Addressing Late Student Loan Payments And Credit Repair

Table of Contents

Understanding the Impact of Late Student Loan Payments on Your Credit

Late student loan payments significantly impact your creditworthiness, potentially hindering your financial future. Let's delve into the consequences.

Credit Score Damage

Late payments result in negative marks on your credit reports, affecting both FICO and VantageScore, the two most commonly used credit scoring models. This damage translates into several serious consequences:

- Negative marks on credit reports: These remain on your report for up to seven years, impacting your credit score throughout that period.

- Impact on approval for loans/credit cards: Lenders view late payments as a sign of poor financial responsibility, making it harder to get approved for new loans, credit cards, or even renting an apartment.

- Higher interest rates: Even if you are approved, you'll likely face higher interest rates on future loans, increasing the overall cost of borrowing.

The severity of the impact depends on factors such as the frequency and duration of late payments. A single late payment might cause a minor dip, while repeated delinquencies can severely damage your credit score.

Debt Collection Agencies

Persistent delinquency can lead to your loan being referred to a debt collection agency. This can significantly worsen the situation:

- Communication strategies: Debt collectors are legally required to follow the Fair Debt Collection Practices Act (FDCPA). Understanding your rights under the FDCPA is crucial. They are required to identify themselves, provide information about the debt, and avoid harassing or abusive tactics.

- Negotiating payment plans: Debt collectors might be willing to negotiate a payment plan. However, always obtain this agreement in writing.

- Avoiding harassment: The FDCPA protects you from abusive debt collection practices. If you experience harassment, document every interaction and report it to the relevant authorities.

The FDCPA prevents debt collectors from using deceptive or unfair practices, giving consumers significant legal protection. Knowing your rights is your first line of defense.

Strategies for Addressing Late Student Loan Payments

Proactive steps are crucial to mitigating the damage caused by late student loan payments. Here's how to tackle this challenge:

Contacting Your Loan Servicer

Immediate communication with your loan servicer is paramount.

- Inquire about repayment options: Explore available options to get back on track, such as modifying your payment plan or exploring temporary relief options.

- Explore forbearance or deferment: Forbearance temporarily suspends your payments, while deferment postpones them, often with specific eligibility requirements. Understand the implications of these options on your overall repayment plan and future interest accrual.

- Negotiate a payment plan: If you're struggling to make your payments, your servicer may be willing to work with you on a modified repayment schedule. This might involve reducing monthly payments or extending the repayment period.

Open communication is key. The sooner you contact your servicer, the more options you may have available.

Exploring Repayment Plans

Several repayment plans are available to suit different financial situations.

- Standard repayment: Fixed monthly payments over a 10-year period.

- Graduated repayment: Payments start low and gradually increase over time.

- Extended repayment: Spreads payments over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest paid.

- Income-driven repayment (IDR) plans: Payments are based on your income and family size. This makes them ideal for those with lower incomes.

Choosing the right plan depends on your financial circumstances and long-term goals.

Consolidating Your Loans

Loan consolidation combines multiple student loans into a single loan.

- Simplified payment process: Managing one payment is simpler than managing multiple payments.

- Potential for lower interest rates (but not always): Consolidation can lead to lower interest rates, but this isn't guaranteed and depends on several factors.

- Impact on credit score during the process: The application process can temporarily affect your credit score, but a consolidated loan with consistent on-time payments will ultimately improve your score over time.

Consider all the implications before opting for consolidation, comparing the overall cost including potential interest savings against the short-term credit score impact.

The Path to Credit Repair After Student Loan Delinquency

Rebuilding your credit after student loan delinquency requires consistent effort and careful planning.

Monitoring Your Credit Report

Regularly checking your credit report is crucial.

- Dispute inaccuracies: Incorrect information on your report can negatively impact your score. Dispute any errors with the relevant credit bureaus.

- Track progress: Monitor your credit score to track the effectiveness of your credit repair strategies.

- Identify areas for improvement: Regularly reviewing your credit report helps identify other areas where you can improve your creditworthiness.

Obtain your free credit reports annually from AnnualCreditReport.com, the only authorized source for free credit reports from Equifax, Experian, and TransUnion.

Building Positive Credit History

Focus on establishing positive credit history.

- On-time payments on all accounts: This is the single most important factor influencing your credit score.

- Responsible credit card usage: Keep your credit utilization low (ideally below 30%) and pay your credit card balances on time, every time.

- Maintaining low credit utilization: High credit utilization is a significant negative factor in credit scoring.

Consistent, responsible financial behavior is key to rebuilding your credit.

Seeking Professional Help

Consider professional help if you are struggling.

- Potential benefits: Credit repair companies can help navigate the complex credit repair process, but be cautious.

- Choosing reputable companies: Thoroughly research and vet any credit repair company before engaging their services. Be aware of scams.

- Understanding the costs and legal aspects: Understand the fees and the legal limits of what credit repair companies can do.

Always verify the legitimacy of any credit repair company before engaging their services. Many resources are available online to help you find legitimate and reputable professionals.

Conclusion

Successfully addressing student loan payment delinquency and embarking on credit repair requires proactive steps and consistent effort. By understanding the impact of delinquency, exploring available repayment options, and actively building positive credit history, you can overcome this challenge and achieve better financial health. Don't let late student loan payments define your future. Take control today and start your journey towards improved credit! Learn more about managing student loan payment delinquency and credit repair strategies by exploring further resources online.

Featured Posts

-

Jalen Brunson Injury Update What Knicks Fans Need To Know

May 17, 2025

Jalen Brunson Injury Update What Knicks Fans Need To Know

May 17, 2025 -

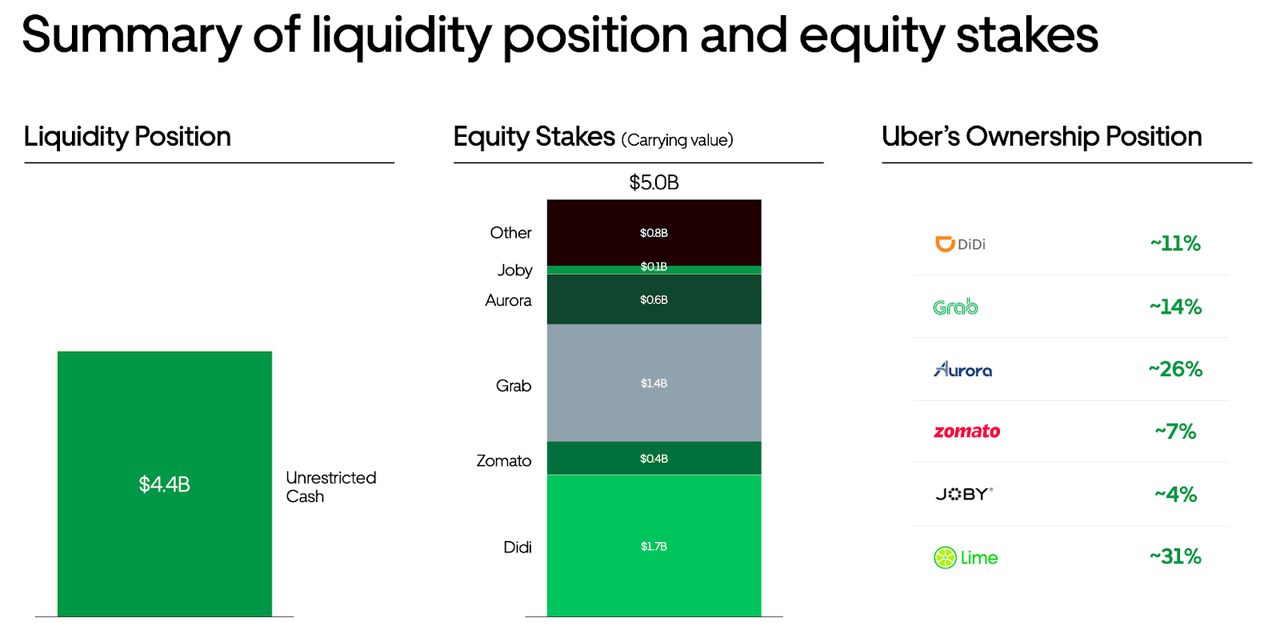

Analyzing Ubers Double Digit Stock Increase In April

May 17, 2025

Analyzing Ubers Double Digit Stock Increase In April

May 17, 2025 -

Valerio Therapeutics 2024 Financial Report Publication Delayed

May 17, 2025

Valerio Therapeutics 2024 Financial Report Publication Delayed

May 17, 2025 -

Previsiones Deportivas Semanales Analisis Y Predicciones De Prensa Latina

May 17, 2025

Previsiones Deportivas Semanales Analisis Y Predicciones De Prensa Latina

May 17, 2025 -

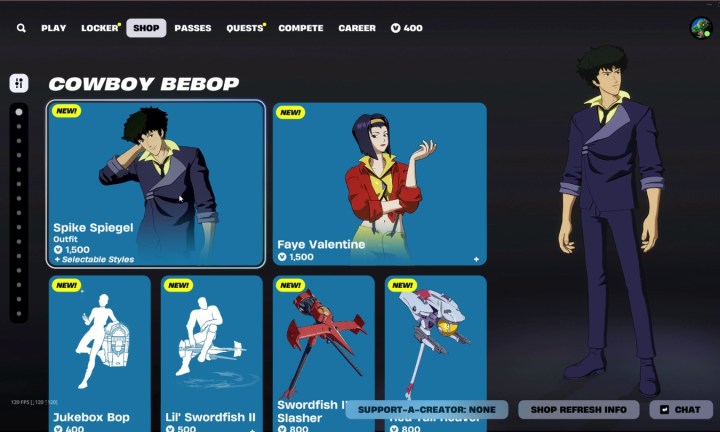

Fortnites Cowboy Bebop Giveaway Grab The Freebies Before They Re Gone

May 17, 2025

Fortnites Cowboy Bebop Giveaway Grab The Freebies Before They Re Gone

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025