Analysis: Toronto Home Sales And Prices Fall Sharply (23% And 4%)

Table of Contents

Sharp Decline in Toronto Home Sales

Sales Volume Plunges by 23%

The Toronto Real Estate Board (TREB) reported a staggering 23% year-over-year drop in home sales in July 2023. This represents a significant contraction compared to July 2022 and continues a downward trend observed throughout the first half of the year.

- Year-over-year decrease: 23%

- Month-over-month decrease: [Insert data if available from TREB]

- Data Source: Toronto Real Estate Board (TREB)

Several factors contributed to this dramatic fall in sales volume:

- Rising Interest Rates: The Bank of Canada's aggressive interest rate hikes have significantly increased borrowing costs, making mortgages more expensive and reducing buyer affordability. This is a major factor impacting the Toronto condo market as well as detached homes.

- Economic Uncertainty: Global economic headwinds and concerns about a potential recession have created uncertainty in the market, leading to decreased buyer confidence and a more cautious approach to purchasing property.

- Reduced Buyer Confidence: The combination of higher interest rates and economic uncertainty has dampened buyer enthusiasm, leading to fewer transactions.

Impact on Different Property Types

The sales decline wasn't uniform across all property types. While all segments experienced a downturn, some were hit harder than others.

- Detached Houses: Experienced a [insert percentage]% decrease, reflecting the sensitivity of this segment to higher interest rates. The suburban Toronto market showed a more pronounced dip than the downtown core.

- Condos: Saw a [insert percentage]% drop, indicating that even more affordable housing options were affected by reduced buyer demand.

- Townhouses: Experienced a [insert percentage]% decline, falling somewhere between detached houses and condos in terms of impact.

Geographic variations within Toronto are also evident. The downtown core, typically more resilient, still saw a notable decrease in sales, although perhaps less dramatic than the suburbs.

Toronto Home Prices Dip by 4%

Average Price Decrease and Market Corrections

The average price of a home in Toronto decreased by approximately 4% in July 2023 compared to July 2022, according to TREB data. This represents a market correction, a period of adjustment following a period of rapid price appreciation.

- Year-over-year price decrease: 4%

- Data Source: Toronto Real Estate Board (TREB)

This decrease, while significant, should be viewed within the context of historical trends. The Toronto real estate market has experienced periods of both rapid growth and correction in the past.

Factors Contributing to Price Reduction

The 4% price drop is a result of the interplay of several factors:

- Supply and Demand: The reduced demand from buyers, coupled with a relatively stable supply of homes on the market, has shifted the balance of power, resulting in lower prices.

- Increased Interest Rates: Higher borrowing costs have directly reduced buyer purchasing power, leading to downward pressure on prices. This has impacted the affordability of even Toronto condos.

- Economic Factors: Broad economic uncertainty is a contributing factor, influencing buyer sentiment and willingness to pay premium prices.

Buyer and Seller Sentiment in the Current Toronto Market

The downturn in the Toronto real estate market has significantly impacted buyer and seller sentiment.

- Buyers: Buyers now have more negotiating power, with less competition for available properties. They can take more time to make decisions and are less likely to engage in bidding wars.

- Sellers: Sellers need to adjust their expectations, potentially lowering their asking prices to attract buyers in a less competitive environment. This means longer time on market and potentially accepting offers below asking price.

- Competition: The level of buyer competition has decreased significantly, providing buyers with more leverage.

Predicting Future Trends in the Toronto Real Estate Market

Predicting the future of the Toronto real estate market with certainty is impossible, but several factors could influence future trends:

- Interest Rate Trajectory: The Bank of Canada's future interest rate decisions will significantly impact affordability and buyer demand.

- Economic Recovery: A robust economic recovery could boost buyer confidence and lead to a market rebound.

- Government Policies: Government interventions, such as changes to mortgage rules or tax policies, could influence market dynamics.

Potential scenarios include a continued decline, market stabilization at current levels, or a potential rebound depending on these factors.

Conclusion

The Toronto real estate market experienced a substantial decline in July 2023, with home sales plummeting by 23% and average prices dropping by 4%. Rising interest rates, economic uncertainty, and reduced buyer confidence are the primary drivers of this downturn, significantly impacting both buyers and sellers. The market correction presents both challenges and opportunities, depending on one's position.

Call to Action: Stay informed about the dynamic Toronto real estate market. Monitor the Toronto Real Estate Board (TREB) website ([insert TREB website link here]) for the latest updates on Toronto home sales and prices. Understanding the current trends in the Toronto real estate market is crucial for making informed decisions whether you're a buyer or seller. Learn more about navigating the fluctuating Toronto real estate market by [insert link to another relevant article or resource].

Featured Posts

-

Andor Showrunner Calls Star Wars Series His Most Important Work

May 08, 2025

Andor Showrunner Calls Star Wars Series His Most Important Work

May 08, 2025 -

Xrp Price Jump Us Presidents Post On Trump And Ripple

May 08, 2025

Xrp Price Jump Us Presidents Post On Trump And Ripple

May 08, 2025 -

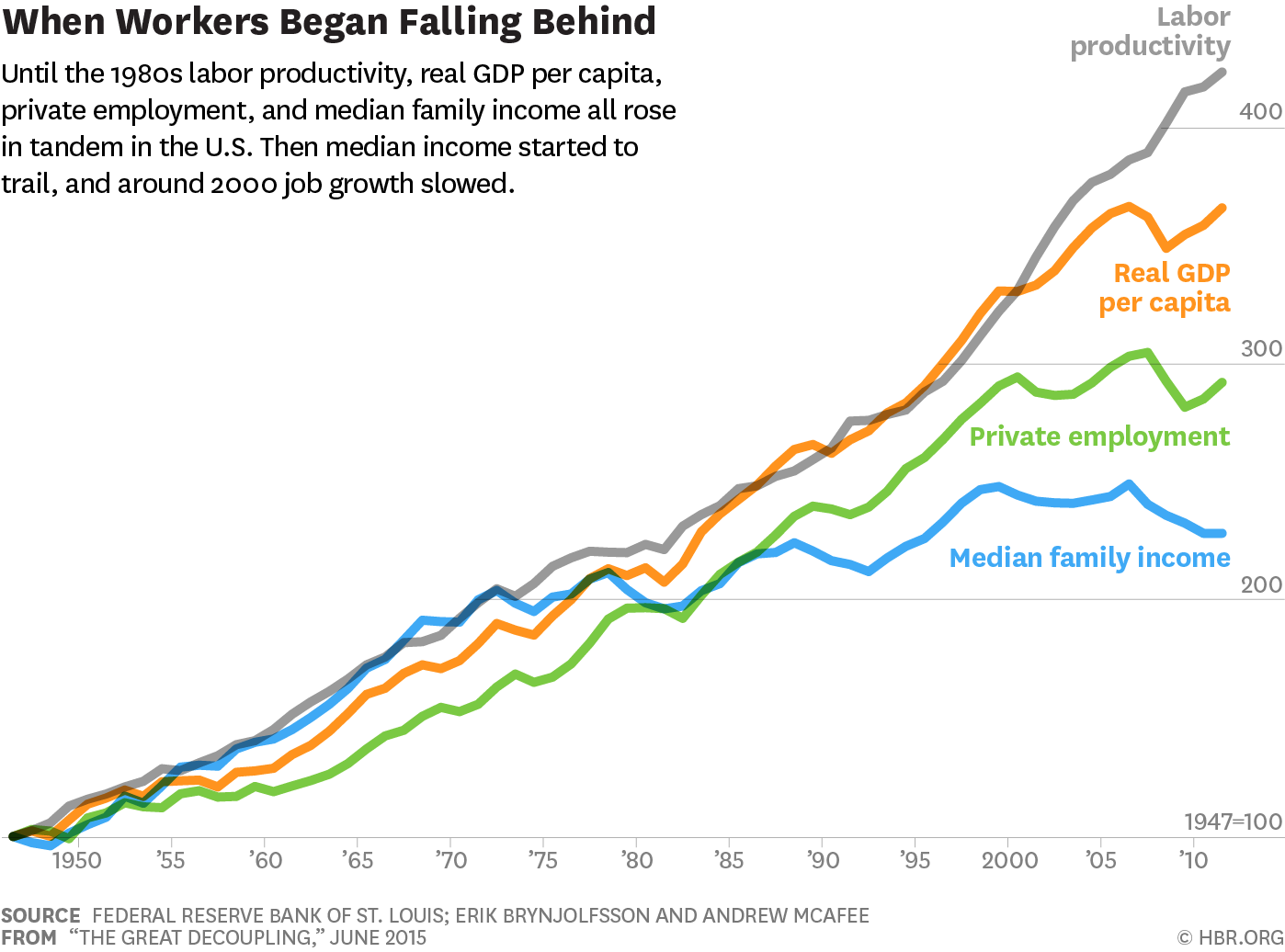

What Is The Great Decoupling And Why Does It Matter

May 08, 2025

What Is The Great Decoupling And Why Does It Matter

May 08, 2025 -

Travis Kalanick On Ubers Past A Costly Mistake With Project Decision

May 08, 2025

Travis Kalanick On Ubers Past A Costly Mistake With Project Decision

May 08, 2025 -

Dogecoin Shiba Inu And Sui Price Surge Understanding The Reasons

May 08, 2025

Dogecoin Shiba Inu And Sui Price Surge Understanding The Reasons

May 08, 2025