5 Steps To Success: Your Guide To Private Credit Employment

Table of Contents

Step 1: Develop In-Demand Skills for Private Credit Employment

Securing a role in private credit employment demands a strong foundation of technical skills. Employers in private equity, hedge funds, and other private credit firms look for candidates proficient in various areas of credit analysis.

- Master financial modeling techniques: Develop expertise in discounted cash flow (DCF) and leveraged buyout (LBO) modeling. These are crucial for valuing potential investments and assessing the financial health of borrowers.

- Develop strong accounting and valuation skills: A thorough understanding of accounting principles (GAAP, IFRS) and valuation methodologies is essential for analyzing financial statements and assessing the creditworthiness of borrowers. This includes understanding different valuation methods like comparable company analysis and precedent transactions.

- Understand debt structuring and legal aspects of private credit transactions: Familiarity with different types of debt instruments (senior secured loans, mezzanine financing, subordinated debt), covenants, and legal agreements is vital.

- Gain proficiency in industry-specific software: Mastering tools like the Bloomberg Terminal provides access to real-time market data, crucial for effective credit analysis and due diligence.

- Learn the intricacies of credit analysis and due diligence: Develop strong skills in assessing credit risk, conducting thorough due diligence investigations, and preparing comprehensive credit reports. This includes understanding financial ratios, credit scoring models, and qualitative factors that affect credit risk.

Step 2: Network Strategically Within the Private Credit Industry

Networking is paramount in the private credit industry. Building relationships can unlock hidden opportunities and provide invaluable insights.

- Attend industry conferences and events: Networking events provide opportunities to meet private credit professionals, learn about new trends, and build relationships.

- Actively engage on LinkedIn: Connect with professionals working in private credit, participate in relevant groups, and share insightful content to increase your visibility.

- Conduct informational interviews: Reach out to professionals in private credit for informational interviews to learn about their career paths, gain insights into specific roles, and explore potential opportunities.

- Seek mentorship from experienced professionals: A mentor can provide guidance, advice, and support, accelerating your career progression in private credit.

- Leverage your existing network: Tap into your existing professional network to identify potential leads and connections within the private credit world.

Step 3: Craft a Compelling Resume and Cover Letter for Private Credit Jobs

Your resume and cover letter are your first impression. They must showcase your skills and experience effectively to land an interview for private credit jobs.

- Tailor your resume and cover letter: Customize your application materials for each specific job description, highlighting relevant skills and experience. Use keywords from the job description.

- Quantify your achievements: Use numbers and data to demonstrate your impact in previous roles. For example, instead of "Improved efficiency," write "Improved efficiency by 15% through process optimization."

- Optimize your resume for Applicant Tracking Systems (ATS): Ensure your resume is ATS-friendly to increase its chances of being seen by recruiters.

- Highlight relevant keywords: Integrate keywords related to private credit, credit analysis, financial modeling, and other relevant skills mentioned in the job description.

- Showcase your understanding of the private credit industry: Demonstrate your knowledge of market trends and specific areas within private credit.

Step 4: Ace the Private Credit Job Interview

The interview is your chance to demonstrate your expertise and enthusiasm. Preparation is key to succeeding in a private credit interview.

- Practice answering behavioral and technical questions: Prepare for common interview questions focusing on your experiences, skills, and understanding of private credit.

- Prepare for case studies and financial modeling exercises: Many private credit interviews include case studies or modeling exercises to assess your analytical abilities. Practice your skills with example cases.

- Research the firm and interviewer: Thorough research demonstrates your genuine interest and allows you to ask insightful questions.

- Demonstrate your enthusiasm: Showcase your passion for private credit and the specific role you are interviewing for.

- Ask insightful questions: Prepare thoughtful questions to show your interest and engagement.

Step 5: Negotiate Your Private Credit Employment Offer

Securing a competitive compensation package is crucial. Confidently negotiating your offer is essential in private credit employment.

- Research industry salary ranges: Use online resources and networking to understand typical salary ranges for similar roles in your location.

- Understand the entire compensation package: Consider base salary, bonuses, benefits, and other perks when evaluating the overall compensation.

- Prepare your desired salary range: Research thoroughly and determine a salary range that aligns with your skills and experience.

- Know your worth: Confidently articulate your value and contributions to the firm during salary negotiations.

- Carefully review the employment contract: Thoroughly review the contract before signing to ensure you understand all terms and conditions.

Conclusion:

Securing your dream role in private credit employment requires dedication and strategic effort. By following these five steps – developing in-demand skills, networking effectively, crafting a compelling application, acing the interview, and negotiating confidently – you can significantly increase your chances of success. Don't delay your journey to a fulfilling career in private credit; start implementing these steps today and unlock your potential in the dynamic world of private credit employment!

Featured Posts

-

India Pakistan Conflict The Enduring Significance Of Kashmir And The Risk Of Renewed Hostilities

May 08, 2025

India Pakistan Conflict The Enduring Significance Of Kashmir And The Risk Of Renewed Hostilities

May 08, 2025 -

Is The Bitcoin Price Rebound Sustainable A Look At Market Indicators

May 08, 2025

Is The Bitcoin Price Rebound Sustainable A Look At Market Indicators

May 08, 2025 -

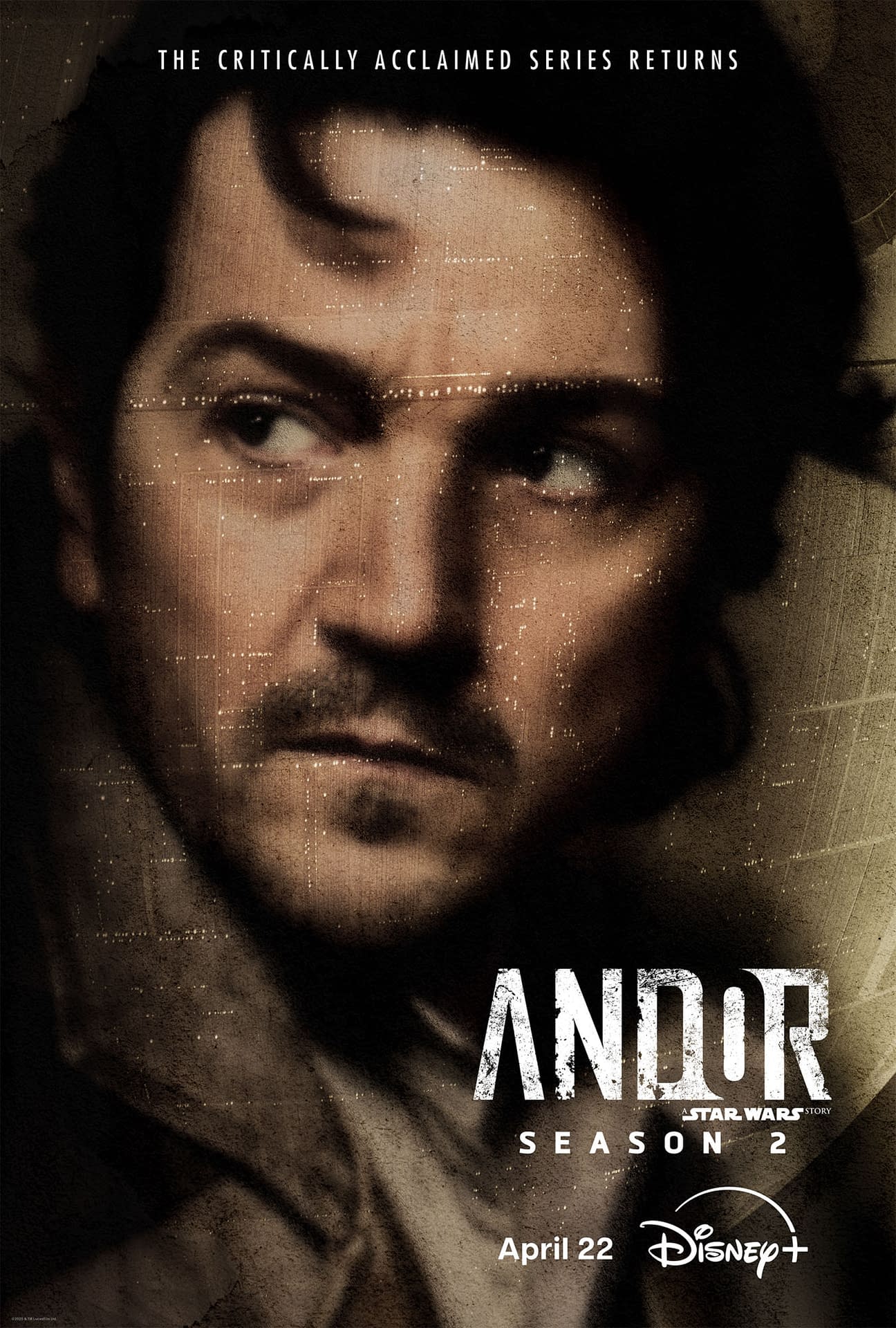

Andor Season 2 Your Essential Guide Before The Premiere

May 08, 2025

Andor Season 2 Your Essential Guide Before The Premiere

May 08, 2025 -

110 Growth Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Growth Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

Re Examining The Thunder Bulls Offseason Trade A Deeper Dive

May 08, 2025

Re Examining The Thunder Bulls Offseason Trade A Deeper Dive

May 08, 2025