Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV

Knowing where to access the daily Amundi MSCI World II UCITS ETF Dist NAV is the first step to effective tracking. Several reliable sources provide this information:

- Official Sources:

- Amundi Website: Check Amundi's official website for their ETF listings. They typically provide daily NAV updates. [Insert Amundi Website Link Here if available]

- ETF Provider Websites: Many financial data providers host ETF information. Look for the ETF's fact sheet or similar pages. [Insert example link if available - a general example would be fine]

- Financial News Websites: Reputable financial news websites and aggregators such as Yahoo Finance, Google Finance, and Bloomberg often provide real-time or delayed NAV data for popular ETFs like the Amundi MSCI World II UCITS ETF Dist. Simply search for the ETF's ticker symbol.

- Brokerage Platforms: Most brokerage platforms (e.g., Interactive Brokers, Fidelity, TD Ameritrade) display the NAV of ETFs held in your portfolio and allow you to look up others. The availability and timing may vary depending on your brokerage.

- Data Providers: Professional financial data providers like Bloomberg Terminal and Refinitiv Eikon offer comprehensive data, including real-time ETF NAV updates. Access usually requires a subscription.

Understanding the Factors Affecting Amundi MSCI World II UCITS ETF Dist NAV

The Amundi MSCI World II UCITS ETF Dist NAV is not static; it fluctuates based on several key factors:

- Market Fluctuations: The primary driver of Amundi MSCI World II UCITS ETF Dist NAV changes is the performance of the underlying assets within the MSCI World Index. Market volatility and individual stock price fluctuations directly impact the overall value of the ETF. A rising market generally leads to an increased NAV, while a falling market will decrease it.

- Currency Exchange Rates: Because the MSCI World Index includes companies globally, currency exchange rates significantly affect the Amundi MSCI World II UCITS ETF Dist NAV. Changes in the value of foreign currencies relative to the ETF's base currency (likely EUR) will influence the NAV calculation. This introduces currency risk and foreign exchange factors.

- Dividend Distributions: The Amundi MSCI World II UCITS ETF Dist pays dividends. When underlying holdings distribute dividends, the ETF's NAV will generally drop by a corresponding amount on the ex-dividend date. This is because the dividend yield is now paid out to investors. Investors should check the distribution date announcements to understand the impact on NAV.

- Expense Ratio: While less dramatic than other factors, the ETF's expense ratio (the annual fee charged by the fund manager) gradually erodes the NAV over time.

Interpreting and Utilizing Amundi MSCI World II UCITS ETF Dist NAV Data

Understanding the Amundi MSCI World II UCITS ETF Dist NAV and its nuances is vital for informed investment:

- NAV vs. Market Price: The NAV represents the theoretical value of the ETF's assets, while the market price is the actual price at which the ETF trades on the exchange. These may differ slightly due to the bid-ask spread and trading volume. A wider spread can lead to larger discrepancies.

- Performance Tracking: By tracking the Amundi MSCI World II UCITS ETF Dist NAV over time, investors can easily calculate the return on investment (ROI) and assess the ETF's performance. This is essential for evaluating ETF performance against your investment goals.

- Investment Decisions: Monitoring the NAV helps investors make informed buy/sell decisions. For example, a consistently decreasing NAV might signal a need to re-evaluate your investment strategy as part of your portfolio management.

- Benchmarking: Comparing the ETF's NAV to the MSCI World Index, its benchmark, allows investors to assess the ETF's performance relative to the broader market. This helps gauge the fund manager's skill in tracking the index.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV Tracking for Informed Investment

Tracking the Amundi MSCI World II UCITS ETF Dist NAV is crucial for informed investment decision-making. Understanding where to find the NAV, the factors that affect it, and how to interpret the data empowers investors to manage risk and optimize returns. Regularly monitoring the Amundi MSCI World II UCITS ETF Dist NAV and comparing it to its benchmark allows for effective ETF NAV tracking and contributes to successful portfolio management. Make sure to actively track the Amundi MSCI World II UCITS ETF Dist NAV and leverage this vital metric to make smarter investment choices. For a deeper understanding of ETF investing, consider exploring additional resources and conducting further research on Amundi ETF offerings and investment strategies.

Featured Posts

-

Analisi Borsa Europa Prudente Italgas In Luce Banche In Difficolta

May 24, 2025

Analisi Borsa Europa Prudente Italgas In Luce Banche In Difficolta

May 24, 2025 -

Explanation Kyle Walker Mystery Women And Annie Kilners Departure

May 24, 2025

Explanation Kyle Walker Mystery Women And Annie Kilners Departure

May 24, 2025 -

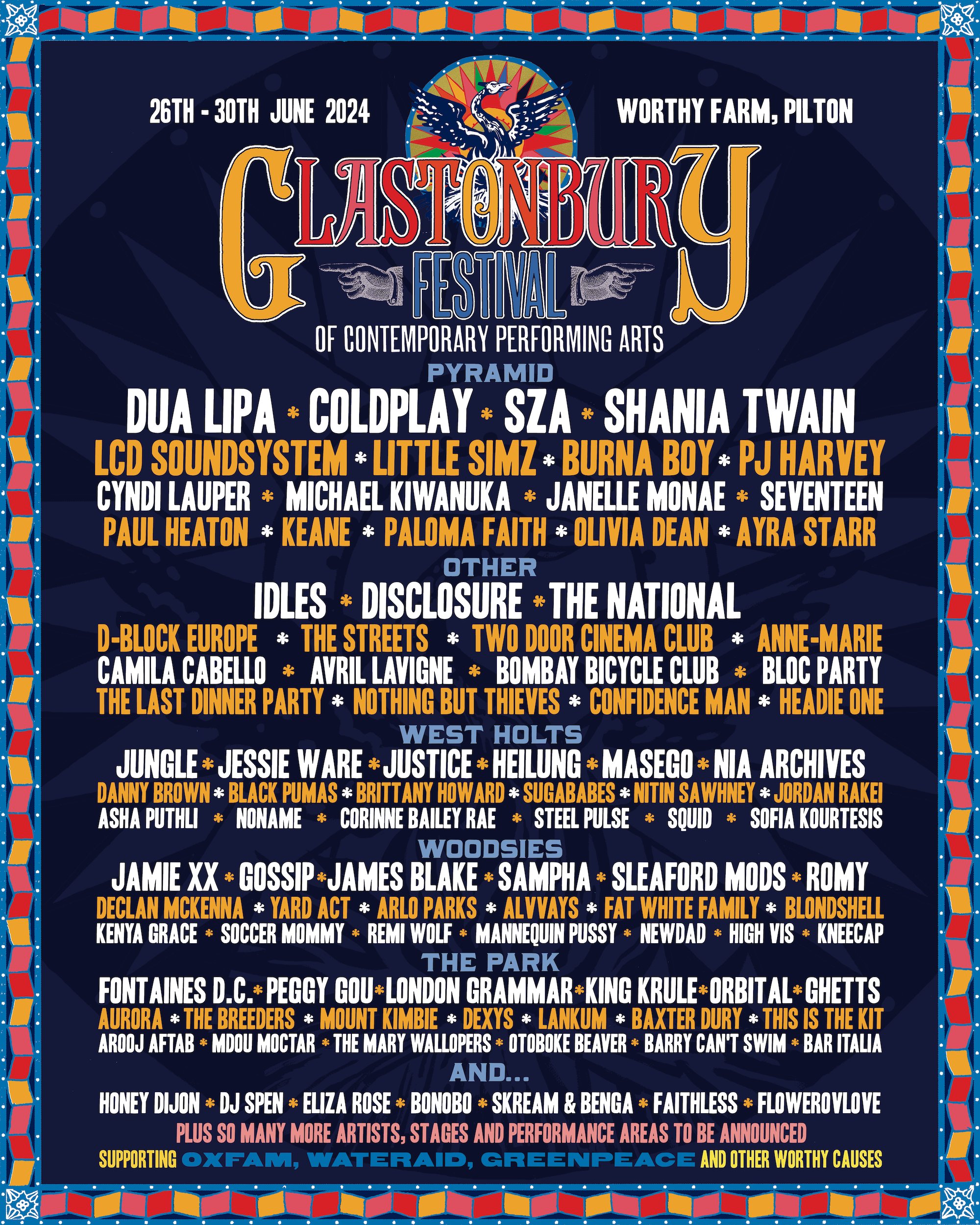

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 24, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 24, 2025 -

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025 -

Exploring The Planned M62 Relief Route Through Bury

May 24, 2025

Exploring The Planned M62 Relief Route Through Bury

May 24, 2025

Latest Posts

-

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025 -

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025