ABN Amro Bonus Scandal: Potential Fine From Dutch Regulator

Table of Contents

Keywords: ABN Amro, bonus scandal, Dutch regulator, fine, penalty, financial misconduct, investigation, compliance, banking regulation, Netherlands, AFM, Netherlands Authority for the Financial Markets, regulatory breaches, internal controls, risk management, financial penalties, compliance failures, sanctions, financial penalty, regulatory fine, reputational risk, financial impact, stock price, investor confidence, corporate governance, risk management, internal controls, compliance program, remedial actions, corporate responsibility.

The ABN Amro bonus scandal continues to unfold, with the Dutch regulator, the Netherlands Authority for the Financial Markets (AFM), preparing to levy a substantial fine against the bank. This follows an ongoing investigation into alleged breaches of financial regulations related to bonus payments. The potential financial ramifications are significant, and this article delves into the details of the scandal and the expected repercussions.

The Allegations Behind the ABN Amro Bonus Scandal

The core of the ABN Amro bonus scandal centers around allegations of improper bonus payouts to employees. The investigation focuses on whether these bonuses violated internal company policies and, more critically, breached external regulations set by the AFM. The alleged misconduct involved potentially awarding bonuses that did not accurately reflect performance or that contravened established risk management frameworks.

- Specific examples of alleged violations: While precise details remain largely confidential during the ongoing investigation, reports suggest that bonuses were awarded despite significant financial risks being ignored, and potentially even encouraged. Further details are expected to emerge as the investigation progresses.

- Timeframe of the alleged misconduct: The alleged improper bonus payments are believed to have occurred over a period spanning several years, although the exact timeframe is yet to be officially confirmed by the AFM.

- Individuals implicated in the scandal: At this stage, no specific individuals have been publicly named in connection with the scandal. However, the investigation is likely to focus on senior management and those responsible for overseeing the bank’s compensation and risk management systems.

The Dutch Regulator's Investigation and Potential Actions

The AFM, the Netherlands Authority for the Financial Markets, plays a crucial role in overseeing the conduct of financial institutions within the Netherlands. They possess significant investigative powers, including the authority to demand documents, conduct interviews, and ultimately impose substantial fines for violations of financial regulations. Their investigation into ABN Amro's bonus practices is thorough and ongoing.

- Timeline of the investigation: The investigation began [Insert Start Date if available], and its completion timeline remains uncertain, depending on the complexity of the evidence gathering and analysis.

- Details on the investigation's findings: At present, only limited details regarding the AFM’s findings have been publicly released. The regulator is committed to a full and transparent investigation, with the findings to be made public once completed.

- Previous actions taken by the AFM: The AFM has a history of taking strong action against financial institutions that violate regulations. Previous cases involving similar violations have resulted in significant fines and other sanctions, setting a precedent for potential consequences ABN Amro may face.

The Potential Fine Amount and its Implications

The potential fine against ABN Amro is expected to be substantial. While the exact amount remains speculative, analysts suggest a range of [Insert estimated range if available] euros, depending on the severity of the violations uncovered during the investigation and the bank's cooperation with the AFM.

- Range of potential fine amounts: Given the scale of the alleged misconduct and the potential reputational damage involved, a fine at the higher end of the estimated range or even exceeding it, is considered plausible by many financial experts.

- Impact on ABN Amro's financial performance: A substantial fine will undoubtedly negatively impact ABN Amro's financial performance, affecting profits and potentially leading to a reduction in shareholder dividends.

- Potential reputational damage: Beyond the financial impact, the scandal and any resulting fine will inflict significant reputational damage on ABN Amro, potentially eroding investor confidence and impacting its ability to attract and retain clients.

ABN Amro's Response and Future Compliance Measures

In response to the allegations, ABN Amro has issued public statements expressing their commitment to cooperate fully with the AFM's investigation. While they have not admitted to wrongdoing, the bank has acknowledged the seriousness of the allegations and has indicated a willingness to implement necessary improvements to its compliance program.

- ABN Amro’s public statements on the matter: ABN Amro's official communications have emphasized their commitment to upholding the highest ethical standards and strengthening their internal control mechanisms.

- Steps taken to improve internal controls and risk management: The bank is likely to implement enhanced training programs for employees, refine its bonus structures to align more closely with risk-averse strategies, and strengthen its internal auditing processes to ensure greater transparency and accountability.

- Any changes to bonus structures or compensation policies: Expect to see significant changes to ABN Amro's bonus schemes, likely moving away from purely performance-based rewards and incorporating stricter risk-assessment criteria.

Conclusion

The ABN Amro bonus scandal highlights the critical importance of robust compliance programs within the financial sector. The potential fine from the Dutch regulator underscores the serious consequences of violating financial regulations. The outcome of this case will have broader implications for banking practices and regulatory oversight in the Netherlands. It serves as a stark reminder of the need for stringent internal controls, effective risk management, and a commitment to ethical conduct in the financial industry.

Call to Action: Stay informed on the latest developments in the ABN Amro bonus scandal and the resulting regulatory actions. Follow our updates for further analysis on this evolving situation and its impact on the financial landscape. Search for "ABN Amro bonus scandal" for related news and learn more about the intricacies of Dutch banking regulations and compliance procedures.

Featured Posts

-

Assessing Googles Ai Capabilities An Investor Perspective

May 22, 2025

Assessing Googles Ai Capabilities An Investor Perspective

May 22, 2025 -

Occasionmarkt Bloeit Abn Amro Ziet Verkopen Flink Stijgen

May 22, 2025

Occasionmarkt Bloeit Abn Amro Ziet Verkopen Flink Stijgen

May 22, 2025 -

Huizenmarkt Outlook Abn Amros Analyse Van Prijzen En Rente

May 22, 2025

Huizenmarkt Outlook Abn Amros Analyse Van Prijzen En Rente

May 22, 2025 -

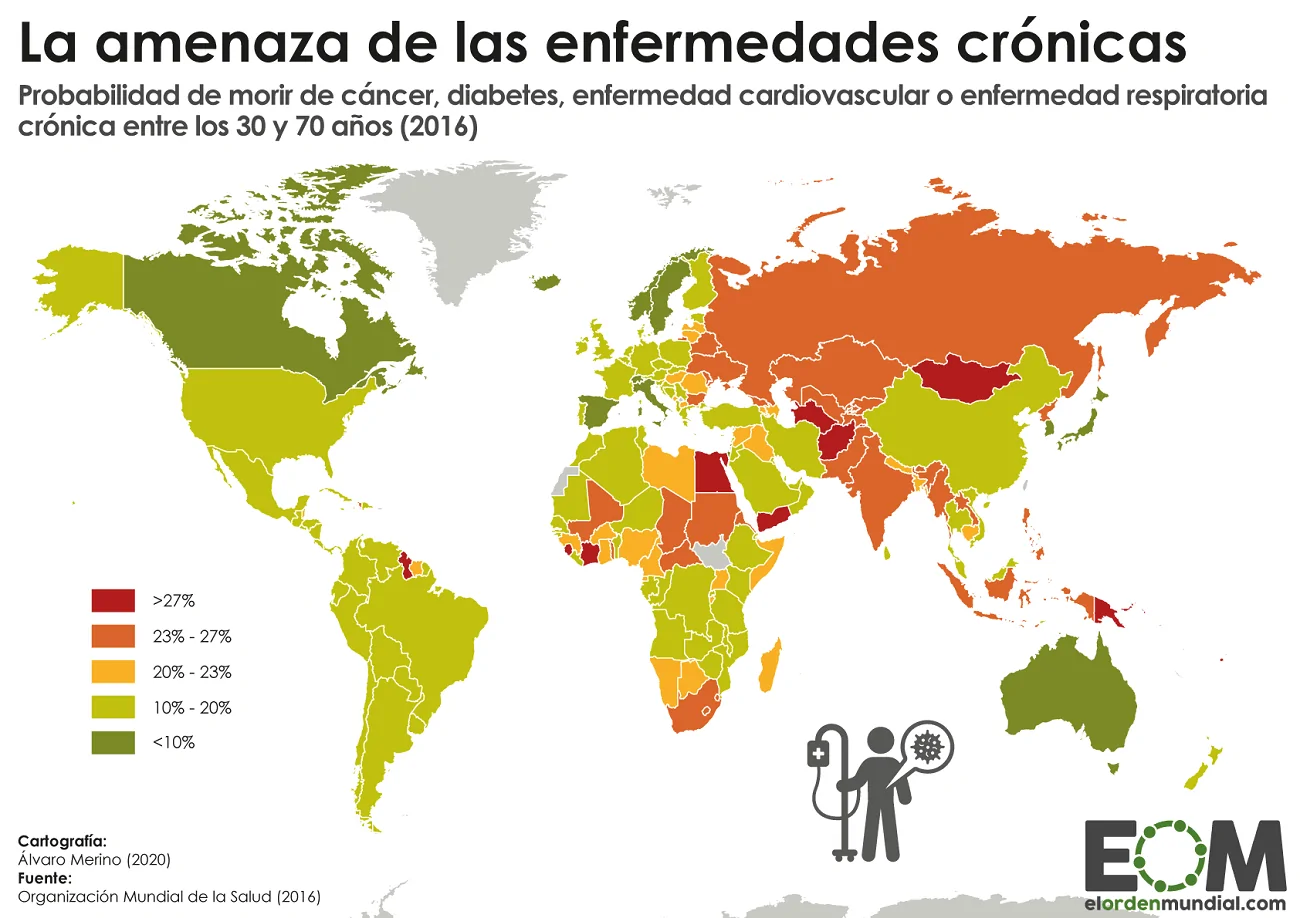

El Superalimento Que Combate Las Enfermedades Cronicas Mas Alla Del Arandano

May 22, 2025

El Superalimento Que Combate Las Enfermedades Cronicas Mas Alla Del Arandano

May 22, 2025 -

Southport Racial Hate Crime Tory Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Crime Tory Councillors Wife Sentenced

May 22, 2025

Latest Posts

-

Broadcoms V Mware Deal An Extreme Cost Increase For At And T And Others

May 22, 2025

Broadcoms V Mware Deal An Extreme Cost Increase For At And T And Others

May 22, 2025 -

Extreme Price Increases Projected For V Mware Following Broadcom Acquisition

May 22, 2025

Extreme Price Increases Projected For V Mware Following Broadcom Acquisition

May 22, 2025 -

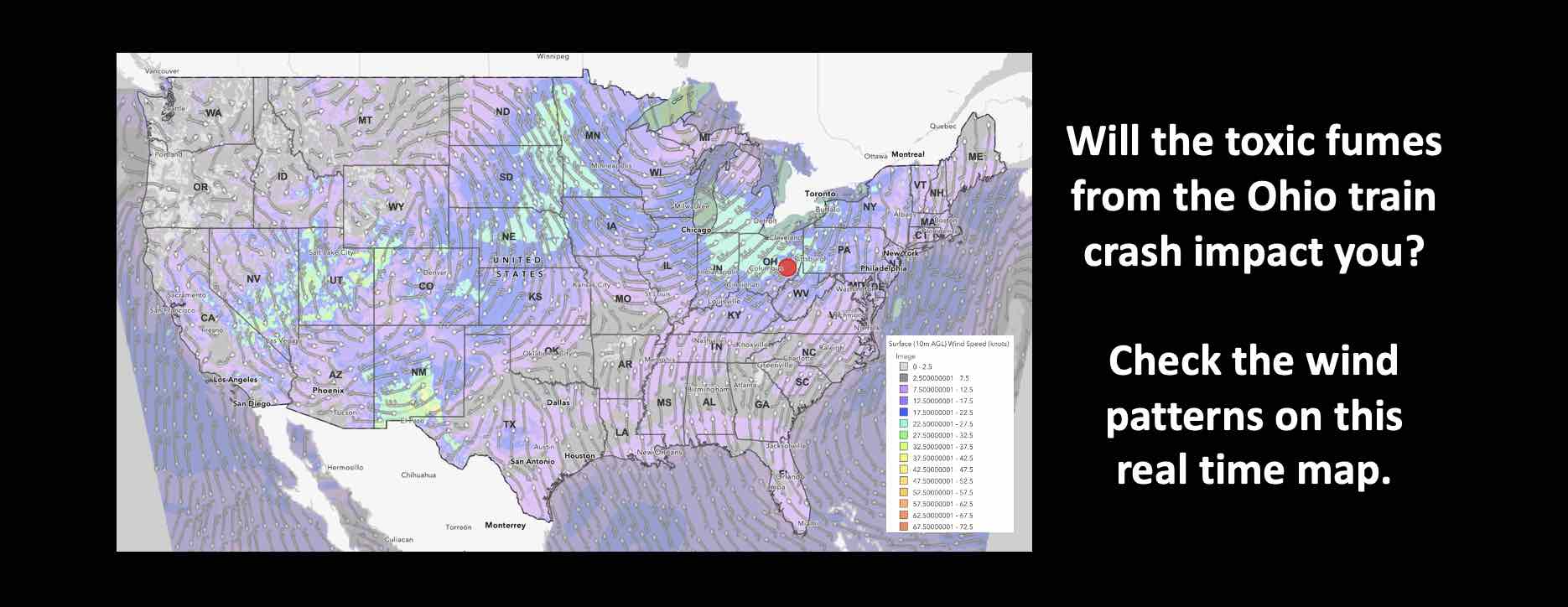

Persistent Pollution Toxic Chemical Impact Of Ohio Train Derailment On Buildings

May 22, 2025

Persistent Pollution Toxic Chemical Impact Of Ohio Train Derailment On Buildings

May 22, 2025 -

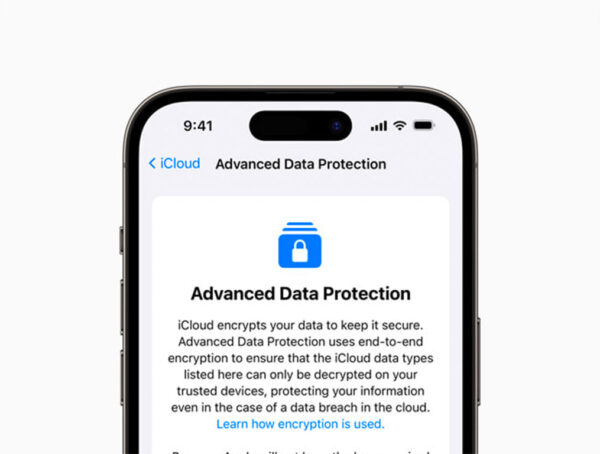

Data Breach Exposes Millions In Losses From Compromised Executive Office365 Accounts

May 22, 2025

Data Breach Exposes Millions In Losses From Compromised Executive Office365 Accounts

May 22, 2025 -

Federal Charges Hacker Made Millions Targeting Executive Office365 Inboxes

May 22, 2025

Federal Charges Hacker Made Millions Targeting Executive Office365 Inboxes

May 22, 2025