Analysis Of Tesla's Q1 Earnings: 71% Net Income Decrease Explained

Table of Contents

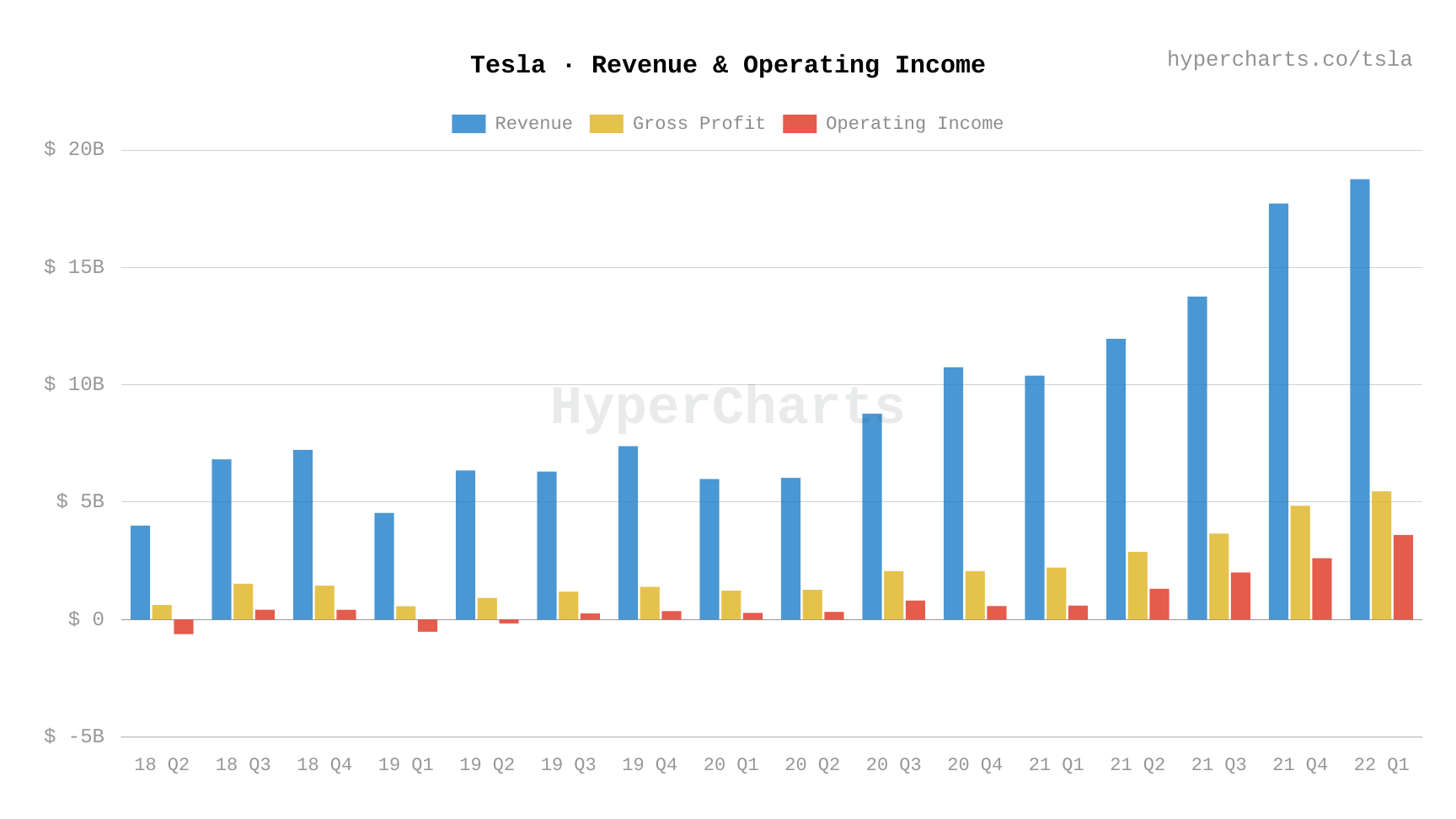

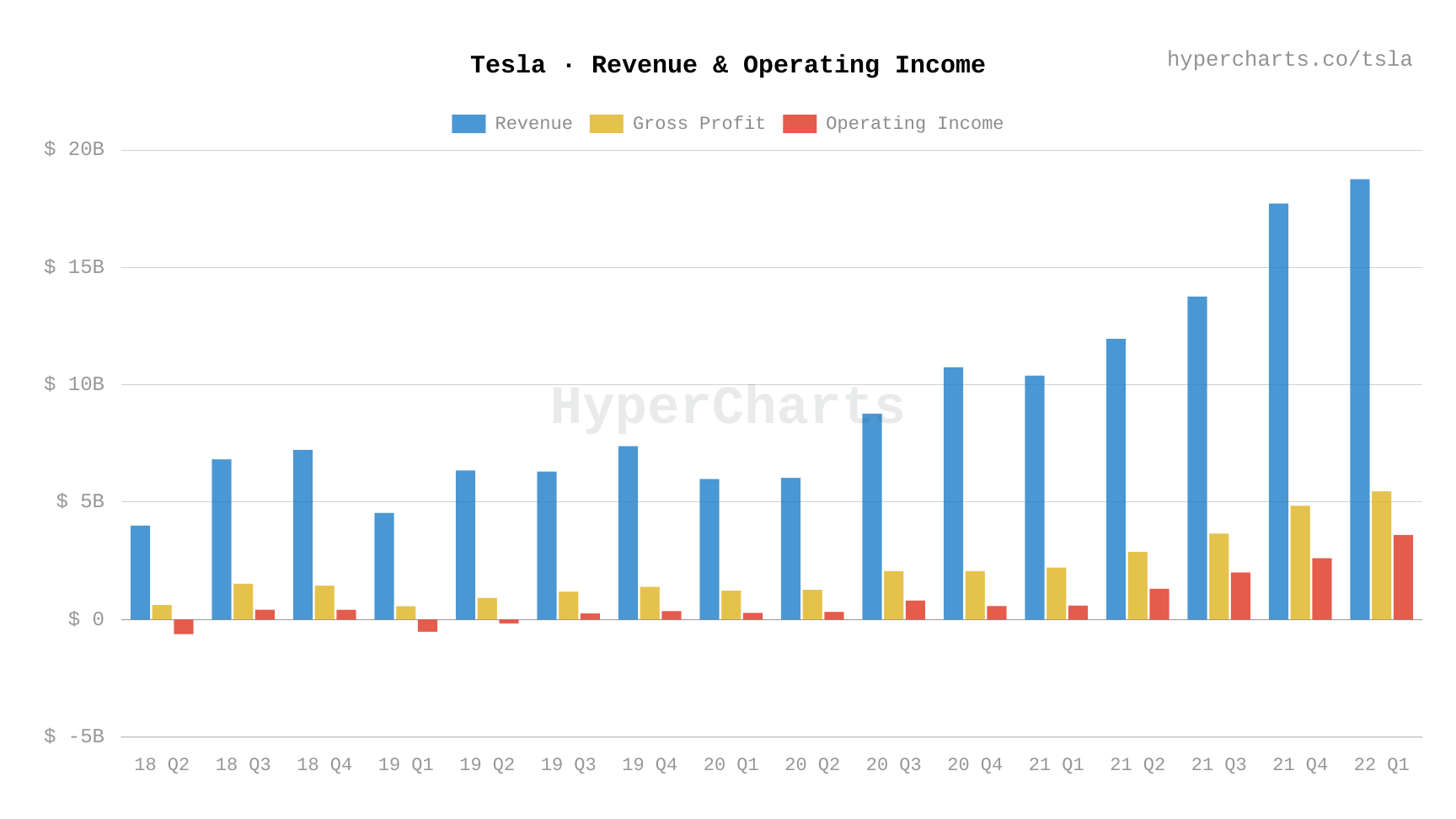

Price Cuts and Their Impact on Tesla's Profitability

Tesla's aggressive price reductions, implemented throughout Q1, significantly impacted its profitability. While the strategy aimed to boost sales volume and solidify market share, the short-term effect was a considerable reduction in profit margins.

The Strategy Behind Tesla's Aggressive Price Reductions

Tesla's CEO, Elon Musk, publicly justified the price cuts as a necessary move to increase affordability and stimulate demand in a potentially slowing market. The company aimed to maintain its position as a market leader by making its vehicles more accessible to a broader customer base.

- Impact on Average Selling Prices (ASP): The price cuts resulted in a noticeable decrease in Tesla's ASP, impacting overall revenue. Precise figures would require access to Tesla's financial statements, but reports suggest a considerable drop.

- Effect on Sales Volume: While sales volume likely increased due to the price cuts, the extent to which this offset the reduction in ASP remains to be seen. Further analysis of Tesla’s sales data is required to fully understand this relationship.

- Market Share Growth: The success of this strategy in terms of market share growth requires detailed analysis comparing Tesla’s market share before and after the price cuts against key competitors. Preliminary reports indicate mixed results, with some market segments showing growth and others demonstrating stagnation.

(Insert chart here illustrating the changes in ASP, sales volume, and profit margins.)

Increased Competition in the EV Market

The EV market is rapidly evolving, with several strong competitors emerging to challenge Tesla's dominance. This heightened competition contributed significantly to the pressure on Tesla's profitability in Q1.

Emerging Competitors and Their Market Share Gains

Companies like BYD, Rivian, and several other established and emerging automakers are making significant inroads into the EV market, both in terms of technological advancements and market share.

- Competitive Pricing Strategies: Competitors are employing aggressive pricing strategies, often offering comparable vehicles at lower price points than Tesla.

- Impact of New Model Releases: New model releases from competitors are attracting customers with innovative features and technologies, putting pressure on Tesla's sales.

- Technological Advancements: Competitors are rapidly advancing their battery technology, autonomous driving capabilities, and other features, making Tesla's technological advantage less pronounced.

(Insert chart here comparing Tesla's market share to its main competitors.)

Supply Chain Disruptions and Their Influence on Production Costs

Fluctuations in raw material prices and ongoing supply chain disruptions added to Tesla's cost pressures in Q1.

Raw Material Costs and Production Bottlenecks

The prices of key raw materials, such as lithium and nickel, which are essential for battery production, have been highly volatile.

- Impact of Raw Material Prices: These price fluctuations directly impact Tesla's production costs, squeezing profit margins.

- Supply Chain Issues: Various supply chain bottlenecks, ranging from semiconductor shortages to logistical challenges, affected Tesla's production capacity, resulting in increased costs and potentially lower output.

- Overall Cost Impact: The combined effect of raw material price volatility and supply chain disruptions led to a significant increase in Tesla's overall production costs.

(Insert chart here showing fluctuations in raw material prices and production output.)

Increased Operational Expenses and Investments

Tesla’s significant investments in R&D, new Gigafactories, and expanding its global infrastructure also impacted its short-term profitability.

R&D Spending, Expansion Plans, and Their Financial Impact

Tesla continues to invest heavily in research and development for its autonomous driving technology and other advanced features. The expansion of its manufacturing capacity globally through new Gigafactories also demands substantial capital expenditure.

- R&D Expenses: The considerable expense of developing cutting-edge technologies like Full Self-Driving (FSD) directly impacts short-term profitability.

- Gigafactory Expansion Costs: Building and operating new Gigafactories across the globe is a massive undertaking with significant capital expenditure.

- Impact on Short-Term Profitability: These investments, although crucial for long-term growth, significantly impact Tesla's short-term profitability.

(Insert data here on Tesla’s R&D spending and capital expenditure.)

Other Contributing Factors Affecting Tesla's Q1 Earnings

Several other factors influenced Tesla's Q1 earnings, contributing to the overall decline.

External Factors & Unexpected Events

Macroeconomic conditions, regulatory changes, and currency fluctuations can significantly impact a global company like Tesla.

- Macroeconomic Headwinds: Global economic slowdown or regional economic crises can affect consumer demand for luxury goods like Tesla vehicles.

- Regulatory Changes: Changes in government regulations and subsidies in key markets can impact sales and profitability.

- Currency Fluctuations: Fluctuations in exchange rates can impact the profitability of international sales.

(Provide data and news articles supporting the mentioned factors.)

Conclusion: Understanding Tesla's Q1 Earnings Decline

Tesla's 71% net income decrease in Q1 2024 is the result of a confluence of factors. Price cuts, intensified competition, supply chain disruptions, increased operational expenses, and external factors all played a significant role. The interplay of these challenges highlights the complexities faced by even the most dominant players in a rapidly evolving market. Understanding these contributing factors is crucial for evaluating Tesla's long-term prospects.

Key Takeaways: The Q1 results demonstrate that maintaining profitability in a competitive and rapidly changing market requires a delicate balance between aggressive growth strategies and cost management. Tesla's challenges underscore the importance of adapting to evolving market dynamics and managing operational costs effectively.

Call to Action: Stay tuned for our next analysis of Tesla's Q2 earnings to see how the company addresses these challenges and mitigates the impact of these factors on its future financial performance. For more in-depth analysis on Tesla's financial performance and future Tesla Earnings Analysis, continue exploring our website.

Featured Posts

-

John Travoltas Family Home Addressing A Recent Photo Controversy

Apr 24, 2025

John Travoltas Family Home Addressing A Recent Photo Controversy

Apr 24, 2025 -

Open Ais Interest In Google Chrome A Chat Gpt Chiefs Revelation

Apr 24, 2025

Open Ais Interest In Google Chrome A Chat Gpt Chiefs Revelation

Apr 24, 2025 -

Btc Price Increase Analyzing The Influence Of Trumps Policies

Apr 24, 2025

Btc Price Increase Analyzing The Influence Of Trumps Policies

Apr 24, 2025 -

Oil Price Update Market News And Analysis For April 23

Apr 24, 2025

Oil Price Update Market News And Analysis For April 23

Apr 24, 2025 -

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 24, 2025

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 24, 2025

Latest Posts

-

Nyt Strands Game 374 Hints And Solutions For March 12

May 10, 2025

Nyt Strands Game 374 Hints And Solutions For March 12

May 10, 2025 -

Nyt Strands Answers Game 357 Sunday February 23

May 10, 2025

Nyt Strands Answers Game 357 Sunday February 23

May 10, 2025 -

Solutions For Nyt Strands Sunday February 23 2024 Game 357

May 10, 2025

Solutions For Nyt Strands Sunday February 23 2024 Game 357

May 10, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025 -

Solve Nyt Strands Game 349 February 15 Hints And Answers

May 10, 2025

Solve Nyt Strands Game 349 February 15 Hints And Answers

May 10, 2025