Assessing Climate Risk Before Applying For A Home Loan

Table of Contents

Understanding the Types of Climate Risks

Climate change presents a multitude of risks to homeowners, impacting property values, insurance costs, and even habitability. Understanding these risks is the first step in making an informed decision about your home purchase. The major climate risks you should consider include flooding, wildfires, extreme heat, sea-level rise, and drought. Failing to account for these factors can lead to significant financial burdens and unforeseen challenges in the future.

Flood Risk Assessment

Flood risk is a significant concern for many prospective homeowners. Utilizing resources like FEMA's flood maps (floodmap.fema.gov) is crucial. These maps provide detailed information about flood zones and the likelihood of flooding in specific areas. However, FEMA maps aren't the only source; community-specific flood risk data often offers more granular detail. Always check historical flood records for the property itself – even if the property isn't officially in a designated flood zone, past flooding incidents indicate potential future vulnerability. Consider the property's elevation and proximity to waterways, rivers, and coastlines.

- Look for evidence of past flooding: Check with neighbors or local authorities.

- Check insurance rates related to flood risk: Higher premiums signal higher risk.

- Consider elevation certificates: These documents provide precise elevation data, crucial for flood insurance assessments.

Wildfire Risk Assessment

Wildfire risk is escalating in many regions. Online tools and resources from organizations like your local fire department, the National Fire Protection Association (NFPA), and state forestry agencies can help determine your area's wildfire risk. Analyze factors like vegetation density and the property's proximity to wildlands. Understanding local fire prevention and suppression efforts is also vital. A property surrounded by dense, dry vegetation presents a much higher risk than one with well-maintained landscaping and defensible space.

- Check local fire department records: Inquire about past wildfires and fire suppression efforts in your target area.

- Examine building materials and defensible space: Non-flammable materials and cleared landscaping can significantly reduce wildfire risk.

- Consider home insurance related to wildfire risk: Insurance premiums for properties in high-risk areas are often significantly higher.

Assessing Risk from Extreme Heat and Drought

Extreme heat and drought significantly impact property values and infrastructure. Extreme heat can damage buildings, increase energy costs, and reduce comfort levels. Drought leads to water scarcity, impacting landscaping, agriculture, and potentially even municipal water supplies.

- Investigate water resource management in the area: Understand the region's water supply and potential for future restrictions.

- Consider future water restrictions and costs: Water scarcity can lead to higher water bills and limits on outdoor water use.

- Assess the vulnerability of landscaping and outdoor structures: Drought-resistant landscaping can mitigate some of the impacts of prolonged dry periods.

Sea-Level Rise and Coastal Erosion

For coastal properties, sea-level rise and coastal erosion are serious concerns. Research projections for sea-level rise in your area using NOAA (National Oceanic and Atmospheric Administration) data and other reputable sources. Analyze the risk of coastal erosion and its potential to diminish property value or even render a property uninhabitable.

- Consult with coastal specialists or engineers: They can provide professional assessments of coastal erosion risk.

- Research local adaptation plans and seawalls: Understand what measures are in place to mitigate sea-level rise and erosion.

- Consider the long-term implications of erosion: Erosion can significantly reduce property size and value over time.

Incorporating Climate Risk into Your Home Buying Decision

Your climate risk assessment directly affects your home choice. Properties in high-risk areas might require more significant upfront investments for mitigation measures or may carry higher insurance costs. Openly disclosing climate risks to your lender is crucial. Transparency is key to building trust and securing the best possible loan terms.

Impact on Home Loan Approval

Lenders are increasingly factoring climate risk into their underwriting process. Properties in high-risk areas might face higher interest rates or even loan denial. A comprehensive climate risk assessment report can strengthen your application and demonstrate your awareness of potential risks.

- Be transparent about climate risks with your lender: Don't hide information; open communication is essential.

- Consider obtaining a climate risk assessment report: This professional assessment provides objective data to support your application.

- Explore loan options specifically designed for high-risk areas (if available): Some lenders offer specialized programs for properties in climate-vulnerable zones.

Insurance Implications

Homeowners insurance premiums in high-risk areas are often significantly higher. Securing adequate coverage can be challenging, and some insurers may refuse coverage altogether in extremely vulnerable locations.

- Compare home insurance quotes from different providers: Shop around to find the best rates and coverage.

- Consider supplemental flood or wildfire insurance: These policies provide added protection against specific climate-related risks.

- Understand policy limitations related to climate risks: Review your policy carefully to understand what is and isn't covered.

Resources for Assessing Climate Risk

Several reputable organizations and online tools provide crucial climate risk information.

- FEMA (Federal Emergency Management Agency): Provides flood maps and related resources (floodmap.fema.gov).

- NOAA (National Oceanic and Atmospheric Administration): Offers data on sea-level rise, extreme weather events, and other climate-related information (www.noaa.gov).

- ClimateCheck: Provides climate risk scores for individual properties (www.climatecheck.com). (Note: Check for similar providers in your region.)

Utilize interactive mapping tools: Many websites provide interactive maps displaying climate risk data. Access publicly available data on climate projections: Government agencies and research institutions publish valuable information. Consult with climate change experts or environmental consultants: Professional assessments can provide in-depth analysis.

Conclusion

Assessing climate risk before applying for a home loan is crucial for protecting your financial investment and ensuring long-term security. By understanding the various types of climate risks and utilizing available resources, you can make informed decisions that mitigate potential future losses. Don't underestimate the importance of proactive planning; taking the time to thoroughly assess climate risk before you apply for a home loan can save you significant financial and emotional stress in the years to come. Begin your due diligence today and ensure you're prepared to make a smart, climate-conscious decision concerning your home loan. Conduct a thorough climate risk assessment and secure your future.

Featured Posts

-

Investing In Ai 12 Top Stocks Based On Reddit Discussion

May 21, 2025

Investing In Ai 12 Top Stocks Based On Reddit Discussion

May 21, 2025 -

Why Invest In Middle Management A Return On Investment For Companies And Employees

May 21, 2025

Why Invest In Middle Management A Return On Investment For Companies And Employees

May 21, 2025 -

Gangsta Granny David Walliams Celebrated Childrens Book

May 21, 2025

Gangsta Granny David Walliams Celebrated Childrens Book

May 21, 2025 -

Half Dome Secures Abn Group Victoria Account

May 21, 2025

Half Dome Secures Abn Group Victoria Account

May 21, 2025 -

Antiques Roadshow Leads To Arrest American Couple Detained In Britain

May 21, 2025

Antiques Roadshow Leads To Arrest American Couple Detained In Britain

May 21, 2025

Latest Posts

-

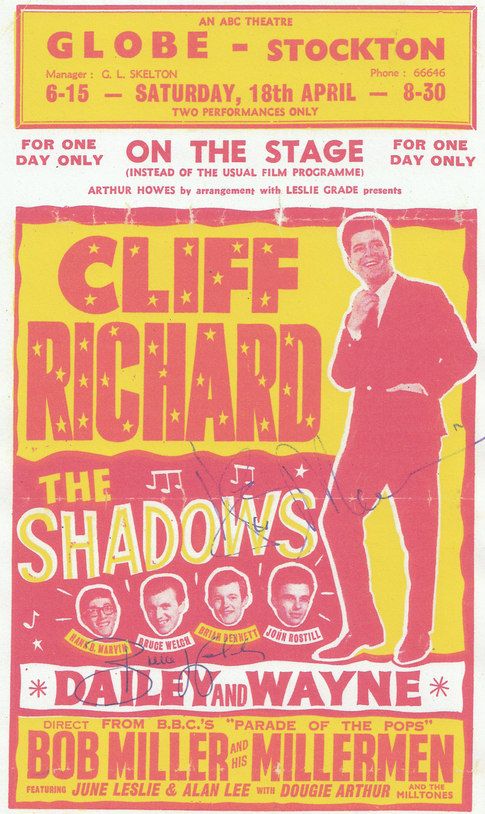

Unexpected Twist Challenges In Matt Lucas And David Walliams Cliff Richard Project

May 21, 2025

Unexpected Twist Challenges In Matt Lucas And David Walliams Cliff Richard Project

May 21, 2025 -

A Problem For The Matt Lucas And David Walliams Cliff Richard Musical

May 21, 2025

A Problem For The Matt Lucas And David Walliams Cliff Richard Musical

May 21, 2025 -

Cliff Richard Musical By Matt Lucas And David Walliams Faces A Setback

May 21, 2025

Cliff Richard Musical By Matt Lucas And David Walliams Faces A Setback

May 21, 2025 -

Gangsta Granny Activities And Resources For Kids

May 21, 2025

Gangsta Granny Activities And Resources For Kids

May 21, 2025 -

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025