Analyzing The U.S. Dollar: A Potential Repeat Of Nixon-Era Volatility

Table of Contents

Parallels Between Today's Economy and the Nixon Era

Analyzing the U.S. dollar effectively requires a comparison to historical precedents. Striking similarities exist between the current economic landscape and that of the late 1960s and early 1970s, a period culminating in the Nixon Shock.

Inflationary Pressures

The current inflationary environment bears a resemblance to the inflationary pressures experienced in the late 1960s and early 1970s.

-

Comparing Inflation Rates: While the current inflation rate might not yet match the extreme levels seen during the Nixon era, the persistent upward trend raises serious concerns. The U.S. dollar inflation rate in 2023 is significantly higher than the average of the preceding decade. Similarly, in the late 1960s, inflation began a steady climb, eroding the purchasing power of the dollar.

-

Contributing Factors: Both periods share contributing factors, albeit with some differences. Supply chain disruptions, energy price volatility, and increased government spending are current drivers, mirroring similar pressures in the Nixon era, albeit with different geopolitical contexts.

-

The Role of Government Spending: In both instances, significant government spending played a role in fueling inflationary pressures. The Vietnam War in the late 1960s and early 1970s, coupled with domestic social programs, contributed to a surge in inflation. Similarly, substantial government spending in response to the COVID-19 pandemic and other economic initiatives today adds to inflationary pressures and impacts the U.S. dollar inflation rate.

Growing National Debt

Analyzing the U.S. dollar's vulnerability also requires examining the national debt. The current U.S. national debt is at historically high levels, echoing the debt burden during the Nixon administration.

-

National Debt Data: The sheer magnitude of the national debt raises concerns about the long-term stability of the U.S. dollar. The ratio of debt to GDP is significantly higher than it was even at the peak of the Cold War.

-

Impact on Interest Rates and Investor Confidence: This substantial debt increases the pressure on interest rates and can negatively impact investor confidence in the U.S. dollar. Higher interest rates can stifle economic growth and further destabilize the dollar.

-

Potential for Devaluation: A continuously rising national debt carries an increased risk of dollar devaluation, as investors may seek alternative assets considered safer and less susceptible to inflation. This impacts the U.S. dollar debt sustainability.

Geopolitical Instability

The geopolitical landscape today presents several parallels to the international tensions of the Nixon era, affecting the U.S. dollar's strength and stability.

-

Specific Geopolitical Conflicts: The ongoing war in Ukraine, tensions with China, and instability in various regions of the world create uncertainty similar to the Cold War tensions.

-

Impact on Global Markets: These conflicts disrupt global supply chains, increase energy prices, and negatively impact investor sentiment, consequently affecting the U.S. dollar's value. The U.S. dollar geopolitical risk is amplified by such events.

-

International Trade and Currency Reserves: The shifting global power dynamics and the increased use of alternative currencies by some nations to reduce dependence on the U.S. dollar pose challenges to the dollar’s international role, much like the growing challenges to the Bretton Woods system during the Nixon era.

The Nixon Shock and its Long-Term Consequences

Understanding the Nixon Shock is crucial for analyzing the U.S. dollar's potential for future volatility.

Closing the Gold Window

President Nixon's decision to close the gold window in August 1971 was a watershed moment in global finance.

-

Events Leading Up to the Decision: Years of increasing inflation and pressure on the dollar's convertibility to gold culminated in this drastic measure. The U.S. was struggling to maintain the Bretton Woods system, which pegged the value of the dollar to gold.

-

Impact on the Bretton Woods System: Closing the gold window effectively ended the Bretton Woods system, marking a significant shift in the global monetary order. This immediately impacted the U.S. dollar's relationship with other currencies.

-

Immediate Market Reaction: The announcement triggered significant volatility in global currency markets as exchange rates began to fluctuate freely. This is a critical lesson in understanding the consequences of major policy shifts on the dollar.

The Rise of Floating Exchange Rates

The abandonment of fixed exchange rates in favor of a floating exchange rate system had profound and long-lasting consequences for the U.S. dollar.

-

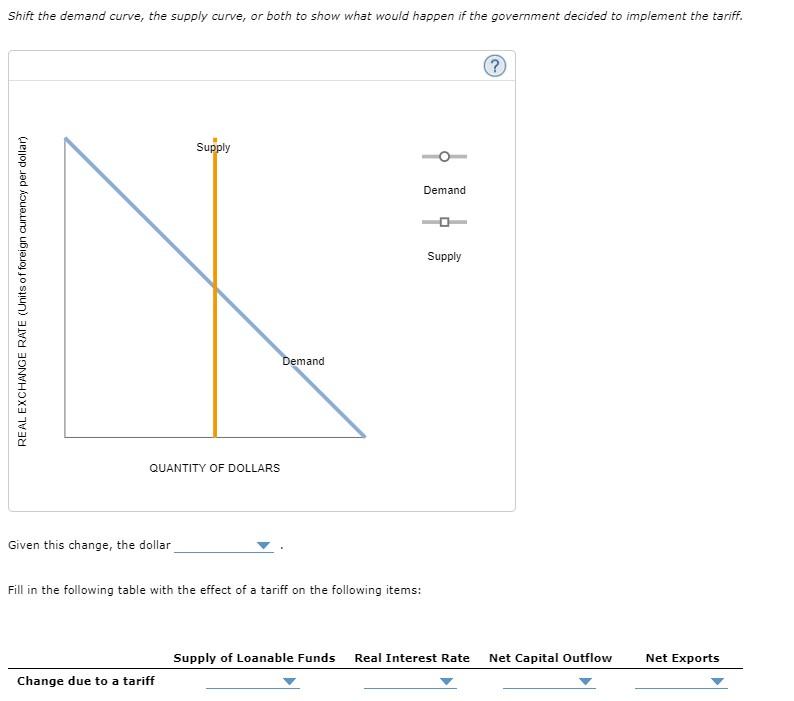

Mechanics of Floating Exchange Rates: Under a floating exchange rate system, the value of a currency is determined by supply and demand in the foreign exchange market.

-

Increased Volatility: The shift to floating exchange rates introduced increased volatility into currency markets, making it more challenging to predict the U.S. dollar's value. The dollar volatility became a characteristic of the post-Bretton Woods era.

-

Implications for International Trade and Investment: The increased volatility introduced uncertainty into international trade and investment, as businesses and investors had to grapple with fluctuating exchange rates.

Mitigating the Risk of a Repeat

Preventing a repeat of Nixon-era volatility requires proactive policy adjustments.

Fiscal Responsibility

Maintaining the value of the U.S. dollar necessitates stringent fiscal discipline.

-

Policy Measures to Control Government Spending: Implementing policies to control government spending and reduce the national debt are critical for long-term stability. This includes reducing unnecessary expenditures and implementing tax reforms to increase revenue.

-

U.S. Dollar Stability and Responsible Government Spending: The link between responsible government spending and U.S. dollar stability cannot be overstated. Fiscal prudence is vital for maintaining confidence in the dollar and preventing inflationary pressures.

Monetary Policy

The Federal Reserve plays a crucial role in managing inflation and interest rates to prevent excessive U.S. dollar volatility.

-

Effectiveness of Current Monetary Policy Tools: The current monetary policy tools employed by the Federal Reserve need to be assessed for their effectiveness in controlling inflation and maintaining a stable U.S. dollar.

-

Potential Adjustments: Adjustments may be required to address changing economic conditions. For example, interest rate hikes to combat inflation need careful calibration to avoid triggering a recession.

Geopolitical Engagement

Constructive engagement in international affairs is vital for minimizing geopolitical risks and their impact on the U.S. dollar.

- International Cooperation: Promoting diplomacy and cooperation on global issues can reduce uncertainty and stabilize currency markets. International cooperation is vital for achieving long-term global economic stability and reducing U.S. dollar vulnerability to geopolitical shocks.

Conclusion

Analyzing the U.S. dollar reveals unsettling parallels between the current economic climate and the conditions preceding the Nixon Shock. The high inflation, soaring national debt, and significant geopolitical uncertainties mirror those of the late 1960s and early 1970s. Our analysis highlights the potential for significant volatility in the U.S. dollar, similar to the dramatic shifts experienced after the closure of the gold window. The rise of floating exchange rates and the ensuing increased volatility serve as a stark reminder of the consequences of unchecked inflationary pressures and unsustainable debt levels. The potential for a repeat of such events emphasizes the urgent need for fiscal responsibility, effective monetary policy, and proactive geopolitical engagement. Analyzing the U.S. dollar's future requires careful observation of these trends. Stay informed, engage in the conversation, and let's work together to navigate the potential challenges ahead. The future of the U.S. dollar depends on sound policy and proactive measures to ensure stability and maintain its global role.

Featured Posts

-

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025 -

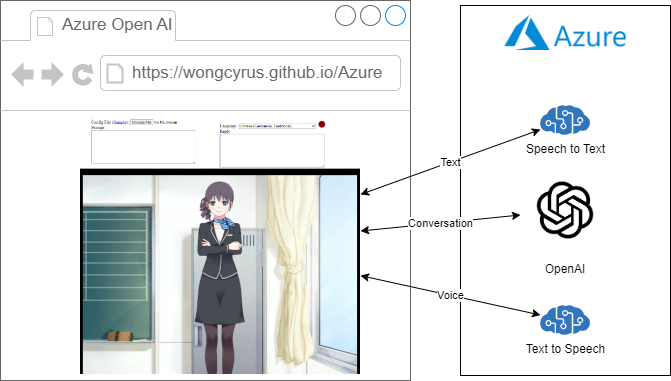

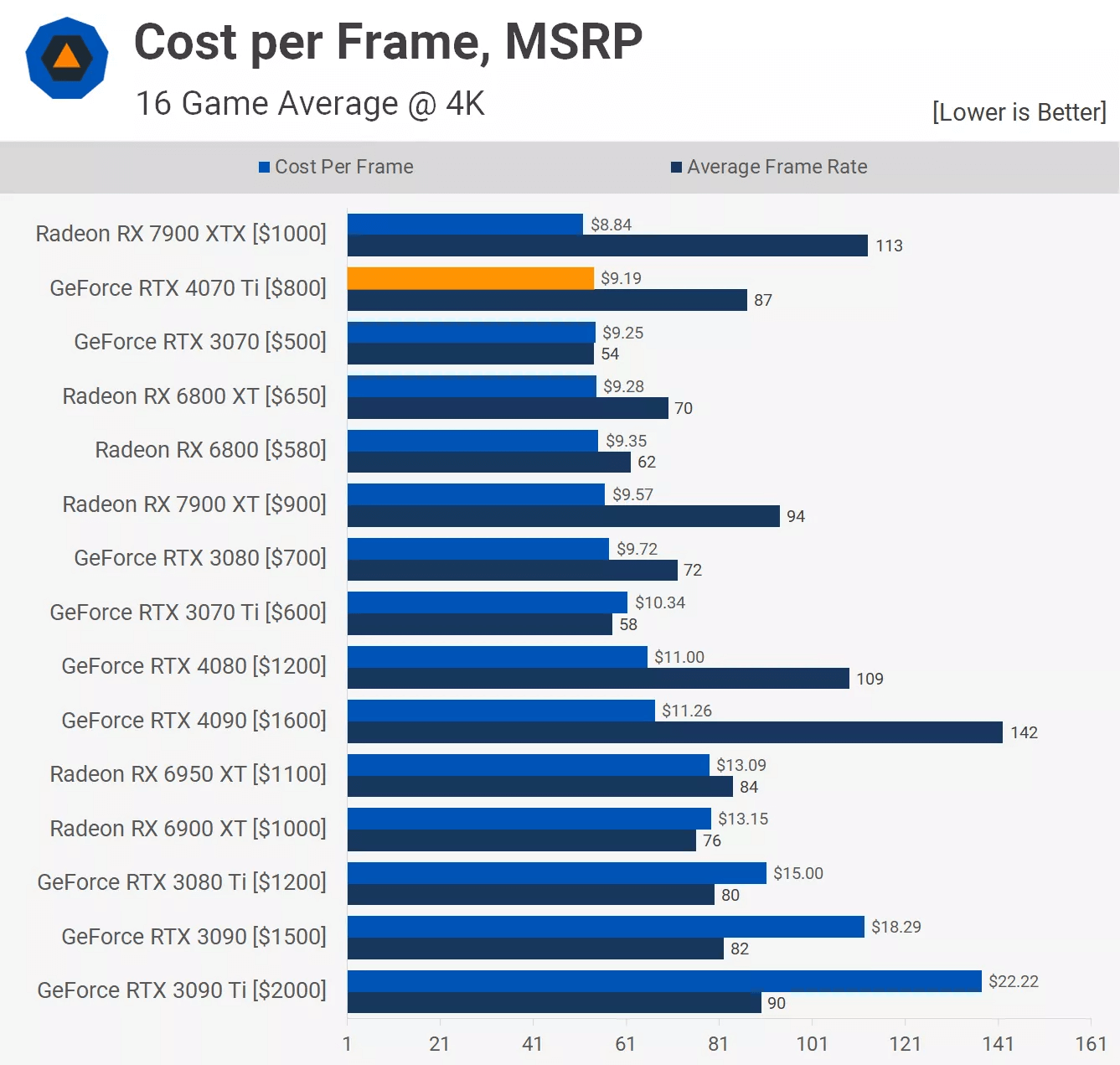

Gpu Prices A Look At The Latest Trends

Apr 28, 2025

Gpu Prices A Look At The Latest Trends

Apr 28, 2025 -

Auto Dealerships Intensify Opposition To Electric Vehicle Regulations

Apr 28, 2025

Auto Dealerships Intensify Opposition To Electric Vehicle Regulations

Apr 28, 2025 -

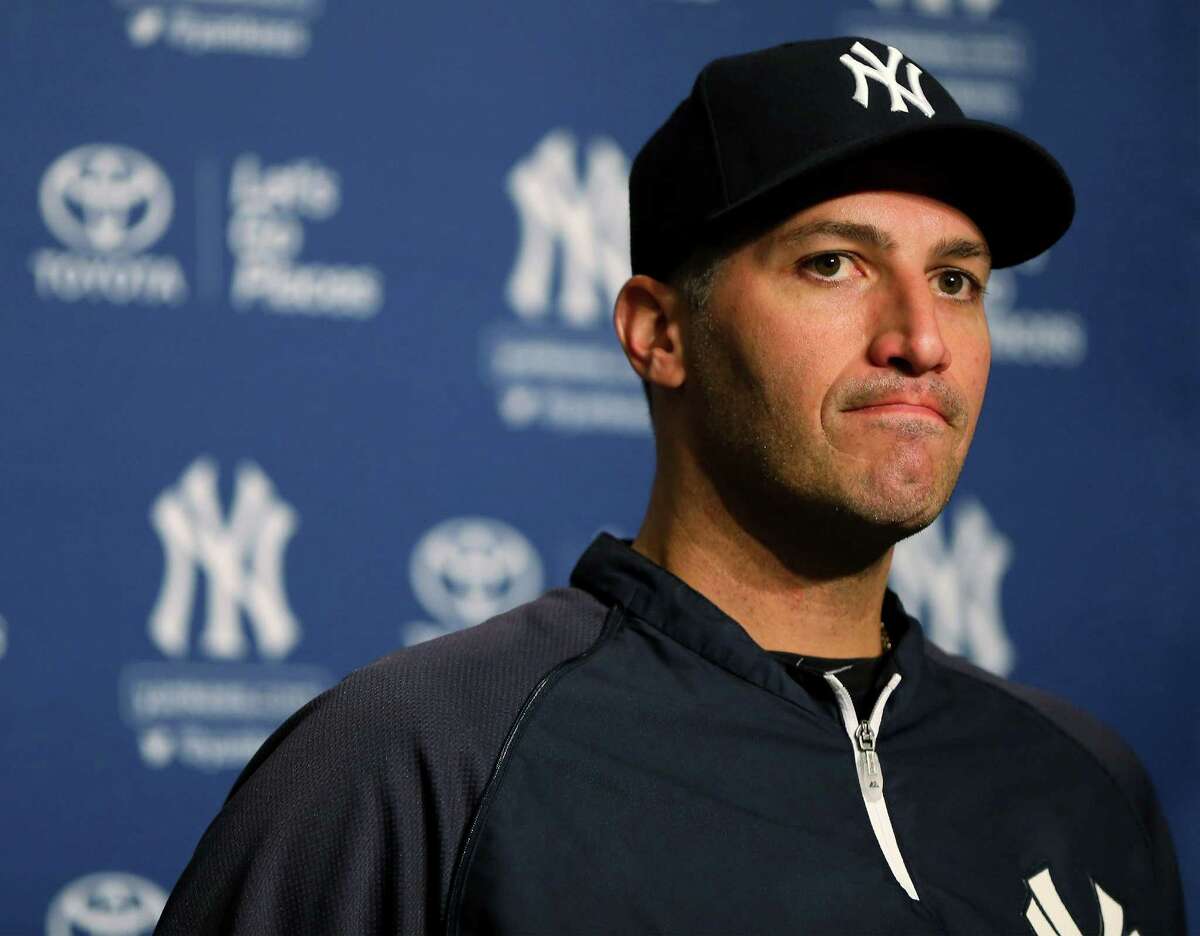

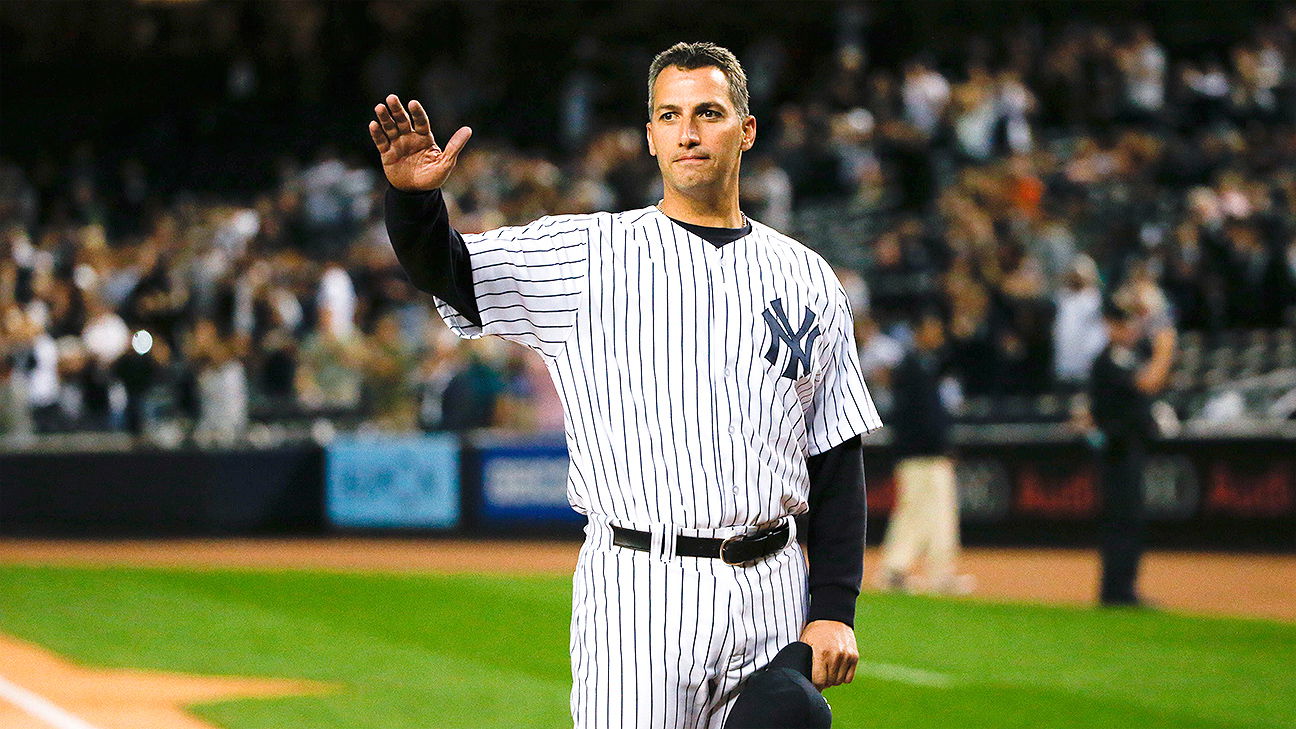

Series Saving Win For Yankees Thanks To Judge And Goldschmidt

Apr 28, 2025

Series Saving Win For Yankees Thanks To Judge And Goldschmidt

Apr 28, 2025 -

Top Chefs Fishermans Stew Wins Over Eva Longoria

Apr 28, 2025

Top Chefs Fishermans Stew Wins Over Eva Longoria

Apr 28, 2025

Latest Posts

-

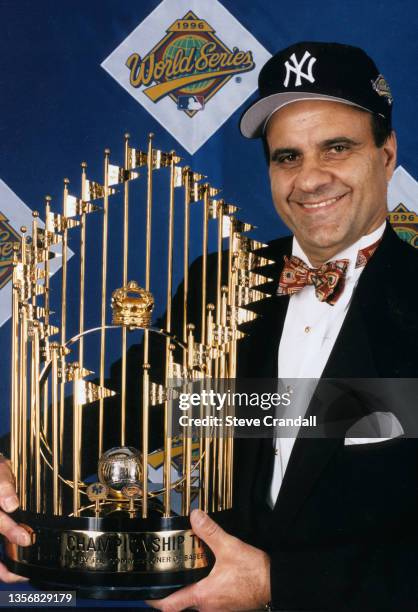

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025 -

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025 -

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025 -

Yankees Rally Past Astros Rodon Leads The Charge

Apr 28, 2025

Yankees Rally Past Astros Rodon Leads The Charge

Apr 28, 2025