Analyzing Bitcoin's Rebound: Predicting Future Market Trends

Table of Contents

Factors Contributing to Bitcoin's Rebound

Several intertwined factors contribute to Bitcoin's recent rebound. Understanding these factors is paramount for accurately predicting its future price movements.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin's price volatility. Several key indicators play a crucial role:

-

Inflation: High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. A strong correlation exists between rising inflation rates and Bitcoin price increases. For instance, during periods of high inflation in 2021, Bitcoin's price saw substantial gains. This is due to the limited supply of Bitcoin, unlike fiat currencies which can be printed leading to devaluation.

-

Interest Rate Hikes: Interest rate hikes by central banks, while aimed at curbing inflation, can negatively impact risk assets, including Bitcoin. Increased borrowing costs can reduce investor appetite for speculative investments. However, the relationship is complex and not always straightforward.

-

Geopolitical Events: Global instability and uncertainty often lead to a flight to safety, pushing investors towards Bitcoin as a decentralized, relatively uncorrelated asset. Major geopolitical events, like wars or political upheavals, can drastically impact the cryptocurrency market. Analyzing the relationship between Bitcoin price volatility and macroeconomic indicators is key to understanding these fluctuations.

Regulatory Developments

Regulatory clarity and uncertainty significantly impact Bitcoin's market sentiment. Developments in various jurisdictions influence investor confidence and market participation:

-

Positive Regulatory Signals: Favorable regulatory announcements or clear guidelines from governments can boost investor confidence and lead to price increases. The introduction of Bitcoin ETFs in specific jurisdictions provides a clear example of this effect.

-

Negative Regulatory Crackdowns: Conversely, harsh regulatory crackdowns or ambiguous policies can create uncertainty and trigger price drops. Specific regions with stringent anti-crypto stances can significantly influence global market sentiment. Monitoring regulatory developments is crucial to predicting Bitcoin’s future trends.

-

Varying Global Regulations: The lack of consistent global regulations contributes to volatility. The different approaches taken by various governments create uncertainty and influence investor decisions regarding Bitcoin adoption.

Institutional Adoption

The growing adoption of Bitcoin by institutional investors is a significant factor driving its price.

-

Increased Institutional Holdings: Major corporations and investment firms are increasingly adding Bitcoin to their portfolios, leading to substantial buy-side pressure on the market. This suggests a growing acceptance of Bitcoin as a legitimate asset class.

-

Bitcoin ETF Approvals: The approval of Bitcoin exchange-traded funds (ETFs) signifies a significant step toward mainstream adoption. This increased accessibility attracts a larger pool of investors, boosting liquidity and potentially driving price increases.

-

Corporate Treasury Reserves: Some companies are actively holding Bitcoin in their treasury reserves as a form of diversification and a hedge against traditional financial risks. This trend signifies long-term confidence in Bitcoin as a store of value.

Technical Analysis of Bitcoin's Rebound

Technical analysis plays a crucial role in analyzing Bitcoin's rebound and predicting future price movements.

Chart Patterns

Analyzing Bitcoin price charts reveals important patterns offering potential insights:

-

Support and Resistance Levels: Identifying key support and resistance levels provides insight into potential price turning points. Breaks above resistance levels often indicate strong bullish momentum, while breaks below support levels suggest a potential bearish trend.

-

Trendlines: Drawing trendlines connects consecutive price highs or lows to identify the overall trend (uptrend, downtrend, or sideways). This visual representation helps in predicting future price movements.

-

Chart Patterns (Head and Shoulders, Double Bottom, etc.): Classic chart patterns often predict future price action. These patterns combined with technical indicators provide a more comprehensive market analysis. For instance, a double bottom pattern can indicate a bullish reversal.

Volume Analysis

Analyzing Bitcoin's trading volume provides crucial context for price movements:

-

High Volume Confirmation: Strong price increases accompanied by high trading volume confirm the strength of the bullish trend and suggests it’s more likely to continue.

-

Low Volume Rallies: Conversely, price increases with low volume might suggest a weaker trend that could easily reverse.

-

Volume Divergence: Discrepancies between price action and volume can signal a potential trend reversal. For instance, rising prices with decreasing volume may indicate weakening momentum.

Predicting Future Bitcoin Market Trends

Based on the factors discussed above, several scenarios for Bitcoin's future are possible.

Scenario Planning

-

Bullish Scenario: Continued institutional adoption, positive regulatory developments, and persistent inflation could drive Bitcoin's price significantly higher.

-

Bearish Scenario: Increased regulatory scrutiny, a macroeconomic downturn, and a loss of investor confidence could lead to a substantial price decline.

-

Sideways Scenario: A balance between bullish and bearish factors could result in a period of price consolidation, with relatively limited gains or losses. This scenario suggests a lack of clear dominant factors.

Risk Assessment

Investing in Bitcoin carries inherent risks:

-

Volatility: Bitcoin is known for its extreme price volatility. Sudden and significant price swings are common, and investors must be prepared for potential losses.

-

Regulatory Uncertainty: The lack of consistent global regulations introduces uncertainty and risk. Changes in regulatory frameworks can significantly impact Bitcoin's price.

-

Security Risks: The security of Bitcoin exchanges and wallets is paramount. Investors must take appropriate measures to protect their holdings against theft or hacking.

Conclusion

Analyzing Bitcoin's rebound requires a comprehensive approach, considering macroeconomic factors, regulatory developments, institutional adoption, and technical indicators. By carefully analyzing Bitcoin's rebound and considering the factors discussed above, you can develop a more informed strategy for navigating the ever-changing cryptocurrency market. Continue your own analysis of Bitcoin's rebound to stay ahead of the curve!

Featured Posts

-

Apples Ai Ambitions A Path To Innovation Or Stagnation

May 09, 2025

Apples Ai Ambitions A Path To Innovation Or Stagnation

May 09, 2025 -

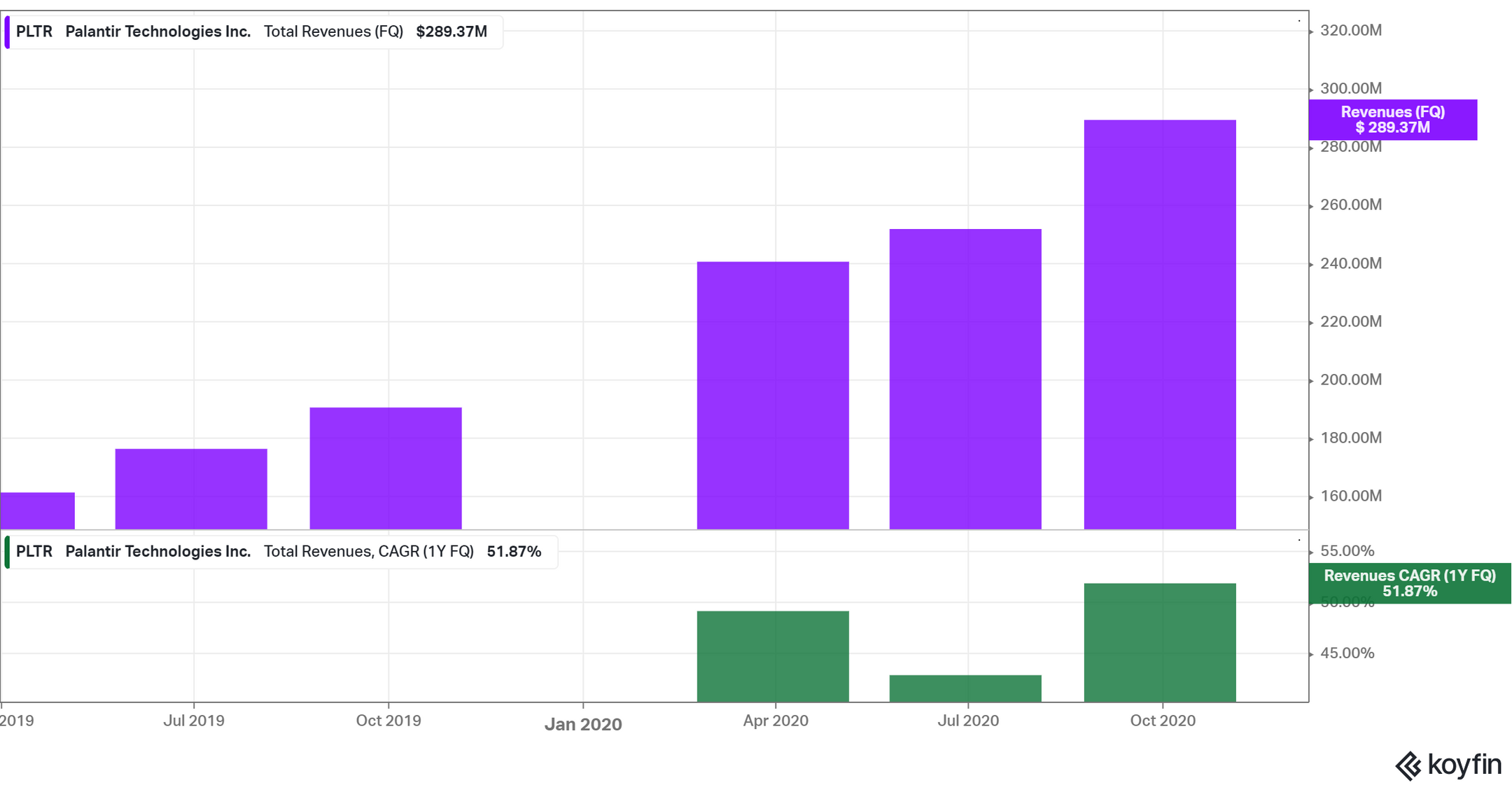

Is Palantir Stock A Buy Before May 5th A Wall Street Perspective

May 09, 2025

Is Palantir Stock A Buy Before May 5th A Wall Street Perspective

May 09, 2025 -

Lawsons Future Uncertain As Colapinto Makes Strong Case For Red Bull Seat

May 09, 2025

Lawsons Future Uncertain As Colapinto Makes Strong Case For Red Bull Seat

May 09, 2025 -

La Cite De La Gastronomie De Dijon Analyse Des Problemes Rencontres Par Epicure

May 09, 2025

La Cite De La Gastronomie De Dijon Analyse Des Problemes Rencontres Par Epicure

May 09, 2025 -

Attorney Generals Fentanyl Demonstration A Closer Look

May 09, 2025

Attorney Generals Fentanyl Demonstration A Closer Look

May 09, 2025