Analyzing QBTS Stock's Potential Response To Upcoming Earnings

Table of Contents

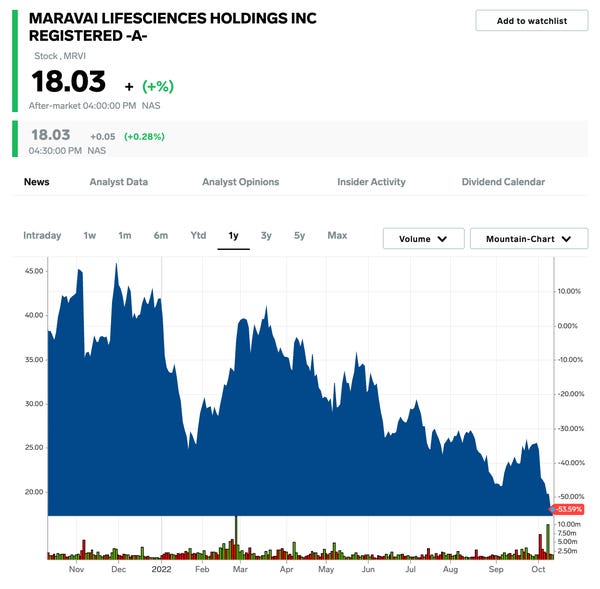

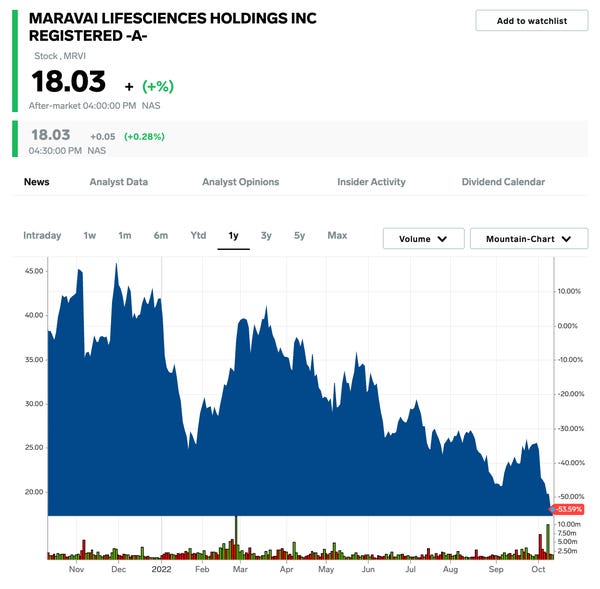

Reviewing QBTS's Recent Performance and Financial Trends

Understanding QBTS's recent financial health is critical for predicting its reaction to the upcoming earnings announcement. Let's examine several key metrics:

Key Financial Metrics to Watch:

-

Revenue Growth (YoY and QoQ): Analyzing year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth reveals the company's trajectory. A consistent upward trend indicates strong performance, while a decline warrants closer scrutiny. Investors should compare reported figures to analyst expectations to gauge market reaction potential.

-

Earnings Per Share (EPS): EPS is a fundamental metric reflecting QBTS's profitability per share. Significant deviations from expectations—both positive and negative—can significantly impact the stock price. A positive surprise often leads to a price increase, while a miss can result in a decline.

-

Profit Margins: Analyzing gross profit margins, operating margins, and net profit margins helps assess QBTS's efficiency and profitability. Improving margins suggest increased operational effectiveness, a positive indicator for investors.

-

Cash Flow: Examining operating cash flow, investing cash flow, and free cash flow reveals QBTS's liquidity and ability to generate cash. Strong cash flow is generally a positive sign, indicating financial stability.

-

Debt Levels: The company's debt-to-equity ratio and overall debt burden are important indicators of financial risk. High levels of debt can raise concerns among investors, potentially impacting the stock price negatively.

Market Sentiment and Analyst Predictions:

Before the earnings release, it's crucial to assess market sentiment toward QBTS. This includes:

-

Analyst Ratings and Price Targets: Reviewing recent analyst ratings (buy, hold, sell) and price targets provides a sense of market expectations. A consensus of positive ratings might suggest a bullish outlook.

-

Recent News and Events: Any significant news impacting QBTS (new product launches, partnerships, regulatory changes) should be considered as these can influence investor sentiment and the stock's price.

-

Overall Market Conditions: The broader economic climate plays a role. A strong overall market might cushion the blow of a disappointing earnings report, while a weak market could exacerbate negative reactions.

Factors Influencing QBTS Stock's Post-Earnings Reaction

The market's response to QBTS's earnings will depend on several interacting factors:

Impact of Earnings Beat or Miss:

-

Exceeding Expectations: If QBTS surpasses analyst expectations, a positive market reaction is likely, potentially leading to a significant price increase. The magnitude of the beat will influence the strength of this response.

-

Falling Short of Expectations: Conversely, missing expectations could trigger a sell-off, causing the stock price to decline. The severity of the miss will determine the extent of the price drop.

-

Guidance: Management's guidance for future quarters is critical. Positive guidance often outweighs a minor earnings miss, while negative guidance can overshadow even a strong earnings beat. Analyzing past earnings reports and the market's response can provide insight into how QBTS historically reacts to earnings surprises and guidance.

The Role of Market Context:

The broader market environment plays a significant role:

-

Economic Climate: A strong economy generally supports positive stock performance, while a recessionary environment can negatively impact even well-performing companies like QBTS.

-

Competition and Sector Trends: The performance of QBTS's competitors and overall sector trends influence investor sentiment. Strong competitor performance might overshadow QBTS's positive results, while a sector downturn could negatively impact the stock price regardless of QBTS’s performance.

-

Geopolitical Events and Macroeconomic Factors: Unexpected geopolitical events (wars, trade disputes) or significant macroeconomic shifts (interest rate hikes, inflation) can influence investor risk appetite and impact QBTS's stock regardless of its earnings.

Strategies for Investors Considering QBTS Stock

Investors should carefully consider both the opportunities and risks:

Risk Assessment and Mitigation:

-

Inherent Risks: Investing in QBTS, or any stock, involves inherent risks. These include market volatility, company-specific risks (e.g., competition, regulatory changes), and macroeconomic risks.

-

Risk Management Strategies: Diversification (spreading investments across different assets) and using stop-loss orders (automatic sell orders triggered at a predetermined price) can help mitigate potential losses.

-

Due Diligence: Thorough research is essential before investing. This involves analyzing financial statements, understanding the company's business model, and assessing the competitive landscape.

Trading Strategies Based on Earnings Report:

-

Trading Strategies: Different trading strategies can be employed depending on the anticipated outcome (beat, miss, meet expectations). For example, a conservative approach might involve buying shares before the earnings announcement if the outlook is positive and holding them for the long term.

-

Long-Term vs. Short-Term: Long-term investors may focus on fundamental analysis and the company's long-term growth prospects, while short-term traders might exploit short-term price fluctuations based on the earnings report.

-

Avoid Impulsive Decisions: It's crucial to avoid making impulsive trading decisions solely based on the earnings announcement. Consider the broader context and your overall investment strategy.

Conclusion: Preparing for QBTS Earnings and Making Informed Decisions

Analyzing QBTS stock's potential response to upcoming earnings requires considering several interconnected factors: the company's financial performance, analyst predictions, market sentiment, and the broader economic environment. Remember to conduct your own thorough research and understand the inherent risks involved before making any investment decisions. Assess QBTS's earnings impact carefully and understand QBTS's stock's response to previous reports to build a more accurate prediction. Stay informed and analyze QBTS stock’s potential response to the upcoming earnings to make well-informed investment decisions.

Featured Posts

-

Taiwans Energy Transition Increased Reliance On Lng Imports

May 21, 2025

Taiwans Energy Transition Increased Reliance On Lng Imports

May 21, 2025 -

Dexter Original Sin Steelbook Is It Worth The Buy Before Dexter New Blood

May 21, 2025

Dexter Original Sin Steelbook Is It Worth The Buy Before Dexter New Blood

May 21, 2025 -

Vanja Mijatovic Zvanicno Promenila Ime

May 21, 2025

Vanja Mijatovic Zvanicno Promenila Ime

May 21, 2025 -

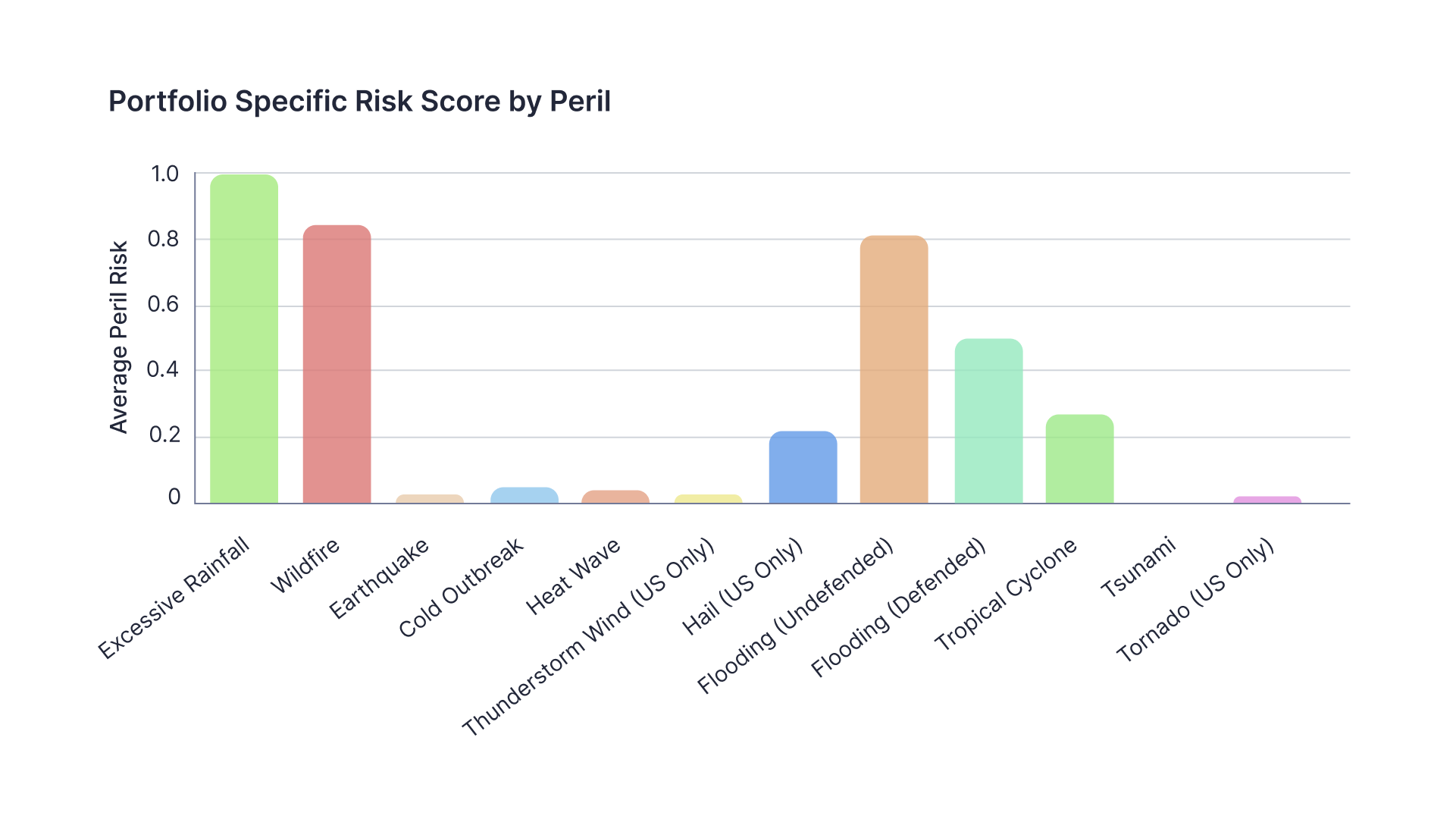

Assessing Climate Risk Before Applying For A Home Loan

May 21, 2025

Assessing Climate Risk Before Applying For A Home Loan

May 21, 2025 -

Is Canada Post Facing Bankruptcy A Report Recommends Ending Door To Door Mail Service

May 21, 2025

Is Canada Post Facing Bankruptcy A Report Recommends Ending Door To Door Mail Service

May 21, 2025

Latest Posts

-

Manchester City Eyeing Arsenal Great To Replace Pep Guardiola A Detailed Look

May 22, 2025

Manchester City Eyeing Arsenal Great To Replace Pep Guardiola A Detailed Look

May 22, 2025 -

Report Manchester City Targets Arsenal Legend As Potential Guardiola Replacement

May 22, 2025

Report Manchester City Targets Arsenal Legend As Potential Guardiola Replacement

May 22, 2025 -

Pep Guardiolas Successor Is A Former Arsenal Star The Top Candidate For Manchester City

May 22, 2025

Pep Guardiolas Successor Is A Former Arsenal Star The Top Candidate For Manchester City

May 22, 2025 -

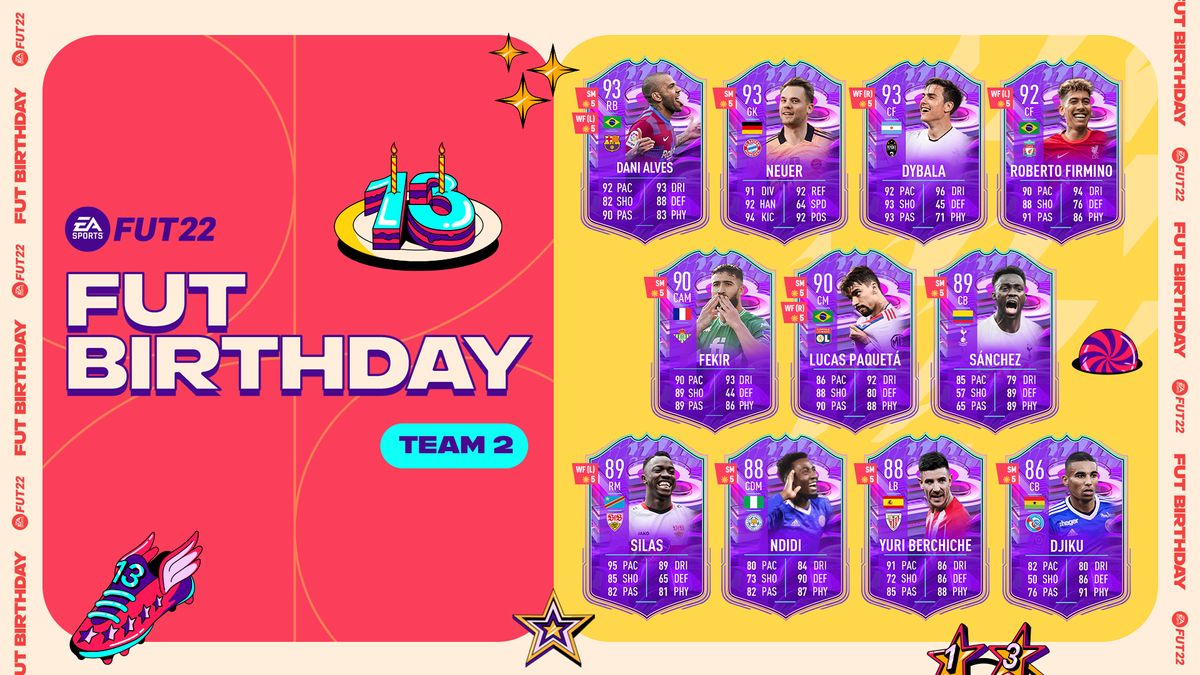

Ea Fc 24 Fut Birthday Tier List Of The Best Players For Your Squad

May 22, 2025

Ea Fc 24 Fut Birthday Tier List Of The Best Players For Your Squad

May 22, 2025 -

Best Ea Fc 24 Fut Birthday Cards A Complete Tier List Guide

May 22, 2025

Best Ea Fc 24 Fut Birthday Cards A Complete Tier List Guide

May 22, 2025