Broadcom's VMware Deal: An Extreme Cost Increase For AT&T And Others?

Table of Contents

The Deal's Mechanics and Market Dominance

Broadcom's $61 billion purchase of VMware represents a monumental consolidation in the networking and infrastructure market. Broadcom, already a major player in semiconductor chips and networking solutions, now controls VMware's dominant virtualization and cloud computing technologies. This acquisition dramatically expands Broadcom's portfolio, giving them unparalleled control over key components of modern data centers and networks.

Broadcom’s potential to leverage this newfound market power is substantial. This enhanced market position raises significant concerns:

- Increased Pricing Power: Broadcom could leverage its market dominance to significantly raise prices for VMware products and services, impacting telecoms heavily reliant on their technology.

- Reduced Competition: The acquisition eliminates a major competitor, potentially stifling innovation and reducing the availability of competitive alternatives for telecom providers.

- Bundling and Tying: Broadcom could bundle VMware products with their other offerings, potentially forcing customers into less favorable terms.

The deal has already attracted significant antitrust scrutiny and regulatory review, with concerns raised about the potential for anti-competitive practices. The outcome of these investigations will significantly shape the future landscape.

Increased Costs for AT&T and Other Telecoms

AT&T, a heavy user of VMware’s virtualization technologies across its vast network infrastructure, stands to be significantly affected. Their reliance on VMware for critical services means that any price increases will directly translate to higher operational costs. This could include:

- Increased Licensing Fees: Higher costs for VMware software licenses, impacting their capital expenditure (CAPEX) budgets.

- Higher Support Contracts: Increased charges for maintenance, updates, and technical support, impacting operational expenditure (OPEX).

- Reduced Negotiation Power: The diminished competitive landscape reduces AT&T's leverage to negotiate favorable pricing.

This scenario is not unique to AT&T. Other major telecom companies like Verizon and T-Mobile, also significant VMware customers, face similar challenges. The ripple effects could be substantial:

- Reduced Profitability: Higher costs could squeeze profit margins, forcing companies to cut investments or increase service prices for consumers.

- Strategic Re-evaluation: Telecoms might need to re-evaluate their technology strategies and explore alternatives to mitigate the impact.

- Impact on Innovation: Higher costs could stifle innovation as companies allocate more resources to maintaining existing infrastructure rather than developing new services.

Alternative Solutions and Mitigation Strategies

Facing potential cost increases, AT&T and other telecom companies have several avenues to explore:

- Open-Source Alternatives: Migrating to open-source virtualization solutions like OpenStack or Proxmox can provide a cost-effective alternative.

- Competitor Offerings: Exploring virtualization solutions offered by competitors like Red Hat, Citrix, or Nutanix can lessen reliance on VMware.

Mitigation strategies also include:

- Aggressive Contract Negotiation: Negotiating favorable long-term contracts with Broadcom to secure better pricing.

- VMware Optimization: Streamlining VMware deployments and optimizing resource utilization to minimize costs.

- Phased Migration: Gradually migrating to alternative solutions to avoid a complete and disruptive overhaul.

However, the potential for vendor lock-in represents a significant long-term concern. The longer a company relies on VMware, the more challenging and costly a transition to a new platform becomes.

The Broader Implications for the Tech Industry

The Broadcom-VMware deal sets a significant precedent for industry consolidation and has far-reaching implications for the tech landscape:

- Reduced Innovation: Less competition could lead to slower innovation in the virtualization and cloud computing sectors.

- Market Power Concerns: The deal raises broader concerns about unchecked market power and its potential to stifle competition in other technology segments.

- Cybersecurity and Data Privacy: Increased concentration of power in a single entity raises questions regarding cybersecurity risks and the protection of sensitive data.

Conclusion: Navigating the Impact of Broadcom's VMware Deal

Broadcom's VMware deal presents substantial challenges for AT&T and other telecom companies, potentially leading to extreme cost increases. The acquisition creates a landscape of reduced competition, heightened pricing power for Broadcom, and significant strategic implications for all players. However, proactive mitigation strategies, exploration of alternative technologies, and strong regulatory oversight are crucial to navigate this shift. Stay updated on the evolving implications of Broadcom's VMware deal and its potential to reshape the telecommunications landscape. Continue reading our analysis on [link to related articles/resources].

Featured Posts

-

Occasionverkoop Abn Amro Flinke Groei Door Meer Autobezitters

May 22, 2025

Occasionverkoop Abn Amro Flinke Groei Door Meer Autobezitters

May 22, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Settlement

May 22, 2025

16 Million Fine For T Mobile A Three Year Data Breach Settlement

May 22, 2025 -

Sse Adjusts Spending 3 Billion Cut To Focus On Core Priorities

May 22, 2025

Sse Adjusts Spending 3 Billion Cut To Focus On Core Priorities

May 22, 2025 -

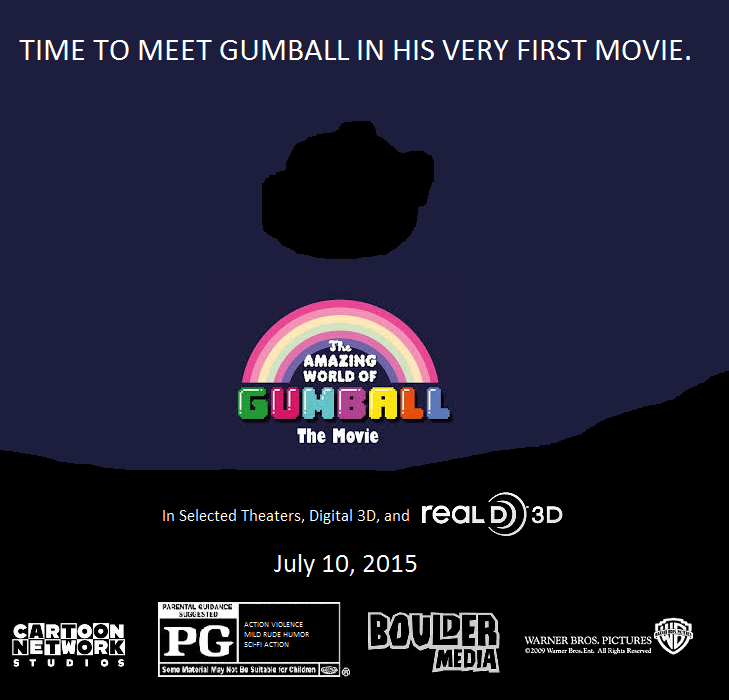

The Evolving World Of Gumball A Teaser

May 22, 2025

The Evolving World Of Gumball A Teaser

May 22, 2025 -

Najib Razak And The 2002 French Submarine Bribery Allegations

May 22, 2025

Najib Razak And The 2002 French Submarine Bribery Allegations

May 22, 2025

Latest Posts

-

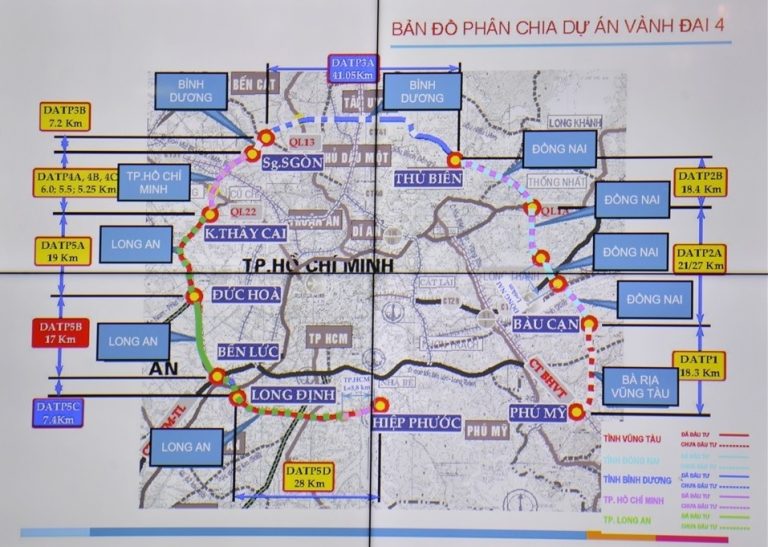

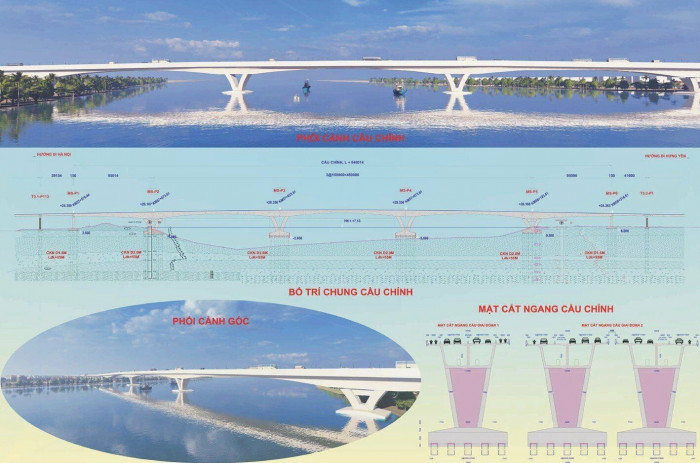

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025 -

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025 -

Dong Nai Kien Nghi Duong Cao Toc 4 Lan Xe Xuyen Rung Ma Da Den Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Duong Cao Toc 4 Lan Xe Xuyen Rung Ma Da Den Binh Phuoc

May 22, 2025 -

De Xuat Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Ket Noi Dong Nai Va Binh Phuoc

May 22, 2025

De Xuat Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Ket Noi Dong Nai Va Binh Phuoc

May 22, 2025 -

7 Du An Ket Noi Giao Thong Tp Hcm Long An Uu Tien Dau Tu

May 22, 2025

7 Du An Ket Noi Giao Thong Tp Hcm Long An Uu Tien Dau Tu

May 22, 2025