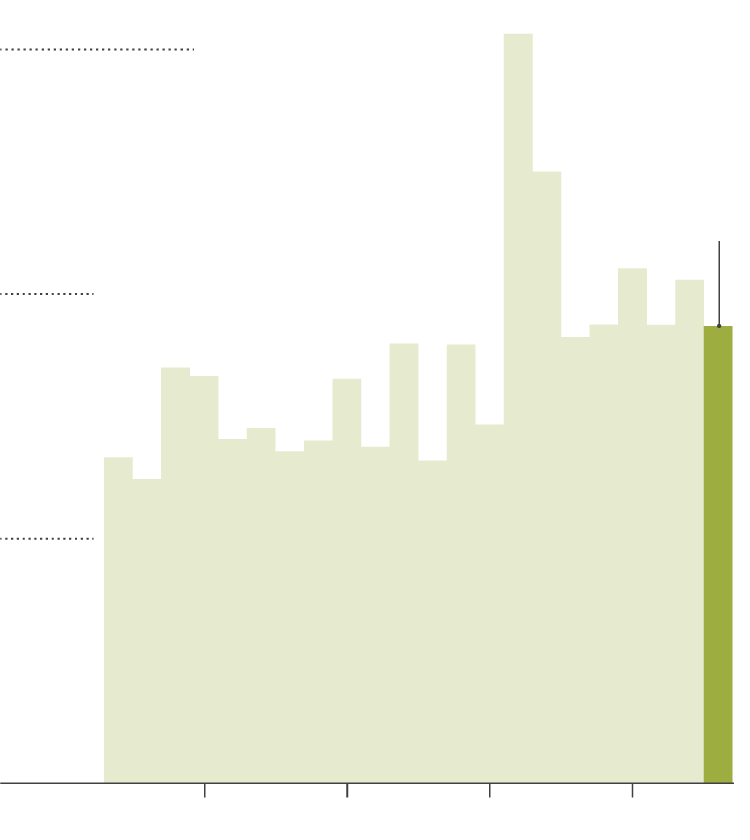

8% Stock Market Increase On Euronext Amsterdam After Trump's Tariff Action

Table of Contents

Trump's Tariff Actions and Market Reactions

President Trump's latest tariff actions, targeting specific sectors in [mention specific countries/sectors], initially sparked widespread concern among global market analysts. The perceived impact was largely negative, with predictions of decreased trade, supply chain disruptions, and potential economic slowdown.

- Initial negative predictions from analysts: Many experts forecast significant downturns, particularly in technology and manufacturing sectors heavily reliant on US-China trade.

- Specific sectors expected to be affected: The technology and manufacturing sectors were identified as particularly vulnerable, alongside agricultural exports from affected countries.

- Unanticipated positive market response in Amsterdam: However, the Euronext Amsterdam market reacted in a counter-intuitive manner, experiencing a sharp 8% increase.

This positive response, despite the potential negative impact of the tariffs, can be partly attributed to sophisticated hedging strategies employed by investors. Some may have anticipated a less severe impact than initially predicted or capitalized on market volatility for short-term gains. Others may have seen opportunities in sectors less directly affected by the tariffs.

Euronext Amsterdam's Unique Position in the European Market

Euronext Amsterdam's unique composition played a crucial role in its disproportionately positive response. Certain sectors listed on the exchange appear to have benefited significantly from the situation.

- Strong performance of specific sectors: The energy and financial sectors demonstrated particularly strong performance, potentially benefiting from factors unrelated to the tariffs.

- Potential for decreased competition due to tariffs: Some companies listed on Euronext Amsterdam may have experienced a decrease in competition due to the tariffs impacting their foreign rivals.

- Focus on companies less directly exposed to US trade: A significant portion of the companies listed on Euronext Amsterdam have limited direct exposure to US trade, making them less vulnerable to the negative impacts of the tariffs.

The Netherlands' robust economic health and overall market stability also contributed to the positive performance of Euronext Amsterdam, providing a buffer against global uncertainties.

Investor Sentiment and Speculative Trading

The rapid Euronext Amsterdam stock market increase was significantly fueled by investor sentiment and speculative trading. Market optimism, driven by various factors beyond the immediate tariff impact, played a critical role.

- Short-term speculative trading: A considerable amount of short-term trading activity was observed, contributing to the rapid price increase.

- Market optimism and its impact on share prices: Positive sentiment, perhaps fueled by unrelated positive economic news or broader market trends, pushed share prices upwards.

- Increased trading volume on Euronext Amsterdam: The 8% increase was accompanied by a notable surge in trading volume, indicating heightened investor activity.

It remains to be seen whether this Euronext Amsterdam stock market increase reflects a genuine market correction or simply short-term speculation. The inherent risk associated with such rapid price changes underscores the importance of cautious investment strategies.

Global Market Influences and Ripple Effects

The Euronext Amsterdam stock market increase didn't occur in isolation; it's part of a broader global market dynamic. Its movement was influenced by and, in turn, influenced other markets.

- Impact on other European stock exchanges: While the 8% jump was unique to Euronext Amsterdam, it did create some ripples on other European exchanges, albeit less pronounced.

- Correlation with movements in the US and Asian markets: The overall global market sentiment, including fluctuations in US and Asian markets, played a role in the Euronext Amsterdam response.

- Long-term implications for investors in Euronext Amsterdam: The long-term implications remain uncertain, dependent on the evolving global economic landscape and the lasting impacts of the tariffs.

Predicting the future is challenging, considering ongoing global economic uncertainty and potential shifts in geopolitical dynamics.

Conclusion

The 8% Euronext Amsterdam stock market increase following Trump's tariff action resulted from a confluence of factors: a counter-intuitive market reaction, Euronext Amsterdam's unique market position, strong investor sentiment, and broader global market influences. While the increase is significant, investors should proceed with caution. The inherent volatility of the market demands thorough research and professional financial advice before making any investment decisions. Remember that past performance is not indicative of future results.

Call to Action: Stay informed on the dynamic developments affecting the Euronext Amsterdam stock market and its response to global economic events. Follow our blog for further analysis and insights into the Euronext Amsterdam stock market increase and other significant market movements.

Featured Posts

-

French Pms Disagreement With Macrons Leadership Revealed

May 25, 2025

French Pms Disagreement With Macrons Leadership Revealed

May 25, 2025 -

Top R And B Tracks This Week Featuring Leon Thomas And Flo

May 25, 2025

Top R And B Tracks This Week Featuring Leon Thomas And Flo

May 25, 2025 -

Cac 40 Weekly Performance Mixed Signals Amidst Market Fluctuations March 7 2025

May 25, 2025

Cac 40 Weekly Performance Mixed Signals Amidst Market Fluctuations March 7 2025

May 25, 2025 -

Oleg Basilashvili Test Na Znanie Filmov I Spektakley

May 25, 2025

Oleg Basilashvili Test Na Znanie Filmov I Spektakley

May 25, 2025 -

Record Global Forest Loss Driven By Devastating Wildfires

May 25, 2025

Record Global Forest Loss Driven By Devastating Wildfires

May 25, 2025

Latest Posts

-

The Issue Of Thames Water Executive Bonuses A Public Perspective

May 25, 2025

The Issue Of Thames Water Executive Bonuses A Public Perspective

May 25, 2025 -

Investigating Thames Water Executive Bonuses Transparency And Public Trust

May 25, 2025

Investigating Thames Water Executive Bonuses Transparency And Public Trust

May 25, 2025 -

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 25, 2025

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 25, 2025 -

Thames Waters Executive Pay Packages Fair Or Unfair

May 25, 2025

Thames Waters Executive Pay Packages Fair Or Unfair

May 25, 2025 -

Analysis Of Thames Water Executive Bonuses A Case Study In Corporate Accountability

May 25, 2025

Analysis Of Thames Water Executive Bonuses A Case Study In Corporate Accountability

May 25, 2025