Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value

Table of Contents

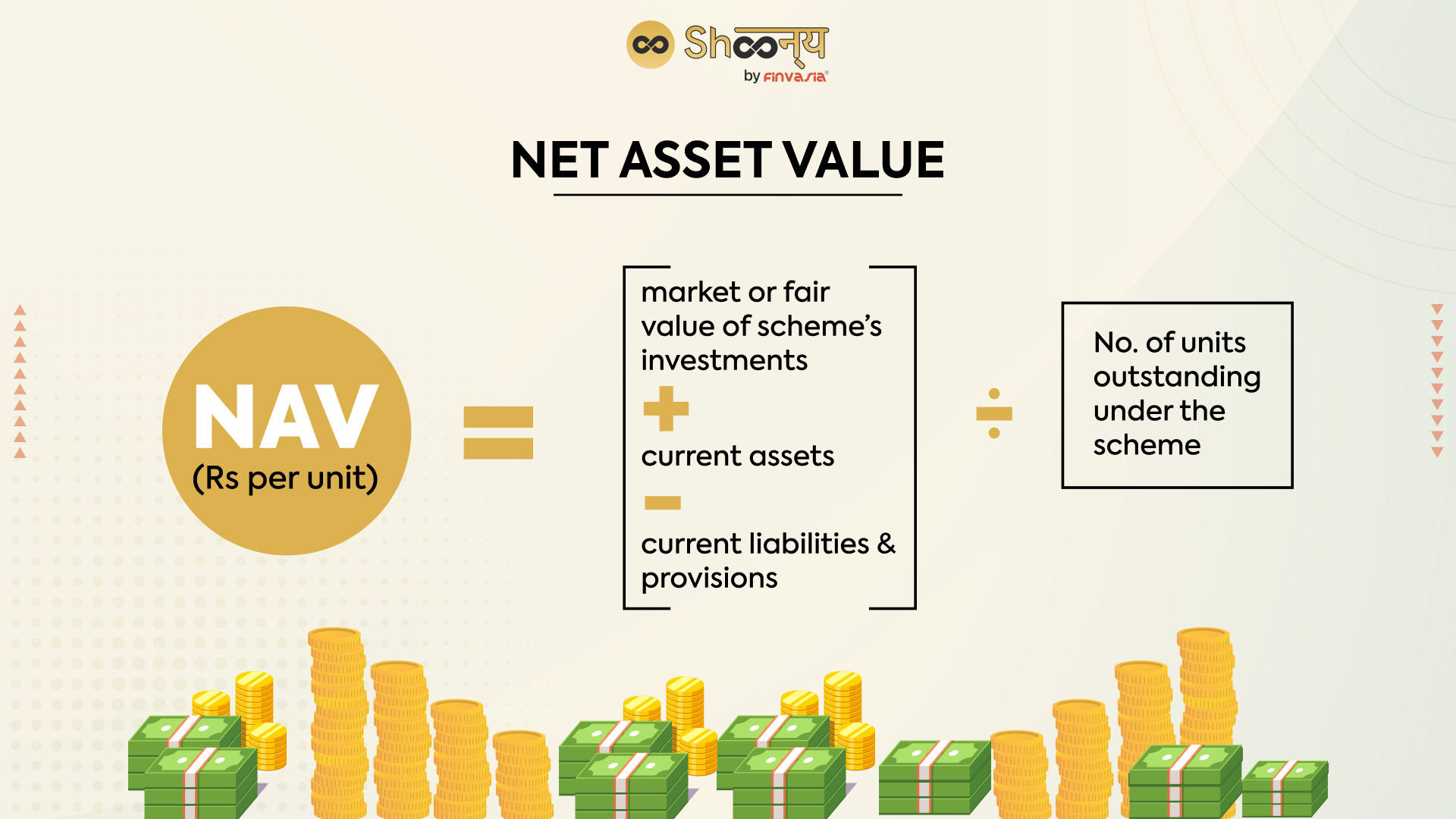

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi MSCI All Country World UCITS ETF USD Acc, this means it reflects the total value of all the global stocks held within the ETF, adjusted for any liabilities. Because this ETF tracks the MSCI All Country World Index, its NAV is heavily influenced by the performance of global equities across various sectors and countries. The calculation considers the market value of each holding, converted to US Dollars (USD Acc), minus any expenses or liabilities, then divided by the total number of outstanding ETF shares.

- NAV represents the per-share value of the ETF's underlying assets. This is the intrinsic value of your investment.

- Calculated daily, usually at market close. The NAV provides a snapshot of the ETF's value at the end of each trading day.

- Reflects the total value of the ETF's holdings minus liabilities, divided by the number of outstanding shares. This ensures a fair and accurate representation of the ETF's worth.

- Crucial for understanding ETF performance and price discrepancies. Comparing the NAV to the market price helps identify potential arbitrage opportunities or market inefficiencies.

Factors Affecting Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors influence the daily fluctuations of the Amundi MSCI All Country World UCITS ETF USD Acc NAV. Understanding these factors is essential for interpreting NAV movements and managing expectations.

- Global market trends: The performance of global stock markets, including those in developed economies like the US, Europe, and Japan, and emerging markets, directly impacts the NAV. Positive market sentiment generally leads to a higher NAV, while negative sentiment leads to a lower NAV. This includes factors like economic growth, interest rate changes, and geopolitical events.

- Currency fluctuations between USD and other currencies in the ETF’s holdings: Since the ETF is denominated in USD (USD Acc), fluctuations in exchange rates between the USD and other currencies represented in the underlying index will affect the overall NAV. A strengthening dollar can lead to a higher NAV, while a weakening dollar can have the opposite effect.

- Dividend payments from underlying stocks reduce the NAV, but investors receive the dividends separately. When the underlying companies pay dividends, the NAV decreases to reflect the distribution. However, investors receive these dividends directly, so their total investment value is not necessarily reduced.

- Changes in the composition of the underlying index (MSCI All Country World): The MSCI All Country World Index is rebalanced periodically, which can impact the ETF's holdings and, consequently, its NAV. Additions and removals of companies from the index can lead to changes in the overall value.

How to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Accessing the daily Amundi MSCI All Country World UCITS ETF USD Acc NAV is straightforward through several reliable channels:

- Check Amundi's official website: The ETF provider's website is the most reliable source for official NAV data.

- Use major financial data providers (Bloomberg, Refinitiv, etc.): Professional financial data platforms offer detailed information on ETFs, including historical and real-time NAV data.

- Consult your brokerage account statement: Most brokerage accounts display the current NAV of your held ETFs directly within your portfolio overview.

- Utilize dedicated ETF tracking websites and apps: Many financial websites and apps provide real-time and historical NAV information for various ETFs.

Using NAV to Make Informed Investment Decisions

Understanding and tracking the Amundi MSCI All Country World UCITS ETF USD Acc NAV is vital for informed investment decisions.

- Track NAV changes over time to assess the ETF's growth: Monitoring the NAV's performance over time helps evaluate the ETF's long-term growth and compare it to your investment goals.

- Compare NAV to the ETF's market price to identify potential arbitrage opportunities (though usually minimal for liquid ETFs): While arbitrage opportunities are rare in liquid ETFs, comparing the NAV to the market price can highlight any significant discrepancies.

- Use NAV data for buy/sell decisions based on personal investment goals: The NAV provides a crucial benchmark for evaluating whether to buy or sell the ETF based on your individual investment strategy and risk tolerance.

Conclusion

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV is crucial for any investor seeking exposure to the global equity market through this ETF. By regularly monitoring the NAV and understanding the factors influencing its fluctuations, investors can make more informed investment decisions, track performance effectively, and better manage their portfolio. Remember to consult the ETF's prospectus for a complete understanding of the investment and its associated risks. Regularly monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV is a key component of successful long-term investing in this diversified global equity ETF.

Featured Posts

-

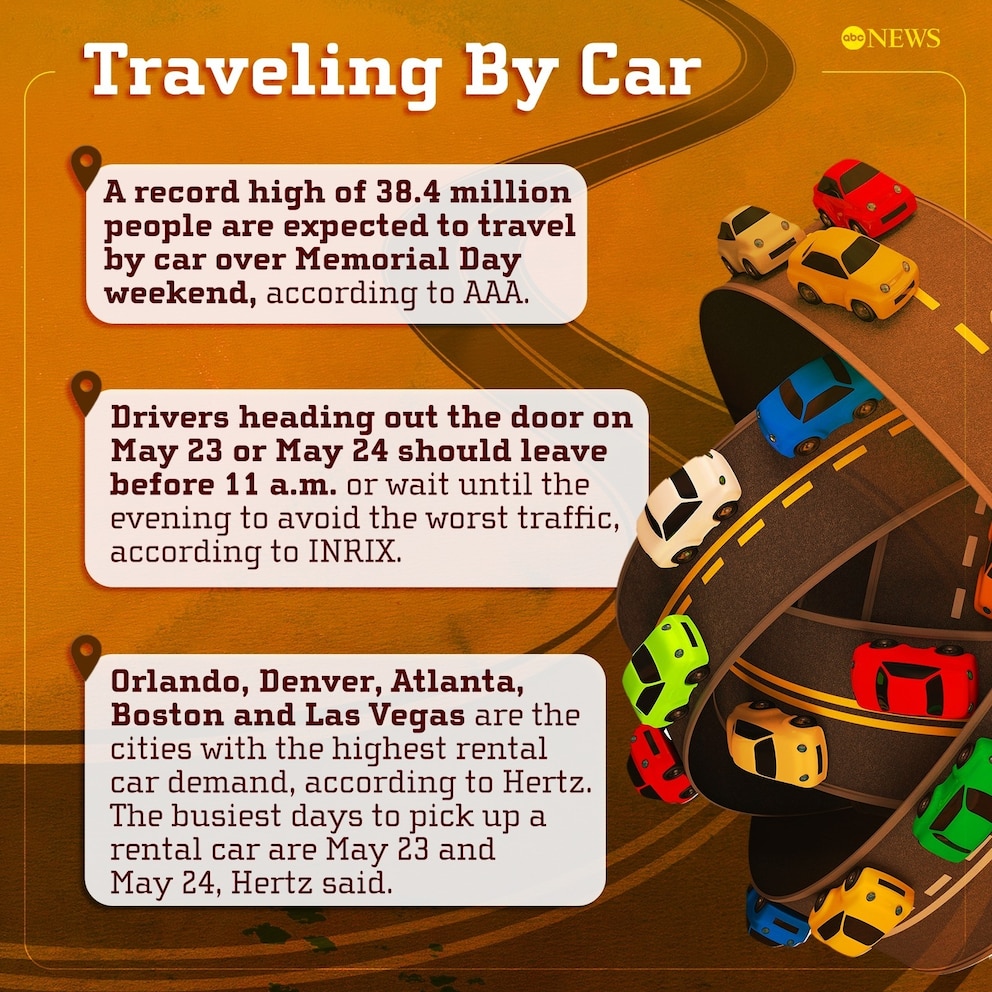

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 25, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 25, 2025 -

Net Asset Value Nav Explained Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025

Net Asset Value Nav Explained Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025 -

The Ferrari Challenge South Floridas Premier Racing Event

May 25, 2025

The Ferrari Challenge South Floridas Premier Racing Event

May 25, 2025 -

Memorial Day 2025 Flight Bookings When To Fly And Save Money

May 25, 2025

Memorial Day 2025 Flight Bookings When To Fly And Save Money

May 25, 2025 -

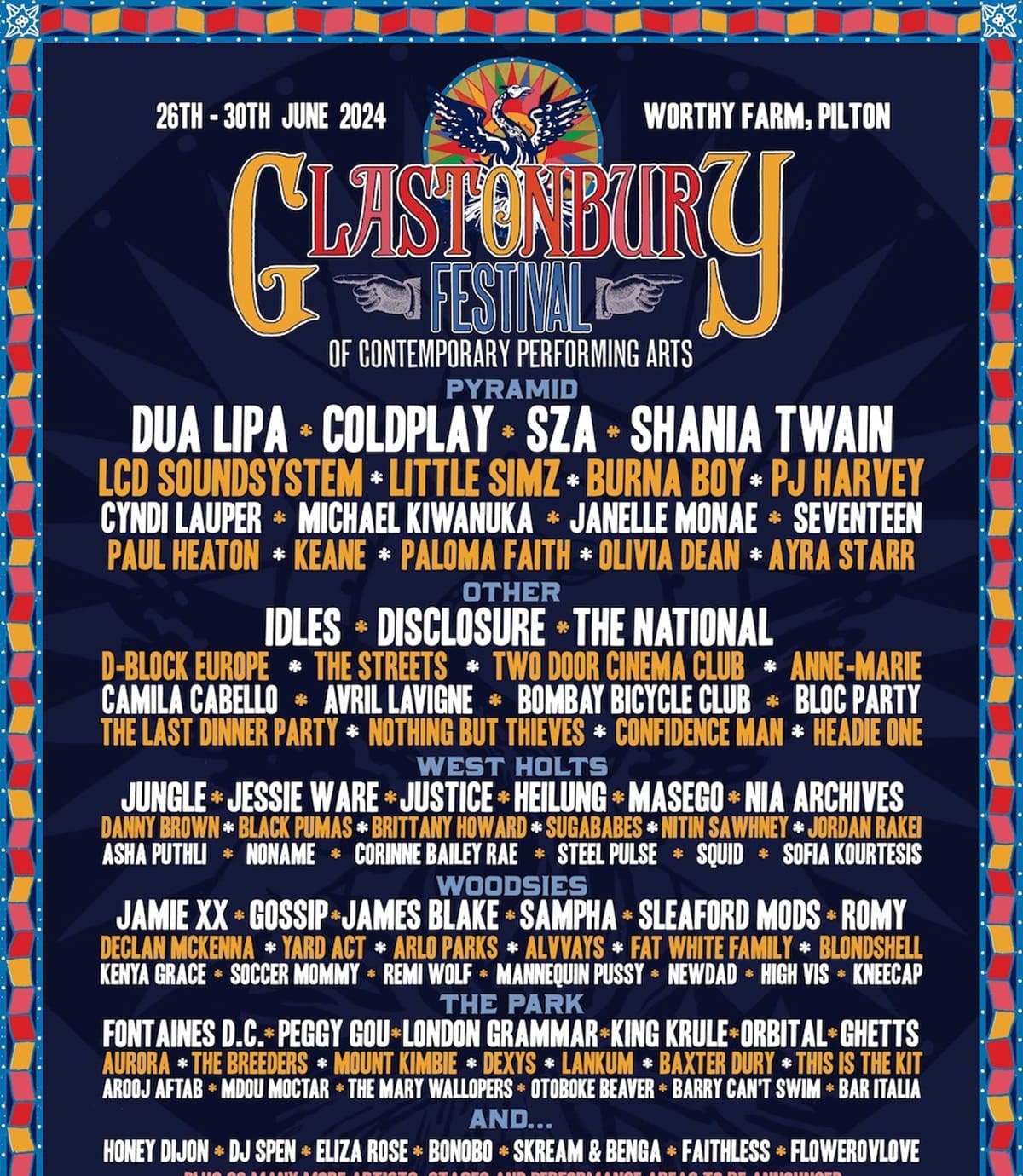

Glastonbury 2024 Unannounced Us Band To Play

May 25, 2025

Glastonbury 2024 Unannounced Us Band To Play

May 25, 2025

Latest Posts

-

Live Major Incident On Princess Road Pedestrian Vs Vehicle

May 25, 2025

Live Major Incident On Princess Road Pedestrian Vs Vehicle

May 25, 2025 -

Pedestrian Hit By Vehicle On Princess Road Live Emergency Response

May 25, 2025

Pedestrian Hit By Vehicle On Princess Road Live Emergency Response

May 25, 2025 -

Princess Road Incident Emergency Services Respond To Pedestrian Accident Live Updates

May 25, 2025

Princess Road Incident Emergency Services Respond To Pedestrian Accident Live Updates

May 25, 2025 -

M62 Westbound Roadworks Resurfacing Project Between Manchester And Warrington Causes Closure

May 25, 2025

M62 Westbound Roadworks Resurfacing Project Between Manchester And Warrington Causes Closure

May 25, 2025 -

Live M56 Traffic Updates Motorway Closed Due To Accident

May 25, 2025

Live M56 Traffic Updates Motorway Closed Due To Accident

May 25, 2025