AEX Index Falls Below Key Support Level, Marking A Year's Low

Table of Contents

Technical Analysis: Breaking the Key Support Level

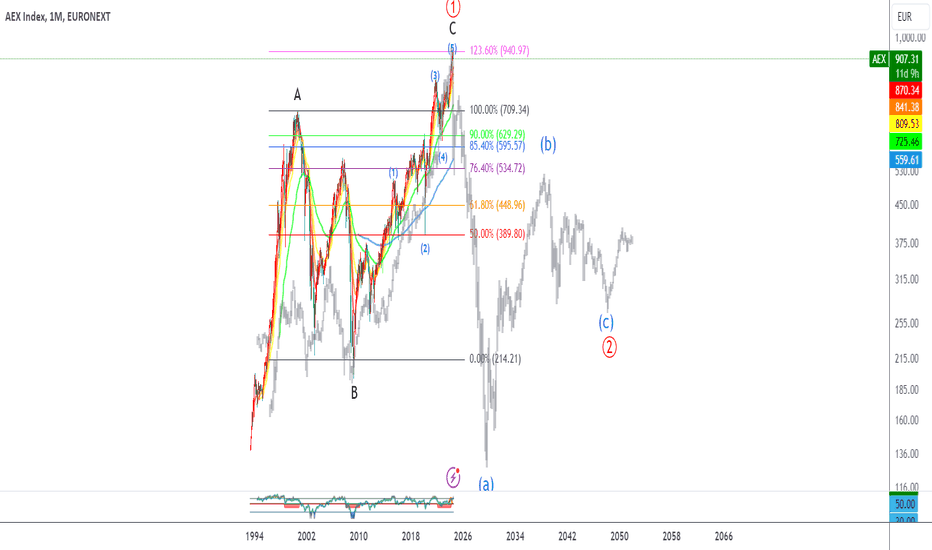

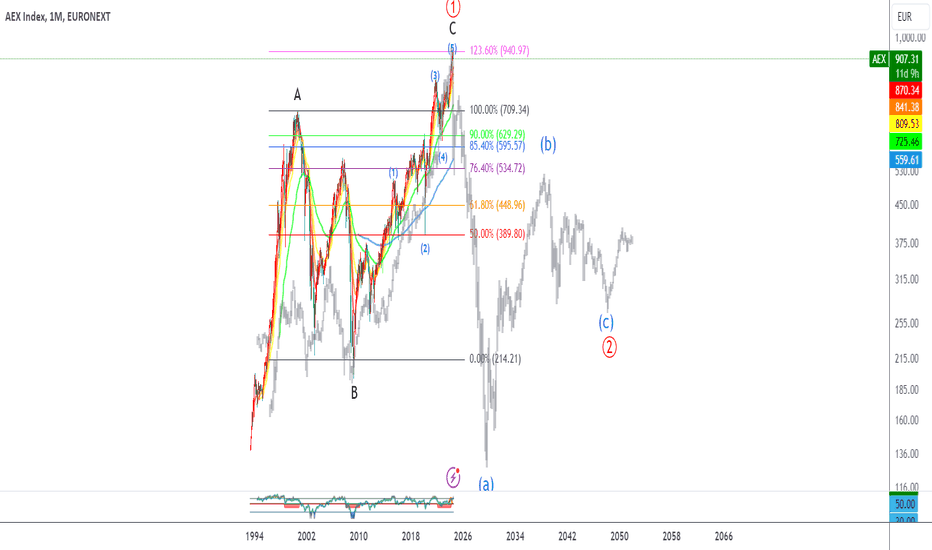

The AEX Index's recent plunge signifies a breach of a key support level, a price point previously believed to provide resistance against further declines. This support level, around 700 points (adjust this figure based on current market data), had held steady for several months, providing a sense of stability to the market. The breakdown indicates a bearish shift in market sentiment and suggests further potential for downward pressure. Several technical indicators confirmed this trend.

- 50-day moving average crossed below the 200-day moving average: This "death cross" is a classic bearish signal, suggesting a sustained downtrend.

- Relative Strength Index (RSI) fell below 30: This indicates oversold conditions, but in the context of a sustained downtrend, it may simply signify further potential for decline before any rebound.

- Moving Average Convergence Divergence (MACD) generated a bearish crossover: This confirmed the weakening momentum and potential for continued downward movement.

[Insert relevant chart/graph here visually demonstrating the technical indicators and the breakdown of the support level].

Underlying Economic Factors Contributing to the AEX Index Decline

The AEX Index's decline isn't occurring in isolation. Several broader economic factors contribute to this market downturn. These include:

- Rising inflation and interest rates: Increased inflation and subsequent interest rate hikes by the European Central Bank (ECB) are impacting corporate profitability and investor sentiment. Higher borrowing costs make expansion and investment more challenging.

- Global economic slowdown: Global economic growth is slowing, impacting demand for Dutch exports and creating uncertainty about future corporate earnings.

- Geopolitical uncertainties: Ongoing geopolitical tensions, particularly the war in Ukraine and its impact on energy prices, add to the market volatility and investor apprehension.

- Specific sector performance: Certain sectors within the AEX Index, such as the energy sector, have experienced significant underperformance due to fluctuating oil and gas prices. This sector's weight in the index contributes heavily to the overall decline. [Further details on specific sectors and their performance can be added here].

Impact on Investors and Investment Strategies

The AEX Index decline impacts investors differently depending on their investment horizon and risk tolerance. Short-term investors may experience significant losses, while long-term investors might view this as a buying opportunity, depending on their outlook. However, prudent risk management is paramount.

Several investment strategies can be considered in light of this market downturn:

- Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk. Don't over-concentrate your investments within the AEX Index or the Dutch market.

- Risk management: Implement stop-loss orders to limit potential losses. Re-evaluate your risk tolerance and adjust your portfolio accordingly.

- Value investing: Look for undervalued companies within the AEX Index that offer potential for long-term growth despite the current market conditions.

- Defensive stock selection: Consider investing in companies with resilient business models, less sensitive to economic fluctuations (e.g., consumer staples, utilities).

Conclusion: Navigating the AEX Index Downturn: A Call to Action

The AEX Index's fall below a key support level, fueled by a confluence of economic and geopolitical factors, presents a challenging environment for investors. Understanding the underlying reasons for this decline and adapting your investment strategy accordingly is crucial. Monitor the AEX Index closely, analyze the performance of individual companies, and consider diversifying your holdings to mitigate risk. Don't hesitate to consult with a financial advisor to adjust your AEX Index investment strategy and develop a robust plan for navigating this period of market volatility. Staying informed and proactive is key to successfully navigating the fluctuations of the AEX Index and maintaining a healthy investment portfolio.

Featured Posts

-

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025 -

Guccis New Designer Demna Gvasalias Impact On The Brand

May 24, 2025

Guccis New Designer Demna Gvasalias Impact On The Brand

May 24, 2025 -

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025 -

Vozrastnye Kharakteristiki Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025

Vozrastnye Kharakteristiki Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

Atfaq Washntn Wbkyn Altjary Artfae Mwshr Daks Alalmany Fwq 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Altjary Artfae Mwshr Daks Alalmany Fwq 24 Alf Nqtt

May 24, 2025

Latest Posts

-

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025 -

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025