Net Asset Value (NAV) Explained: Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

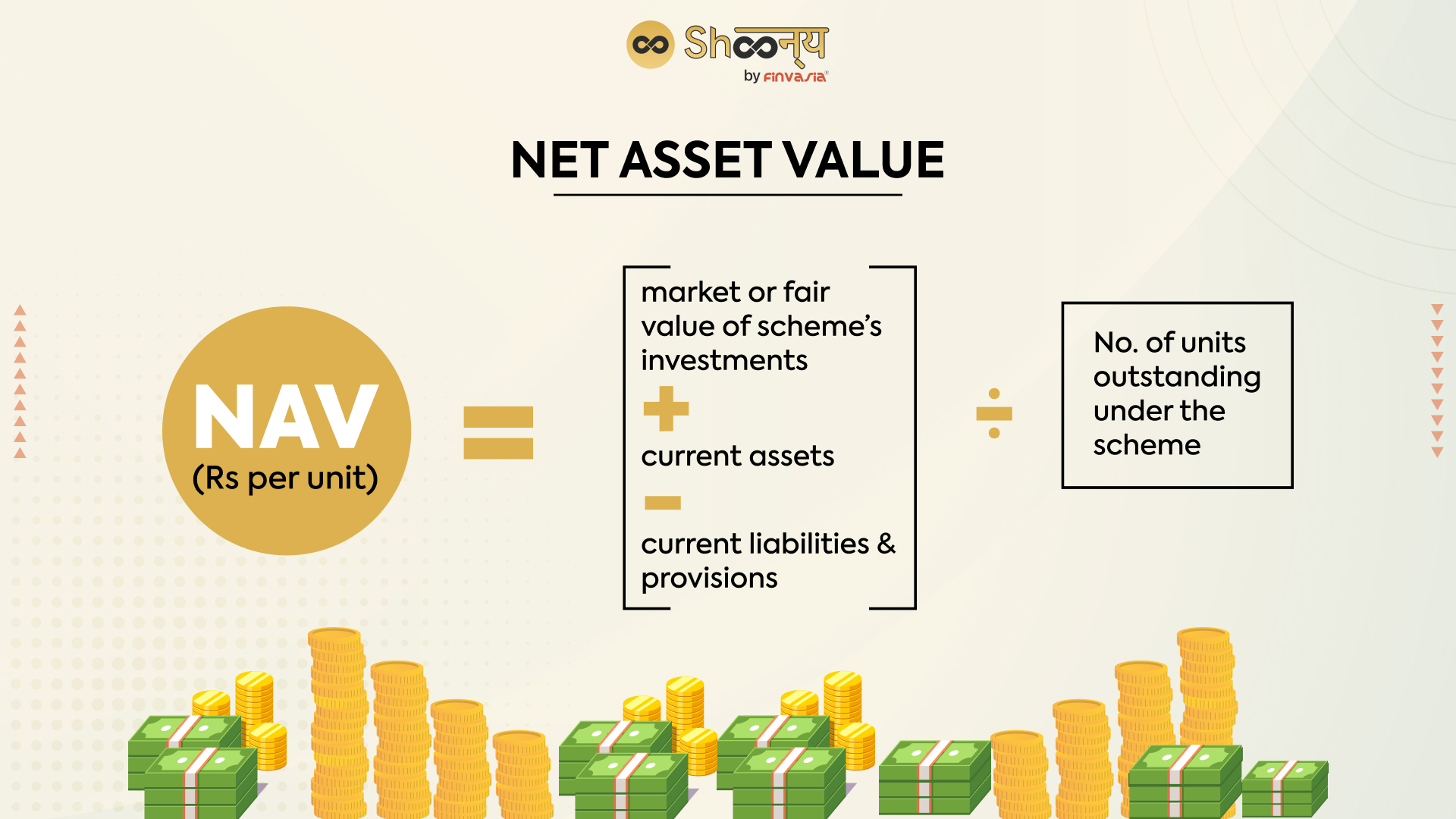

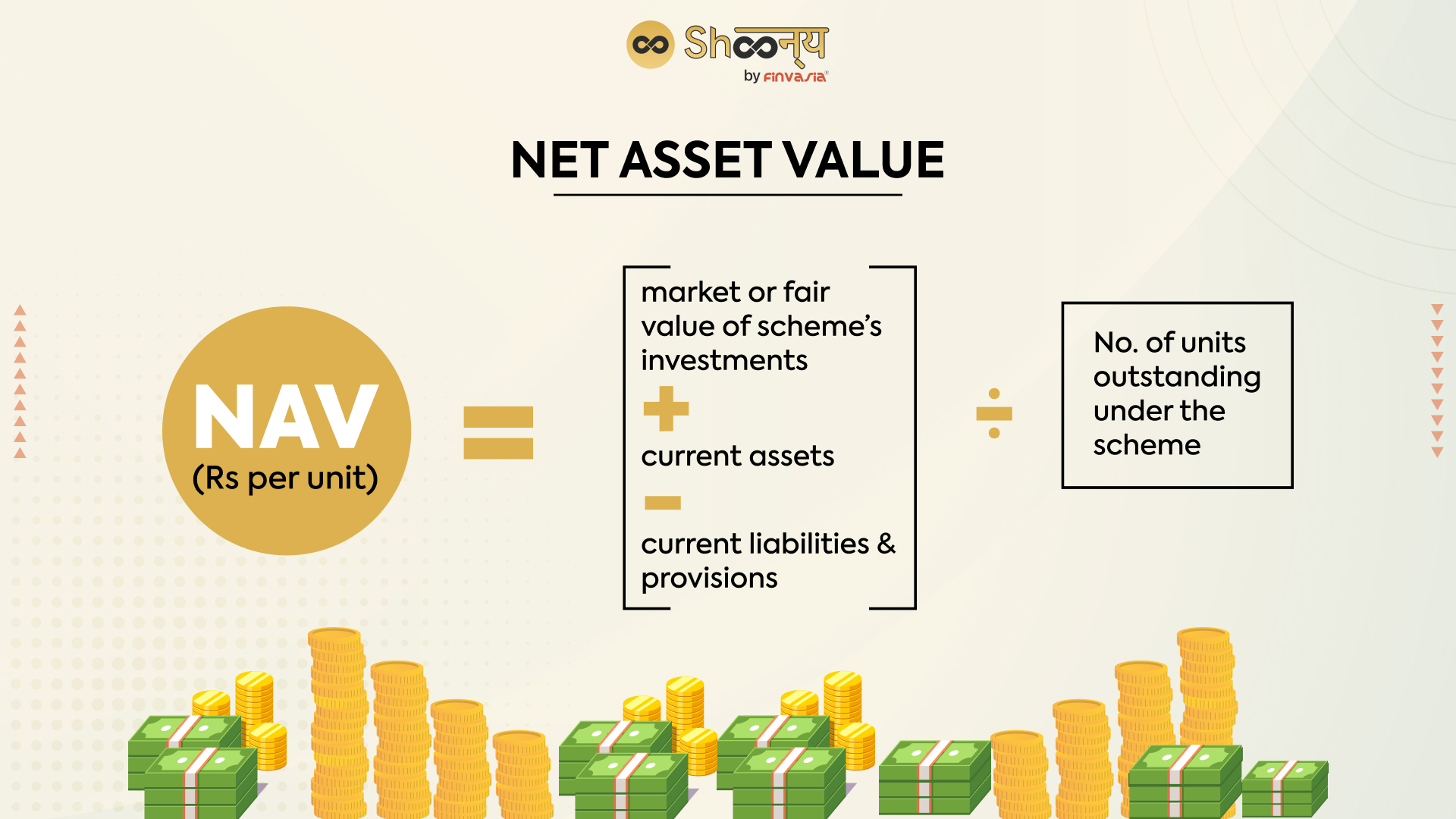

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net worth of an investment fund, like an ETF, per share. It's calculated by subtracting the fund's liabilities (expenses, debts) from its assets (the total market value of all its holdings). Understanding this simple formula is key to comprehending ETF pricing and performance.

- Calculation: NAV = (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

- NAV vs. Market Price: While the NAV is the intrinsic value of an ETF share, the market price is the price at which it trades on the exchange. These can differ slightly, especially in less liquid ETFs.

- Influencing Factors: Several factors affect an ETF's NAV, including:

- Fluctuations in the market value of the underlying assets.

- Dividend income received by the ETF.

- Management fees and other operating expenses.

Example: Let's say an ETF holds $10 million in assets and has $100,000 in liabilities with 1 million outstanding shares. The NAV would be ($10,000,000 - $100,000) / 1,000,000 = $9.90 per share.

NAV and the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Amundi MSCI World Catholic Principles UCITS ETF Acc, like other ETFs, has a daily calculated NAV. However, its unique investment strategy, focusing on companies adhering to Catholic principles, influences its NAV calculation. This involves a specific screening process that excludes companies involved in activities considered contrary to these principles (e.g., weapons manufacturing, abortion services). This screening affects the selection of underlying assets and thus impacts the overall NAV.

- Calculation Frequency: The NAV is typically calculated daily, at the close of market.

- Publication: You can find the daily NAV on Amundi's official website, major financial news sources, and through your brokerage account.

- Official Source: [Insert Link to Amundi's Official NAV Data Source for this ETF].

Why is NAV Important for ETF Investors?

Monitoring the NAV is crucial for several reasons:

- Performance Assessment: Changes in NAV reflect the ETF's performance over time. Tracking the NAV allows investors to measure gains or losses.

- Return Calculation: The NAV is used to calculate the ETF's rate of return. This provides a clear picture of investment growth.

- ETF Comparison: Comparing the NAVs of different ETFs helps investors assess relative performance and make informed choices.

- Buy/Sell Decisions: While the market price dictates the actual transaction price, the NAV provides valuable context for evaluating whether an ETF is trading at a premium or discount to its intrinsic value.

Understanding the Risks Associated with NAV Fluctuations

NAV isn't static; it fluctuates with market conditions.

- Market Volatility: Changes in the market value of the underlying assets directly impact the ETF's NAV. A market downturn will generally lead to a decrease in NAV.

- Market Correlation: The NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc will generally correlate with the overall market performance, although its specific holdings and screening criteria may moderate this correlation.

- NAV-Market Price Discrepancies: Minor discrepancies between NAV and market price are normal, especially in less liquid ETFs. Significant discrepancies might signal market inefficiencies or other factors.

- Investor Implications: Fluctuations can result in gains or losses for investors. Understanding these fluctuations helps manage risk and make informed decisions.

Amundi MSCI World Catholic Principles UCITS ETF Acc: A Deeper Dive into its Investment Strategy

The Amundi MSCI World Catholic Principles UCITS ETF Acc invests in a diversified portfolio of global equities. The "Catholic Principles" aspect signifies a responsible investing approach. The screening process, excluding companies involved in certain industries, shapes the portfolio composition and impacts the NAV.

- Investment Strategy: The ETF seeks to track the MSCI World Index, but with the additional layer of ethical screening aligned with Catholic social teachings.

- Asset Types: The ETF primarily holds equities (stocks) across various sectors but excludes companies that do not meet its ethical criteria.

- NAV Impact: The specific holdings and the exclusion of certain companies influence the ETF’s NAV, potentially making it less volatile than a purely market-tracking index.

Conclusion: Making Informed Decisions with Net Asset Value (NAV)

Understanding Net Asset Value (NAV) is paramount for successful ETF investing. For the Amundi MSCI World Catholic Principles UCITS ETF Acc, regularly monitoring the NAV provides valuable insights into its performance and allows you to make better-informed investment decisions. By understanding the factors influencing NAV and its relationship to market price, you can navigate market volatility effectively. Remember to regularly check the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc and consult with a financial advisor for personalized advice. Further resources on NAV and ETF investing are readily available online and through your financial institution. Start making informed decisions with Net Asset Value today!

Featured Posts

-

Matt Maltese Discusses Her In Deep Intimacy Growth And His Sixth Album

May 25, 2025

Matt Maltese Discusses Her In Deep Intimacy Growth And His Sixth Album

May 25, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 25, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 25, 2025 -

Ferrari Challenge Racing Days A South Florida Spectacle

May 25, 2025

Ferrari Challenge Racing Days A South Florida Spectacle

May 25, 2025 -

Meregdraga Porsche 911 80 Millio Forint Az Extrak Ara

May 25, 2025

Meregdraga Porsche 911 80 Millio Forint Az Extrak Ara

May 25, 2025 -

Frankfurt Aktien Dax Entwicklung Und Wichtige Faelligkeiten Am 21 Maerz 2025

May 25, 2025

Frankfurt Aktien Dax Entwicklung Und Wichtige Faelligkeiten Am 21 Maerz 2025

May 25, 2025

Latest Posts

-

M6 Closed Van Overturn Causes Long Queues

May 25, 2025

M6 Closed Van Overturn Causes Long Queues

May 25, 2025 -

Major Delays On M6 After Van Crash

May 25, 2025

Major Delays On M6 After Van Crash

May 25, 2025 -

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025 -

Live Major Incident On Princess Road Pedestrian Vs Vehicle

May 25, 2025

Live Major Incident On Princess Road Pedestrian Vs Vehicle

May 25, 2025 -

Pedestrian Hit By Vehicle On Princess Road Live Emergency Response

May 25, 2025

Pedestrian Hit By Vehicle On Princess Road Live Emergency Response

May 25, 2025