Analyzing The Changes In Elon Musk's Net Worth During Trump's First 100 Days

Table of Contents

The first 100 days of Donald Trump's presidency were a period of significant uncertainty and volatility in the global economy. This period also saw notable fluctuations in the net worth of Elon Musk, the visionary behind Tesla and SpaceX. The interplay between Trump's policies, market reactions, and the performance of Musk's companies makes this a fascinating case study in the complex relationship between political events and the fortunes of high-profile individuals. This article analyzes the key factors that contributed to the changes in Elon Musk's net worth during this turbulent time.

The Macroeconomic Climate of Trump's First 100 Days

Initial Market Reactions and Investor Sentiment

Trump's election victory was met with a mixed reaction from the markets. While some sectors anticipated deregulation and economic stimulus, others were concerned about protectionist trade policies and unpredictable governance. This uncertainty significantly impacted investor sentiment and consequently, the stock market. The initial days saw a surge in the Dow Jones Industrial Average, driven by hopes of tax cuts and infrastructure spending. However, this bullish trend wasn't uniform across all sectors.

- Tax Cut Promises: The promise of significant corporate tax cuts fueled optimism in certain sectors, particularly among large corporations.

- Infrastructure Spending Plans: Announcements regarding massive infrastructure investment generated positive expectations for related industries.

- Protectionist Trade Rhetoric: Concerns about potential trade wars and protectionist measures created uncertainty and negatively affected some sectors reliant on international trade.

- Dow Jones Performance: The Dow Jones Industrial Average experienced significant volatility, reaching record highs but also experiencing periods of correction during this period. Precise data regarding the daily fluctuations would require referencing specific financial indices for the timeframe.

This fluctuating macroeconomic climate directly impacted Tesla's stock price, as investor confidence ebbed and flowed with the overall market sentiment and the specifics of the unfolding political landscape.

Regulatory Changes and Their Potential Influence

The potential for regulatory changes under the Trump administration significantly impacted expectations surrounding Tesla and SpaceX. While some anticipated deregulation that could benefit Tesla, others feared changes that could hinder the company's progress.

- Environmental Regulations: Concerns arose regarding potential rollbacks of environmental regulations, which could have impacted Tesla's position as a leader in electric vehicles, although the ultimate impact was less significant than initially feared.

- Automotive Industry Regulations: The auto industry was anticipating changes in fuel efficiency standards and other regulations. Any easing of these regulations could have potentially benefited Tesla, but the actual changes were slower to materialize than some had initially predicted.

- Space Exploration Policy: The Trump administration's focus on space exploration created both opportunities and uncertainties for SpaceX. Increased funding or new contracts could have boosted SpaceX's valuation, but policy changes could also have introduced new risks or complications.

Tesla's Performance During Trump's First 100 Days

Stock Price Volatility and Key Events

Tesla's stock price mirrored the broader market volatility during this period, experiencing significant ups and downs. Several events directly influenced these fluctuations.

- Production Challenges: Reports of production bottlenecks and delays in Model 3 production negatively impacted investor confidence.

- Elon Musk's Tweets: Musk's often controversial tweets, especially those related to production targets and future plans, frequently triggered stock price swings.

- Financial Reports: Quarterly financial reports and announcements of production targets and delivery numbers influenced investor sentiment and subsequently the stock price.

- Product Announcements: New product announcements and updates also impacted the stock price, depending on how they were received by investors and analysts. A visual representation of Tesla's stock price during this 100-day period would be highly beneficial here (chart or graph).

Production Targets and Market Share

Tesla's ambitious production targets for the Model 3 were a key focus during these 100 days. The company's success (or lack thereof) in meeting these targets directly impacted its stock price and market valuation.

- Model 3 Production: The ramp-up of Model 3 production was crucial, and any delays or production shortfalls significantly affected investor confidence.

- Market Share Competition: Tesla's competitive position within the electric vehicle market remained a significant factor influencing its stock price and overall valuation within the broader automotive industry.

- Production Numbers: Precise data on the number of vehicles produced and delivered during this period is essential for a complete picture of Tesla's performance.

SpaceX's Contributions (or Lack Thereof) to Musk's Net Worth

SpaceX Contracts and Funding

SpaceX's activities during Trump's first 100 days had a less direct and immediately apparent impact on Musk's net worth compared to Tesla. However, securing major contracts or funding rounds would have certainly had a positive influence.

- NASA Contracts: Any new contracts awarded to SpaceX by NASA or other governmental agencies would have positively impacted its valuation and, by extension, Musk's net worth.

- Commercial Launches: The number and success of commercial satellite launches would also have had an effect, though perhaps less dramatic than major government contracts.

- Funding Rounds: While less directly related to the Trump administration, any significant funding rounds for SpaceX during this period would have increased Musk's net worth.

Impact of Space Exploration Policy

The Trump administration's renewed focus on space exploration could have had a positive influence on SpaceX's future prospects. While the immediate impact on Musk's net worth might have been limited during the initial 100 days, long-term implications were significant.

- Increased Budget Allocations: Increased budget allocations to NASA or other space agencies would likely have created more opportunities for SpaceX to secure contracts in the future.

- Policy Changes: Specific policy changes related to space exploration could have either helped or hindered SpaceX's growth and long-term prospects.

Other Factors Affecting Elon Musk's Net Worth

Personal Investments and Diversification

Musk's personal investments and holdings outside of Tesla and SpaceX could also have contributed to or offset changes in his overall net worth.

- Other Ventures: Details about any other investments or entrepreneurial activities would need to be included to provide a complete assessment.

- Stock Holdings: Fluctuations in the value of other stocks held by Musk would impact his net worth.

Public Perception and Media Influence

Public perception of Elon Musk and his companies significantly influences their stock prices and valuations. Negative media coverage or controversies could negatively affect his net worth.

- News Stories: Significant news stories, both positive and negative, surrounding Elon Musk, Tesla, and SpaceX would have directly impacted investor sentiment and the overall valuation of his holdings.

- Social Media: Social media trends and public opinion expressed on platforms like Twitter significantly impacted the perception of the companies and therefore Elon Musk's net worth.

Conclusion

The fluctuations in Elon Musk's net worth during Trump's first 100 days were a complex interplay of several factors. Macroeconomic conditions, Tesla's production challenges and stock price volatility, SpaceX's ongoing progress, public perception, and Musk's personal investments all played significant roles. Analyzing the specific events and data from this period provides valuable insights into the intricate relationship between political climates, market dynamics, and the fortunes of high-profile individuals. To further your understanding of Elon Musk's net worth and its relationship to political and economic events, research specific events during this period, explore detailed financial data, and conduct a deeper analysis using keywords like "Elon Musk net worth analysis," "Trump administration economic policy impact," "Tesla stock price fluctuations," and "SpaceX funding."

Featured Posts

-

Frantsiya Polsha Klyuchevye Punkty Novogo Soglasheniya

May 09, 2025

Frantsiya Polsha Klyuchevye Punkty Novogo Soglasheniya

May 09, 2025 -

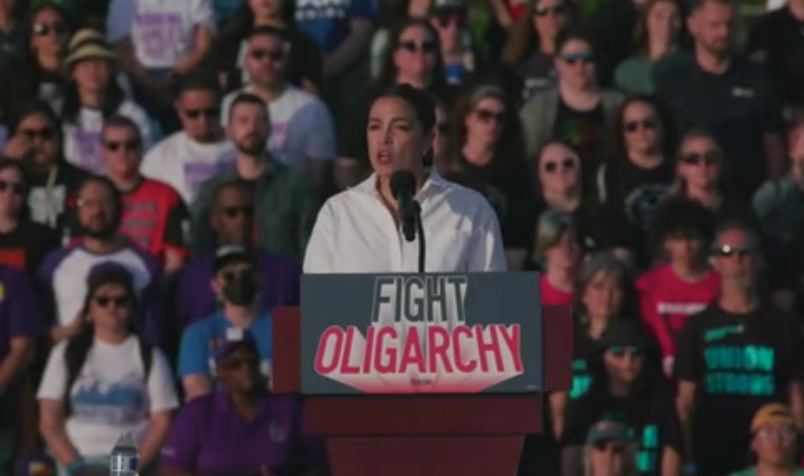

Aocs Brutal Fact Check Of Foxs Jeanine Pirro Full Story

May 09, 2025

Aocs Brutal Fact Check Of Foxs Jeanine Pirro Full Story

May 09, 2025 -

Uk Citys Transformation Caravan Dwellers And Growing Concerns

May 09, 2025

Uk Citys Transformation Caravan Dwellers And Growing Concerns

May 09, 2025 -

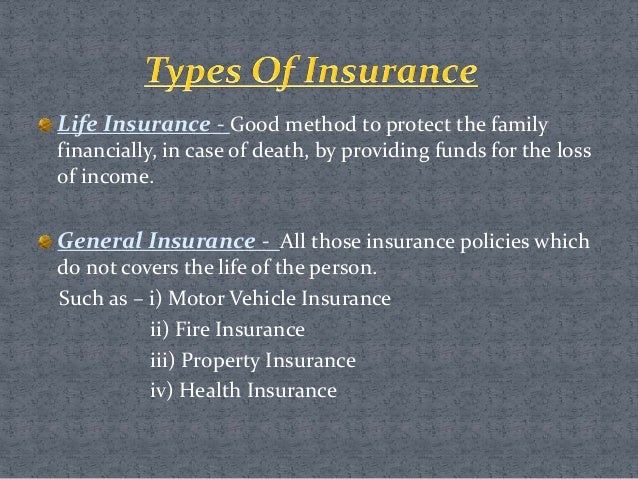

Indian Insurance Sector Seeks Bond Forward Regulatory Reform

May 09, 2025

Indian Insurance Sector Seeks Bond Forward Regulatory Reform

May 09, 2025 -

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 09, 2025

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 09, 2025