers (round numbers).

- Examples of Past Support Levels: Past support levels for AAPL have included (Note: these are examples and may change; always refer to current market data): $130, $150, and $170. These levels held for extended periods before price increases resumed.

- Reasons for their Importance: These levels often coincide with periods of significant buying interest or periods where investors viewed the stock as undervalued.

- Potential Future Impact: Identifying and monitoring these support levels can help traders anticipate potential buying opportunities, mitigating losses during market downturns.

Identifying Major Resistance Levels

Conversely, resistance levels represent price points where the upward momentum of a stock is expected to stall due to increased selling pressure. For AAPL, resistance levels are often psychological barriers or previous price peaks.

- Examples of Past Resistance Levels: Previous resistance levels for AAPL have included (Note: these are examples and may change; always refer to current market data): $180, $200, and $220. These levels frequently marked periods of price consolidation or temporary pullbacks.

- Reasons for their Importance: These levels often reflect periods of profit-taking or where investors viewed the stock as overvalued.

- Potential Future Impact: Recognizing resistance levels enables traders to identify potential selling opportunities or to adjust their profit targets accordingly.

Technical Indicators for Apple Stock (AAPL) Analysis

Technical indicators provide valuable insights into the momentum and potential direction of AAPL's price. Combining them with price level analysis gives a more comprehensive picture.

Moving Averages (MA)

Moving averages smooth out price fluctuations, revealing underlying trends. The 50-day and 200-day moving averages are commonly used. A "golden cross" (50-day MA crossing above the 200-day MA) is often considered a bullish signal, while a "death cross" (the opposite) suggests bearish sentiment. Analyzing these crossovers in relation to support and resistance levels can enhance trading decisions.

- Advantages of using MAs: Provides clear trend identification and potential buy/sell signals.

- Disadvantages of using MAs: Can lag behind significant price changes and generate false signals.

- Examples of Successful Applications: Many successful AAPL traders have used moving average crossovers to time their entries and exits.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 typically suggest an overbought market (potential for a price correction), while readings below 30 indicate an oversold market (potential for a price rebound).

- RSI Thresholds: 70 and 30 are common thresholds, but these can vary depending on the market and individual trading strategies.

- Limitations of RSI: RSI is not a perfect predictor; it's most effective when used in conjunction with other indicators and price action analysis.

- Combination with other indicators: Combining RSI with moving averages or volume analysis provides more robust signals.

Volume Analysis

Volume confirms price movements. High volume during a price increase indicates strong buying pressure, while high volume during a price decrease signifies strong selling pressure. Conversely, low volume during price movements can indicate weak conviction and a potential reversal.

- Interpreting volume spikes: Significant increases in volume often accompany breakouts or breakdowns through support and resistance levels.

- Volume-price confirmation: A price increase coupled with high volume is a more reliable bullish signal than a price increase with low volume.

Factors Influencing Apple Stock (AAPL) Price

Beyond technical analysis, several factors significantly impact AAPL's price:

Macroeconomic Factors

Broader economic conditions influence AAPL's performance. Interest rate hikes, inflation, and recessionary fears can all affect investor sentiment and AAPL's stock price.

- Examples: Rising interest rates can increase borrowing costs for businesses, potentially slowing economic growth and impacting consumer spending on Apple products. Inflation can reduce purchasing power and affect demand for Apple's products.

Company-Specific News

Apple's product launches, financial reports, and management decisions directly impact its stock price. Positive news generally leads to price increases, while negative news can cause price drops.

- Examples: The launch of a new iPhone model often triggers positive market reactions, while disappointing earnings reports can cause price declines.

Industry Competition

Competition from other tech giants (e.g., Samsung, Google) influences AAPL's market share and profitability, directly affecting its stock price.

- Examples: The introduction of competing products with similar or superior features can put downward pressure on AAPL's stock price.

Conclusion: Trading Apple Stock (AAPL) Based on Price Levels and Technical Analysis

Mastering Apple stock technical analysis requires understanding key support and resistance levels (like the historical examples mentioned, although these may shift), applying technical indicators like moving averages and RSI effectively, and considering the wider macroeconomic environment and industry competition. Remember, successful trading involves analyzing AAPL stock prices across multiple timeframes, combining technical and fundamental analysis, and always managing risk. While this information can help in forming your trading strategy, remember that stock market investments involve inherent risk. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. Analyze AAPL stock prices, learn to identify key AAPL support and resistance, and master Apple stock technical analysis to improve your trading approach.

Featured Posts

-

Vozrastnye Kharakteristiki Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025

Vozrastnye Kharakteristiki Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

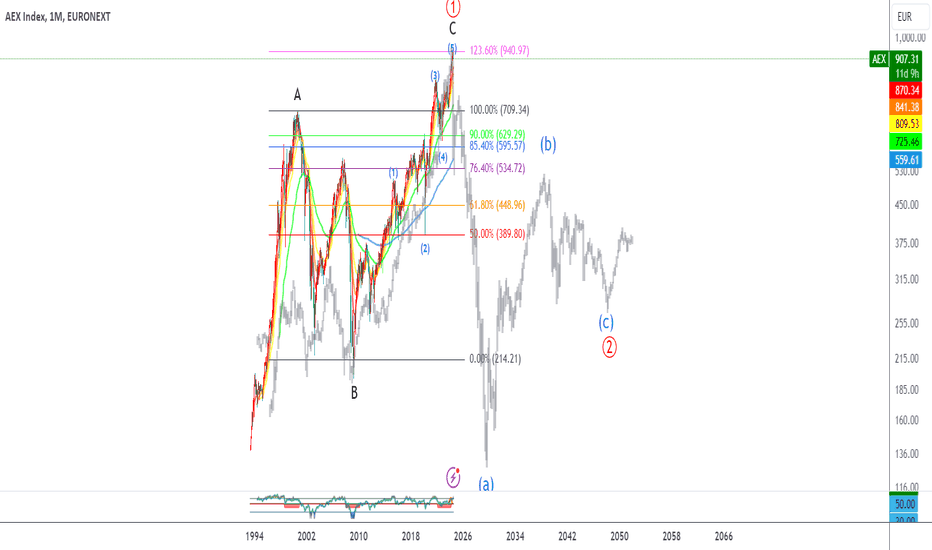

Aex Index Falls Below Key Support Level Marking A Years Low

May 24, 2025

Aex Index Falls Below Key Support Level Marking A Years Low

May 24, 2025 -

Open Ais Next Move Jony Ives Ai Hardware Company A Target

May 24, 2025

Open Ais Next Move Jony Ives Ai Hardware Company A Target

May 24, 2025 -

Alix Earles Dwts Debut A Gen Z Influencers Smart Marketing Strategy

May 24, 2025

Alix Earles Dwts Debut A Gen Z Influencers Smart Marketing Strategy

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Latest Posts

-

Odd Burger Expands Reach Vegan Meals Now At 7 Eleven Canada

May 24, 2025

Odd Burger Expands Reach Vegan Meals Now At 7 Eleven Canada

May 24, 2025 -

Burclar Ve Zeka Bir Iliski Var Mi

May 24, 2025

Burclar Ve Zeka Bir Iliski Var Mi

May 24, 2025 -

Londons Odd Burger Vegan Meals Coming To 7 Eleven Across Canada

May 24, 2025

Londons Odd Burger Vegan Meals Coming To 7 Eleven Across Canada

May 24, 2025 -

En Akilli Burclar Zeka Duezeyleri Ve Oezellikleri

May 24, 2025

En Akilli Burclar Zeka Duezeyleri Ve Oezellikleri

May 24, 2025 -

Dahilik Ve Burclar Genetik Etkinin Rolue

May 24, 2025

Dahilik Ve Burclar Genetik Etkinin Rolue

May 24, 2025