Apple Q2 Earnings Preview: Stock Price Under Pressure

Table of Contents

Slowing iPhone Sales & Revenue Projections

The anticipated slowdown in iPhone sales is a major talking point for Apple Q2 earnings. Analyst predictions and market reports paint a picture of lower-than-expected unit sales compared to both Q1 and the same period last year. Several factors contribute to this projected decline:

- Saturated Markets: The global smartphone market is reaching saturation, leaving less room for significant growth in iPhone sales. Many consumers are upgrading less frequently, extending the lifespan of their devices.

- Economic Uncertainty: The global economic slowdown is impacting consumer spending on premium electronics like iPhones. Rising inflation and interest rates are forcing consumers to prioritize essential spending, leaving discretionary purchases like new smartphones lower on the list.

- Fierce Competition: Android manufacturers continue to offer compelling alternatives at lower price points, putting pressure on Apple's market share. This competition is particularly acute in emerging markets where price sensitivity is high.

- Supply Chain Disruptions: While less of a concern than in previous quarters, lingering supply chain issues could still affect iPhone production and availability, impacting sales figures. The impact of geopolitical instability on the supply chain remains a wildcard.

Impact of Macroeconomic Factors

Macroeconomic headwinds are undeniably impacting Apple's Q2 performance and investor sentiment. Inflation, rising interest rates, and the looming threat of a recession are creating a challenging environment for consumer spending:

- Inflation's Bite: Rising inflation is eroding consumer purchasing power, making premium products like iPhones less accessible to a significant portion of the market. This effect is amplified for consumers already facing budget constraints.

- Interest Rate Hikes: Increased interest rates increase borrowing costs, potentially discouraging consumers from taking on debt to purchase expensive electronics. This impacts both new purchases and upgrades.

- Economic Uncertainty: Global economic uncertainty fosters cautious consumer behavior, leading to delayed purchases and a preference for saving rather than spending on discretionary items.

Performance of Other Apple Product Lines

While iPhone sales are under scrutiny, the performance of other Apple product lines will play a crucial role in shaping the overall Q2 results. Their contribution to revenue and potential to offset weakness in iPhone sales needs careful examination:

- Mac Sales: The PC market downturn is expected to impact Mac sales, although the premium positioning of Macs may offer some resilience against the overall decline.

- iPad Sales: The ongoing shift towards tablets for both productivity and entertainment should support iPad sales, though growth may be more moderate than in previous years.

- Wearables & Services: The wearables segment (Apple Watch, AirPods) and the Services segment are anticipated to continue their growth trajectory, acting as key drivers of Apple's overall revenue and demonstrating the company's diversification strategy. The strength of the services ecosystem is increasingly critical to Apple's financial performance.

Analyst Predictions & Stock Price Implications

Analysts' predictions for Apple's Q2 earnings vary, resulting in a range of EPS (earnings per share) forecasts. These predictions, coupled with investor sentiment, will heavily influence the stock price's reaction to the earnings announcement:

- EPS Predictions: The spread of EPS predictions reflects the uncertainty surrounding the various factors affecting Apple's performance.

- Market Capitalization Impact: The ultimate impact on Apple's market capitalization will depend on whether the company meets or exceeds analyst expectations and how investors interpret the results in the context of the broader market conditions.

- Investor Sentiment: Investor sentiment leading up to and immediately following the earnings release will be shaped by macroeconomic conditions, competitive pressures, and Apple's communication regarding its future outlook.

Conclusion

Apple's Q2 earnings announcement will be a pivotal moment. While challenges exist, particularly concerning slowing iPhone sales and macroeconomic headwinds, the performance of other product lines and the resilience of the Services segment could mitigate the negative impacts. The overall effect on Apple's stock price will hinge on the company's ability to meet or exceed market expectations.

Call to Action: Stay tuned for our comprehensive analysis of Apple's Q2 earnings following the official announcement. Learn how to manage your Apple stock investments effectively during market volatility, and subscribe to our newsletter for continuous updates on Apple Q2 earnings and future Apple stock price predictions.

Featured Posts

-

Market Close Frankfurt Dax Dips Below 24 000 Points

May 24, 2025

Market Close Frankfurt Dax Dips Below 24 000 Points

May 24, 2025 -

Elektromobiliu Ikrovimas Europoje Porsche Isplecia Savo Tinkla

May 24, 2025

Elektromobiliu Ikrovimas Europoje Porsche Isplecia Savo Tinkla

May 24, 2025 -

Pariss Financial Health Assessing The Impact Of The Luxury Market Decline

May 24, 2025

Pariss Financial Health Assessing The Impact Of The Luxury Market Decline

May 24, 2025 -

40 Svadeb Na Kharkovschine Kakaya Data Stala Samoy Populyarnoy Fotoreportazh

May 24, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Samoy Populyarnoy Fotoreportazh

May 24, 2025 -

Analysis Open Ais Interest In Jony Ives Ai Technology

May 24, 2025

Analysis Open Ais Interest In Jony Ives Ai Technology

May 24, 2025

Latest Posts

-

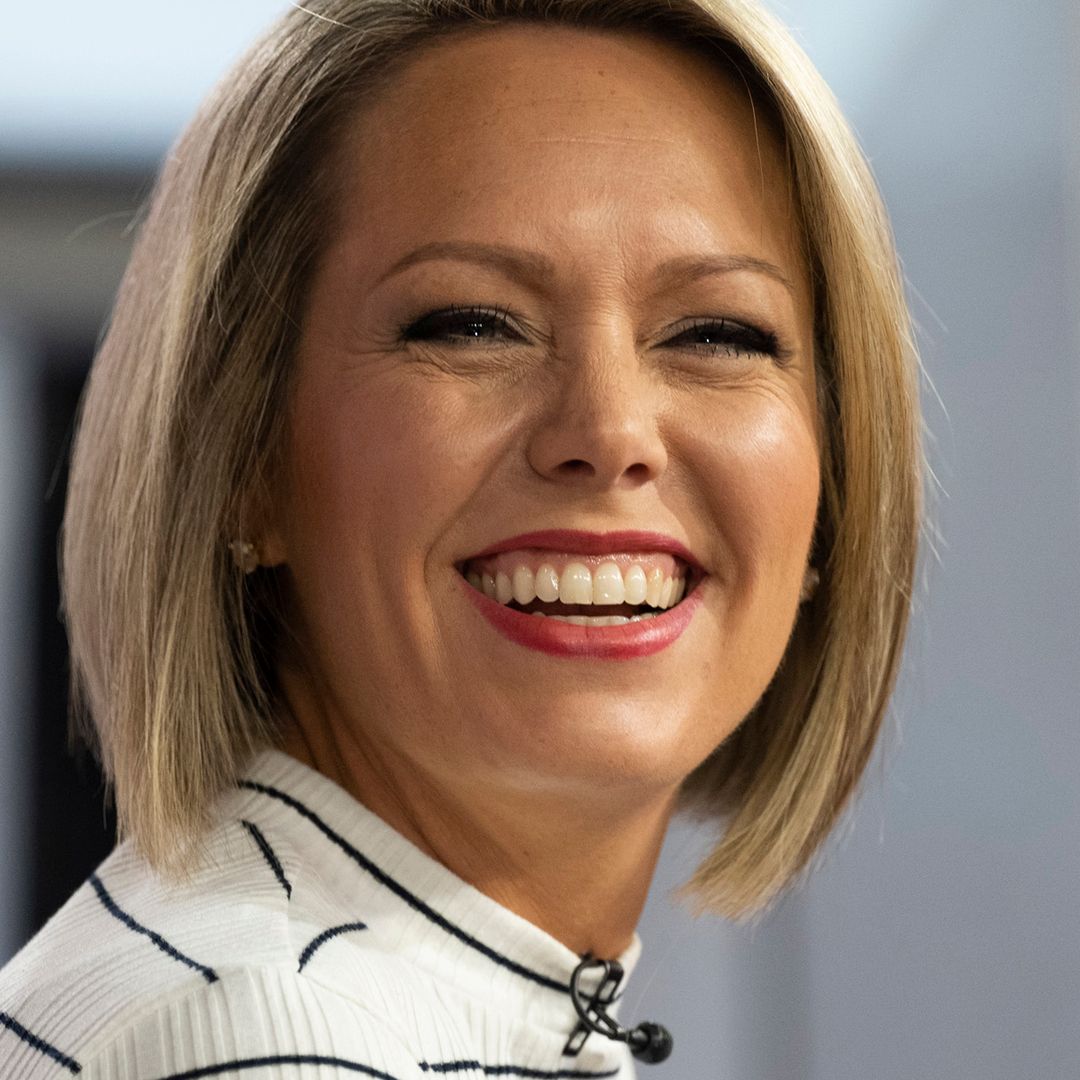

Why Dylan Dreyer Almost Missed Hosting The Today Show The Full Story

May 24, 2025

Why Dylan Dreyer Almost Missed Hosting The Today Show The Full Story

May 24, 2025 -

New Post From Dylan Dreyer Featuring Brian Fichera Causes Stir Online

May 24, 2025

New Post From Dylan Dreyer Featuring Brian Fichera Causes Stir Online

May 24, 2025 -

Fans React To Dylan Dreyers New Photo With Husband Brian Fichera

May 24, 2025

Fans React To Dylan Dreyers New Photo With Husband Brian Fichera

May 24, 2025 -

Dylan Dreyers Today Show Transformation A Remarkable Journey

May 24, 2025

Dylan Dreyers Today Show Transformation A Remarkable Journey

May 24, 2025 -

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025