SPAC Stock Surge: Should You Invest In This MicroStrategy Competitor?

Table of Contents

Understanding the SPAC Stock Surge Phenomenon

The recent excitement around SPACs stems from a confluence of factors. But what exactly are SPACs, and why are they surging in popularity?

What are SPACs?

SPACs, often called "blank check companies," are publicly traded companies with no specific business operations. Their sole purpose is to raise capital through an initial public offering (IPO) to acquire a private company, taking it public through a de-SPAC transaction. This process bypasses the traditional IPO route, offering a potentially faster and less arduous path to market for private companies. Key terms to understand include:

- SPAC (Special Purpose Acquisition Company): A shell company raising capital for acquisitions.

- IPO (Initial Public Offering): The initial sale of stock to the public.

- De-SPAC Transaction: The merger between the SPAC and a private target company.

- Warrant: A right, but not an obligation, to buy shares of the company at a predetermined price.

Why the Recent Surge?

Several factors fuel the current SPAC boom:

- Low Interest Rates and Abundant Capital: Easy access to cheap capital makes SPACs an attractive investment vehicle for both sponsors and investors.

- Access to Pre-IPO Investments: SPACs provide investors with opportunities to participate in promising private companies before they go public.

- Potential for High Returns (and High Losses): The potential for substantial returns is a significant draw, although the risk of significant losses is equally present.

Risks Associated with SPAC Investments:

While the potential rewards are enticing, investors should be acutely aware of the inherent risks:

- Lack of Due Diligence: Investors often commit capital before comprehensive due diligence on the target company is complete.

- Conflicts of Interest: Potential conflicts of interest can arise between SPAC sponsors and investors.

- Management Issues: The management team of the acquired company may not always be the best fit, leading to poor post-merger performance.

- Underperformance Post-Merger: Many SPAC mergers result in underperforming stocks, leading to significant losses for investors.

Analyzing MicroStrategy's Business Model and Competitors

MicroStrategy's significant investment in Bitcoin has dramatically influenced its stock price, creating a benchmark for other companies potentially exploring similar strategies.

MicroStrategy's Success with Bitcoin:

MicroStrategy's bold strategy of accumulating a large Bitcoin reserve has positioned it as a leader in corporate Bitcoin adoption. This has drawn attention and significant investor interest, but also carries significant risks tied to Bitcoin's volatility. Their business model, while now heavily reliant on this strategy, initially focused on business intelligence software.

Identifying Potential MicroStrategy Competitors via SPACs:

Several SPACs are targeting companies operating in adjacent sectors, potentially positioning themselves as competitors to MicroStrategy:

- [SPAC Ticker 1]: Targeting a company in the blockchain technology space.

- [SPAC Ticker 2]: Focusing on a firm developing cryptocurrency management solutions.

- [SPAC Ticker 3]: Aimed at a company providing data analytics services with a focus on cryptocurrency markets. (Note: Replace bracketed information with actual examples.)

These SPACs' success will depend on their target companies’ ability to execute their strategies effectively and compete with established players like MicroStrategy. A detailed financial and strategic comparison is crucial before investing.

Assessing the Competitive Landscape:

The market for Bitcoin-related services and data analytics is becoming increasingly crowded. While several SPACs aim to disrupt the market, established players like MicroStrategy possess significant advantages in brand recognition, capital, and technological infrastructure. Success for a newcomer requires a distinct competitive advantage, innovative technology, or a niche market strategy.

Should You Invest in a MicroStrategy Competitor via a SPAC?

Investing in a SPAC targeting a MicroStrategy competitor involves a careful weighing of potential benefits against substantial risks.

Weighing the Risks and Rewards:

- High Potential Returns: Successful SPAC mergers can generate substantial returns.

- High Risk of Losses: The vast majority of SPACs underperform, leading to investor losses.

- Thorough Due Diligence is Crucial: Independent and comprehensive research is paramount before committing funds.

Diversification and Portfolio Allocation:

Never put all your eggs in one basket. Diversification across various asset classes is crucial for mitigating risk. Investing a significant portion of your portfolio in a single SPAC, especially in a high-risk sector, is ill-advised. Your risk tolerance should guide your investment decisions.

Due Diligence Checklist:

Before investing, perform thorough due diligence:

- Management Team: Scrutinize the SPAC sponsor's and target company’s management team’s track record.

- Financials: Carefully analyze the target company’s financial statements and projections.

- Business Plan: Evaluate the target company’s business plan for feasibility and market viability.

- Competitive Landscape: Assess the competitive landscape and the target company’s ability to differentiate itself.

Conclusion: Making Informed Decisions on SPAC Stock Surge Investments

The "SPAC stock surge" presents both opportunities and considerable risks. Investing in a MicroStrategy competitor through a SPAC requires a clear understanding of the competitive landscape, thorough due diligence, and a realistic assessment of potential losses. Before jumping into the excitement of the SPAC stock surge, thoroughly research potential investments and carefully assess the risks associated with MicroStrategy competitors entering the market through SPAC mergers. Remember, informed investment decisions are key to navigating the volatile world of SPACs and maximizing your chances of success.

Featured Posts

-

Si Psg Arrin Dominimin 11 Shenja Kyce

May 09, 2025

Si Psg Arrin Dominimin 11 Shenja Kyce

May 09, 2025 -

The Great Decoupling Implications For Global Economies

May 09, 2025

The Great Decoupling Implications For Global Economies

May 09, 2025 -

Franco Colapintos Deleted Drive To Survive Message What He Said

May 09, 2025

Franco Colapintos Deleted Drive To Survive Message What He Said

May 09, 2025 -

Months Of Warnings Dangerous Incidents Preceding Newark Air Traffic Control Outage

May 09, 2025

Months Of Warnings Dangerous Incidents Preceding Newark Air Traffic Control Outage

May 09, 2025 -

Increased Resources For Madeleine Mc Cann Investigation 108 000 Allocation

May 09, 2025

Increased Resources For Madeleine Mc Cann Investigation 108 000 Allocation

May 09, 2025

Latest Posts

-

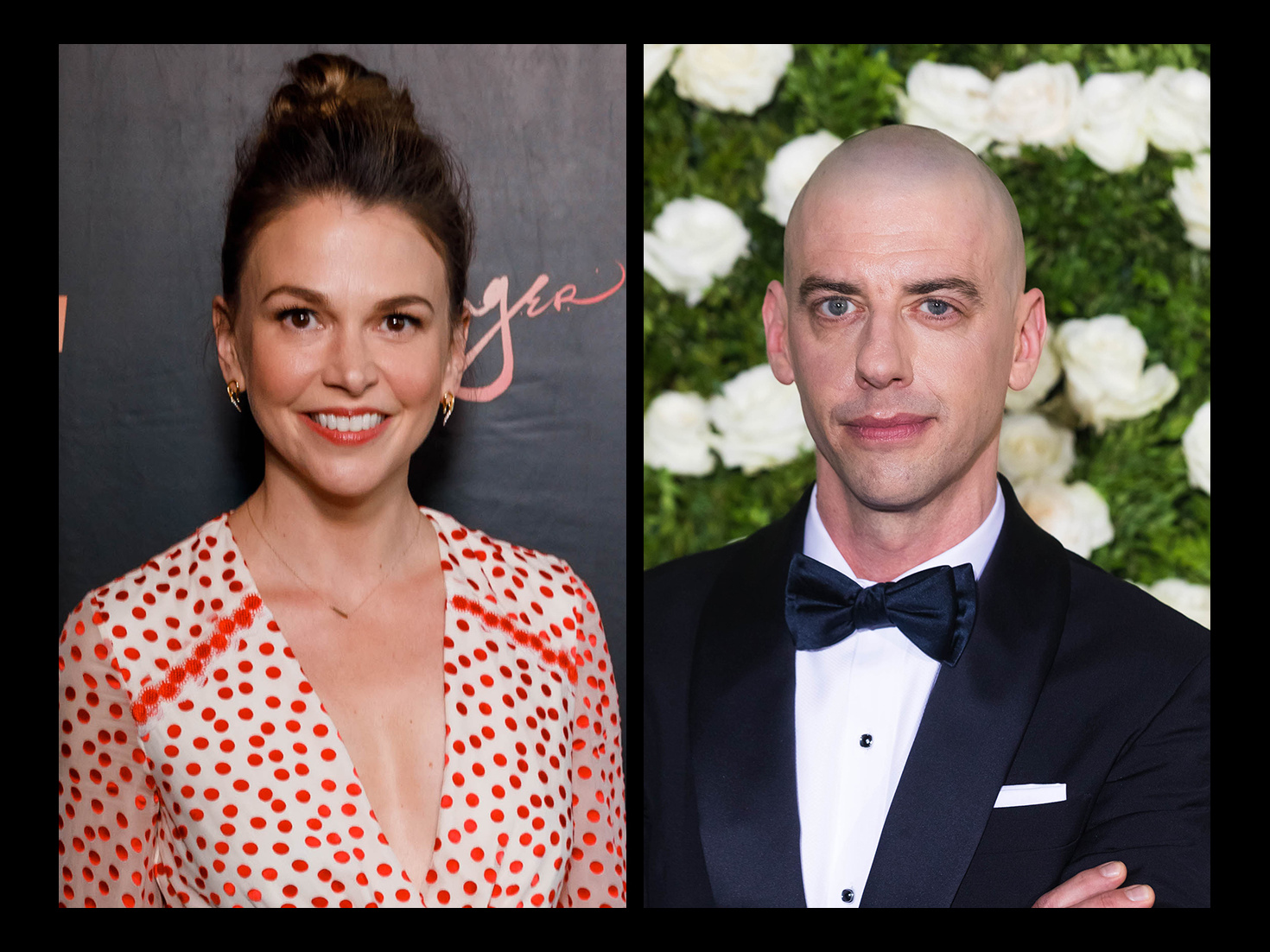

Unexpected Reunion High Potential Finale Features Familiar Faces

May 09, 2025

Unexpected Reunion High Potential Finale Features Familiar Faces

May 09, 2025 -

Seven Year Absence Ends Two Actors Reunite In High Potential Finale

May 09, 2025

Seven Year Absence Ends Two Actors Reunite In High Potential Finale

May 09, 2025 -

High Potential Finale A Surprise Reunion After 7 Years

May 09, 2025

High Potential Finale A Surprise Reunion After 7 Years

May 09, 2025 -

Expected Release Pam Bondi On Epstein Diddy Jfk And Mlk Case Files

May 09, 2025

Expected Release Pam Bondi On Epstein Diddy Jfk And Mlk Case Files

May 09, 2025 -

Voter Reaction To Ag Pam Bondis Release Of Jeffrey Epstein Files

May 09, 2025

Voter Reaction To Ag Pam Bondis Release Of Jeffrey Epstein Files

May 09, 2025