Jeanine Pirro's Stock Market Forecast: A Few Weeks Of Caution?

Table of Contents

Jeanine Pirro, a prominent television personality known for her outspoken views, has recently shared her perspective on the current stock market, suggesting a period of caution. Her pronouncements, while not formal financial analysis, often garner significant attention. This article delves into Jeanine Pirro's stock market forecast, examining the potential reasons behind her "few weeks of caution" prediction and exploring alternative viewpoints. We'll analyze the economic indicators she may have considered and discuss the implications for investors.

Key Economic Indicators Mentioned by Jeanine Pirro

While the exact economic data points cited by Jeanine Pirro may vary depending on the source, several key indicators commonly influence market sentiment and are likely relevant to her forecast. Understanding these indicators is crucial to interpreting her prediction.

-

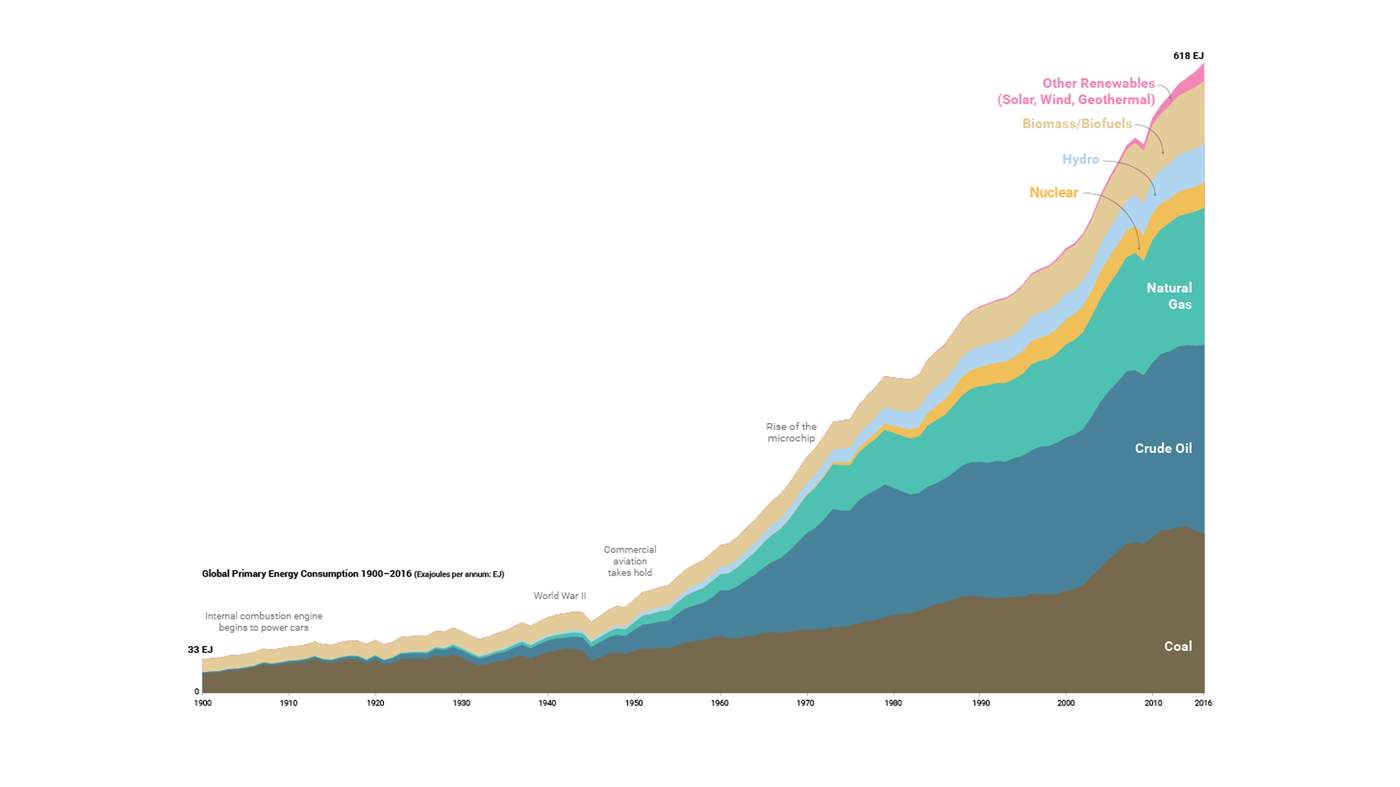

Inflation: Persistently high inflation erodes purchasing power and can lead to the Federal Reserve raising interest rates. This directly impacts consumer spending and corporate profitability, potentially affecting stock prices. For instance, if inflation exceeds expectations, as reported by the Bureau of Labor Statistics (BLS) [link to BLS data], it could trigger a market correction.

-

Interest Rates: Rising interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth. This can negatively impact company earnings and decrease investor confidence. The Federal Reserve's decisions on interest rates [link to Federal Reserve website] are closely watched by market analysts and investors.

-

Geopolitical Tensions: Global events, such as international conflicts or political instability, create uncertainty and can significantly impact market sentiment. Increased geopolitical risk [link to reputable news source covering geopolitical risk] often leads to market volatility as investors seek safer havens. This factor can be difficult to quantify but is a crucial element in any stock market forecast.

-

Unemployment: Unexpectedly high unemployment figures can indicate a weakening economy, leading to decreased consumer spending and potentially negative stock market performance. Regularly released unemployment data [link to relevant government statistics] is a key economic indicator.

Interpreting Pirro's "Few Weeks of Caution" Prediction

Jeanine Pirro's "few weeks of caution" prediction is inherently vague. It doesn't specify the extent of the potential downturn, leaving room for various interpretations.

-

Mild Correction: A mild correction could involve a relatively small drop in stock prices, followed by a rebound. This type of correction is relatively common and can present buying opportunities for long-term investors.

-

More Significant Downturn: Alternatively, her statement could hint at a more substantial market decline. This would require a more cautious approach from investors, potentially involving selling some assets or shifting towards less risky investments.

What does "a few weeks of caution" practically mean for investors? It likely suggests:

- Holding off on major investments: Avoid making significant new investments until the market's direction becomes clearer.

- Diversifying portfolios: Ensure your investments are spread across different asset classes to mitigate risk.

- Staying informed: Keep abreast of market developments and news to make informed decisions.

Alternative Perspectives on the Current Market

It's important to note that Jeanine Pirro's perspective isn't the only one. Other financial experts hold contrasting viewpoints. Some analysts remain bullish on the market, citing factors like strong corporate earnings or potential government stimulus measures. [Link to a bullish market analysis]. Comparing various market forecasts [link to a reputable financial news site comparing forecasts] reveals a range of opinions, highlighting the complexity of predicting market movements.

Weighing the Risks and Rewards

A balanced assessment considers both potential risks (a market downturn) and rewards (potential buying opportunities). A short-term dip could create attractive entry points for long-term investors, allowing them to purchase assets at lower prices. However, the risk of further declines should not be ignored. Careful analysis of individual investment goals and risk tolerance is essential.

Conclusion

Jeanine Pirro's stock market forecast advising "a few weeks of caution" highlights the importance of considering key economic indicators such as inflation, interest rates, and geopolitical tensions. While her prediction offers valuable insight, it's crucial to remember that multiple perspectives exist. Different analysts offer varying forecasts, underlining the inherent uncertainty of the stock market. Ultimately, understanding Jeanine Pirro's Stock Market Forecast, alongside other analyses, helps inform your investment strategy but doesn't provide definitive answers.

Call to Action: Stay informed about Jeanine Pirro's future comments and other market analyses to make well-informed decisions regarding your investment strategy. Learn more about navigating the stock market during periods of uncertainty by researching reputable financial news sources and consulting with a financial advisor. Understand Jeanine Pirro's Stock Market Forecast and its implications for your portfolio before making any significant investment decisions. [Link to a reputable financial news website]

Featured Posts

-

Jeanine Pirro Fact Checked By Aoc Key Moments And Analysis

May 09, 2025

Jeanine Pirro Fact Checked By Aoc Key Moments And Analysis

May 09, 2025 -

Micro Strategys Competitor Is This Spac Stock A Smart Investment

May 09, 2025

Micro Strategys Competitor Is This Spac Stock A Smart Investment

May 09, 2025 -

Metas Legal Battle The 168 Million Whats App Spyware Verdict And Its Significance

May 09, 2025

Metas Legal Battle The 168 Million Whats App Spyware Verdict And Its Significance

May 09, 2025 -

Barbashevs Ot Goal Ties Series Knights Defeat Wild 4 3

May 09, 2025

Barbashevs Ot Goal Ties Series Knights Defeat Wild 4 3

May 09, 2025 -

Is The Great Decoupling Inevitable A Critical Analysis

May 09, 2025

Is The Great Decoupling Inevitable A Critical Analysis

May 09, 2025