Where To Invest: A Guide To The Country's Emerging Business Hot Spots

Table of Contents

The Tech Hub Boom: Investing in Innovation

The technology sector is experiencing explosive growth, making it an attractive area for investment. Several regions within the country are emerging as significant tech hubs, offering exciting opportunities for investors.

Silicon Valley South: A Hotbed of Technological Advancement

Several cities are rapidly transforming into thriving tech centers, attracting significant investment and talent. These "Silicon Valleys South" are characterized by a robust talent pool, supportive government initiatives, and advanced infrastructure.

-

Key Cities:

- City A: Experienced a 15% increase in tech jobs last year, with over $500 million in venture capital investment. Major players include TechGiant Corp and Innovate Solutions.

- City B: Home to a renowned university, fostering a strong talent pipeline. Startups in AI and FinTech are particularly prevalent. Venture capital investment reached $300 million in the last quarter.

- City C: Benefits from government incentives targeting tech companies, resulting in a rapid influx of new businesses. Specializes in green technology and renewable energy solutions.

- City D: Strong infrastructure, including high-speed internet and advanced transportation, supports the growth of the tech sector. Known for its thriving gaming and software development industries.

- City E: A cost-effective alternative to larger tech hubs, attracting smaller startups and offering a lower cost of living for employees.

-

Driving Factors: The growth in these cities is fueled by a combination of factors, including a highly skilled workforce, proximity to universities, government incentives, and a supportive entrepreneurial ecosystem. However, risks include intense competition and the cyclical nature of the tech industry.

Beyond the Big Cities: Unlocking Untapped Potential

While major metropolitan areas dominate the headlines, smaller cities are also experiencing significant growth in the tech sector. These areas offer a compelling proposition: lower operational costs and reduced competition.

-

Promising Smaller Cities:

- Town X: Specializes in biotech and medical technology, benefiting from a skilled workforce and lower real estate costs. Success story: BioTech Startup secured $20 million in Series A funding.

- Town Y: Focuses on software development and digital marketing, attracting remote workers and freelancers. Advantages include a lower cost of living and a strong community spirit.

-

Risks and Rewards: Investing in smaller tech hubs presents a higher risk-reward profile. While the potential for significant returns is substantial, thorough due diligence is crucial to mitigate potential challenges.

Renewable Energy: A Sustainable Investment Future

The shift towards sustainable energy sources presents a significant investment opportunity. Government initiatives and abundant natural resources are driving the growth of the renewable energy sector.

Government Initiatives and Incentives: Fueling Green Growth

Government policies play a crucial role in supporting the development of renewable energy. Various incentives are designed to attract investment and accelerate the transition to cleaner energy sources.

-

Key Government Programs:

- Green Energy Tax Credits: Offers significant tax breaks for investing in renewable energy projects. [Link to relevant government website]

- Renewable Energy Subsidies: Provides direct financial support for renewable energy development. [Link to relevant government website]

- Feed-in Tariffs: Guarantees a fixed price for electricity generated from renewable sources. [Link to relevant government website]

-

Long-Term Potential: The long-term outlook for renewable energy is extremely positive, driven by increasing energy demand, environmental concerns, and government regulations.

Key Regions for Renewable Energy Development: Harnessing Natural Resources

Specific regions within the country boast abundant renewable resources, making them ideal locations for renewable energy projects.

-

High-Potential Regions:

- Region A: Abundant solar energy resources, ideal for large-scale solar farms. Several large-scale projects are already underway.

- Region B: Strong winds, making it a prime location for wind energy development. Significant investment is being made in offshore wind farms.

- Region C: Abundant hydropower resources, with several hydroelectric power plants already in operation.

-

Economic Impact: The development of renewable energy projects generates significant economic benefits, including job creation, improved infrastructure, and regional economic growth.

Real Estate in Emerging Markets: Building for the Future

Real estate investment in emerging markets offers the potential for substantial returns. Population growth, economic expansion, and infrastructure development are key drivers of growth in this sector.

High-Growth Cities: Capitalizing on Urban Expansion

Several cities are experiencing rapid population growth and economic expansion, leading to increased demand for housing and commercial real estate.

-

Cities with Strong Real Estate Growth:

- City X: Population growth of 8% annually, fueled by job creation in the tech and manufacturing sectors. High demand for both residential and commercial properties.

- City Y: Significant infrastructure improvements, including new transportation links and improved public services. Attracting both domestic and international investors.

- City Z: Booming tourism sector, leading to increased demand for hotels and hospitality properties. Strong rental yields are attracting investors.

-

Driving Factors: Factors driving real estate growth include population growth, economic diversification, infrastructure improvements, and lifestyle factors. However, risks include potential market fluctuations and regulatory changes.

Infrastructure Projects and Their Impact: Riding the Wave of Development

Large-scale infrastructure projects have a significant impact on surrounding real estate markets, leading to increased property values and rental income.

-

Impactful Infrastructure Projects:

- High-Speed Rail Line: Expected to significantly increase property values along its route.

- New Airport Development: Will stimulate economic activity and increase demand for housing and commercial space in the surrounding area.

-

Increased Property Values: Infrastructure projects create positive externalities that increase property values and rental income, providing attractive investment opportunities for real estate investors.

Conclusion

This guide has highlighted some of the country's most promising emerging business hot spots, offering insights into the tech sector, renewable energy, and real estate. By carefully analyzing the factors driving growth in these areas and understanding the associated risks and rewards, you can make informed decisions about where to invest. Remember to conduct thorough due diligence before committing to any investment. Start exploring these exciting opportunities and discover the best places to invest in the country's dynamic and rapidly expanding markets. Learn more about the best places to invest your capital by researching these emerging business hot spots.

Featured Posts

-

Are Museum Programs History After Trumps Cuts A Look At The Impact

May 24, 2025

Are Museum Programs History After Trumps Cuts A Look At The Impact

May 24, 2025 -

3 Billion Slash To Sse Spending Plan Impact Of Economic Slowdown

May 24, 2025

3 Billion Slash To Sse Spending Plan Impact Of Economic Slowdown

May 24, 2025 -

Recent Developments In The Kyle Walker And Annie Kilner Case

May 24, 2025

Recent Developments In The Kyle Walker And Annie Kilner Case

May 24, 2025 -

Sharp Drop In Amsterdam Stock Market Down 7 Due To Trade War

May 24, 2025

Sharp Drop In Amsterdam Stock Market Down 7 Due To Trade War

May 24, 2025 -

Borsa Italiana Scenari Europei E Impatto Decisioni Fed Focus Su Italgas E Banche

May 24, 2025

Borsa Italiana Scenari Europei E Impatto Decisioni Fed Focus Su Italgas E Banche

May 24, 2025

Latest Posts

-

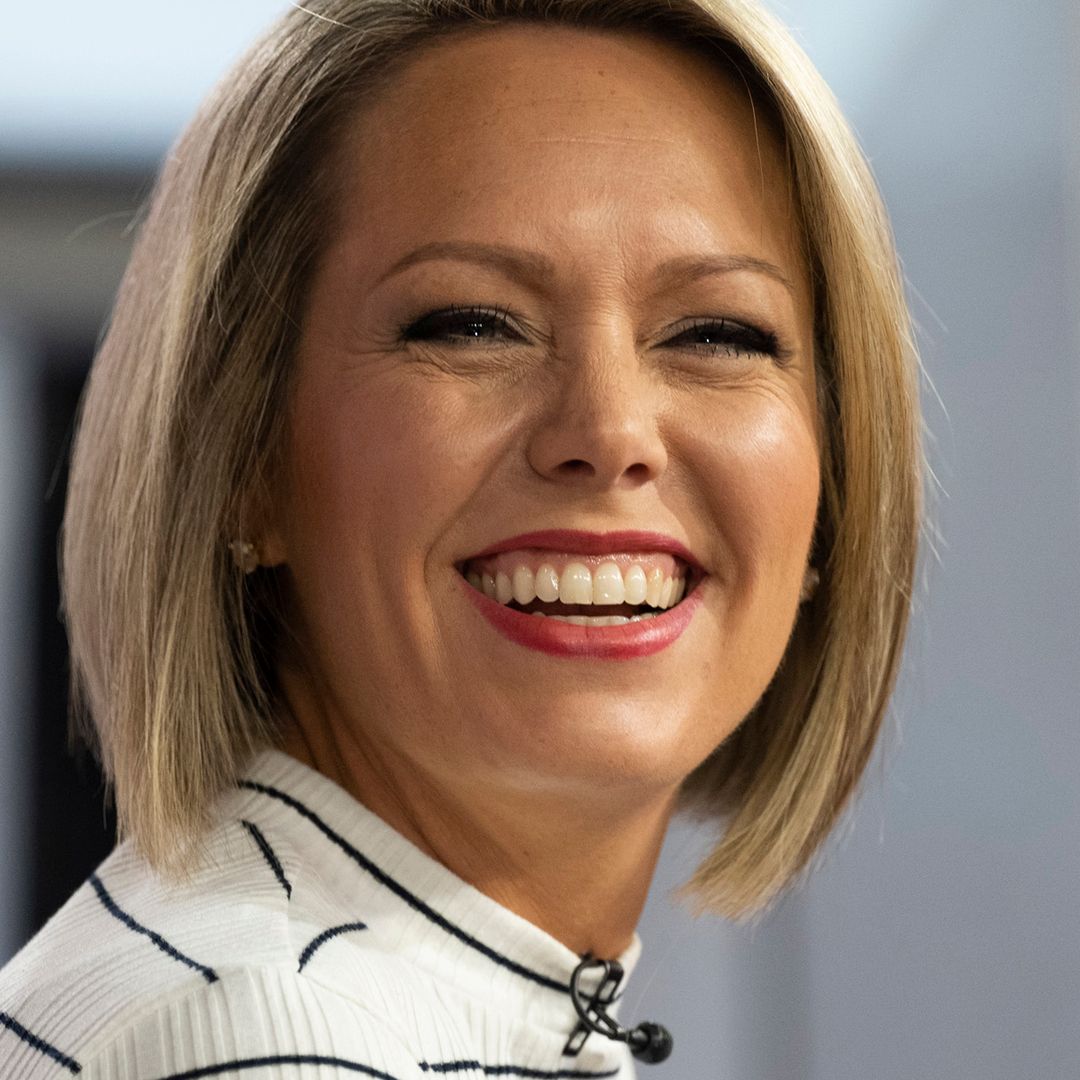

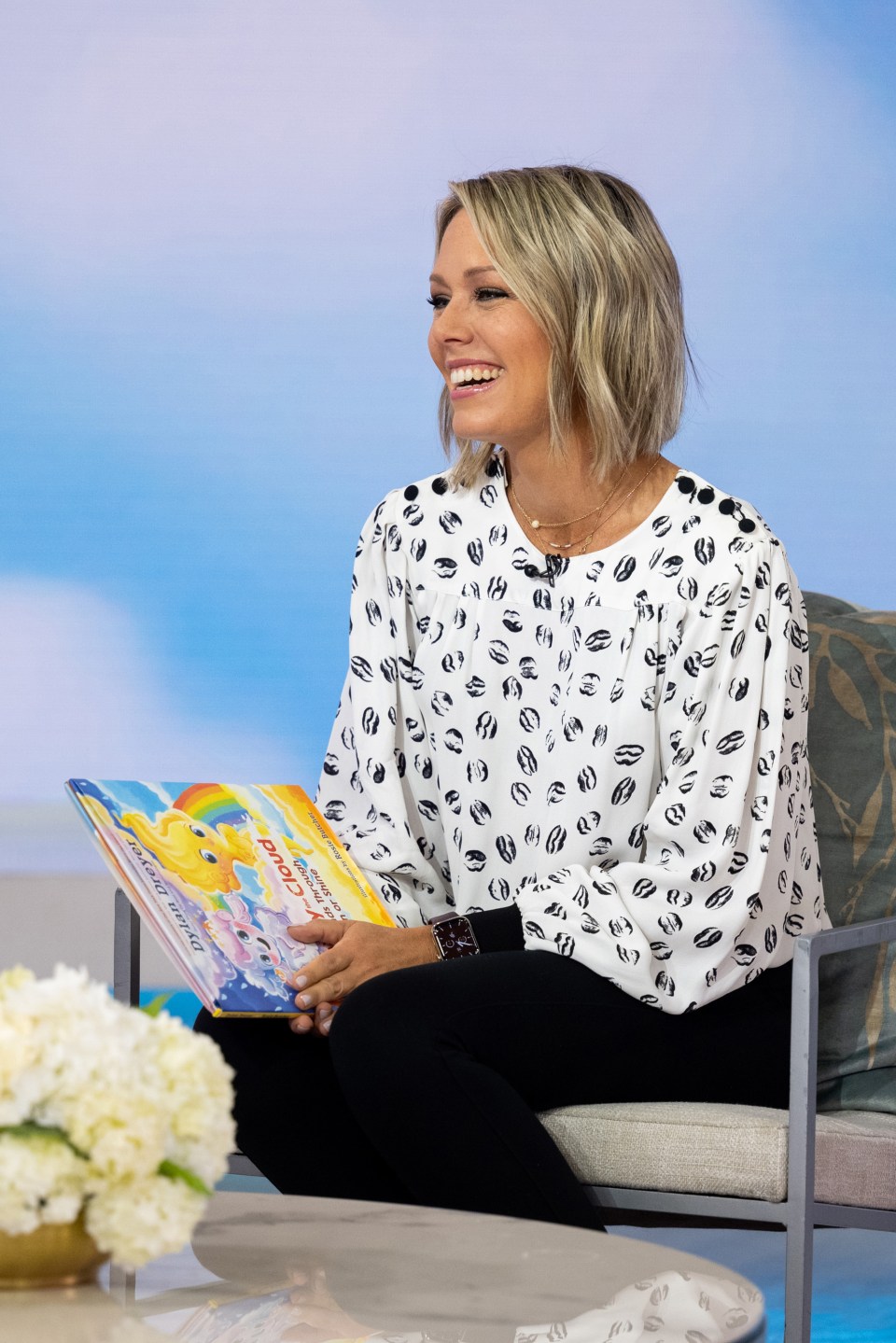

Dylan Dreyers Today Show Transformation A Remarkable Journey

May 24, 2025

Dylan Dreyers Today Show Transformation A Remarkable Journey

May 24, 2025 -

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025 -

Dylan Dreyers Honest Disclosure Leaves Today Co Hosts Speechless

May 24, 2025

Dylan Dreyers Honest Disclosure Leaves Today Co Hosts Speechless

May 24, 2025 -

Unexpected News Dylan Dreyer Faces A Difficult Challenge

May 24, 2025

Unexpected News Dylan Dreyer Faces A Difficult Challenge

May 24, 2025 -

Dylan Dreyer Shares Shocking Personal Update On Today Show

May 24, 2025

Dylan Dreyer Shares Shocking Personal Update On Today Show

May 24, 2025