Analyzing The Investor Rush: Should You Invest In This SPAC?

Table of Contents

Understanding the SPAC Landscape

A Special Purpose Acquisition Company (SPAC), also known as a "blank check company," is a publicly traded company formed solely to raise capital through an initial public offering (IPO) to acquire an existing private company. The SPAC's lifecycle begins with its IPO, where it raises funds from investors. This capital is held in a trust account until a suitable acquisition target is identified. Once a target is found, the SPAC undergoes a "de-SPAC" transaction, a merger with the private company. The combined entity then typically begins trading on a major stock exchange. This process offers investors access to pre-IPO companies and potential high growth opportunities.

- High growth potential: SPACs often target companies in rapidly growing sectors, offering investors the chance for substantial returns.

- Access to pre-IPO companies: Investing in a SPAC provides access to companies that may not be ready for a traditional IPO, allowing investors to participate earlier in their growth trajectory.

- Lower regulatory scrutiny (compared to traditional IPOs): While regulations exist for SPACs, the process is generally considered less onerous than a traditional IPO, leading to a faster timeline. However, this doesn't mean there is no regulatory scrutiny; due diligence is still crucial.

- Potential for substantial returns: Successful de-SPAC transactions can result in significant gains for investors.

- Increased risk of loss due to lack of extensive due diligence: The lack of information about the target company before the merger presents a substantial risk.

The "de-SPAC" merger, or de-SPAC transaction, is the pivotal point in the SPAC lifecycle. It's when the SPAC merges with the target company, making it public. Successful de-SPAC mergers are crucial for investor returns. The current market sentiment towards SPACs is mixed. While the initial boom has cooled, there's still considerable interest, but it's essential to approach SPAC investments with caution and perform thorough due diligence to ascertain whether the current enthusiasm is sustainable.

Assessing the Target Company

Thorough due diligence on the target company is paramount before investing in a SPAC. This involves a deep dive into several key areas:

- Analyze the target company's business model, financial health, management team, and market competition: Understand the company's core operations, revenue streams, profitability, debt levels, and competitive landscape.

- Investigate the potential for future growth and profitability: Assess the target company's growth prospects based on market trends, technological advancements, and competitive advantages.

- Consider the valuation of the target company and whether it's justified: Is the proposed valuation realistic considering the company's current performance and future potential? Look at comparable company valuations.

- Review any potential red flags or risks associated with the target company: Scrutinize the company's financials for inconsistencies, potential liabilities, and any legal or regulatory issues. Investigate any conflicts of interest between the SPAC sponsor and the target company.

"Sponsor alignment" is crucial. The SPAC sponsor is the entity that initiates the SPAC and leads the search for an acquisition target. Their incentives significantly influence the SPAC’s success. A well-aligned sponsor is one that has a strong track record and is incentivized to find a high-quality target. Analyzing successful SPAC mergers like DraftKings (via Diamond Eagle Acquisition Corp.) and unsuccessful ones (many are examples of failed SPAC mergers from 2021-2022) offers valuable insights into the critical success factors.

Evaluating the SPAC's Management Team and Sponsor

The SPAC's management team and sponsor's track record are critical factors to evaluate.

- Research the team's experience in mergers and acquisitions: A seasoned team with a history of successful M&A transactions is more likely to execute a successful de-SPAC.

- Assess their reputation and past successes or failures: Check the backgrounds and reputations of key individuals involved in the SPAC.

- Examine their compensation structure and potential conflicts of interest: Understanding their compensation structure helps you assess their incentives and potential biases.

- Look into the sponsor's reputation and success rate with past SPACs: A sponsor with a history of successful SPACs suggests better chances of success.

The sponsor's incentives are closely tied to the SPAC's performance. Their compensation often depends on the successful merger and the subsequent performance of the combined entity. Transparency and disclosure from the SPAC's management are vital for informed investment decisions.

Identifying and Mitigating Risks

SPAC investing comes with inherent risks:

- Risk of failing to find a suitable target company: The SPAC may not find a target within the specified timeframe, leading to the return of funds to investors (though this can be less than the initial investment).

- Dilution of shares upon merger: Existing shareholders may experience dilution as new shares are issued during the de-SPAC transaction.

- Potential for significant losses if the target company underperforms: If the target company fails to meet expectations, the SPAC's stock price will likely fall.

- Short timeframe for due diligence after target acquisition announcement: Investors typically have a limited time to conduct due diligence after the target acquisition is announced.

- Higher volatility compared to established public companies: SPACs tend to be more volatile than established public companies, as investor sentiment plays a significant role in their valuations.

Risk mitigation strategies include diversifying your investments across multiple SPACs and setting appropriate stop-loss orders to limit potential losses. Understanding your redemption rights, the ability to get your money back under certain circumstances, is vital.

Conclusion

Investing in SPACs offers the potential for high returns but carries significant risks. Thorough due diligence is crucial to mitigating these risks. This includes carefully analyzing the target company's fundamentals, the SPAC’s management team's track record, and understanding the inherent volatility of the SPAC market. Remember to consider the sponsor's incentives and your own risk tolerance. Before jumping into the current SPAC investment frenzy, remember to perform comprehensive due diligence. Carefully analyze the target company, the SPAC's management, and the inherent risks. Only invest in SPACs after a thorough understanding of your investment and risk tolerance. Make informed decisions regarding your SPAC investments.

Featured Posts

-

Ripple Xrp Soars Analysis And 3 40 Price Target

May 08, 2025

Ripple Xrp Soars Analysis And 3 40 Price Target

May 08, 2025 -

Arsenali Akuzohet Per Shkelje Te Rregullores Se Uefa S Ndaj Psg

May 08, 2025

Arsenali Akuzohet Per Shkelje Te Rregullores Se Uefa S Ndaj Psg

May 08, 2025 -

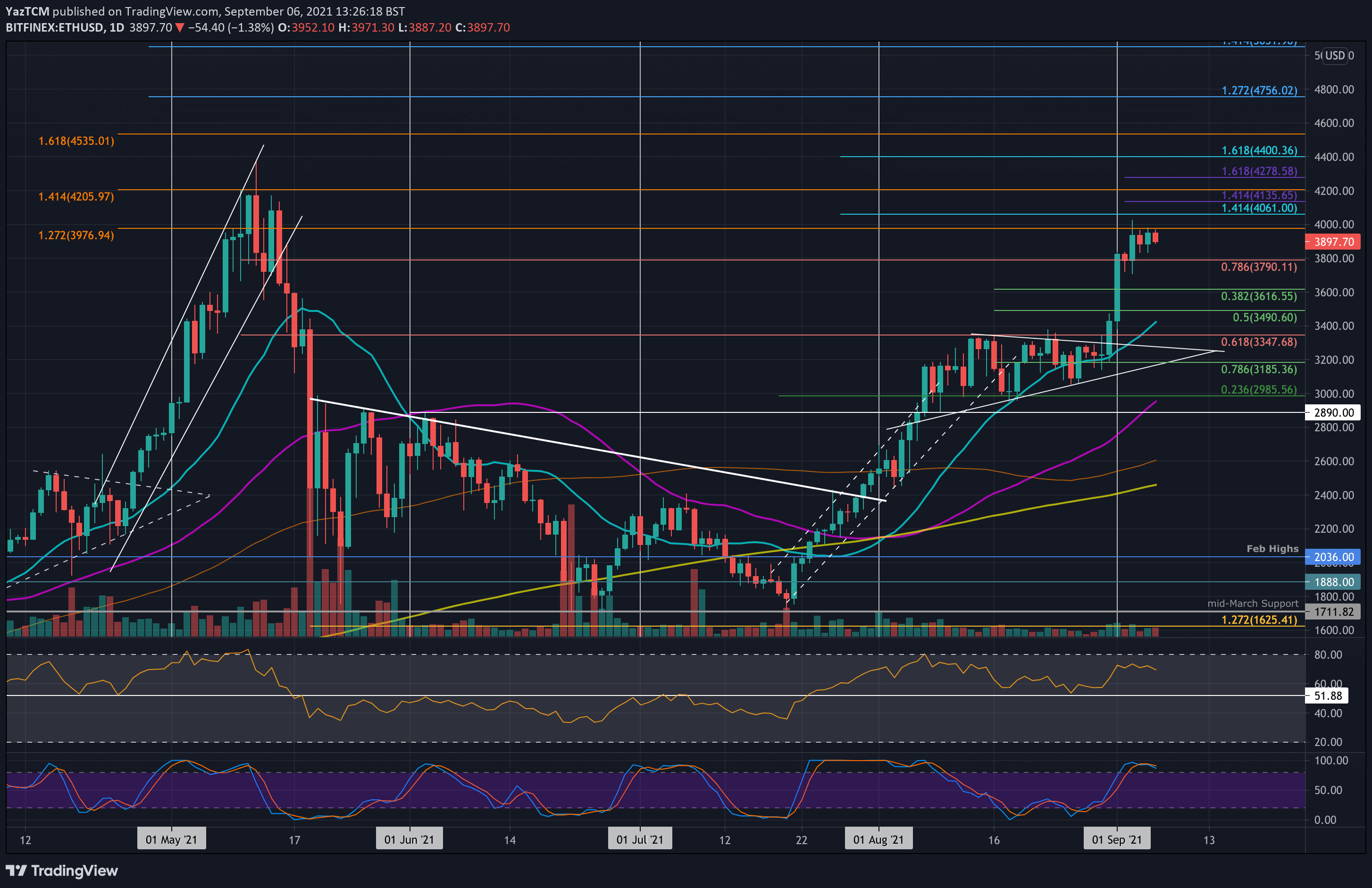

Is This Ethereum Buy Signal Real Weekly Chart Deep Dive

May 08, 2025

Is This Ethereum Buy Signal Real Weekly Chart Deep Dive

May 08, 2025 -

Winning Numbers Daily Lotto Friday 18 April 2025

May 08, 2025

Winning Numbers Daily Lotto Friday 18 April 2025

May 08, 2025 -

Arsenali Perballet Me Sanksione Nga Uefa Pas Dyshimeve Per Shkelje Rregullore Ndaj Psg

May 08, 2025

Arsenali Perballet Me Sanksione Nga Uefa Pas Dyshimeve Per Shkelje Rregullore Ndaj Psg

May 08, 2025