A Chocolate Craving, A Global Brand, And Soaring Prices: The Unexpected Inflation Story

Table of Contents

The Impact of Cocoa Bean Prices on Chocolate Inflation

The foundation of every chocolate bar, the cocoa bean, is at the heart of the chocolate inflation story. Fluctuations in its price directly impact the final cost of the product.

Supply Chain Disruptions

Cocoa bean production is a delicate dance with nature and global stability. Recent years have witnessed significant disruptions to the supply chain, exacerbating price volatility.

- Decreased Crop Yields: Climate change, with its erratic weather patterns and increased pest infestations, is significantly impacting cocoa bean harvests in key producing regions like Ivory Coast and Ghana.

- Transportation Costs: Increased fuel prices and port congestion, compounded by ongoing global logistical challenges, add substantially to the cost of transporting cocoa beans from farm to factory.

- Labor Shortages: A lack of skilled labor in cocoa-producing areas further restricts supply and drives up costs.

Data shows that cocoa bean prices have fluctuated dramatically in recent years, with a sharp increase observed in [insert year and percentage increase, cite source]. This instability directly translates to higher prices for chocolate manufacturers.

Increased Demand vs. Limited Supply

The world's appetite for chocolate is growing. This increased demand, especially from emerging markets with burgeoning middle classes, puts further pressure on already strained cocoa bean supplies.

- Rising Middle Class in Developing Nations: Increased disposable income in developing countries fuels a surge in chocolate consumption.

- Increased Consumption in Developed Countries: Even in established markets, chocolate consumption remains robust, with premium chocolate segments experiencing particularly strong growth.

- Growing Popularity of Premium Chocolate: The trend towards ethically sourced, organic, and high-quality chocolate further intensifies demand, often at a higher price point.

[Insert chart or graph illustrating the growing global demand for chocolate versus relatively flat or declining cocoa bean production]. This imbalance significantly contributes to chocolate inflation.

The Role of Other Ingredients and Manufacturing Costs in Chocolate Inflation

Cocoa beans aren't the only factor driving up chocolate prices. Other ingredients and manufacturing costs play a crucial role.

Rising Sugar and Dairy Prices

Sugar and milk are essential components of most chocolate recipes. Recent price increases in these commodities have a direct impact on the final product cost.

- Global Sugar Production Fluctuations: Weather patterns and global demand affect sugar prices, leading to increased costs for chocolate manufacturers.

- Rising Energy Costs Affecting Dairy Farming: Higher energy prices increase the cost of producing milk, directly impacting the price of dairy products used in chocolate.

- Inflationary Pressure on Packaging Materials: The cost of packaging, from wrappers to boxes, has also increased due to inflation, adding to the overall price.

For example, the price of sugar has increased by [insert percentage and cite source] in the last [time period], while dairy prices have risen by [insert percentage and cite source].

Energy Costs and Transportation

The entire chocolate production and distribution chain is energy-intensive. Rising fuel prices significantly impact every stage, from farming to retail.

- Higher Fuel Costs for Farming, Manufacturing, and Distribution: Increased fuel costs directly increase the cost of transporting cocoa beans, manufacturing chocolate, and delivering it to consumers.

- Increased Shipping Container Rates: Global shipping costs have experienced significant increases in recent years, further contributing to higher chocolate prices.

The cost of shipping a container of cocoa beans has risen by [insert percentage and cite source] in the last [time period], directly impacting the final price of chocolate.

Consumer Behavior and the Chocolate Market

Consumer preferences and buying habits also play a significant role in the chocolate inflation narrative.

Premiumization and Willingness to Pay

Consumers are increasingly willing to pay more for premium chocolate, driving up prices across the board.

- Increased Demand for Organic, Fair-Trade, and Ethically Sourced Chocolate: Consumers are prioritizing sustainability and ethical sourcing, leading to higher prices for these products.

- Willingness to Pay a Premium for Higher Quality: The demand for high-quality, artisanal chocolate fuels the growth of the premium segment, further driving up average prices.

- Brand Loyalty and its Impact on Price Sensitivity: Strong brand loyalty can reduce price sensitivity, allowing companies to maintain higher prices.

This trend towards premiumization means that even consumers willing to spend more are facing higher costs.

Substitution and Budget-Friendly Alternatives

Facing higher prices, some consumers are adjusting their chocolate consumption habits.

- Increased Popularity of Store-Brand Chocolates: Consumers are increasingly turning to cheaper store-brand alternatives to manage their budgets.

- Reduced Consumption: Some consumers are simply reducing their overall chocolate consumption to compensate for higher prices.

- Trade-offs in Other Spending Areas: Increased chocolate prices force consumers to make trade-offs in other areas of their spending.

[Insert data or survey results showing consumer behavior changes in response to higher chocolate prices].

Conclusion

The rise in chocolate inflation is a complex phenomenon driven by a confluence of factors: soaring cocoa bean prices due to supply chain disruptions and increased demand; higher costs for sugar, dairy, and other ingredients; escalating energy and transportation costs; and the growing consumer preference for premium chocolate. These factors have significant implications for consumers, manufacturers, and the cocoa farming industry. The long-term effects could include reduced chocolate consumption, a shift towards more sustainable and ethical sourcing practices, and potential innovation in chocolate production to mitigate price pressures.

To address chocolate inflation, we must explore solutions such as supporting sustainable cocoa farming initiatives, promoting fair trade practices, and becoming more mindful of our chocolate consumption. Further research into “chocolate price trends,” “sustainable cocoa farming,” and "ethical chocolate consumption" is crucial to navigate this evolving landscape. Let's work together to ensure that our chocolate cravings don't break the bank.

Featured Posts

-

Ywm Ykjhty Kshmyr Pakstan Myn Mkml Ykjhty Ka Azhar

May 01, 2025

Ywm Ykjhty Kshmyr Pakstan Myn Mkml Ykjhty Ka Azhar

May 01, 2025 -

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025 -

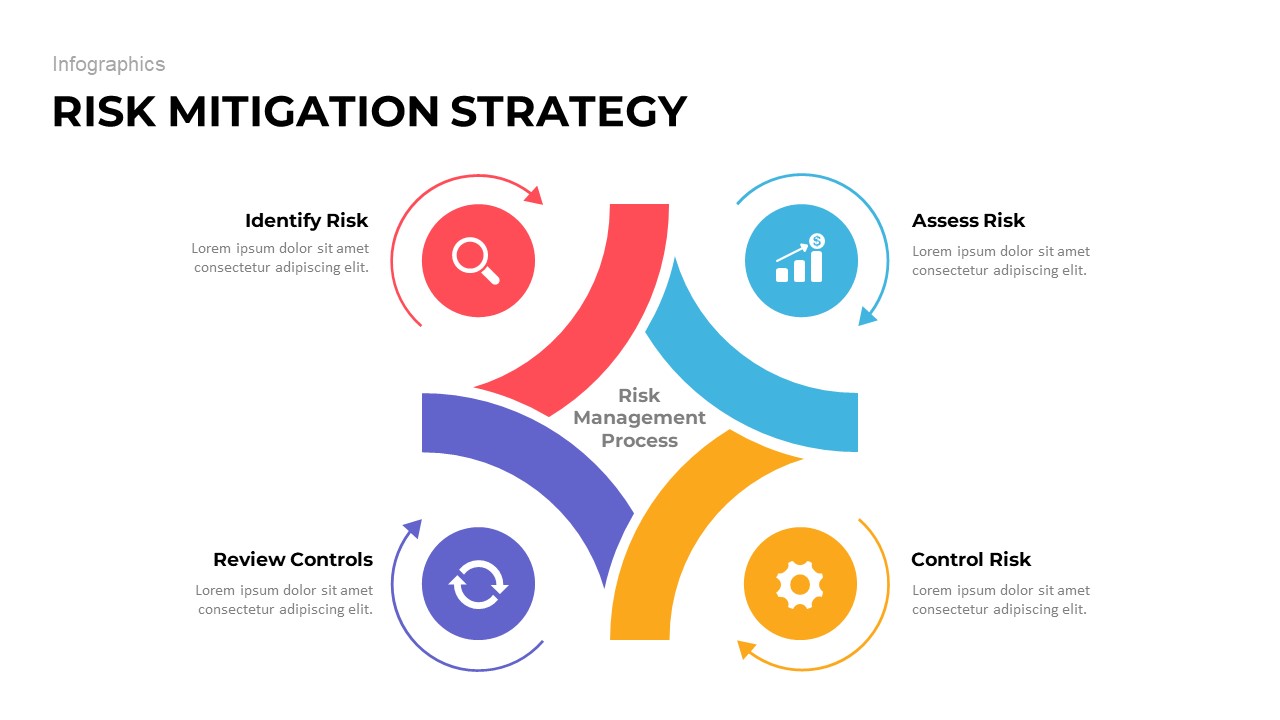

S And P 500 Investment Protection Mitigate Risk With Downside Insurance

May 01, 2025

S And P 500 Investment Protection Mitigate Risk With Downside Insurance

May 01, 2025 -

Hasbro Unveils Dash Rendar Action Figure From Star Wars Shadow Of The Empire

May 01, 2025

Hasbro Unveils Dash Rendar Action Figure From Star Wars Shadow Of The Empire

May 01, 2025 -

Binh Duong Co Dai Su Tinh Nguyen Tien Linh Cam Hung Tich Cuc Cho Cong Dong

May 01, 2025

Binh Duong Co Dai Su Tinh Nguyen Tien Linh Cam Hung Tich Cuc Cho Cong Dong

May 01, 2025

Latest Posts

-

Tkachuk And Panthers Dominate Second Defeat Senators

May 01, 2025

Tkachuk And Panthers Dominate Second Defeat Senators

May 01, 2025 -

Panthers Explosive Second Period Sinks Senators Tkachuk Leads The Charge

May 01, 2025

Panthers Explosive Second Period Sinks Senators Tkachuk Leads The Charge

May 01, 2025 -

Johnstons Record Breaking Goal Propels Stars To Victory Over Avalanche

May 01, 2025

Johnstons Record Breaking Goal Propels Stars To Victory Over Avalanche

May 01, 2025 -

Stars Take 3 2 Series Lead With Johnstons Record Setting Playoff Goal

May 01, 2025

Stars Take 3 2 Series Lead With Johnstons Record Setting Playoff Goal

May 01, 2025 -

Johnstons Speedy Goal Fuels Stars 6 2 Win Over Avalanche 3 2 Series Lead

May 01, 2025

Johnstons Speedy Goal Fuels Stars 6 2 Win Over Avalanche 3 2 Series Lead

May 01, 2025