Analyzing Uber's Double-Digit Stock Increase In April

Table of Contents

Improved Financial Performance and Q1 Earnings Report

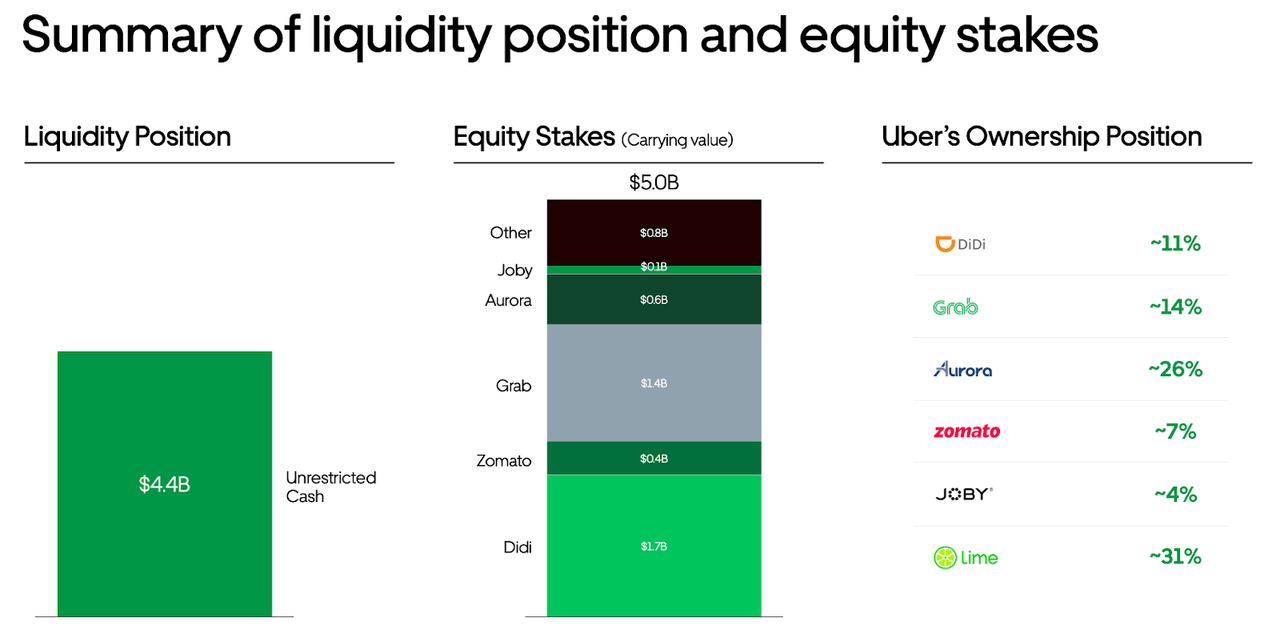

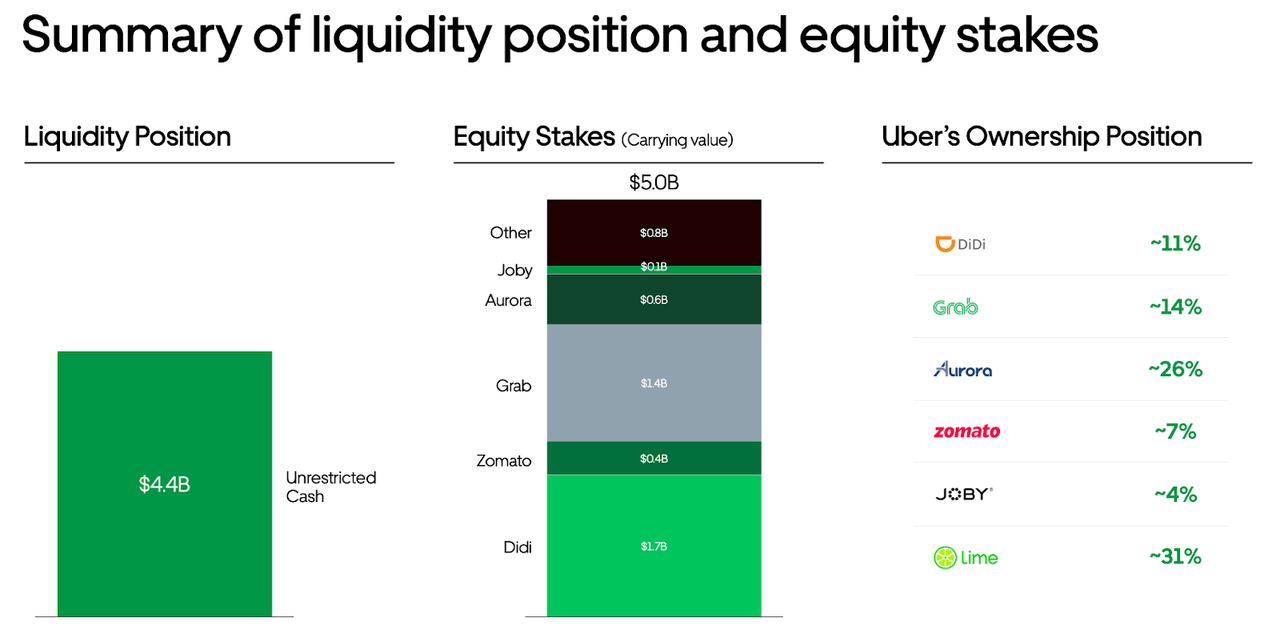

Uber's strong performance in April was significantly influenced by its impressive Q1 2024 earnings report. The report showcased substantial progress across key metrics, bolstering investor confidence and driving up the Uber stock price. This positive financial performance served as a catalyst for the double-digit growth observed in the stock market. Key highlights from the report include:

- Significant increase in Rides revenue: A substantial rebound in ridership, particularly in urban areas, contributed to a notable increase in revenue from Uber's core ride-sharing business. This growth suggests a strengthening recovery in the post-pandemic travel sector.

- Improved profitability in Delivery segment: The food delivery segment showed improved profitability, indicating effective cost management and increased efficiency in operations. This enhanced profitability is crucial for long-term sustainability and investor confidence.

- Stronger-than-expected user engagement: Higher user engagement across both ride-sharing and delivery services points towards increased customer satisfaction and loyalty. This translates into a larger customer base and a more sustainable revenue stream for Uber.

These positive financial indicators, as detailed in the Q1 earnings report, significantly impacted market sentiment and contributed substantially to the increase in the Uber stock price. Keywords used here include Uber earnings, Q1 earnings, revenue growth, profitability, user growth, and financial performance.

Positive Market Sentiment and Industry Trends

Beyond Uber's internal performance, the overall market sentiment towards the ride-sharing and food delivery industries played a significant role in the April stock market rally. Positive industry trends further amplified this positive sentiment, leading to increased investor interest in Uber stock. These contributing factors include:

- Increased consumer spending: A rise in consumer spending across various sectors created a favorable environment for businesses like Uber, which directly benefits from increased discretionary spending.

- Post-pandemic recovery in travel and transportation: The continued recovery in travel and transportation after the pandemic has boosted demand for ride-sharing services, directly benefiting Uber's core business.

- Growing adoption of food delivery services: The ongoing popularity and growth of food delivery services continue to drive revenue and profitability in Uber Eats, contributing to the overall positive market sentiment.

These positive industry trends, combined with the generally positive market sentiment, significantly contributed to the appreciation of Uber stock in April. Keywords: market sentiment, industry trends, ride-sharing, food delivery, consumer spending, post-pandemic recovery.

Strategic Initiatives and Growth Strategies

Uber's proactive implementation of strategic initiatives and growth strategies also played a crucial role in the April stock market surge. The company's ongoing efforts to enhance its services and expand into new markets have strengthened its position and boosted investor confidence. Some key strategies include:

- Launch of new services or features: The introduction of new features and services, such as enhanced safety measures or loyalty programs, aims to improve the user experience and attract new customers, contributing to revenue growth.

- Expansion into new markets: Uber's continuous expansion into new geographical markets provides access to larger customer bases and new revenue streams, strengthening its overall market position.

- Technological advancements and efficiency improvements: Investing in technological advancements and streamlining operations increases efficiency, reduces costs, and improves profitability, all of which positively impact investor sentiment.

These strategic initiatives have demonstrated Uber's commitment to growth and innovation, further driving up the Uber stock price. Keywords: Uber strategy, growth strategy, new services, market expansion, technological advancements.

Impact of External Factors (Geopolitical, Economic)

While internal factors played a dominant role, external factors also contributed to the positive market response to Uber’s performance. The overall global economic climate and geopolitical stability (or lack thereof) can significantly influence investor behavior.

- Impact of global economic growth: A period of relatively strong global economic growth can lead to increased investor confidence and willingness to invest in growth stocks like Uber.

- Changes in fuel prices: Fluctuations in fuel prices can impact Uber's operational costs and profitability. Stable or decreasing fuel prices can positively affect its bottom line.

- Geopolitical stability or instability: Geopolitical stability generally contributes to a positive market environment, encouraging investment, while instability can lead to uncertainty and volatility.

These external factors, in conjunction with internal achievements, provided a favorable backdrop for the April surge in Uber stock. Keywords: geopolitical factors, economic conditions, global economy, fuel prices, external factors.

Analyzing the April Surge and Future Outlook for Uber Stock

In summary, Uber's double-digit stock increase in April was a result of a confluence of factors: strong Q1 earnings showcasing impressive revenue growth and profitability, positive market sentiment fueled by industry trends and increased consumer spending, the successful implementation of strategic initiatives and growth strategies, and a generally favorable external environment. While the future remains uncertain, and risks such as economic downturns or increased competition always exist, the positive momentum observed in April suggests a promising outlook for the company.

Stay informed about future Uber stock performance and its impact on the broader market. Continue analyzing Uber's stock price fluctuations for insightful investment opportunities. Follow our analysis for further updates on Uber stock market trends.

Featured Posts

-

A Fortnite Refund Case Potential Precursor To Cosmetic Policy Updates

May 17, 2025

A Fortnite Refund Case Potential Precursor To Cosmetic Policy Updates

May 17, 2025 -

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 17, 2025

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 17, 2025 -

Exclusive New Hhs Policy Under Rfk Jr Could Eliminate Routine Covid 19 Vaccines For Vulnerable Groups

May 17, 2025

Exclusive New Hhs Policy Under Rfk Jr Could Eliminate Routine Covid 19 Vaccines For Vulnerable Groups

May 17, 2025 -

Significant Bonus For Singapore Airlines Staff A Straits Times Update

May 17, 2025

Significant Bonus For Singapore Airlines Staff A Straits Times Update

May 17, 2025 -

Bajerna Kao Domacin Generalka Kosarkaske Reprezentacije Srbije Pred Evrobasket

May 17, 2025

Bajerna Kao Domacin Generalka Kosarkaske Reprezentacije Srbije Pred Evrobasket

May 17, 2025

Latest Posts

-

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025 -

Jalen Brunson Injury Assessing The Impact On The New York Knicks

May 17, 2025

Jalen Brunson Injury Assessing The Impact On The New York Knicks

May 17, 2025 -

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025 -

The Knicks Jalen Brunson Problem A Slow Road To Recovery

May 17, 2025

The Knicks Jalen Brunson Problem A Slow Road To Recovery

May 17, 2025 -

Will The Knicks Offense Recover Quickly With Brunsons Return

May 17, 2025

Will The Knicks Offense Recover Quickly With Brunsons Return

May 17, 2025