Analysis Of Oil Prices And Market News: April 23, 2024

Table of Contents

Global Oil Supply and Demand Dynamics

Understanding the interplay of global oil supply and demand is crucial for analyzing current price trends. Current crude oil production levels are a complex picture. Saudi Arabia, a key player in OPEC, has indicated a commitment to maintaining production stability, while Russia's output remains impacted by ongoing sanctions. Meanwhile, US shale oil production, although showing resilience, faces challenges related to investment and regulatory hurdles. The recent OPEC+ decision to further cut production has undoubtedly tightened the global supply, contributing to the price increase. These OPEC production cuts reflect a strategic response to market uncertainties and a desire to maintain price stability at a higher level.

The impact of sanctions on oil exports, primarily targeting Russia, continues to disrupt global supply chains. Furthermore, ongoing geopolitical risk in various regions creates uncertainty and influences supply availability. These supply chain disruptions add to the complexity of the market, making accurate forecasting challenging.

Global oil demand forecasts suggest continued growth, particularly in Asia, driven by robust economic expansion. However, economic slowdown in other regions like Europe, coupled with seasonal variations in seasonal oil demand, might temper the overall growth in the near future. The interaction between robust growth in some areas and potential slowdowns in others impacts the overall equilibrium of supply and demand, influencing price stability.

- Saudi Arabia Crude Oil Production (April 23, 2024): [Insert Estimated Production Figures] barrels per day.

- Impact of the Ukraine conflict on oil supply: Significant disruptions to Black Sea exports and increased uncertainty in Eastern Europe.

- Projected global oil demand growth (Q2 2024): [Insert Estimated Growth Percentage].

Impact of Geopolitical Factors on Oil Prices

Geopolitical uncertainty is a significant driver of oil price volatility. The ongoing conflict in Ukraine continues to exert considerable pressure on global energy markets, creating a geopolitical risk premium baked into the oil price. Tensions in the Middle East, a region crucial for global oil production, further exacerbate this volatility. Any escalation in these regions directly translates into increased oil price volatility and heightened market uncertainty. Changes in political climates in major oil-producing nations can also influence production and pricing significantly. The Middle East oil production stability is therefore a critical factor affecting global oil prices.

Analyzing potential future geopolitical events is essential for understanding the oil market outlook. A major shift in relations between key global players could dramatically impact supply chains and prices. Predicting future scenarios is challenging, but considering potential future oil price predictions based on different geopolitical possibilities is crucial for risk management.

- Impact of the Ukraine conflict (short-term): Immediate price increase due to supply disruptions.

- Potential future scenario: Escalation of tensions in the Strait of Hormuz leading to significant price spikes.

- Expert opinion: [Mention a relevant quote from an energy analyst about future geopolitical risks].

Economic Indicators and Their Influence on Oil Prices

The relationship between macroeconomic factors and oil prices is complex but undeniable. Inflation and oil prices typically exhibit a strong correlation; high inflation often leads to increased demand for energy resources. Similarly, interest rates and oil demand are inversely related – higher interest rates tend to dampen economic activity and reduce oil consumption. Strong economic growth and oil prices typically move in tandem, as higher economic activity translates to increased energy demand.

Currency fluctuations, specifically the strength of the US dollar (USD exchange rate), significantly impact oil prices. Oil is typically priced in USD (oil price in USD), so a stronger dollar makes oil more expensive for buyers using other currencies. This impacts global demand dynamics and thus influences prices. Understanding currency fluctuations and oil market interaction is therefore a crucial component of the analysis.

- US Inflation Rate (April 2024): [Insert Data] – This indicates [Effect on oil demand].

- Federal Reserve interest rate hike impact: Potential reduction in oil investment and demand.

- USD strength against other major currencies: [Explain the impact on oil prices for various regions].

Analysis of Oil Futures and Market Sentiment

Analyzing oil futures market trends, specifically Brent crude price and WTI crude oil price, provides insights into market expectations. The current futures curves can offer clues about future price movements. Analyzing the underlying factors driving these movements provides a valuable insight into short and medium-term pricing expectations.

The overall market sentiment analysis—whether it's bullish vs bearish outlook—heavily influences price movements. This sentiment is reflected in various oil market sentiment indicators, such as investor confidence and trader activity. Understanding the prevailing sentiment is crucial for interpreting price fluctuations. Technical indicators can also offer further insights into the direction of prices (though these are beyond the scope of this specific article).

- Brent Crude Price (April 23, 2024): [Insert Price] per barrel.

- WTI Crude Price (April 23, 2024): [Insert Price] per barrel.

- Market sentiment: Currently leaning [Bullish/Bearish] due to [mention reasons].

Conclusion: Key Takeaways and Call to Action

Our Analysis of Oil Prices and Market News for April 23, 2024, reveals a complex interplay of factors influencing current prices. Global oil supply remains tight due to ongoing geopolitical events and OPEC+ production cuts. Strong global demand, coupled with economic indicators and currency fluctuations, creates a volatile market environment. Geopolitical risks remain a significant driver of uncertainty and price volatility. The futures market reflects a mix of bullish and bearish sentiment, depending on the specific outlook considered.

To stay informed about the dynamic oil market, regularly check back for updated Analysis of Oil Prices and Market News. Subscribe to our newsletter or follow our social media for the latest insights and expert opinions on oil price fluctuations. Understanding these factors is crucial for navigating the complexities of this critical global commodity market.

Featured Posts

-

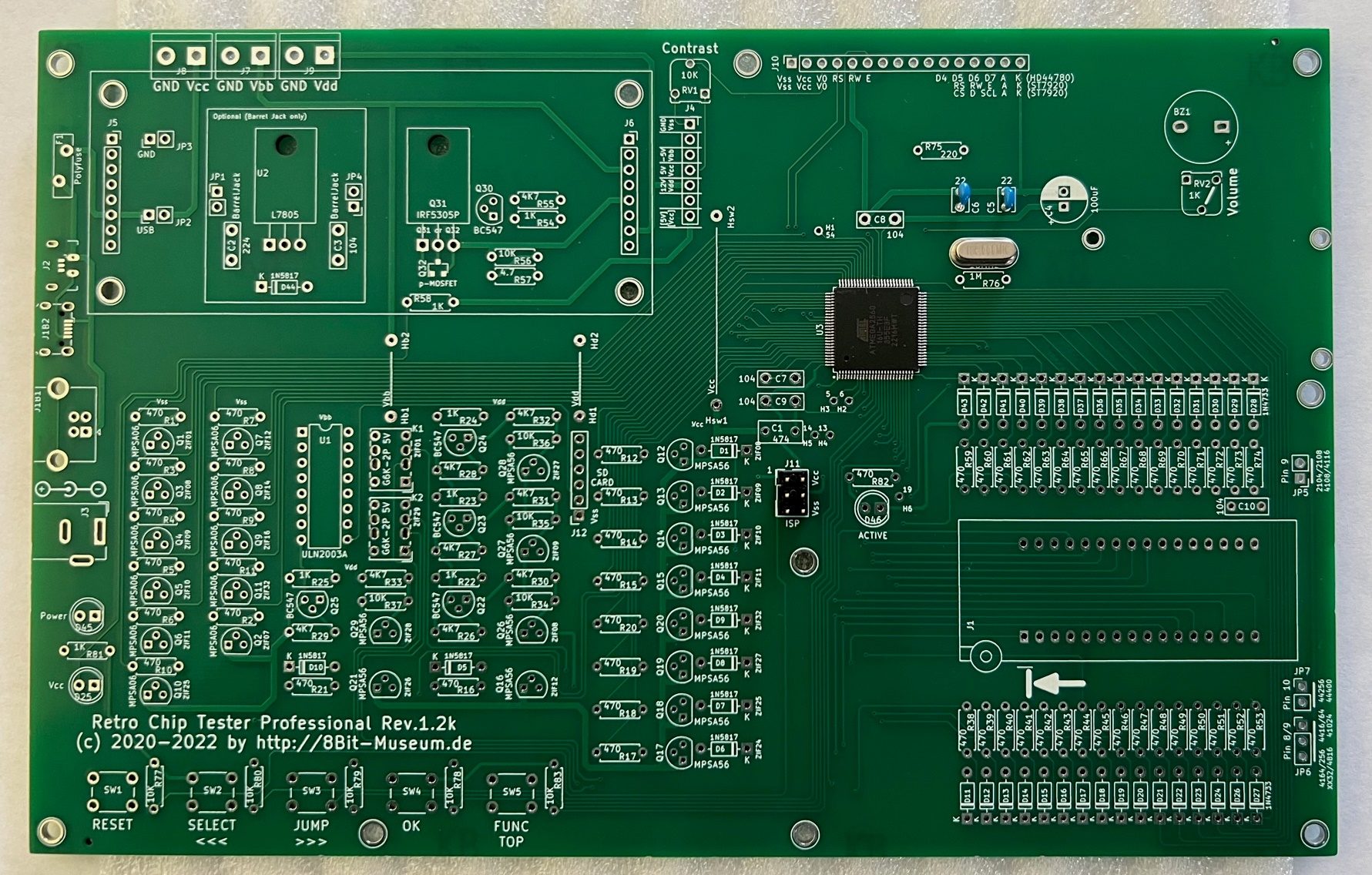

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025 -

Pope Francis Impact Global Reach And Internal Conflicts

Apr 24, 2025

Pope Francis Impact Global Reach And Internal Conflicts

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025 -

Are Bmw And Porsche Losing Ground In China A Look At Market Share And Competition

Apr 24, 2025

Are Bmw And Porsche Losing Ground In China A Look At Market Share And Competition

Apr 24, 2025 -

Indias Bull Market Examining The Forces Behind The Niftys Rise

Apr 24, 2025

Indias Bull Market Examining The Forces Behind The Niftys Rise

Apr 24, 2025