Oil Price Update: Market News And Analysis For April 23

Table of Contents

Geopolitical Factors Influencing Oil Prices

Geopolitical risk remains a primary driver of oil price volatility. Several factors contributed to the fluctuations seen in the oil price on April 23rd:

-

The ongoing conflict in Ukraine: The war in Ukraine continues to disrupt global energy markets. Sanctions imposed on Russia, a major oil and gas producer, have constrained supply, pushing up prices. The uncertainty surrounding the conflict's duration and potential escalation creates further volatility in the crude oil price. Market participants remain wary of potential further disruptions to oil supply chains from this region.

-

OPEC+ production decisions: The Organization of the Petroleum Exporting Countries and its allies (OPEC+) play a significant role in setting global oil production levels. Their decisions regarding production quotas directly impact oil supply and, consequently, prices. Any changes to their strategy, whether increases or decreases in production, can cause significant fluctuations in the oil price. Analysis of their meetings and announcements is crucial for predicting future oil price movements.

-

Sanctions on oil-producing nations: International sanctions on various oil-producing nations can significantly restrict oil exports and create supply shortages, impacting the oil price. The potential for future sanctions or the tightening of existing ones is a constant source of uncertainty in the market. Monitoring geopolitical developments and their potential impact on oil production is essential for understanding oil price dynamics.

-

Regional tensions: Escalating tensions in other oil-rich regions of the world, such as the Middle East, can also impact oil supply and, subsequently, prices. Any instability in these areas can disrupt production and transportation, leading to price increases. The oil market is highly sensitive to political developments in these regions, making geopolitical risk assessment a critical component of oil price forecasting.

Supply Chain Disruptions and Their Effect on Oil Prices

Supply chain disruptions continue to affect oil prices, adding another layer of complexity to the market. Several factors are at play:

-

Oil production levels: Current oil production levels from major producing countries, such as Saudi Arabia, Russia, and the United States, are closely monitored. Any significant changes in production due to technical issues, political instability, or other factors can greatly influence oil prices. Tracking these production figures is crucial for understanding supply dynamics.

-

Transportation and logistics: Disruptions to oil transportation and logistics, such as pipeline closures, port congestion, or tanker shortages, can limit the flow of oil to refineries and consumers, leading to price increases. These logistical bottlenecks can be exacerbated by geopolitical events, natural disasters, or other unforeseen circumstances, adding further volatility to the oil market.

-

Refining capacity: Constraints in refining capacity can limit the ability to process crude oil into usable products like gasoline and diesel, further affecting prices. This constraint can be caused by maintenance, unexpected outages, or simply a lack of investment in new refining capacity. These refining limitations are a key factor driving the price differential between crude oil and refined products.

-

Future supply chain disruptions: The risk of future supply chain disruptions, whether due to unforeseen events or geopolitical instability, introduces considerable uncertainty into the oil market and influences the oil price outlook.

Demand-Side Factors Shaping Oil Prices

Demand-side factors also significantly influence oil prices. Understanding these factors provides a more complete picture of the current market situation:

-

Global economic climate: The overall health of the global economy greatly impacts energy demand. Strong economic growth typically leads to increased energy consumption, including oil, boosting prices. Conversely, a weakening global economy can lead to reduced demand and lower prices. Economic indicators, like GDP growth and industrial production, are closely watched for their impact on oil demand.

-

Seasonal changes: Seasonal variations in oil demand play a role in price fluctuations. For example, demand for gasoline and heating oil tends to be higher during certain times of the year, influencing prices. These seasonal patterns are relatively predictable and can be factored into oil price forecasts.

-

Emerging economies: The growth of emerging economies has significantly increased global oil demand. These economies' expanding industrial sectors and rising middle classes contribute to a higher overall demand for energy, including oil. Continued economic growth in these regions will likely sustain strong demand for oil in the long term.

-

Long-term outlook: The long-term outlook for oil demand growth depends on factors such as technological advancements, government policies promoting renewable energy, and global population growth. These long-term trends are important considerations for long-term oil price forecasts.

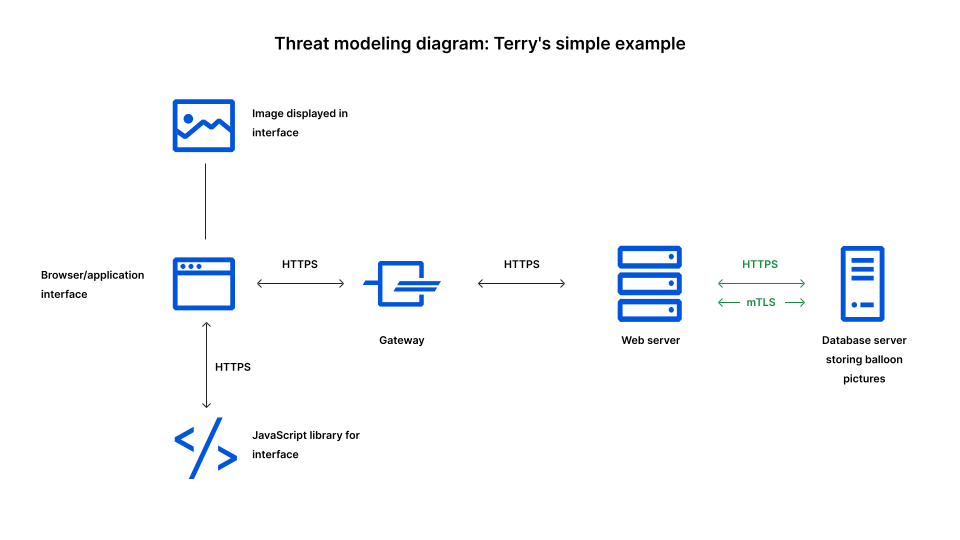

April 23rd Oil Price Performance: Brent vs. WTI

On April 23rd, both Brent and WTI crude oil prices experienced volatility. A detailed analysis of price movements shows:

-

Specific price movements: [Insert specific price data for Brent and WTI crude oil on April 23rd, including opening, closing, high, and low prices. Include relevant charts and graphs illustrating price fluctuations.].

-

Price comparison and divergence: [Explain the differences in price performance between Brent and WTI crude on April 23rd. Discuss potential reasons for any divergence, such as regional supply issues or differences in market sentiment.].

-

Charts and graphs: [Include clear, well-labeled charts and graphs to visually represent the price movements of both Brent and WTI crude oil on April 23rd].

-

Reasons for divergence: [Provide a detailed analysis of the factors that contributed to any significant differences in the price movements of Brent and WTI crude oil on that day. This might include differences in supply, demand, geopolitical factors affecting specific regions, or market speculation].

Conclusion

This oil price update for April 23rd highlights the complex interplay of geopolitical events, supply chain dynamics, and global demand patterns in shaping current crude oil prices. Both Brent and WTI crude experienced volatility, largely driven by ongoing geopolitical instability and concerns over global supply. Understanding these interconnected factors is crucial for navigating the intricacies of this dynamic market.

Call to Action: Stay informed about daily fluctuations in the oil market by regularly checking back for our daily oil price updates. Understanding the factors affecting the oil price, including crude oil price movements and market analysis, is crucial for informed decision-making in this dynamic sector. Continue to follow our regular oil price updates for the latest insights and analysis. Don't miss out on our next oil price update for the most current information on the crude oil price and market trends.

Featured Posts

-

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025 -

Bof As View Understanding And Addressing Elevated Stock Market Valuations

Apr 24, 2025

Bof As View Understanding And Addressing Elevated Stock Market Valuations

Apr 24, 2025 -

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 24, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 24, 2025 -

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025