Analysis: Gold Suffers First Double-Digit Weekly Losses Of 2025

Table of Contents

H2: Key Factors Contributing to Gold's Sharp Decline

The unprecedented double-digit drop in gold prices wasn't a singular event; rather, it was a confluence of factors that converged to create this perfect storm. Let's break down the major contributors.

H3: Strengthening US Dollar

The inverse relationship between the US dollar and gold prices is well-established. A stronger dollar makes gold more expensive for international buyers using other currencies, thus dampening demand. This week, we saw a significant strengthening of the US dollar, as reflected in the [link to relevant financial news source showing Dollar Index movement]. This strength was fueled by [mention specific economic data, e.g., better-than-expected employment figures, increased interest rate expectations].

- Dollar Index increase: [Insert percentage increase and date].

- Supporting economic data: [Cite specific economic indicators and their impact].

- Impact on gold demand: This directly reduced the purchasing power of international investors, leading to lower gold demand.

H3: Rising Interest Rates and Bond Yields

The Federal Reserve's recent interest rate hikes have played a crucial role in gold's decline. Higher interest rates make government bonds, a traditional safe-haven asset, more attractive than non-yielding assets like gold. This shift in investor preference has diverted capital away from gold and into higher-yielding bonds.

- Interest rate hikes: [Mention specific rate increases and dates].

- Impact on bond yields: Higher yields make bonds more competitive, drawing investment away from gold.

- Chart visualization: [Include a chart if possible, showing the correlation between interest rates and gold prices].

H3: Profit-Taking and Technical Corrections

After a period of sustained gold price increases, it's not surprising that some investors chose to take profits. This profit-taking, combined with technical indicators suggesting an overdue correction, likely exacerbated the decline.

- Technical indicators: The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicated overbought conditions, hinting at a potential correction. [Include charts if possible].

- Price patterns: [Describe any relevant price patterns, e.g., head and shoulders, suggesting a bearish trend].

- Investor behavior: Profit-taking contributed significantly to the sell-off, accelerating the price drop.

H3: Reduced Safe-Haven Demand

While geopolitical uncertainty often drives investors towards gold as a safe-haven asset, recent events have arguably reduced this demand. [Mention specific geopolitical events or news that might have contributed to this shift in sentiment]. This decrease in safe-haven buying pressure contributed to the price decline.

- Geopolitical factors: [Discuss any relevant factors, emphasizing their impact on investor confidence].

- Shift in investor sentiment: Investors may have become less risk-averse, shifting their focus to riskier assets.

H2: Implications for Gold Investors and the Market

The double-digit drop in gold prices has significant implications for investors and the broader market.

H3: Short-Term Volatility

The gold market is likely to experience increased volatility in the short term following this significant decline. Investors should exercise caution and consider diversifying their investment portfolios to mitigate risk.

- Short-term investment strategies: Consider hedging strategies or adjusting portfolio allocations to manage risk.

- Cautious approach: Avoid impulsive decisions and rely on a well-defined investment plan.

H3: Long-Term Outlook for Gold

Whether this decline signals a longer-term trend or is simply a temporary correction remains to be seen. Factors such as inflation, economic growth, and geopolitical stability will play crucial roles in shaping the long-term outlook for gold prices.

- Inflationary pressures: High inflation could continue to support gold's value as a hedge against inflation.

- Economic growth: Slowing economic growth could increase safe-haven demand for gold.

- Geopolitical uncertainty: Future geopolitical events could significantly impact gold's price.

H3: Impact on Gold Mining Companies

Lower gold prices directly impact the profitability and stock valuations of gold mining companies. Companies with higher operating costs are particularly vulnerable. [Mention examples of specific mining companies and their potential vulnerability].

- Profitability concerns: Reduced gold prices squeeze profit margins for mining companies.

- Stock valuations: Share prices of gold mining companies are likely to be affected by the drop in gold prices.

3. Conclusion

The first double-digit weekly loss in gold prices of 2025 was a result of a combination of factors: a strengthening US dollar, rising interest rates, profit-taking, and reduced safe-haven demand. This event has introduced significant short-term volatility into the gold market, emphasizing the need for caution and diversified investment strategies. While the long-term outlook for gold remains uncertain, it's crucial to monitor gold prices closely and stay updated on the latest market analysis to make informed decisions regarding your gold investments. Consider diversifying your gold investments and stay informed on the latest gold market analysis to navigate this dynamic environment effectively. Continue to monitor gold prices closely and consider your investment strategy carefully.

Featured Posts

-

The Crucial Role Of Middle Managers In Business

May 06, 2025

The Crucial Role Of Middle Managers In Business

May 06, 2025 -

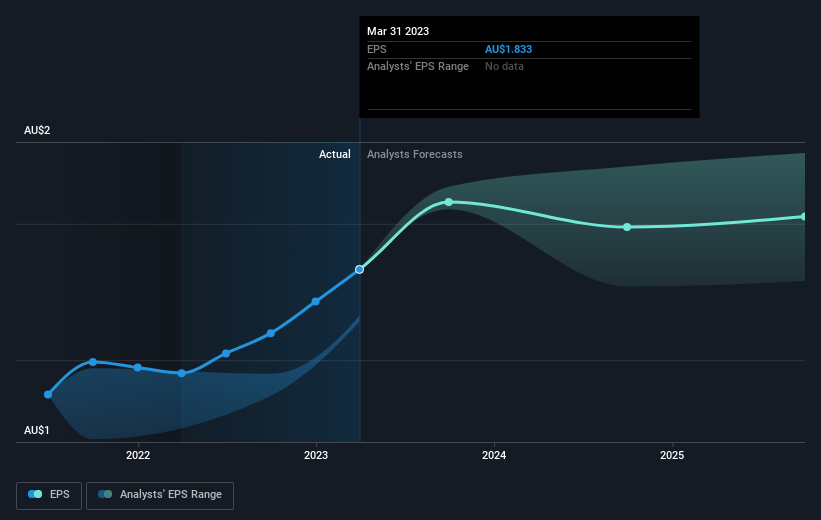

The Impact Of Margin Compression On Westpac Wbc Profitability

May 06, 2025

The Impact Of Margin Compression On Westpac Wbc Profitability

May 06, 2025 -

Far Right Candidate Faces Centrist Mayor In Romanias Election Runoff

May 06, 2025

Far Right Candidate Faces Centrist Mayor In Romanias Election Runoff

May 06, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

May 06, 2025

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

May 06, 2025 -

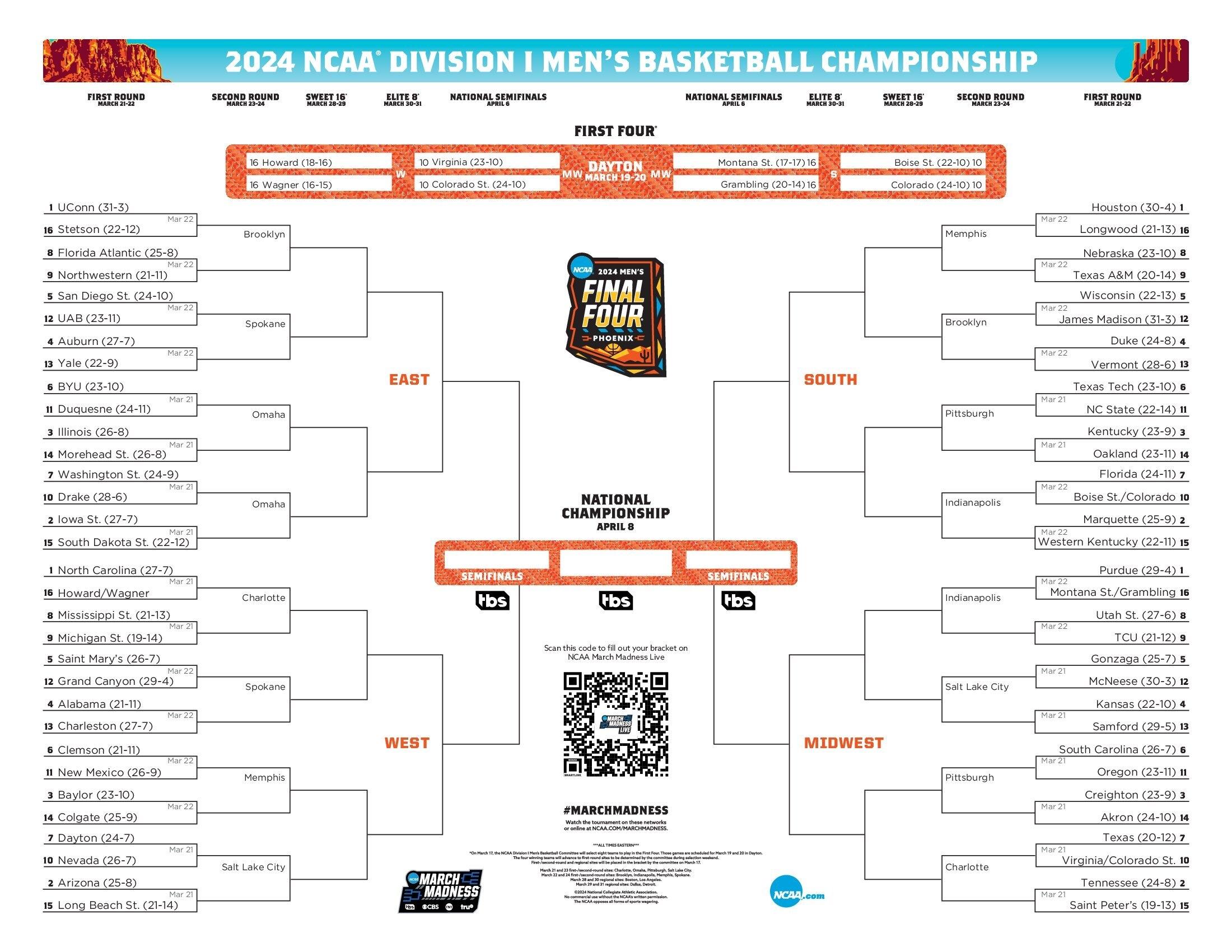

March Madness 2024 Your Guide To Online Streaming Without Cable

May 06, 2025

March Madness 2024 Your Guide To Online Streaming Without Cable

May 06, 2025

Latest Posts

-

Koetue Koku Sorunu Marka Imajini Koruma Yollari

May 06, 2025

Koetue Koku Sorunu Marka Imajini Koruma Yollari

May 06, 2025 -

Hos Kokunun Oenemi Itibari Etkileyen Faktoerler

May 06, 2025

Hos Kokunun Oenemi Itibari Etkileyen Faktoerler

May 06, 2025 -

Nbcs Nba Coverage Reggie Millers Analyst Role And The Future Of Basketball Broadcasting

May 06, 2025

Nbcs Nba Coverage Reggie Millers Analyst Role And The Future Of Basketball Broadcasting

May 06, 2025 -

Itibar Yoenetimi Hos Kokunun Oetesinde Basari

May 06, 2025

Itibar Yoenetimi Hos Kokunun Oetesinde Basari

May 06, 2025 -

Nba Broadcast Changes Reggie Millers Nbc Appointment And What It Means For Fans

May 06, 2025

Nba Broadcast Changes Reggie Millers Nbc Appointment And What It Means For Fans

May 06, 2025