CoreWeave (CRWV) Stock Plunge: Understanding Thursday's Decline

Table of Contents

Potential Factors Contributing to the CRWV Stock Decline

Several factors likely contributed to the sharp decline in CoreWeave's stock price on Thursday. Understanding these interwoven elements is crucial for investors seeking to navigate the complexities of the CRWV stock market performance.

Impact of Broader Market Trends

The overall market sentiment played a significant role. Thursday saw a downturn in the tech sector, potentially influenced by several factors:

- Rising Interest Rates: Continued interest rate hikes by central banks globally can impact investor confidence and lead to a sell-off in growth stocks like CoreWeave.

- Tech Sector Correction: A broader correction within the technology sector, driven by concerns about valuations and future growth, could have negatively affected CRWV.

- Geopolitical Uncertainty: Global events and uncertainties can create volatility in the stock market, affecting even seemingly stable companies like CoreWeave.

The correlation between these broader market trends and the CRWV stock price drop requires further analysis, but their influence cannot be dismissed.

Analysis of CoreWeave's Recent Announcements and Performance

CoreWeave's recent performance and announcements warrant close examination:

- Earnings Reports: Any recent earnings reports showing weaker-than-expected revenue growth or declining profitability could have triggered negative investor sentiment.

- Product Announcements: The reception of any newly launched products or services could impact investor confidence. Negative reviews or lukewarm market response could contribute to a stock price decline.

- Guidance: Revised guidance from CoreWeave, particularly if it indicated slower future growth, could have fueled the sell-off.

Analyzing CoreWeave's key performance indicators (KPIs) – such as revenue growth, customer acquisition cost, and operating margins – is crucial for a complete understanding of the stock's performance.

Investor Sentiment and Speculation

Investor sentiment and speculation often play a significant role in short-term stock price fluctuations:

- Social Media Sentiment: Negative sentiment expressed on social media platforms, forums, and financial news websites can influence investor decisions, leading to a sell-off.

- Short Selling: Increased short-selling activity could amplify downward pressure on the CRWV stock price.

- Analyst Downgrades: Any negative revisions to analyst ratings or price targets for CoreWeave could contribute to the decline.

Understanding the prevailing investor sentiment towards CoreWeave is vital for interpreting the stock's price movement.

Competitive Landscape and Market Saturation

CoreWeave operates in a highly competitive cloud computing market:

- Established Players: Competition from established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) poses a significant challenge.

- Emerging Competitors: The emergence of new players in the specialized cloud computing market could also intensify competition, impacting CoreWeave's market share.

A detailed comparative analysis of CoreWeave's strengths and weaknesses against its competitors is necessary for a comprehensive assessment of its long-term prospects.

Technical Analysis of the CRWV Stock Chart

Analyzing the CRWV stock chart using technical indicators can provide additional insights:

Chart Patterns and Indicators

The CoreWeave stock chart on Thursday likely revealed specific patterns:

- Candlestick Patterns: Bearish candlestick patterns (e.g., engulfing patterns, bearish hammers) might have indicated a strong downward pressure.

- Volume Changes: High trading volume accompanying the price drop could suggest significant selling pressure.

Technical analysis can help identify potential support and resistance levels.

Support and Resistance Levels

Identifying key support and resistance levels is crucial:

- Breached Support: A break below a crucial support level can trigger further selling, accelerating the decline.

- Resistance Levels: Analyzing previous resistance levels can help determine potential price targets during the downturn.

Visual representation through charts and graphs is essential for understanding these technical aspects.

Conclusion: Navigating the CoreWeave (CRWV) Stock Situation and Future Outlook

Thursday's CoreWeave (CRWV) stock plunge resulted from a combination of broader market trends, CoreWeave's recent performance, investor sentiment, and competitive pressures. Both fundamental analysis (company performance, market conditions) and technical analysis (chart patterns, indicators) are crucial for understanding this volatility. While the future outlook for CoreWeave remains uncertain, a careful evaluation of these factors is vital for informed investment decisions. Before making any investment decisions regarding CoreWeave (CRWV) stock, conduct thorough research and consider consulting with a qualified financial advisor. Further resources on CoreWeave stock price and the cloud computing market are available online, offering deeper analysis to support your investment strategy. Remember to always diversify your portfolio and manage risk appropriately when investing in volatile stocks like CoreWeave.

Featured Posts

-

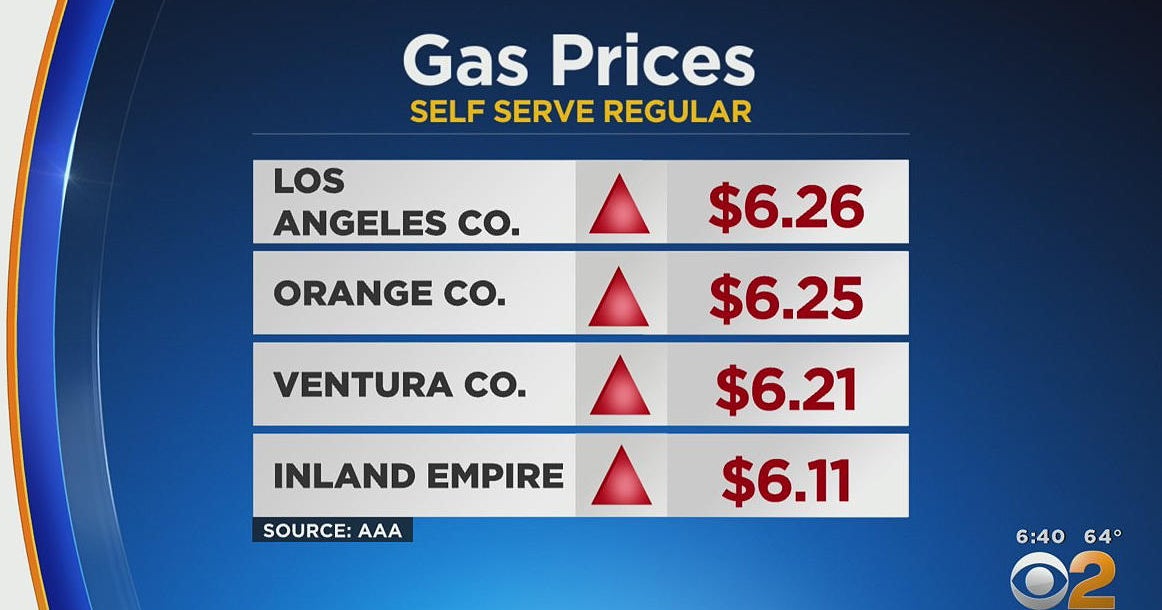

Gas Prices Up 20 Cents Whats Driving The Increase

May 22, 2025

Gas Prices Up 20 Cents Whats Driving The Increase

May 22, 2025 -

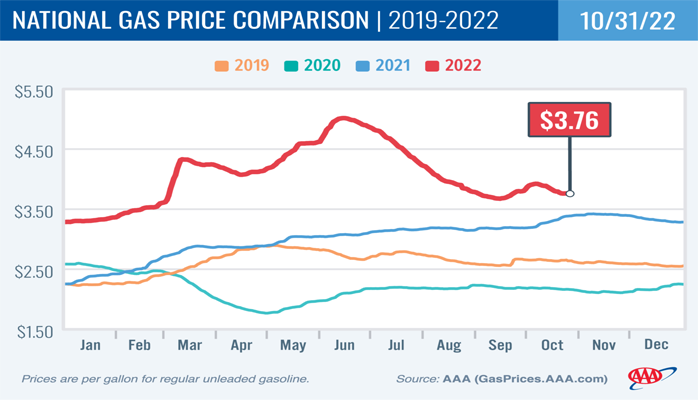

National Average Gas Price Jumps Almost 20 Cents

May 22, 2025

National Average Gas Price Jumps Almost 20 Cents

May 22, 2025 -

Rethinking Middle Management Their Contribution To Company Performance And Employee Satisfaction

May 22, 2025

Rethinking Middle Management Their Contribution To Company Performance And Employee Satisfaction

May 22, 2025 -

Mid Hudson Valley Gas Prices A Recent Spike

May 22, 2025

Mid Hudson Valley Gas Prices A Recent Spike

May 22, 2025 -

Sydney Sweeney And Julianne Moore In Echo Valley First Look At The New Thriller

May 22, 2025

Sydney Sweeney And Julianne Moore In Echo Valley First Look At The New Thriller

May 22, 2025

Latest Posts

-

Remembering Adam Ramey Dropout Kings Vocalist Passes Away At 31

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Passes Away At 31

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Established

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Established

May 22, 2025 -

Dropout Kings Lose Vocalist Adam Ramey A Tragic Loss At 31

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey A Tragic Loss At 31

May 22, 2025 -

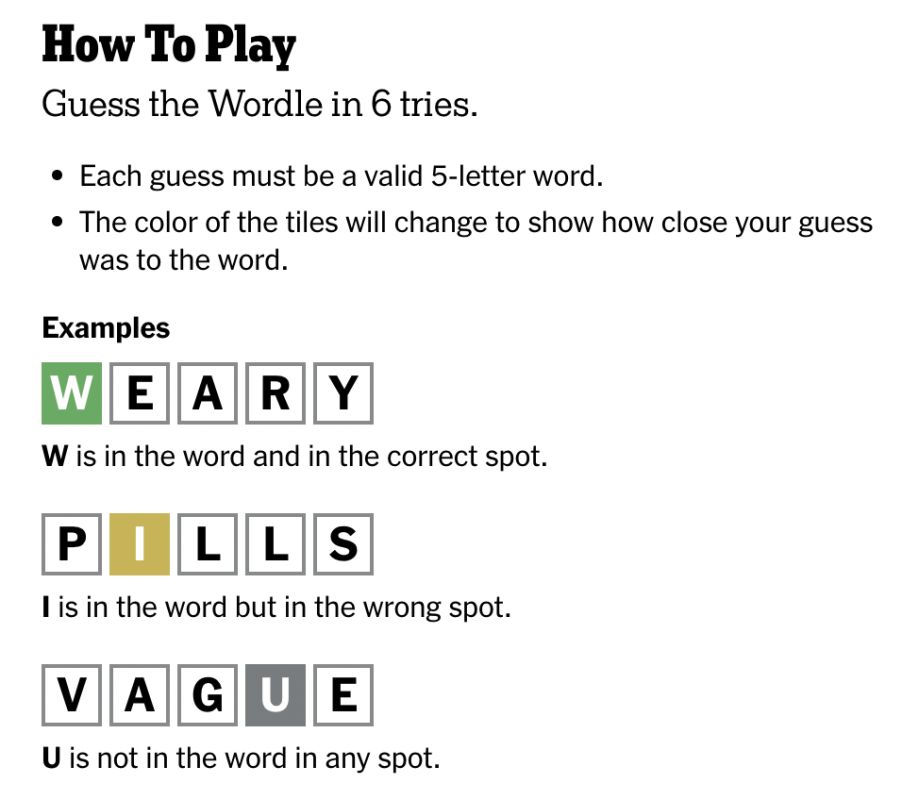

Solve Wordle 1408 Clues And Answer For Sundays Puzzle April 27th

May 22, 2025

Solve Wordle 1408 Clues And Answer For Sundays Puzzle April 27th

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dies By Suicide At 31 Go Fund Me Launched

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dies By Suicide At 31 Go Fund Me Launched

May 22, 2025