Amsterdam Stock Exchange Falls 2% On Trump's New Tariffs

Table of Contents

Impact of Trump's New Tariffs on the AEX Index

President Trump's latest tariffs have sent a ripple effect through the global economy, and the Amsterdam Stock Exchange is feeling the impact acutely. Specific tariffs targeting Dutch exports are the primary driver of the AEX's decline. These tariffs primarily affect several key sectors of the Dutch economy, leading to significant losses for numerous companies.

-

Agriculture and Food Exports: Dutch agricultural products, renowned for their quality, face increased import duties in the US market. This directly impacts companies involved in dairy, flower exports, and other agricultural products, resulting in reduced profits and potentially impacting employment within these sectors.

-

Technology and Semiconductor Industries: The Netherlands houses significant players in the technology sector. Increased tariffs on technologically advanced goods exported to the US could hinder growth and impact companies like ASML Holding NV (ASML), a leading semiconductor equipment manufacturer whose stock price felt the pressure of the news.

-

Financial Services: While not directly targeted, the financial services sector is indirectly affected by the overall market volatility and uncertainty created by the tariffs. Increased risk aversion and reduced investment flows can impact the performance of financial institutions listed on the AEX.

-

Manufacturing and Export-Oriented Businesses: Many Dutch companies rely heavily on exports. The new tariffs increase the cost of their goods in the US market, making them less competitive and impacting their bottom line.

Investor Sentiment and Market Reaction

The announcement of the new tariffs triggered a wave of negative sentiment among investors. The immediate reaction was a noticeable sell-off, particularly in the sectors most directly affected. Trading volumes surged as investors reacted to the news, reflecting increased volatility in the AEX.

-

Increased volatility in trading: The AEX index saw significant price fluctuations throughout the day, indicating uncertainty and nervousness in the market.

-

Sell-off in specific sectors: Companies in the agricultural and technology sectors experienced the sharpest declines, mirroring the direct impact of the new tariffs.

-

Uncertainty regarding future investment: The uncertainty surrounding the potential for further escalation and retaliatory tariffs is deterring investment and creating a cautious market environment.

-

Potential for long-term economic repercussions: Analysts are concerned about the potential for a prolonged period of uncertainty, which could negatively impact long-term economic growth in the Netherlands.

Potential Long-Term Consequences for the Dutch Economy

The long-term consequences of Trump's tariffs on the Dutch economy could be substantial. Reduced export revenue will likely lead to slower economic growth, potentially impacting GDP figures for the coming quarters. Job losses in affected sectors are a serious concern, particularly within agriculture and manufacturing.

-

Reduced economic growth: The decreased competitiveness of Dutch exports could lead to a slowdown in overall economic growth.

-

Job losses in affected sectors: Companies facing reduced profitability may resort to layoffs to cut costs, leading to unemployment in vulnerable sectors.

-

Increased prices for consumers: The increased import costs will likely be passed on to consumers in the form of higher prices for imported goods.

-

Strain on trade relationships: The tariffs could exacerbate existing tensions in trade relations between the US and the European Union, potentially leading to further retaliatory measures. The Dutch government is likely to explore diplomatic channels to mitigate the impact.

Comparison to Other European Markets

While other European stock exchanges also experienced declines following the tariff announcement, the impact on the AEX seems to be more pronounced. This is primarily due to the significant reliance of the Dutch economy on exports to the US, particularly in the agricultural and technology sectors. This concentrated exposure makes the Netherlands more vulnerable to the negative effects of these tariffs compared to some other European nations with more diversified export markets.

Navigating the Fallout of Trump's Tariffs on the Amsterdam Stock Exchange

The 2% drop in the Amsterdam Stock Exchange is a stark reminder of the significant impact global trade policies can have on national economies. The agricultural and technology sectors are particularly vulnerable, facing potential long-term economic consequences, including reduced growth and job losses. The uncertainty surrounding future trade relations adds to the overall economic risk. Staying informed about developments in the AEX and the broader implications of global trade policies is crucial. Regularly check reliable financial news sources for the latest information on AEX performance and potential market fluctuations. Stay updated on the evolving situation with the Amsterdam Stock Exchange and the ongoing impact of global trade policies.

Featured Posts

-

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Expansion

May 25, 2025

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Expansion

May 25, 2025 -

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025 -

Amsterdam Exchange Down 2 Following Latest Us Tariff Announcement

May 25, 2025

Amsterdam Exchange Down 2 Following Latest Us Tariff Announcement

May 25, 2025 -

Pochti 40 Svadeb Na Kharkovschine Populyarnaya Data Dlya Brakosochetaniy Foto

May 25, 2025

Pochti 40 Svadeb Na Kharkovschine Populyarnaya Data Dlya Brakosochetaniy Foto

May 25, 2025 -

Demna Gvasalia Shaping The Future Of Gucci

May 25, 2025

Demna Gvasalia Shaping The Future Of Gucci

May 25, 2025

Latest Posts

-

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025 -

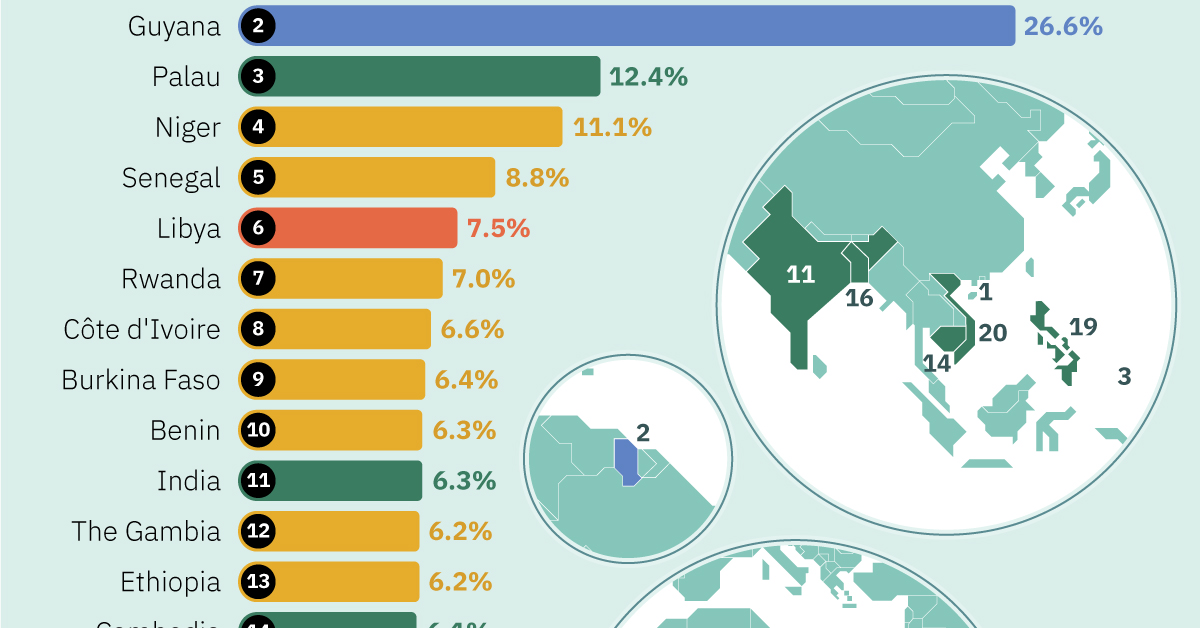

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025 -

The Pilbara Debate Rio Tintos Response To Claims Of Environmental Damage

May 25, 2025

The Pilbara Debate Rio Tintos Response To Claims Of Environmental Damage

May 25, 2025 -

Lower Uk Inflation Impact On Boe Interest Rate Decisions And The Pound Sterling

May 25, 2025

Lower Uk Inflation Impact On Boe Interest Rate Decisions And The Pound Sterling

May 25, 2025 -

Pilbara Iron Ore Mining Rio Tintos Sustainability Efforts And Addressing Criticism

May 25, 2025

Pilbara Iron Ore Mining Rio Tintos Sustainability Efforts And Addressing Criticism

May 25, 2025