Analyzing The Current State Of CoreWeave Stock

Table of Contents

CoreWeave's Financial Performance and Growth Prospects

CoreWeave's financial performance will be a key determinant of its future stock price. Analyzing recent financial reports reveals crucial information about its revenue growth, profitability, and overall financial health. While specific financial data may fluctuate and requires referencing up-to-date reports from reliable sources like the company's investor relations page and SEC filings, key areas to monitor include:

-

Revenue Growth: Look for consistent year-over-year revenue growth, indicating strong market demand for CoreWeave's services. A high growth rate is generally a positive sign for investors. (Source: [Insert Link to Financial Reports]).

-

Profitability: Track CoreWeave's profitability metrics such as gross margin and net income. Positive and growing profitability signifies a sustainable business model. (Source: [Insert Link to Financial Reports]).

-

Debt Levels and Cash Flow: Examine CoreWeave's debt-to-equity ratio and operating cash flow. Low debt and strong cash flow are indicative of financial stability. (Source: [Insert Link to Financial Reports]).

CoreWeave's market share relative to giants like AWS, Google Cloud, and Azure is an important factor. While it may not yet hold a dominant position, its strategic focus on high-performance computing and AI infrastructure positions it for growth in a rapidly expanding market segment.

Future growth potential hinges on several factors, including the burgeoning demand for AI computing and CoreWeave's ability to expand into new markets and forge strategic partnerships.

- Specific revenue figures and year-over-year growth: (Insert data from recent financial reports).

- Key partnerships and collaborations: (List key partnerships, e.g., with specific hardware providers or software companies).

- Projected market size and CoreWeave's anticipated market share: (Insert market size projections and CoreWeave's projected share, citing reputable sources).

Key Risks and Challenges Facing CoreWeave

Despite its growth potential, CoreWeave faces several risks and challenges that investors should carefully consider before investing in CoreWeave stock.

-

Intense Competition: The cloud computing market is fiercely competitive. Established players like AWS, Google Cloud, and Azure possess significant resources and market share. New entrants could also emerge, intensifying competition.

-

Technological Disruptions: Rapid technological advancements could render CoreWeave's current infrastructure obsolete. The company must constantly innovate to stay ahead of the curve.

-

Economic Downturns: Economic recessions can impact demand for cloud computing services, potentially affecting CoreWeave's revenue and profitability.

-

Regulatory Risks: CoreWeave operates in a heavily regulated industry, and compliance with data privacy regulations (e.g., GDPR, CCPA) is critical. Failure to comply could result in significant penalties.

-

Potential impact of new competitors entering the market: (Discuss potential new competitors and their potential impact on CoreWeave's market share).

-

Risks associated with reliance on specific technologies or clients: (Analyze CoreWeave's dependence on specific technologies or large clients).

-

Concerns regarding data security and compliance: (Discuss CoreWeave's data security measures and compliance efforts).

Valuation and Investment Considerations for CoreWeave Stock

Evaluating CoreWeave's stock requires a thorough analysis of its valuation metrics. Factors to consider include:

-

P/E Ratio: Compare CoreWeave's price-to-earnings ratio to those of its competitors. A high P/E ratio may suggest that the stock is overvalued, while a low P/E ratio may indicate undervaluation.

-

Historical Performance and Volatility: Analyze CoreWeave's historical stock price performance and volatility. High volatility can indicate higher risk.

-

Comparison to Competitors: Compare CoreWeave's valuation metrics (P/E ratio, revenue growth, etc.) to those of its main competitors to gauge its relative valuation.

Whether CoreWeave stock is currently undervalued or overvalued depends on various factors and interpretations of financial data and market sentiment. Different investment strategies (value investing, growth investing) will lead to differing conclusions.

- Current stock price and trading volume: (Insert current data).

- Historical price charts and key trend lines: (Provide a chart or link to a chart showcasing historical performance).

- Comparison of key valuation metrics to industry peers: (Compare key metrics to AWS, Google Cloud, and Azure).

Analyst Ratings and Future Outlook for CoreWeave Stock

Analyst ratings and forecasts provide valuable insights into the market's sentiment towards CoreWeave stock. However, it's crucial to remember that analyst opinions can vary, and their predictions aren't guarantees.

- Summary of buy, sell, and hold ratings from reputable analysts: (Summarize ratings from major financial analysts, citing sources).

- Price target ranges provided by analysts: (List the price target ranges given by analysts).

- Key factors driving analyst opinions: (Explain the key reasons driving analysts' positive or negative opinions).

Conclusion: Investing in CoreWeave Stock – A Final Assessment

CoreWeave presents a compelling investment opportunity within the rapidly growing cloud computing and AI infrastructure markets. However, it also faces significant challenges from established competitors and technological disruption. A thorough understanding of its financial performance, growth prospects, valuation, and the risks involved is crucial before making any investment decisions. While the company demonstrates strong potential, the inherent volatility of the tech sector and the competitive landscape necessitate a cautious approach.

Reiterating, the key opportunities lie in CoreWeave’s specialization in high-performance computing and AI, crucial sectors experiencing rapid expansion. The main challenges include fierce competition, regulatory hurdles, and the inherent risks associated with rapidly evolving technology.

Therefore, while the outlook for CoreWeave may be positive for long-term growth, it is vital to conduct thorough due diligence before investing in CoreWeave stock. Understanding the risks and potential rewards associated with CoreWeave stock is crucial for informed decision-making. The future of CoreWeave and its stock price remains dynamic; continued monitoring is essential for investors. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

China Us Trade Surge Exporters Rush To Meet Trade Deal Deadline

May 22, 2025

China Us Trade Surge Exporters Rush To Meet Trade Deal Deadline

May 22, 2025 -

Core Weave Crwv Stock Plunge Understanding Thursdays Decline

May 22, 2025

Core Weave Crwv Stock Plunge Understanding Thursdays Decline

May 22, 2025 -

600 Year Old Chinese Tower Partially Collapses Tourists Scramble For Safety

May 22, 2025

600 Year Old Chinese Tower Partially Collapses Tourists Scramble For Safety

May 22, 2025 -

Gas Prices In Columbus Current Costs And Comparisons

May 22, 2025

Gas Prices In Columbus Current Costs And Comparisons

May 22, 2025 -

De La Suisse A Paris Le Parcours De La Chanteuse Stephane

May 22, 2025

De La Suisse A Paris Le Parcours De La Chanteuse Stephane

May 22, 2025

Latest Posts

-

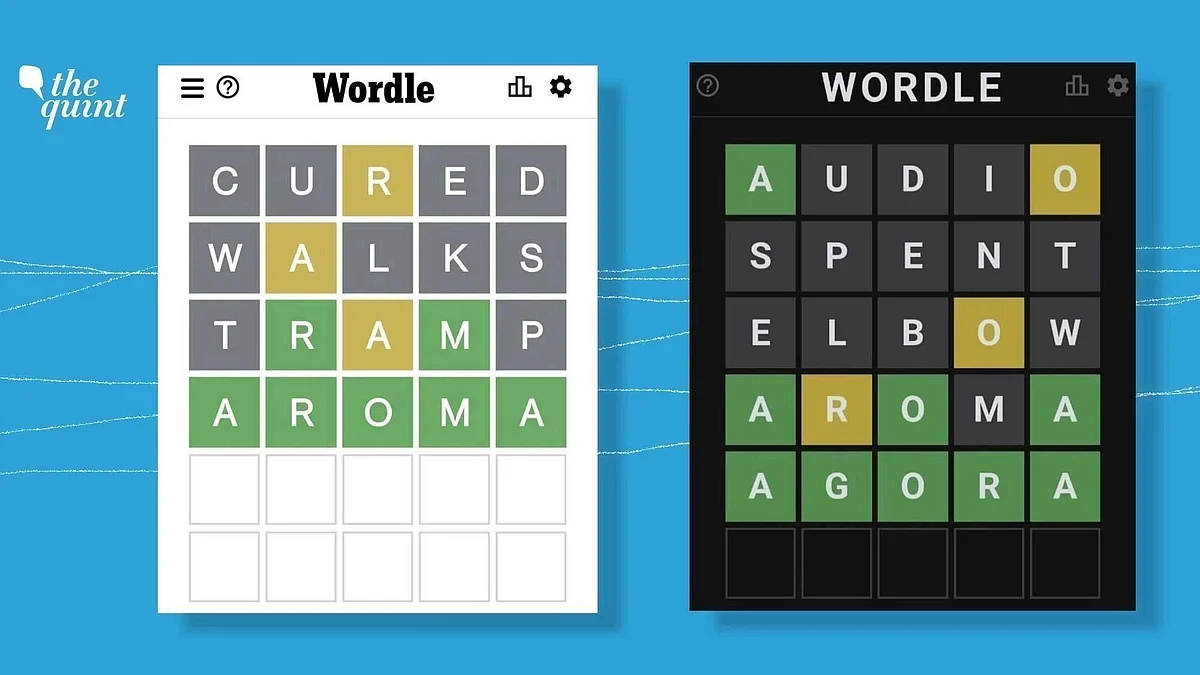

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025 -

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025 -

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025