Amsterdam Exchange: AEX Index Suffers Significant Losses

Table of Contents

Key Factors Contributing to the AEX Index Decline

Several interconnected factors have contributed to the recent decline in the AEX Index. Understanding these factors is crucial for investors seeking to make informed decisions.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. This uncertainty directly impacts the Amsterdam Exchange and the AEX Index.

- Rising Interest Rates: Central banks globally are raising interest rates to combat inflation, increasing borrowing costs for businesses and dampening economic growth. This negatively impacts corporate profitability and investor confidence.

- Energy Crisis: The ongoing energy crisis in Europe, exacerbated by the war in Ukraine, has driven up energy prices, impacting businesses across various sectors and increasing production costs.

- War in Ukraine: The geopolitical instability caused by the war in Ukraine has created uncertainty in global markets, leading to risk aversion and capital flight. This uncertainty directly impacts investor sentiment towards the AEX.

- Supply Chain Disruptions: Persistent supply chain bottlenecks continue to disrupt global trade, impacting production and increasing costs for businesses. This has led to reduced profitability and decreased investor confidence in various AEX-listed companies.

For example, the energy sector within the AEX has seen a percentage drop of X% (replace X with actual data), while the technology sector has experienced a Y% decline (replace Y with actual data). These figures clearly illustrate the significant impact of global economic headwinds on the AEX Index.

Sector-Specific Performance

The AEX Index is composed of various sectors, each exhibiting different levels of resilience during this market downturn.

- Financials: The financial sector, heavily reliant on interest rate environments and global economic stability, has been significantly impacted by rising interest rates and recession fears.

- Energy: The energy sector, while initially benefiting from high energy prices, has experienced volatility due to price fluctuations and geopolitical uncertainty.

- Technology: The technology sector, often considered a growth sector, has not been immune to the broader market downturn, experiencing significant losses due to reduced consumer spending and increased investor risk aversion.

[Insert Chart/Graph illustrating sector performance here]

Impact of Specific Companies

Several major companies listed on the AEX have contributed significantly to the index's decline.

- ING Groep (INGA.AS): ING, a major Dutch bank, has experienced share price declines due to concerns about the impact of rising interest rates on its profitability.

- ASML Holding (ASML.AS): While a generally resilient company, ASML, a leading semiconductor equipment manufacturer, has seen some decline due to broader technology sector weakness.

- Unilever (UNA.AS): Unilever, a consumer goods giant, has experienced pressure due to decreased consumer demand and inflationary pressures affecting its margins.

Analyzing the Impact on Investors

The AEX Index's decline has significant implications for investors.

Portfolio Diversification and Risk Management

The current market conditions underscore the critical importance of portfolio diversification and robust risk management strategies.

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate losses during market downturns.

- Asset Allocation: A well-defined asset allocation strategy, tailored to individual risk tolerance and investment goals, is crucial for navigating market volatility.

- Hedging Techniques: Employing hedging strategies, such as options or futures contracts, can help protect against potential losses.

Long-Term Investment Strategies

Maintaining a long-term investment horizon is crucial during periods of market turbulence. Panic selling often leads to significant losses.

- Buy-and-Hold Strategy: A buy-and-hold strategy, focusing on long-term value creation rather than short-term market fluctuations, can be beneficial.

- Fundamental Analysis: Thorough fundamental analysis of companies before investing can help identify undervalued assets and reduce investment risk.

Potential Recovery and Future Outlook for the AEX Index

The future trajectory of the AEX Index depends on several factors.

Government Intervention and Economic Policies

Government intervention and economic policies can play a significant role in stabilizing the market.

- Fiscal Stimulus: Government spending can stimulate economic growth and boost investor confidence.

- Monetary Policy Changes: Central bank actions, such as interest rate adjustments, can influence market sentiment and economic activity.

- Regulatory Interventions: Regulatory measures aimed at increasing market transparency and stability can help improve investor confidence.

Market Predictions and Analyst Opinions

Predicting the future of the AEX Index is inherently challenging, but analyzing market predictions and expert opinions can offer valuable insights.

- [Mention specific analyst predictions and their rationale here, citing sources].

Conclusion

The recent plunge in the Amsterdam Exchange (AEX) index is a result of a confluence of factors, including global economic uncertainty, sector-specific challenges, and the performance of individual companies. The impact on investors underscores the importance of diversification, risk management, and a long-term investment strategy. While the future outlook remains uncertain, understanding the underlying causes and potential government interventions is crucial for informed investment decisions.

Call to Action: Stay informed about the fluctuations of the Amsterdam Exchange (AEX) index and the Dutch stock market. Utilize reliable sources for up-to-date information to make informed investment decisions, and consider consulting a financial advisor for personalized guidance regarding your investment portfolio in relation to the AEX Index. Understanding the AEX Index is crucial for navigating the complexities of the Dutch and European markets.

Featured Posts

-

Innokentiy Smoktunovskiy K 100 Letiyu So Dnya Rozhdeniya Dokumentalniy Film Menya Vela Kakaya To Sila

May 25, 2025

Innokentiy Smoktunovskiy K 100 Letiyu So Dnya Rozhdeniya Dokumentalniy Film Menya Vela Kakaya To Sila

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Getaway

May 25, 2025

Escape To The Country Top Locations For A Tranquil Getaway

May 25, 2025 -

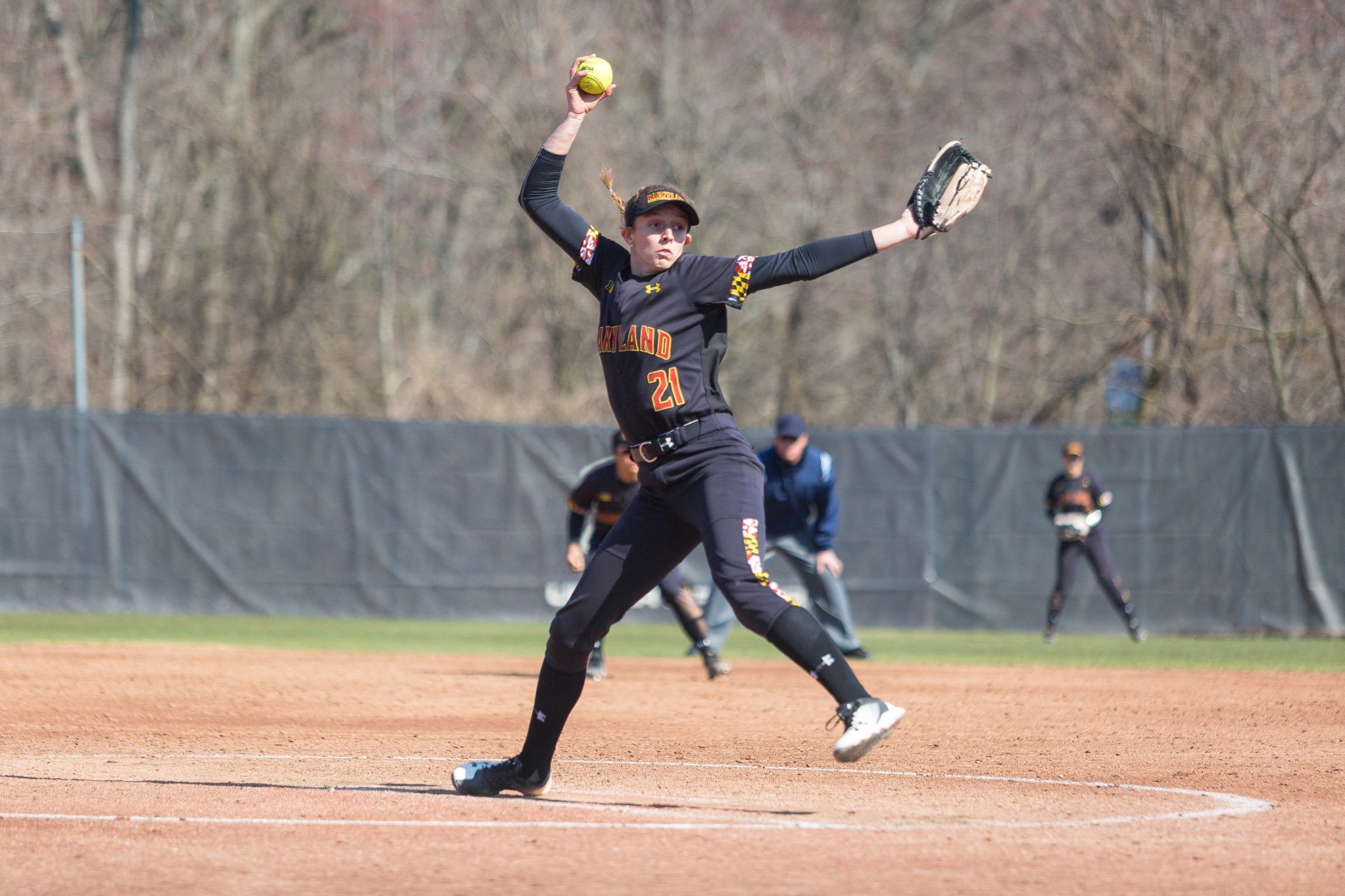

Maryland Softball Defeats Delaware After Late Game Surge 5 4

May 25, 2025

Maryland Softball Defeats Delaware After Late Game Surge 5 4

May 25, 2025 -

Amerikaanse Beurs Daalt Aex Blijft Stijgen Experts Geven Hun Voorspellingen

May 25, 2025

Amerikaanse Beurs Daalt Aex Blijft Stijgen Experts Geven Hun Voorspellingen

May 25, 2025 -

Jorja Smith Biffy Clyro And Blossoms To Headline Bbc Radio 1 Big Weekend

May 25, 2025

Jorja Smith Biffy Clyro And Blossoms To Headline Bbc Radio 1 Big Weekend

May 25, 2025

Latest Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6 Claims

May 25, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6 Claims

May 25, 2025 -

Palisades Fire A List Of Celebrities Who Lost Their Homes

May 25, 2025

Palisades Fire A List Of Celebrities Who Lost Their Homes

May 25, 2025 -

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025