Indian Insurance Sector Seeks Bond Forward Regulatory Reform

Table of Contents

Current Regulatory Landscape and its Limitations

The existing regulatory framework governing bond forward contracts in India presents several limitations that stifle the growth and efficient functioning of the bond forward market for insurance companies. While the Reserve Bank of India (RBI) oversees overall financial market regulation, specific guidelines concerning the use of bond forwards by insurers are fragmented and lack clarity. This ambiguity creates significant legal hurdles and market inefficiencies. The current regulatory landscape suffers from:

- Lack of clear guidelines on permissible usage of bond forwards by insurance companies: The absence of explicit rules leaves insurers uncertain about the extent to which they can utilize bond forwards for hedging and other risk management purposes.

- Restrictions on hedging strategies using bond forwards: Current restrictions limit the types of hedging strategies insurers can employ, hindering their ability to effectively manage their interest rate exposure.

- Limited access to necessary infrastructure and clearing mechanisms: A lack of robust infrastructure and clearing mechanisms increases transaction costs and operational risks, making bond forwards less attractive to insurers.

- High transaction costs associated with bond forwards: The high costs associated with trading bond forwards in the current environment further discourage their use by insurance companies. This creates liquidity constraints within the market.

The Need for Regulatory Reform and its Benefits

Regulatory reform is not merely desirable; it's crucial for the development of a robust and dynamic bond forward market in India. A streamlined regulatory environment will significantly benefit the Indian insurance sector by:

- Improving risk management capabilities for insurance companies: Clearer regulations will empower insurers to effectively manage interest rate risk, improving their financial stability and protecting policyholders' interests.

- Increasing investment opportunities and higher returns: A more efficient bond forward market will open up new investment avenues for insurers, potentially leading to higher returns on investment.

- Enhancing market efficiency and reduced transaction costs: Improved infrastructure and streamlined processes will reduce transaction costs and enhance the overall efficiency of the bond forward market.

- Attracting greater foreign investment in the Indian insurance sector: A well-regulated bond forward market will attract more foreign investment, contributing to the growth and development of the Indian insurance market.

Specific Areas Requiring Regulatory Attention

To achieve a truly robust and efficient bond forward market, the Indian regulatory authorities need to address several specific areas:

- Defining permissible hedging strategies for insurance companies using bond forwards: Clear guidelines are necessary to define the permissible hedging strategies insurers can use, allowing them to employ appropriate risk management techniques.

- Establishing robust clearing and settlement mechanisms: Efficient clearing and settlement mechanisms are essential to reduce counterparty risk and enhance market transparency.

- Introducing standardized contract terms and conditions: Standardized contracts will reduce ambiguity and promote fairness in the bond forward market.

- Strengthening the regulatory oversight of market participants: Enhanced oversight will ensure market integrity and protect investors from fraudulent activities.

International Best Practices and Lessons Learned

Examining international best practices in regulating bond forward markets offers valuable insights for India. Developed markets like the United Kingdom and the United States have established sophisticated regulatory frameworks for over-the-counter (OTC) derivatives, including bond forwards. A comparative analysis of these regulatory models can inform the design of a suitable framework for the Indian context. Key lessons learned include the importance of:

- Clear and concise regulations: Ambiguity should be avoided to ensure regulatory clarity.

- Effective oversight mechanisms: Robust oversight is crucial to prevent market manipulation and fraud.

- Strong risk assessment frameworks: A comprehensive framework is necessary for effective risk management.

- Well-defined roles and responsibilities: Clearly defined roles and responsibilities for market participants and regulators are vital for a smooth-functioning market.

Driving Forward Regulatory Reform in the Indian Insurance Sector

The arguments for regulatory reform in the Indian bond forward market are compelling. A reformed regulatory environment will significantly improve risk management capabilities within the Indian insurance sector, attract foreign investment, and enhance market efficiency. Policymakers and stakeholders must take immediate steps to address the current shortcomings and implement the necessary reforms. This includes providing regulatory clarity, modernizing regulations, liberalizing the market, and fostering the development of a vibrant bond forward market. By embracing these changes, India can unlock the full potential of the bond forward market, strengthening its insurance sector and contributing to the overall growth of its economy. The time for action is now – let's drive forward regulatory reform in the Indian bond forward market.

Featured Posts

-

North Carolina Daycare Suspension The Wfmy News 2 Story

May 09, 2025

North Carolina Daycare Suspension The Wfmy News 2 Story

May 09, 2025 -

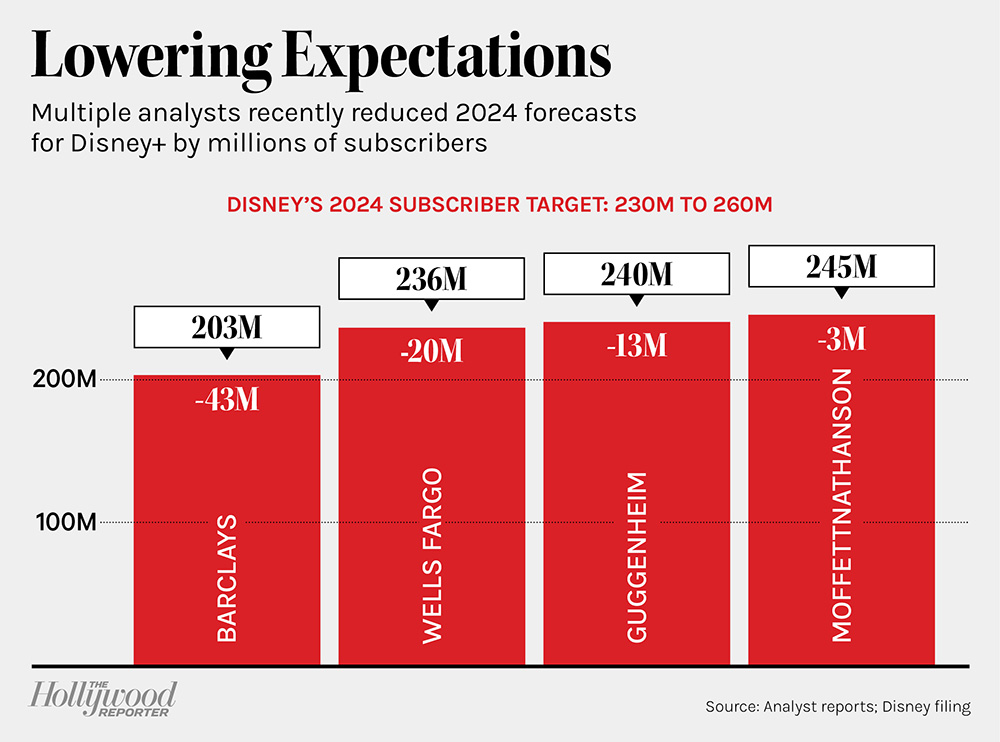

Strong Parks And Streaming Boost Disneys Profit Forecast

May 09, 2025

Strong Parks And Streaming Boost Disneys Profit Forecast

May 09, 2025 -

Leon Draisaitl Injury Oilers Leading Scorer Exits Game

May 09, 2025

Leon Draisaitl Injury Oilers Leading Scorer Exits Game

May 09, 2025 -

Draisaitl Hellebuyck And Kucherov 2023 Hart Trophy Finalists

May 09, 2025

Draisaitl Hellebuyck And Kucherov 2023 Hart Trophy Finalists

May 09, 2025 -

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025