UK Inflation Slows, BOE Rate Cut Expectations Diminish: Pound Rises

Table of Contents

Falling UK Inflation Figures and Their Significance

The latest UK inflation data reveals a welcome slowdown. While inflation remains stubbornly high, the recent figures represent a significant decrease compared to previous months and initial projections. This unexpected positive development can be attributed to several factors, including easing energy prices and a weakening in consumer demand.

- CPI (Consumer Price Index): The CPI, a key measure of inflation, showed a [insert latest CPI percentage] decrease, down from [insert previous month's CPI percentage].

- RPI (Retail Price Index): The RPI, another important inflation indicator, also experienced a reduction to [insert latest RPI percentage], compared to [insert previous month's RPI percentage].

- Specific Price Changes: Significant price reductions were observed in key sectors, such as energy, where prices fell by [insert percentage], and food, experiencing a [insert percentage] decrease.

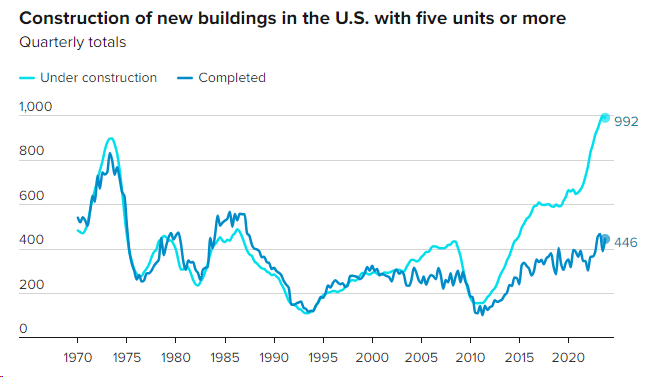

[Insert relevant chart or graph visually representing the CPI and RPI data over the past few months].

These positive shifts in the UK inflation rate provide much-needed relief for consumers and businesses struggling with the cost-of-living crisis. Lower UK inflation rates indicate reduced inflationary pressure across the economy.

Diminished Expectations for BOE Rate Cuts

The decreased UK inflation rate significantly impacts the likelihood of the Bank of England implementing further interest rate cuts. The market's initial expectation of a continued easing of monetary policy has now shifted, with many analysts predicting a pause or even a potential interest rate hike in the coming months.

- Market Reaction: Financial markets reacted positively to the inflation data, with yields on UK government bonds rising, reflecting a reduced appetite for safe-haven assets as inflation concerns ease.

- BOE Statements: While no concrete announcements have been made, some BOE officials have hinted at a more cautious approach to future monetary policy decisions, suggesting that the central bank will closely monitor inflation data before making any further rate adjustments. This implies a reduced likelihood of another rate cut.

The shift in expectations demonstrates the market's sensitivity to inflation data and its significant influence on central bank decisions regarding interest rates.

The Pound's Response to Lower Inflation and Reduced Rate Cut Expectations

The positive correlation between lower inflation, less anticipated rate cuts, and a strengthening Pound is clearly evident. The reduced likelihood of further interest rate cuts makes UK assets more attractive to international investors, leading to increased demand for the Pound Sterling.

- GBP Performance: Since the release of the inflation data, the Pound has strengthened against major currencies like the US dollar (USD) and the Euro (EUR), appreciating by [insert percentage] and [insert percentage] respectively.

- Economic Impact: This strengthening GBP has several implications for the UK economy. It could potentially curb inflation further by making imports cheaper, but simultaneously make UK exports more expensive, potentially affecting trade balances. The impact on businesses and consumers will depend on their specific exposure to international trade.

This movement in the GBP exchange rate highlights the significant impact of macroeconomic factors on currency trading in the foreign exchange market.

Analyzing the Long-Term Outlook for UK Inflation and the Pound

Predicting future inflation trends and the Pound's trajectory remains challenging. While the recent data is encouraging, several factors could influence the economic outlook, including:

- Global Economic Conditions: Global economic uncertainty, supply chain disruptions, and geopolitical tensions could continue to impact UK inflation.

- Government Policies: Fiscal and monetary policies implemented by the UK government will play a crucial role in shaping future inflation and the value of the Pound.

Experts are divided on the long-term outlook for GBP forecasts. Some predict continued stabilization, others foresee further volatility, depending on the evolving economic landscape and future inflation forecasts.

Conclusion: Understanding the Impact of UK Inflation Slowdown on the Pound

In conclusion, the slowdown in UK inflation has significantly impacted the economic outlook, diminishing expectations for BOE rate cuts and leading to a rise in the value of the Pound Sterling. The improved inflation figures represent a positive development for the UK economy, although the long-term effects remain to be seen. It's crucial to monitor future inflation data, BOE statements on monetary policy, and the subsequent impact on the GBP exchange rate. Stay updated on the latest developments in UK inflation and its effect on the Pound Sterling by subscribing to our newsletter!

Featured Posts

-

Your Complete Guide To Bbc Radio 1 Big Weekend 2025 Tickets

May 25, 2025

Your Complete Guide To Bbc Radio 1 Big Weekend 2025 Tickets

May 25, 2025 -

Flood Advisories Issued For Miami Valley Due To Severe Storms

May 25, 2025

Flood Advisories Issued For Miami Valley Due To Severe Storms

May 25, 2025 -

The Sutton Hoo Ship Burial New Insights Into Sixth Century Cremation Practices

May 25, 2025

The Sutton Hoo Ship Burial New Insights Into Sixth Century Cremation Practices

May 25, 2025 -

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025 -

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey V Filme

May 25, 2025

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey V Filme

May 25, 2025

Latest Posts

-

Atletico Madrid In Geriden Gelislerinin Sirri

May 25, 2025

Atletico Madrid In Geriden Gelislerinin Sirri

May 25, 2025 -

Atletico Madrid Zorlu Maclarda Geriden Gelip Kazanmak

May 25, 2025

Atletico Madrid Zorlu Maclarda Geriden Gelip Kazanmak

May 25, 2025 -

Geriden Gelen Atletico Madrid Taktik Ve Stratejiler

May 25, 2025

Geriden Gelen Atletico Madrid Taktik Ve Stratejiler

May 25, 2025 -

Atletico Madrid In Geriden Gelis Basarilari

May 25, 2025

Atletico Madrid In Geriden Gelis Basarilari

May 25, 2025 -

4 Gol 30 Dakika Soerloth La Liga Yi Kasip Kavurdu

May 25, 2025

4 Gol 30 Dakika Soerloth La Liga Yi Kasip Kavurdu

May 25, 2025