270MWh BESS Project Financing In Belgium: Challenges And Solutions

Table of Contents

Understanding the Belgian Energy Landscape and BESS Regulations

Regulatory Framework for Energy Storage

Belgium's regulatory environment for energy storage is evolving, presenting both opportunities and challenges for BESS projects. Navigating this landscape requires a thorough understanding of the relevant legislation and procedures.

- Permitting Processes: Obtaining the necessary permits for a 270MWh BESS project involves navigating various regional and federal authorities, leading to potentially lengthy timelines. Specific regulations vary depending on the project location and capacity.

- Grid Connection Rules: Connecting a large-scale BESS project to the Belgian grid requires compliance with Elia's (the Belgian transmission system operator) technical standards and grid code. This involves detailed studies on grid impact and potential upgrades.

- Feed-in Tariffs: While Belgium doesn't have specific feed-in tariffs dedicated solely to BESS, participation in capacity mechanisms and ancillary services markets can generate revenue streams.

The regulatory complexity, coupled with potential delays in permitting, represents a significant hurdle for investors. Clear communication with regulatory bodies and proactive engagement throughout the permitting process are crucial for mitigating these risks.

Market Demand and Incentives for BESS

The Belgian market for BESS is experiencing significant growth, driven by the increasing integration of renewable energy sources like wind and solar. Government incentives further bolster this trend.

- Government Subsidies: Various regional and federal programs offer subsidies and tax breaks for renewable energy projects, often including energy storage components. These incentives can significantly reduce the project's upfront capital costs.

- Tax Breaks: Investment tax credits and accelerated depreciation allowances can enhance the financial attractiveness of BESS investments.

- Carbon Credits: Participation in carbon emissions trading schemes can generate additional revenue streams for BESS projects by providing grid stability services and reducing reliance on fossil fuels.

The strong market demand coupled with government support creates a favorable environment for BESS deployment, although securing these incentives requires careful planning and compliance with specific eligibility criteria.

Key Challenges in Securing 270MWh BESS Project Financing

High Capital Expenditure (CAPEX) and Return on Investment (ROI)

A 270MWh BESS project necessitates substantial upfront investment. Achieving a competitive ROI requires careful financial planning and risk management.

- CAPEX Breakdown: Major CAPEX components include battery systems (representing a significant portion), power conversion systems (inverters), land acquisition, permitting costs, engineering, procurement, and construction (EPC) expenses, and grid connection fees.

- Battery Technology Costs and Lifespan: Battery technology costs are a crucial factor influencing both CAPEX and ROI. The lifespan and degradation rate of battery systems affect long-term operational costs and the overall project profitability. Choosing the right battery chemistry and ensuring proper maintenance are critical considerations.

Securing Debt and Equity Financing

Securing sufficient financing for a project of this scale presents unique challenges. Investors assess the risk profile carefully, demanding detailed due diligence and robust financial projections.

- Financing Options: Potential funding sources include project finance loans from banks, equity investments from private equity firms or specialized energy funds, and corporate debt financing.

- Risk Perception and Due Diligence: Investors are concerned about technological risks (battery degradation, system failures), regulatory uncertainties, and market price volatility. Thorough due diligence, including technical audits and detailed financial modeling, is essential to alleviate these concerns.

- Credit Rating Agencies: A positive credit rating can significantly enhance the project's appeal to lenders and investors.

Managing Financial Risks

BESS projects are subject to various financial risks that need careful consideration and mitigation.

- Technological Risks: Battery degradation, system malfunctions, and unforeseen technical issues can impact project performance and profitability. Risk mitigation strategies include selecting reliable technology providers, incorporating redundancy in the system design, and securing comprehensive warranties.

- Regulatory Changes: Changes in regulations, permits, or grid connection rules can negatively affect project feasibility. Staying updated on regulatory developments and engaging with policymakers are vital.

- Market Price Volatility: Electricity prices and carbon credit prices can fluctuate, impacting project revenue streams. Hedging strategies and robust financial models that account for price volatility are essential.

Strategies for Successful 270MWh BESS Project Financing in Belgium

Developing a Compelling Investment Case

A successful financing strategy begins with a strong investment proposal that clearly demonstrates the project's viability.

- Key Performance Indicators (KPIs): Defining and tracking relevant KPIs (e.g., capacity factor, discharge duration, return on equity) is crucial for demonstrating project performance and meeting investor expectations.

- Financial Models and Sensitivity Analysis: Detailed financial models, including sensitivity analysis to key parameters (e.g., battery costs, electricity prices), are essential to showcase project resilience and profitability under various scenarios.

Leveraging Public Funding and Incentives

Exploring and securing available public funding is crucial for enhancing project financial feasibility.

- Government Programs: Actively research and apply for relevant Belgian government programs offering grants, subsidies, and tax incentives for renewable energy and energy storage projects.

- Regional Initiatives: Consider regional-level funding programs which may offer additional support.

Exploring Innovative Financing Structures

Innovative financing mechanisms can attract a broader range of investors.

- Power Purchase Agreements (PPAs): PPAs can secure long-term revenue streams by contracting electricity sales to off-takers.

- Green Bonds: Issuing green bonds can appeal to environmentally conscious investors seeking sustainable investments.

- Crowdfunding: Crowdfunding platforms can mobilize capital from a wider investor base.

Building Strong Partnerships

Collaboration with experienced partners is essential for successful project execution and financing.

- EPC Contractors: Partnering with experienced EPC contractors ensures efficient project construction and management.

- Technology Providers: Selecting reliable technology providers minimizes technological risks.

- Financial Advisors: Engaging financial advisors specializing in energy projects provides valuable expertise in structuring financing deals and managing financial risks.

- Grid Operators: Close collaboration with grid operators ensures seamless grid connection.

- Local Communities: Engaging with local communities can foster social acceptance and address potential concerns.

Conclusion: Unlocking the Potential of 270MWh BESS Project Financing in Belgium

Securing financing for a 270MWh BESS project in Belgium presents significant challenges, including high CAPEX, regulatory complexities, and market risks. However, the substantial growth potential in the Belgian energy storage market, coupled with available government incentives, makes it an attractive investment opportunity. By developing a compelling investment case, leveraging public funding, exploring innovative financing structures, and building strong partnerships, developers can successfully navigate these complexities and unlock the considerable potential of BESS projects. Further research into evolving technologies, regulatory updates, and innovative financial models is crucial for success in this dynamic landscape. We encourage you to explore the potential of 270MWh BESS projects in Belgium by contacting relevant stakeholders and accessing available resources and support for BESS project financing. The future of energy storage in Belgium is bright, and with careful planning and execution, large-scale BESS projects can play a vital role in achieving the country's ambitious renewable energy goals.

Featured Posts

-

Ftc Appeals Activision Blizzard Acquisition A Deep Dive

May 04, 2025

Ftc Appeals Activision Blizzard Acquisition A Deep Dive

May 04, 2025 -

Perkins Coie Law Firm Wins Legal Victory Against Trump Order

May 04, 2025

Perkins Coie Law Firm Wins Legal Victory Against Trump Order

May 04, 2025 -

Kivinin Kabugunun Faydalari Ve Riskleri Yemeden Oence Bilmeniz Gerekenler

May 04, 2025

Kivinin Kabugunun Faydalari Ve Riskleri Yemeden Oence Bilmeniz Gerekenler

May 04, 2025 -

Security Row Prince Harry Reveals Rift With King Charles

May 04, 2025

Security Row Prince Harry Reveals Rift With King Charles

May 04, 2025 -

Chinas Electric Vehicle Onslaught Is The Us Prepared To Compete

May 04, 2025

Chinas Electric Vehicle Onslaught Is The Us Prepared To Compete

May 04, 2025

Latest Posts

-

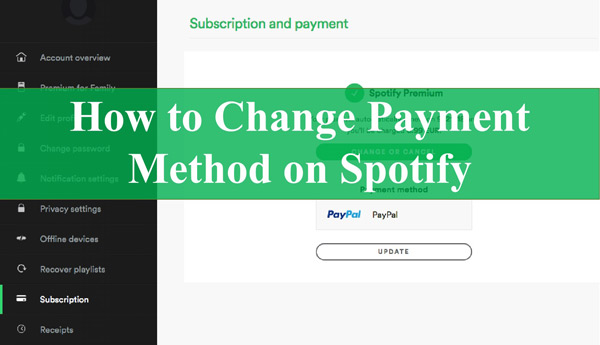

Spotify I Phone App More Payment Choices For Users

May 04, 2025

Spotify I Phone App More Payment Choices For Users

May 04, 2025 -

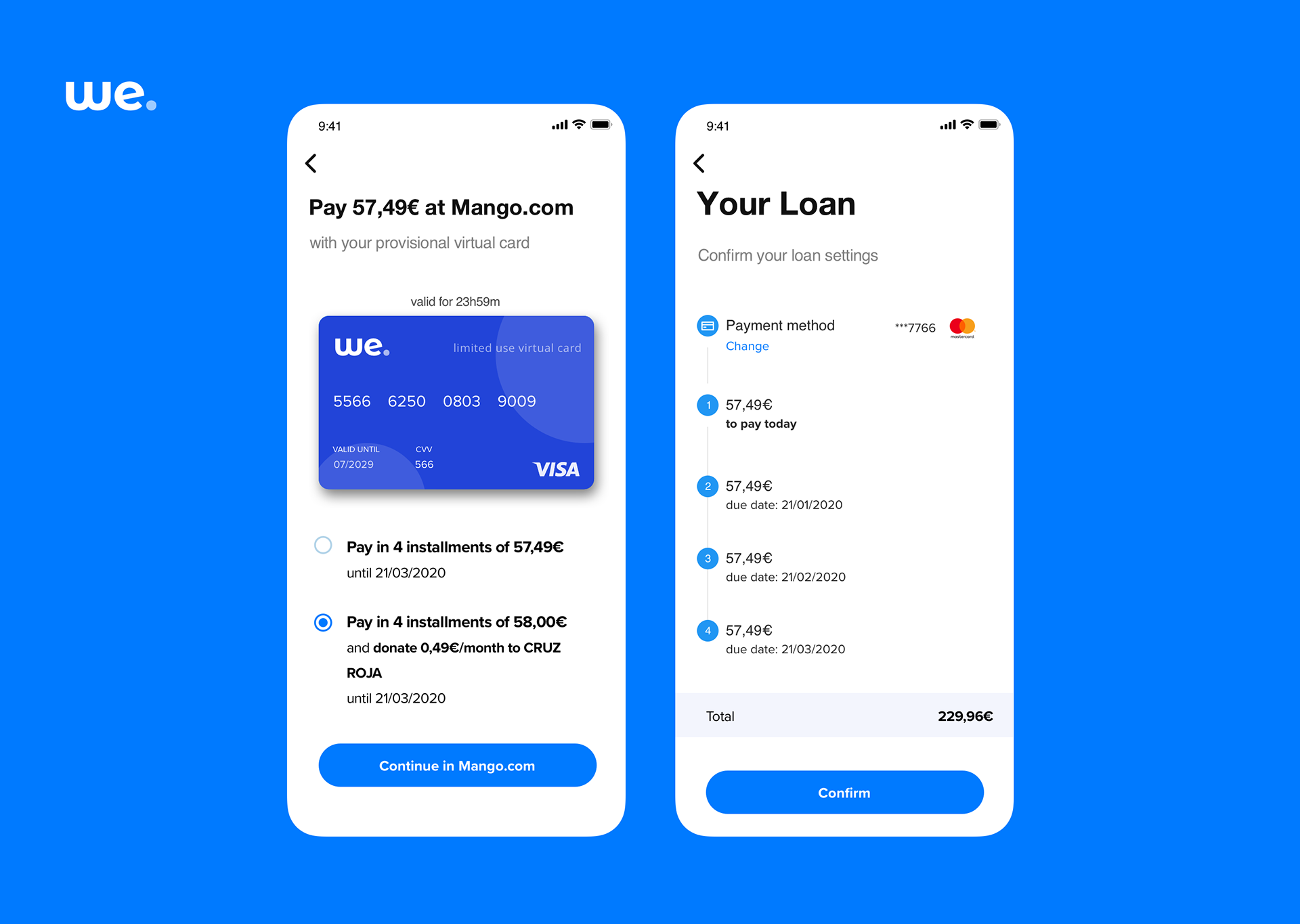

Enhanced Payment Flexibility On Spotifys I Phone App

May 04, 2025

Enhanced Payment Flexibility On Spotifys I Phone App

May 04, 2025 -

Spotify Updates I Phone App With Customizable Payment Options

May 04, 2025

Spotify Updates I Phone App With Customizable Payment Options

May 04, 2025 -

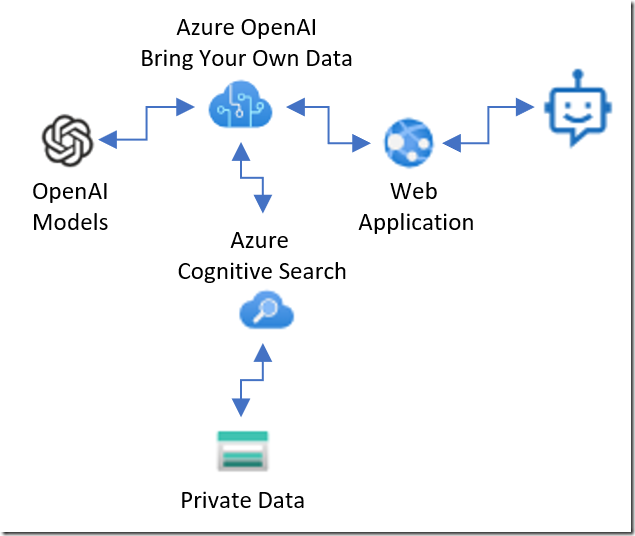

Building Voice Assistants Open Ais 2024 Breakthrough

May 04, 2025

Building Voice Assistants Open Ais 2024 Breakthrough

May 04, 2025 -

Spotify I Phone App Flexible Payment Options Now Available

May 04, 2025

Spotify I Phone App Flexible Payment Options Now Available

May 04, 2025