Analysis Of Musk's X Debt Sale: How The Financials Paint A New Picture

Table of Contents

The Scale and Structure of the Debt Sale

The sheer scale of Musk's X debt sale is staggering. While precise figures remain partially undisclosed, reports suggest billions of dollars were raised through a combination of high-yield bonds and term loans. This leveraged financing strategy, typical in private equity acquisitions, reflects the substantial financial burden undertaken to acquire and restructure the platform.

- Specific figures: While exact amounts are confidential, leaked information points to a debt burden exceeding previous financing rounds significantly.

- Comparison to previous financing rounds: Previous funding rounds for Twitter involved a mix of equity and debt, but this sale represents a predominantly debt-focused approach, signifying a considerable shift in financial strategy.

- Unusual aspects: The high-yield nature of the bonds indicates a higher risk profile for investors, reflecting the perceived uncertainty surrounding X's financial health and future profitability. The terms, including interest rates and repayment schedules, are critical in understanding the long-term financial implications for X. These details, often shrouded in secrecy, will be crucial for assessing the true cost of this financing. Keywords: X debt financing, high-yield bonds, term loan, debt restructuring, leveraged buyout.

Impact on X's Financial Health and Stability

The massive debt incurred through Musk's X debt sale dramatically impacts X's financial health and stability. The immediate effect is a significantly increased debt-to-equity ratio, increasing the financial risk profile of the company.

- Debt-to-equity ratio: Before the sale, X had a manageable debt-to-equity ratio. The current increase significantly elevates the risk of default, especially if revenue projections fall short.

- Impact on future investment and growth: The substantial debt servicing costs will likely constrain X's ability to invest in product development, marketing, and expansion, potentially hindering its future growth.

- Risk of default: The high-yield nature of the debt increases the likelihood of default if X fails to generate sufficient revenue to meet its debt obligations. This poses a significant threat to the company's long-term viability. Keywords: X financial performance, debt burden, credit rating, financial stability, default risk, solvency.

Strategic Implications of the Debt Sale

Musk's stated reasons for the debt sale are multifaceted and remain somewhat ambiguous. However, the funds are likely earmarked for several key purposes: debt repayment, potential acquisitions to expand X's capabilities, and covering ongoing operational expenses.

- Connection to Musk's vision: The debt sale might be viewed as a calculated risk to fuel Musk's broader vision for X, which includes integrating it with other ventures and creating a "everything app."

- Impact on product development and expansion: The debt burden could hamper X's ability to innovate and compete effectively with other social media platforms. It may lead to cuts in research and development or slower expansion into new markets.

- Risk and reward: The strategic choices made with the debt funding represent a high-stakes gamble. The potential rewards are significant – a dominant position in the tech landscape. However, the risks of default and financial instability are equally substantial. Keywords: X strategic direction, Musk's vision, acquisition strategy, operational efficiency, long-term investment.

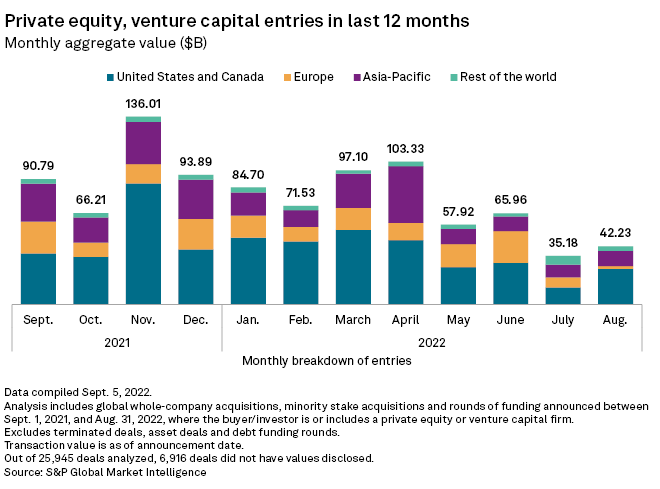

The Role of Private Equity and Institutional Investors

The investors participating in Musk's X debt sale are a mix of private equity firms and institutional investors, each with unique motivations and risk appetites. Identifying these players provides insight into the perceived risk and potential future trajectory of X.

- Prominent investors: While many remain anonymous, analyzing those publicly involved gives a picture of the market's perceived risk-reward profile.

- Investor confidence: The participation of large, established investors signals a degree of confidence in X's long-term prospects, despite the high-risk financing.

- Future partnerships: This debt sale could pave the way for future collaborations, providing X with access to capital and strategic expertise. Keywords: Private equity, institutional investors, venture capital, funding rounds, investor confidence.

Conclusion

This analysis of Musk's X debt sale reveals a complex financial picture. The substantial debt taken on presents significant challenges to X's financial stability and long-term prospects, raising questions about its future trajectory. While the strategic implications remain to be seen, understanding the intricacies of this debt sale is crucial for anyone following the evolving narrative of X and its ambitious owner. Further analysis of Musk's X debt sale and its consequences is necessary to fully grasp the long-term impact on the platform and the broader technology landscape. Stay informed on further developments related to Musk's X debt sale and its impact on the future of the platform.

Featured Posts

-

Stock Market Valuation Concerns Bof As Rationale For Investor Calm

Apr 29, 2025

Stock Market Valuation Concerns Bof As Rationale For Investor Calm

Apr 29, 2025 -

Harvard Faces Trump Administration In Court Over Funding Cuts

Apr 29, 2025

Harvard Faces Trump Administration In Court Over Funding Cuts

Apr 29, 2025 -

Trump To Pardon Pete Rose After His Death The Latest Updates

Apr 29, 2025

Trump To Pardon Pete Rose After His Death The Latest Updates

Apr 29, 2025 -

Arne Slots Impact Liverpools Close Call In The Premier League Race

Apr 29, 2025

Arne Slots Impact Liverpools Close Call In The Premier League Race

Apr 29, 2025 -

Mesa Anticipates Shen Yuns Return

Apr 29, 2025

Mesa Anticipates Shen Yuns Return

Apr 29, 2025

Latest Posts

-

A Look Into Our Farm Next Door The Lives Of Amanda Clive And Family

Apr 30, 2025

A Look Into Our Farm Next Door The Lives Of Amanda Clive And Family

Apr 30, 2025 -

The Family Next Door Farming Life With Amanda Clive And Their Children

Apr 30, 2025

The Family Next Door Farming Life With Amanda Clive And Their Children

Apr 30, 2025 -

Ravenseats Recent Setbacks Amanda Owen Provides A Family Update

Apr 30, 2025

Ravenseats Recent Setbacks Amanda Owen Provides A Family Update

Apr 30, 2025 -

New Challenges For Amanda Owen And Family At Ravenseat Farm

Apr 30, 2025

New Challenges For Amanda Owen And Family At Ravenseat Farm

Apr 30, 2025 -

Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025