Analysis: Trump's Comments On Banning Congressional Stock Trading In Time Interview

Table of Contents

Trump's Stance on a Congressional Stock Trading Ban

In his Time interview, Trump didn't offer a definitive "yes" or "no" on a complete Congressional stock trading ban. Instead, he expressed a nuanced position, highlighting concerns about potential conflicts of interest. His reasoning appeared rooted in a belief that the current system allows for undue influence and the appearance of impropriety. While he didn't explicitly endorse a ban, his comments suggested a willingness to consider stronger regulations.

- Direct quotes from the interview: (Insert direct quotes from the Time interview here, accurately attributed. If quotes are unavailable, replace with a paraphrased summary of his stance).

- Key arguments used: Trump’s arguments likely focused on the perception of impropriety and the potential for conflicts of interest to undermine public trust in government. He may have cited specific examples of perceived abuses (if mentioned in the interview).

- Potential inconsistencies: (Analyze any inconsistencies between his current statements and past actions or statements on this or similar issues).

The Current Debate Surrounding Congressional Stock Trading

The debate surrounding Congressional stock trading is fueled by legitimate ethical concerns and a lack of comprehensive, universally-agreed-upon regulations. Currently, there are limited restrictions on members of Congress trading stocks, leading to numerous criticisms.

- Existing legislation (or lack thereof): Currently, the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 exists, but it is widely considered inadequate to prevent conflicts of interest. (Explain the limitations of the STOCK Act).

- Ethical concerns: The core ethical concern revolves around the potential for insider trading, where lawmakers could use non-public information gained through their official duties for personal financial gain. This erodes public trust.

- Examples of perceived conflicts of interest: (Provide specific, high-profile examples of alleged conflicts of interest involving Congressional stock trading. Include links to reputable sources).

- Statistics on Congressional stock trading activity: (Include statistics on the frequency and volume of Congressional stock trades, if available. Cite the source).

- Examples of high-profile cases: (Give examples of cases that have fueled the public debate, emphasizing the need for stricter regulations).

- Mention of existing bills: (Discuss existing legislative proposals aimed at reforming or banning Congressional stock trading, including details on their current status and sponsors).

Potential Impacts of a Congressional Stock Trading Ban

A Congressional stock trading ban presents both advantages and disadvantages. A balanced approach requires careful consideration of both.

- Potential benefits:

- Increased public trust in government: A ban could significantly improve public perception of Congress's integrity.

- Reduced potential for conflicts of interest: Eliminating the opportunity for lawmakers to profit from their positions minimizes the appearance of impropriety.

- Improved perception of government integrity: This reform could signal a commitment to ethical conduct and transparency.

- Potential drawbacks:

- Impact on individual legislators' financial freedom: A ban could restrict the financial choices available to lawmakers.

- Potential for unintended consequences: The ban might have unforeseen impacts on the financial markets or the composition of Congress.

- Difficulty in enforcing such a ban: Establishing clear definitions and effective mechanisms for enforcement would be crucial.

- Further Considerations:

- Arguments for and against a ban: (Summarize the arguments from different political viewpoints and interest groups).

- Comparison to other countries: (Compare existing regulations in other countries with similar systems to provide context).

- Potential loopholes and implementation challenges: (Discuss possible loopholes in the legislation and the challenges of effective enforcement).

Public Opinion and the Future of Congressional Stock Trading Legislation

Public opinion overwhelmingly favors stricter regulations on Congressional stock trading. Polls consistently show strong support for a ban or significant reforms. (Cite specific polls and surveys if available).

- Polling data: (Present data from reputable polling organizations to illustrate public sentiment).

- Bipartisan support or opposition: (Analyze the level of bipartisan support for potential legislation and identify key political hurdles).

- Legislative pathways: (Discuss the various legislative pathways that could lead to the enactment of a ban or significant reforms, considering the challenges and potential compromises).

Conclusion

Trump's comments, while not a full endorsement of a Congressional stock trading ban, contribute to the ongoing national conversation surrounding this critical issue. The arguments for a ban center on restoring public trust and eliminating potential conflicts of interest. However, opponents raise concerns about legislators' financial freedom and potential unintended consequences. This analysis highlights the urgency for a serious discussion about the need for stricter regulations, or a complete ban, to ensure greater transparency and restore public confidence in the integrity of our government. Stay informed on the progress of legislation related to Congressional stock trading bans, and contact your representatives to share your opinion on this critical issue affecting the integrity of our government. The future of ethical governance hinges on addressing the concerns surrounding Congressional stock trading.

Featured Posts

-

Cassidy Hutchinson Memoir A Deeper Look Into The January 6th Hearings

Apr 26, 2025

Cassidy Hutchinson Memoir A Deeper Look Into The January 6th Hearings

Apr 26, 2025 -

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025 -

Why Florida A Cnn Anchor Reveals His Go To Vacation Spot

Apr 26, 2025

Why Florida A Cnn Anchor Reveals His Go To Vacation Spot

Apr 26, 2025 -

Construction Resumes On Worlds Tallest Abandoned Skyscraper A Decade Long Pause Ends

Apr 26, 2025

Construction Resumes On Worlds Tallest Abandoned Skyscraper A Decade Long Pause Ends

Apr 26, 2025 -

Line Wait For Nintendo Switch 2 At Game Stop Was It Worth It

Apr 26, 2025

Line Wait For Nintendo Switch 2 At Game Stop Was It Worth It

Apr 26, 2025

Latest Posts

-

Teslas Canadian Price Hike A Strategic Move To Clear Pre Tariff Stock

Apr 27, 2025

Teslas Canadian Price Hike A Strategic Move To Clear Pre Tariff Stock

Apr 27, 2025 -

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025 -

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025 -

Cma Cgm Expands Global Reach 440 Million Turkish Logistics Acquisition

Apr 27, 2025

Cma Cgm Expands Global Reach 440 Million Turkish Logistics Acquisition

Apr 27, 2025 -

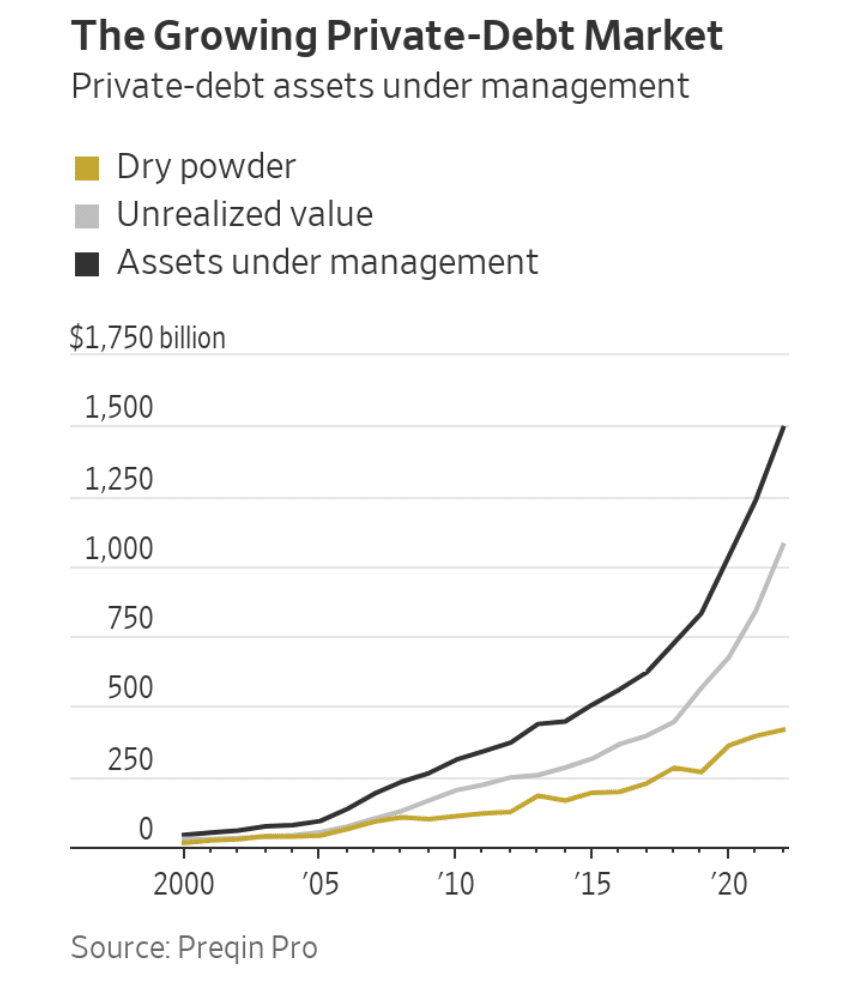

Analysis Of Private Credit Market Vulnerabilities Credit Weekly Update

Apr 27, 2025

Analysis Of Private Credit Market Vulnerabilities Credit Weekly Update

Apr 27, 2025