Analyzing Palantir Stock Before The May 5th Earnings Release

Table of Contents

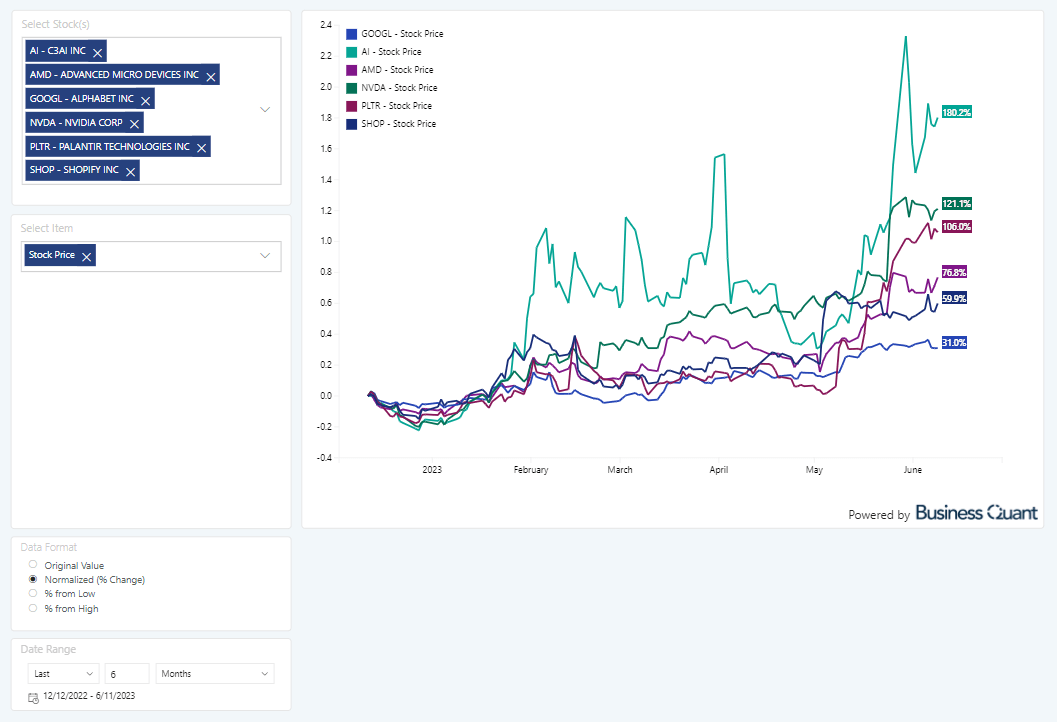

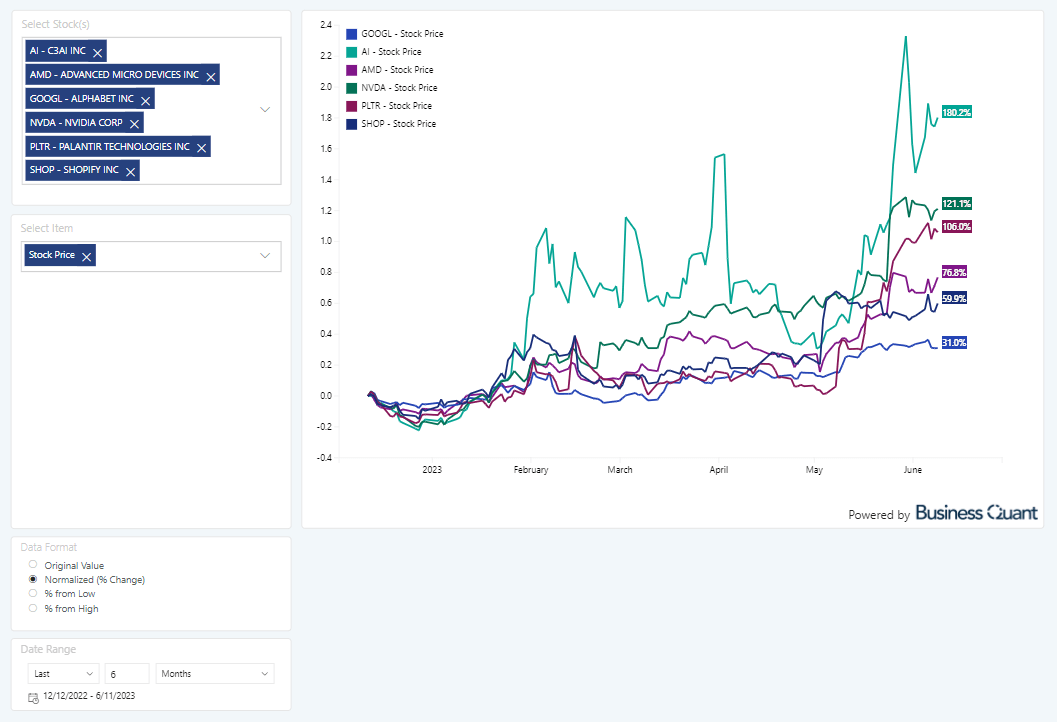

Recent Palantir Performance and Market Trends

Q4 2022 Earnings Recap

Palantir's Q4 2022 earnings report revealed a mixed bag. While the company exceeded revenue expectations, driven by strong growth in its government business, profitability remained a concern for some analysts. Revenue growth was impressive, exceeding projections, showcasing continued demand for Palantir's data analytics platform. However, the net income fell short of expectations, prompting a slight dip in the stock price immediately following the release. Key takeaways included:

- Strong Revenue Growth: Palantir demonstrated robust revenue growth in Q4 2022, surpassing analyst predictions. This positive trend signals continued market demand for its data analytics solutions.

- Profitability Concerns: While revenue was strong, the company's profitability metrics didn't fully meet expectations, raising some concerns about long-term sustainability. Further analysis of operating margin is needed before drawing firm conclusions.

- Government Sector Strength: The government sector continued to be a significant driver of Palantir's revenue growth. This sector's consistent performance provides a solid foundation for future growth.

Post-Q4 2022, several press releases highlighted new partnerships and contract wins, suggesting continued momentum. Understanding these developments is crucial when analyzing Palantir Q4 earnings, Palantir revenue growth, and Palantir profitability before the upcoming release.

Overall Market Sentiment Towards Palantir

Current market sentiment towards Palantir is cautiously optimistic. Recent stock price movements have shown volatility, reflecting investor uncertainty about the company's long-term profitability. Trading volume has been relatively high, suggesting active engagement from both buyers and sellers. Analyst ratings are varied, with some maintaining a positive outlook while others express reservations concerning the company's path to sustained profitability. Keeping a close watch on Palantir stock price, Palantir analyst ratings, and Palantir trading volume is crucial.

Competitor Analysis

Palantir faces competition from established players in the data analytics and artificial intelligence markets. Companies like AWS, Microsoft, and Google offer competing solutions, presenting both challenges and opportunities for Palantir. The competitive landscape is dynamic, with ongoing innovation and market consolidation. Understanding Palantir competitors and the Palantir competitive landscape is essential for assessing its future prospects.

Key Metrics to Watch for in the May 5th Earnings Release

Revenue Growth

Palantir revenue growth is a paramount indicator of the company's success. Analysts will scrutinize the reported figures for Q1 2023, comparing them to previous quarters and forecasting future growth. A strong upward trend in Palantir revenue growth forecast would likely boost investor confidence.

Profitability and Margins

Sustained profitability and margin expansion are critical for Palantir's long-term viability. Investors will closely examine the company's Palantir profitability and Palantir operating margin to assess its ability to generate consistent profits.

Customer Acquisition and Retention

The rate of Palantir customer acquisition and Palantir customer churn are key indicators of the health of the company's business. High customer acquisition coupled with low churn would signal a positive trend.

Guidance for Future Quarters

Management's Palantir guidance for future quarters will provide valuable insight into the company's expectations and outlook. This Palantir future outlook will significantly impact the stock price reaction after the earnings release.

Potential Risks and Opportunities for Palantir Investors

Geopolitical Risks

Palantir's international operations expose it to Palantir geopolitical risk. Geopolitical instability or changes in government policies could impact its business operations. Furthermore, its Palantir international expansion strategies need careful monitoring.

Technological Disruptions

Rapid technological advancements could disrupt Palantir's market position. The company must continuously innovate to maintain its competitive edge, addressing potential Palantir technological disruption.

Regulatory Scrutiny

Palantir operates in a heavily regulated industry, making it susceptible to Palantir regulation and Palantir compliance issues. Any regulatory changes or investigations could significantly impact its operations.

Growth Opportunities

Despite the risks, Palantir possesses significant growth potential across various sectors. The company's data analytics platform is applicable to numerous industries, presenting substantial Palantir growth opportunities and potential for Palantir market expansion.

Conclusion: Preparing for Palantir's May 5th Earnings Release

Analyzing Palantir stock before its May 5th earnings release requires a thorough assessment of its recent performance, market trends, key metrics, and potential risks and opportunities. Understanding the factors discussed above – from revenue growth and profitability to geopolitical risks and growth opportunities – is crucial for making informed investment decisions. Remember to conduct your own thorough research and consider consulting a financial advisor before making any investment choices. Continue your Palantir stock analysis and stay informed about the upcoming earnings release to make well-informed investment decisions.

Featured Posts

-

Golden Knights Beat Red Wings Hertl Scores Two Hat Tricks In One Month

May 09, 2025

Golden Knights Beat Red Wings Hertl Scores Two Hat Tricks In One Month

May 09, 2025 -

Young Thugs Uy Scuti Release Date Hints Dropped

May 09, 2025

Young Thugs Uy Scuti Release Date Hints Dropped

May 09, 2025 -

Jeanine Pirros Stock Market Forecast A Few Weeks Of Caution

May 09, 2025

Jeanine Pirros Stock Market Forecast A Few Weeks Of Caution

May 09, 2025 -

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025 -

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 09, 2025

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 09, 2025