Amundi Dow Jones Industrial Average UCITS ETF (Dist): NAV Explained

Table of Contents

What is NAV and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF (Dist)?

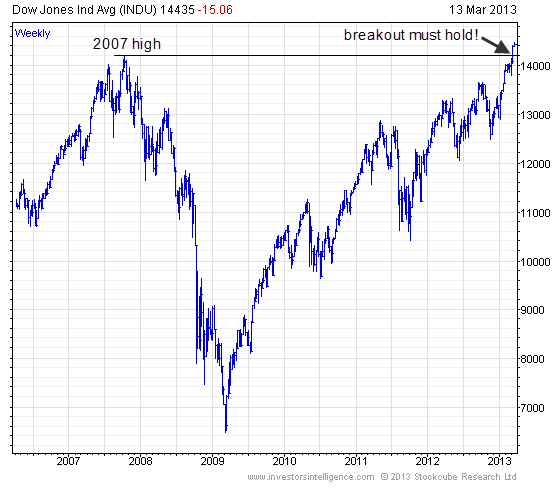

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), this means calculating the total value of its holdings in the 30 companies that make up the Dow Jones Industrial Average (DJIA), subtracting any expenses or liabilities, and then dividing by the total number of ETF shares.

-

Components of the NAV Calculation:

- Asset Value: The market value of all the securities held by the ETF, tracking the DJIA.

- Liabilities: These include expenses such as management fees, administrative costs, and any other outstanding obligations.

- Outstanding Shares: The total number of Amundi Dow Jones Industrial Average UCITS ETF (Dist) shares currently held by investors.

-

The Role of the Custodian: A custodian, an independent third party, plays a vital role in verifying the accuracy of the asset values used in the NAV calculation, ensuring transparency and accountability.

-

Frequency of NAV Calculation: The NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is typically calculated daily, reflecting the closing prices of the underlying DJIA components. You can usually find this information on the ETF provider's website and on major financial data providers. Finding this data is crucial for tracking performance. Search for "Amundi ETF NAV" or "Dow Jones Industrial Average ETF NAV" to locate the most up-to-date information.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist), directly impacting its value and your potential returns.

-

Market Movements of the DJIA: As the ETF tracks the DJIA, its NAV is directly influenced by the performance of the index. A rising DJIA generally leads to a higher NAV, and vice-versa. Understanding "DJIA impact on NAV" is key to successful investing.

-

Currency Fluctuations: While the Amundi Dow Jones Industrial Average UCITS ETF (Dist) primarily focuses on US-based companies, any currency fluctuations between the US dollar and the Euro (or other currencies held) can impact the NAV. This is especially important to consider when assessing "currency risk."

-

Dividend Impact: Dividends paid by the underlying companies in the DJIA are received by the ETF and contribute to its NAV. Understanding the "dividend impact" is crucial for accurately projecting NAV growth.

-

Management Fees: The ETF's management fees, also known as the expense ratio, are deducted from the asset value, slightly reducing the NAV over time. Keeping an eye on the "expense ratio" is important for long-term investors.

Interpreting the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV

Understanding how to interpret the NAV is critical for effective investment management.

-

Tracking Performance: By comparing the NAV on different dates, you can track the ETF's performance over time. This allows you to gauge the growth of your investment relative to the "NAV performance."

-

ETF Price vs. NAV: The market price of the ETF may differ slightly from its NAV, creating a premium or discount. Understanding this "premium/discount" is important to identify potential buying or selling opportunities.

-

Investment Strategy: The NAV reflects the success of the ETF’s underlying investment strategy – closely mirroring the DJIA.

-

Accessing NAV Data: Reliable daily "historical NAV data" can be found on the Amundi website and major financial data platforms.

Amundi Dow Jones Industrial Average UCITS ETF (Dist): Distribution Impact on NAV

The Amundi Dow Jones Industrial Average UCITS ETF (Dist) distributes dividends received from the underlying companies to its shareholders. This impacts the NAV.

-

Dividend Distribution: Distributions reduce the NAV, as the assets are distributed to investors. This is reflected on the "ex-dividend date," the date on which the share price is adjusted to reflect the distribution.

-

Timing and Frequency: The frequency and amount of distributions are not fixed and depend on the dividends paid by the underlying DJIA companies. Checking the "distribution history" will give you a clearer picture.

-

Tax Implications: Remember that dividend distributions are usually taxable events. Understanding the "tax implications" is vital for responsible financial planning. You may want to consider the impact of "reinvested dividends" on your overall tax liability.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is essential for making informed investment decisions. By understanding the factors affecting the NAV, including the influence of the DJIA, dividends, and management fees, you can better track your investment's performance and make sound buy and sell decisions. Regularly monitor the NAV and consult the ETF's official documentation for the most accurate and up-to-date information. Remember to consider the impact of distributions on your overall return. For comprehensive details on the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV and other relevant information, visit the Amundi website [insert link here]. Mastering your understanding of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV will empower you to make better investment decisions.

Featured Posts

-

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025 -

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025 -

130 Years After The Scandal A Push To Honor Alfred Dreyfus

May 24, 2025

130 Years After The Scandal A Push To Honor Alfred Dreyfus

May 24, 2025 -

Kueloenleges Porsche 911 80 Millio Forintos Extrak

May 24, 2025

Kueloenleges Porsche 911 80 Millio Forintos Extrak

May 24, 2025

Latest Posts

-

I Phone Ai I Phone

May 24, 2025

I Phone Ai I Phone

May 24, 2025 -

Ces Unveiled Europe L Evenement Tech A Ne Pas Manquer A Amsterdam

May 24, 2025

Ces Unveiled Europe L Evenement Tech A Ne Pas Manquer A Amsterdam

May 24, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Quelles Innovations Attendre

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Quelles Innovations Attendre

May 24, 2025 -

Retour Du Ces Unveiled A Amsterdam Nouveautes Technologiques En Europe

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Nouveautes Technologiques En Europe

May 24, 2025 -

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 24, 2025

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 24, 2025