700+ Point Sensex Rally: Today's Stock Market News And Analysis

Table of Contents

Key Factors Driving the 700+ Point Sensex Rally

Several interconnected factors contributed to today's remarkable Sensex rally. Understanding these drivers is crucial for interpreting the current market sentiment and predicting future trends.

Positive Global Sentiment

Positive global cues played a significant role in boosting investor confidence. Improved US economic data, easing inflation concerns in other major economies, and the strong performance of global indices all contributed to a more optimistic global outlook.

- Improved US Economic Data: Stronger-than-expected US employment figures and easing inflation numbers signaled a resilient US economy, reducing fears of a significant economic slowdown. This positive sentiment spilled over into other global markets.

- Easing Global Inflation Concerns: Signs of easing inflation in major economies like the Eurozone and the UK lessened anxieties about aggressive interest rate hikes by central banks, which is beneficial for global stock markets.

- Positive Global Index Performance: The positive performance of the Dow Jones and Nasdaq, along with other major global indices, created a ripple effect, boosting investor confidence and encouraging participation in the Indian stock market.

- Increased Foreign Institutional Investor (FII) Inflow: Increased foreign investment further fueled the Sensex rally. Positive global sentiment and expectations of strong Indian economic growth likely attracted significant FII investment.

Domestic Economic Indicators

Positive domestic economic news also significantly boosted investor confidence. Strong corporate earnings, positive manufacturing PMI data, and supportive government policies all contributed to the market surge.

- Strong Q[Quarter] Corporate Earnings Reports: Several major Indian companies reported strong earnings for the [Quarter] quarter, exceeding market expectations and demonstrating robust corporate health. This positive news reassured investors about the Indian economy's underlying strength.

- Positive Manufacturing PMI Data: A rise in the manufacturing Purchasing Managers' Index (PMI) indicated expansion in the manufacturing sector, signaling strong industrial activity and economic growth.

- Government Initiatives Supporting Economic Growth: Government policy announcements supporting infrastructure development, ease of doing business, and other pro-growth initiatives further enhanced investor sentiment.

- Stable Rupee Against the Dollar: A relatively stable Indian Rupee against the US dollar reduced currency risks and encouraged foreign investment, further contributing to the market rally.

Sector-Specific Performance

The Sensex rally wasn't uniform across all sectors. Some sectors significantly outperformed others, contributing disproportionately to the overall market surge.

- Strong Performance of IT Sector driven by robust deal wins and increased demand for digital services. The IT sector benefited from strong global demand for technology services and successful contract wins.

- Banking Sector Gains due to improved asset quality and increased credit growth. The banking sector experienced gains fueled by improved asset quality and increased credit growth.

- Positive Outlook for FMCG Sector based on strong consumer spending and rural demand. The FMCG sector showed strength owing to robust consumer spending and an increase in demand from rural markets.

Analyzing the Sustainability of the Sensex Rally

While today's 700+ point Sensex rally is impressive, its sustainability hinges on several factors. A balanced perspective is crucial, considering both potential catalysts for continued growth and potential triggers for a correction.

- Potential for Continued FII Inflow: Continued positive global sentiment and strong Indian economic growth could attract further foreign investment, sustaining the rally.

- Impact of Upcoming Macroeconomic Data Releases: Upcoming macroeconomic data releases, such as inflation figures and GDP growth estimates, will significantly impact market sentiment and could either reinforce or reverse the current trend.

- Geopolitical Risks and their Potential Influence: Geopolitical risks, both global and regional, could significantly affect market sentiment and potentially trigger a correction.

- Long-term Growth Prospects of the Indian Economy: The long-term growth prospects of the Indian economy remain a crucial factor influencing investor confidence and the sustainability of the rally.

Investment Strategies in the Wake of the Sensex Rally

The significant Sensex rally calls for a cautious and strategic approach to investment. Investors should prioritize risk management and diversification.

- Importance of a Diversified Investment Portfolio: A well-diversified portfolio across different asset classes and sectors is crucial to mitigate risk and safeguard investments.

- Considering Risk Tolerance Before Making Investment Decisions: Investors should carefully assess their risk tolerance before making any investment decisions, ensuring their investment strategy aligns with their risk profile.

- Long-term Investment Strategy Over Short-term Gains: Adopting a long-term investment strategy focused on consistent growth rather than chasing short-term gains is essential for maximizing returns.

- Seeking Professional Financial Advice if Needed: Seeking professional financial advice from qualified advisors can provide valuable insights and personalized guidance tailored to individual investment goals and risk tolerance.

Conclusion: Understanding the Implications of the 700+ Point Sensex Rally

The 700+ point Sensex rally is a complex event driven by a confluence of global and domestic factors including positive global sentiment, strong domestic economic indicators, and sector-specific performance. While the rally is impressive, its sustainability depends on various factors that need careful consideration. Analyzing market trends and making informed investment decisions is crucial. To stay updated on the latest developments in the Sensex and the Indian stock market, subscribe to our newsletter for further stock market analysis and insights into future market surges. Remember to conduct thorough research before making any investment decisions related to the Sensex rally.

Featured Posts

-

Unraveling The Mystery 5 Theories About David In He Morgan Brothers High Potential

May 09, 2025

Unraveling The Mystery 5 Theories About David In He Morgan Brothers High Potential

May 09, 2025 -

Nottingham Attacks Unflinching Accounts From Those Who Survived

May 09, 2025

Nottingham Attacks Unflinching Accounts From Those Who Survived

May 09, 2025 -

Solve Nyt Strands Game 402 Hints And Answers For April 9

May 09, 2025

Solve Nyt Strands Game 402 Hints And Answers For April 9

May 09, 2025 -

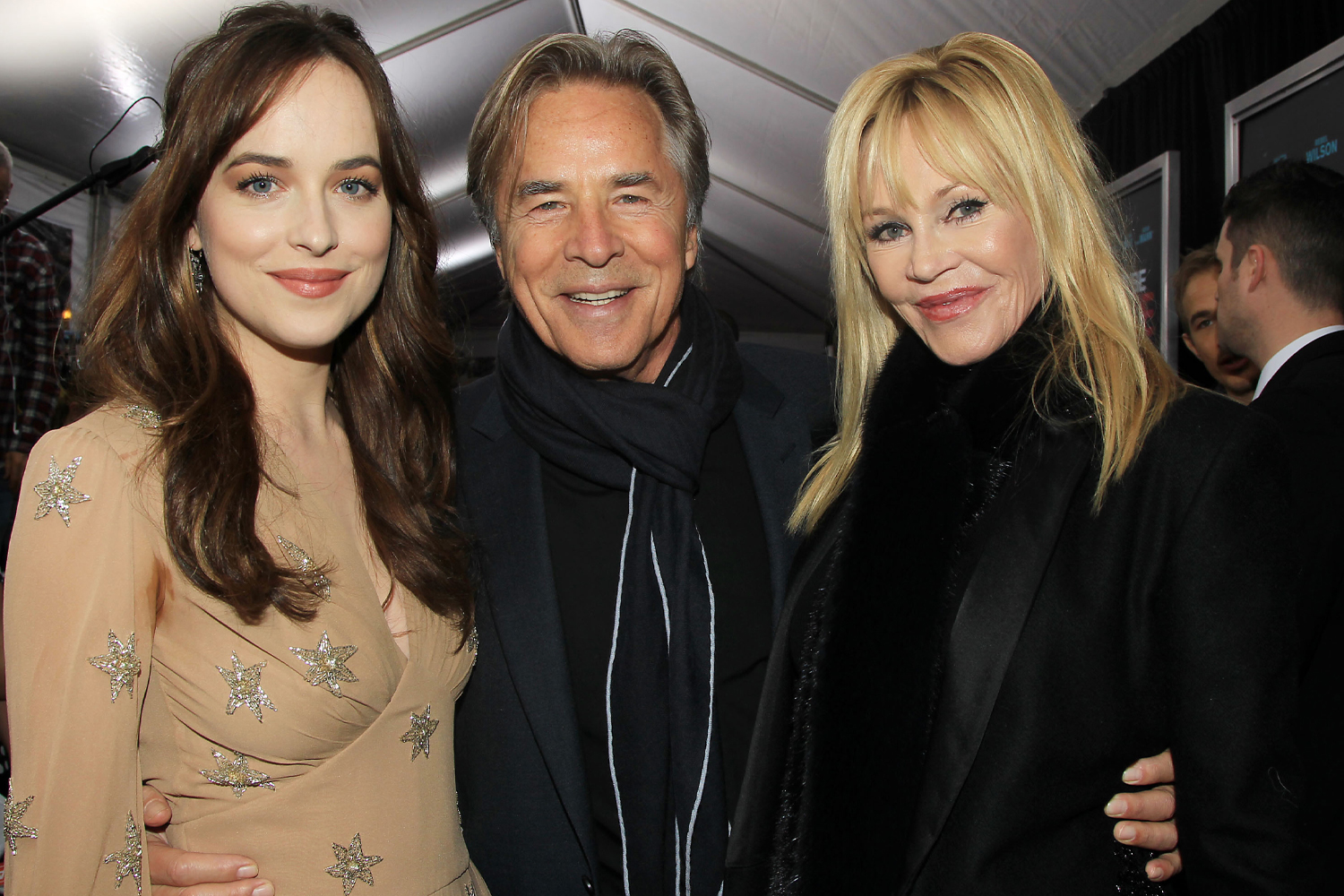

Dakota Johnsons Family Supports Her At Materialist Premiere

May 09, 2025

Dakota Johnsons Family Supports Her At Materialist Premiere

May 09, 2025 -

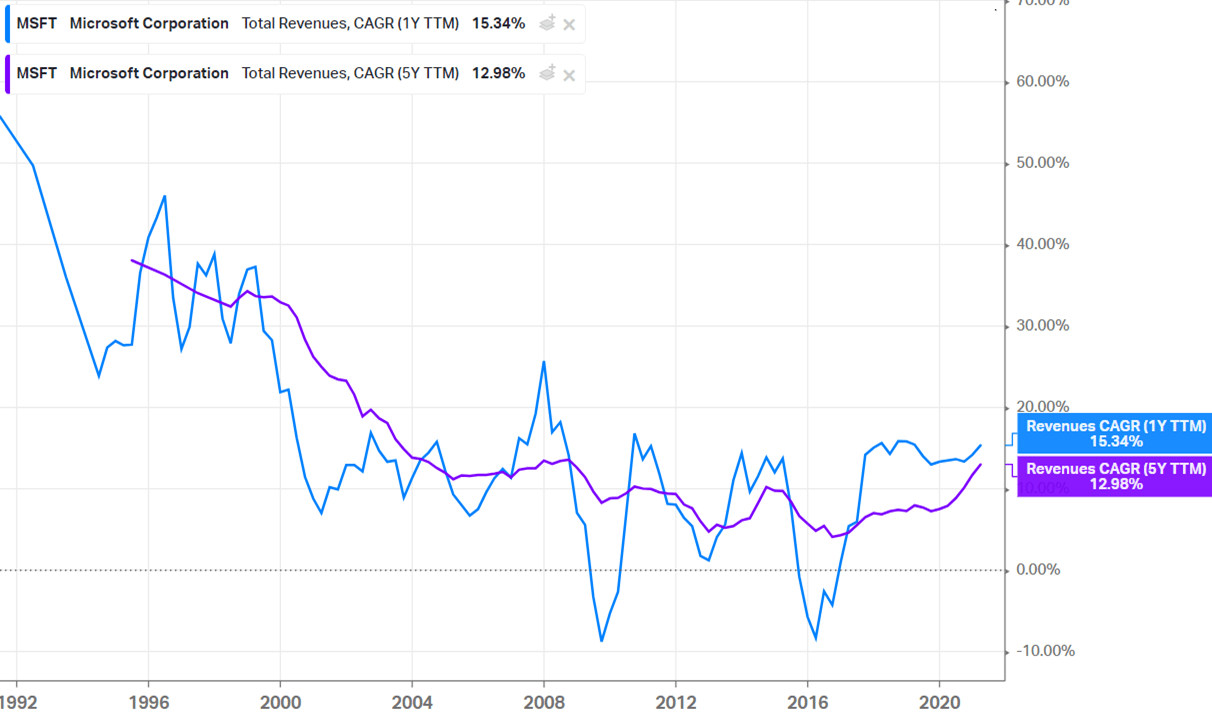

Will Palantir Reach A 1 Trillion Valuation By The End Of The Decade

May 09, 2025

Will Palantir Reach A 1 Trillion Valuation By The End Of The Decade

May 09, 2025