Analysis: Trump Media's Partnership With Crypto.com And Its Effect On $CRO

Table of Contents

Trump Media's Influence on Public Perception

The association with TMTG has undoubtedly had a profound effect on Crypto.com's public image. The impact, however, is complex and presents both potential benefits and significant drawbacks.

Brand Association and Positive/Negative Sentiment

Trump's highly polarizing brand brings inherent risks and rewards.

-

Potential Positives: The partnership could attract a significant new demographic to Crypto.com, particularly those who align with Trump's political views. This could lead to increased brand awareness and a surge in user registration and trading volume. The association with a high-profile figure like Trump might also lend Crypto.com a sense of legitimacy in the eyes of some investors.

-

Potential Negatives: Conversely, the partnership could alienate a substantial portion of Crypto.com's existing user base and potential customers who hold opposing political views. The inherent controversy surrounding Trump could expose Crypto.com to reputational damage and erode trust among investors wary of political entanglements. This could lead to decreased user adoption and negative press coverage.

-

Impact on User Base and Adoption: The net effect on Crypto.com's user base remains to be seen. A careful analysis of user acquisition and retention rates following the announcement is crucial to gauge the success of this strategy.

Media Coverage and Public Relations

The media's response to the partnership has been a mixture of excitement, skepticism, and outright condemnation.

- Diverse Media Reactions: Major news outlets have offered diverse perspectives, ranging from analyses of the strategic implications to critical assessments of the potential reputational risks for both entities.

- Influence on Public Opinion of $CRO: This varied media coverage has undoubtedly influenced public sentiment towards $CRO. The resulting narrative has affected investor confidence and trading decisions.

- Social Media's Amplifying Effect: Social media has amplified the discussion around the partnership, leading to a robust, and sometimes chaotic, debate among users. Positive and negative sentiment have spread rapidly, influencing $CRO's price and public perception.

Market Reaction and $CRO Price Volatility

The announcement of the partnership immediately triggered significant market activity, revealing both short-term and potential long-term consequences for $CRO.

Immediate Price Movements

- Pre-Announcement, Announcement, and Post-Announcement Price Analysis: A detailed analysis of $CRO's price before, during, and after the partnership announcement would reveal significant short-term price fluctuations.

- Price Charts and Graphs: Visual representations of these price movements are crucial for demonstrating the immediate impact of the news. Data from reputable cryptocurrency tracking websites would be essential for accurate charting.

- Short-Term Pumps and Dumps: The partnership likely led to short-term speculation, resulting in rapid price increases (pumps) followed by potential corrections (dumps).

Long-Term Implications for $CRO's Value

The long-term impact of this partnership on $CRO's value remains uncertain, influenced by several interconnected factors:

- Sustained Growth or Decline: The long-term success hinges on how effectively Crypto.com mitigates the risks and capitalizes on the potential gains.

- Increased Trading Volume and Investor Confidence: Increased trading activity resulting from the publicity could contribute to sustained growth. However, continued negative press could undermine investor confidence.

- Overall Cryptocurrency Market Conditions: The overall health of the broader cryptocurrency market plays a vital role. A bull market could overshadow negative sentiment, while a bear market could exacerbate any negative impacts.

Strategic Implications for Crypto.com's Business

The partnership presents both opportunities and challenges for Crypto.com's business strategy.

Target Audience Expansion

- Reaching a New Demographic: The partnership provides access to a previously untapped segment of the market: supporters of TMTG and its affiliated personalities. This could dramatically increase Crypto.com's user base and brand reach.

- Increased User Acquisition and Market Share: Success depends on Crypto.com's ability to convert this newly acquired audience into active users and traders. Retention strategies will be key.

Marketing and Promotional Opportunities

- Marketing Potential: The alliance provides significant marketing opportunities, allowing Crypto.com to leverage TMTG's substantial media presence to reach a broad audience. This could involve co-branded campaigns and promotional activities.

- Return on Investment (ROI): Determining the true ROI of this partnership will require long-term monitoring of user acquisition, trading volume, and brand perception.

Regulatory and Compliance Considerations

- Potential Regulatory Issues: The partnership could trigger regulatory scrutiny, especially concerning compliance with financial regulations and anti-money laundering (AML) rules.

- Impact on Crypto.com's Regulatory Standing: Navigating these regulatory challenges effectively is vital for maintaining a positive regulatory standing and minimizing potential legal risks.

Conclusion: Assessing the Long-Term Impact of Trump Media's Partnership on Crypto.com and $CRO

Trump Media's Partnership with Crypto.com and its Effect on $CRO is a complex and evolving situation. While the partnership offers potential for expanded brand awareness and user acquisition, it also carries significant risks related to reputational damage and regulatory hurdles. The immediate market reaction demonstrated the inherent volatility associated with this type of high-profile collaboration. The long-term impact on $CRO's value will depend on several factors, including Crypto.com's ability to manage the associated risks, the overall cryptocurrency market conditions, and the sustained public reaction to the partnership.

We encourage you to share your thoughts and analysis on Trump Media's Partnership with Crypto.com and its Effect on $CRO. Continue monitoring the situation closely and engage in further research and discussion on this pivotal development in the intersection of politics, media, and the cryptocurrency market.

Featured Posts

-

Sonys Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025

Sonys Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025 -

Get Ready For Andor Season 2 A Pre Viewing Guide

May 08, 2025

Get Ready For Andor Season 2 A Pre Viewing Guide

May 08, 2025 -

Celtics Coach On Jayson Tatums Wrist Injury Update And Next Steps

May 08, 2025

Celtics Coach On Jayson Tatums Wrist Injury Update And Next Steps

May 08, 2025 -

See Cyndi Lauper And Counting Crows Perform Live At Jones Beach

May 08, 2025

See Cyndi Lauper And Counting Crows Perform Live At Jones Beach

May 08, 2025 -

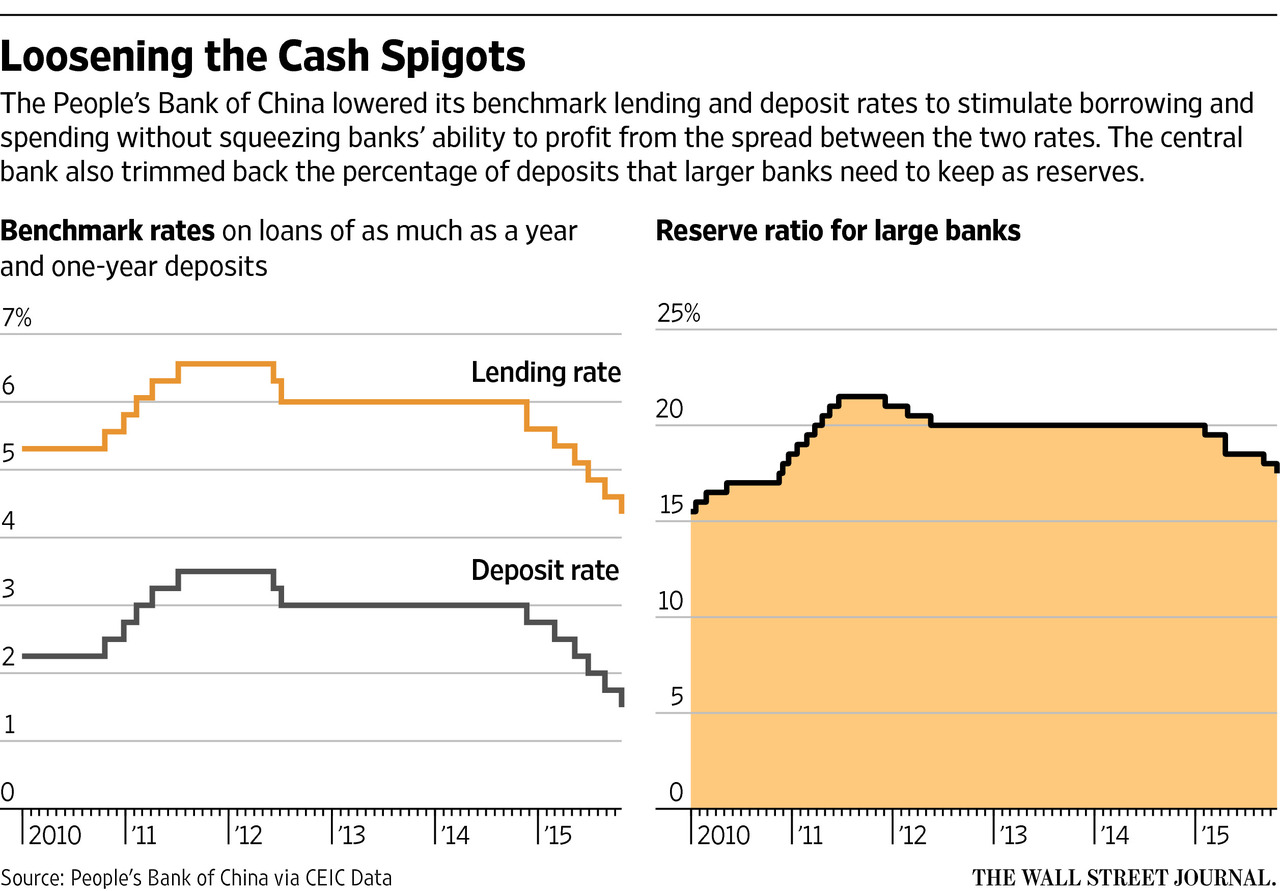

The Impact Of Chinas Rate Cuts On Bank Lending And The Economy

May 08, 2025

The Impact Of Chinas Rate Cuts On Bank Lending And The Economy

May 08, 2025