1050% VMware Price Hike: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

The 1050% VMware Price Hike: A Closer Look

Reports suggest that Broadcom's acquisition of VMware could lead to a staggering 1050% increase in licensing costs for certain VMware services. While the exact details remain somewhat opaque, the projected increases represent a seismic shift in the enterprise software landscape. This isn't a small price adjustment; we're talking about a potentially crippling cost increase for many organizations.

-

Specific VMware products affected: While not all products are expected to see this level of increase, reports indicate that key virtualization and cloud management products within VMware's vSphere suite are likely to be significantly impacted. This includes vCenter Server, ESXi, and other essential components.

-

Examples of increased costs: A small business currently paying $10,000 annually for VMware licensing could face a bill exceeding $100,000 after the acquisition. Larger enterprises, already spending millions, would see their costs explode into the tens or even hundreds of millions, depending on their specific VMware deployment.

-

Comparison to other virtualization software: While VMware currently holds a dominant market share, this drastic price hike could drive many businesses to explore alternative virtualization solutions like Microsoft Hyper-V, Citrix XenServer, or open-source options like Proxmox VE. The price difference could become a significant factor in this reevaluation.

AT&T's Concerns and Public Opposition

AT&T, a major telecommunications company heavily reliant on VMware technology for its vast infrastructure, has publicly voiced strong opposition to the acquisition. Their concerns are rooted in the potential for drastically increased VMware licensing costs, threatening their operational budget and potentially affecting service delivery. The 1050% VMware price hike represents a significant financial burden that could undermine their competitive advantage.

-

AT&T's reliance on VMware technology: AT&T utilizes VMware extensively across its network infrastructure, making them particularly vulnerable to the proposed price increases. The scale of their VMware deployment makes them a significant voice in this debate.

-

Quotes from AT&T representatives: AT&T executives have stated publicly that the potential price hike is unacceptable and could stifle innovation within the industry. Their concerns reflect the anxieties of many businesses dependent on VMware's virtualization platform. They've stressed the negative impact on their operational costs and competitiveness.

-

Official statements and filings: AT&T has submitted formal statements to regulatory bodies, emphasizing the detrimental effects of the acquisition and the proposed price increases on competition and the broader market. These filings are key to understanding the depth of their concerns.

Broader Implications for the Enterprise Cloud Market

The potential 1050% VMware price hike has far-reaching implications for the entire enterprise cloud market. The ripple effects could be significant and far-reaching, impacting innovation and competition.

-

Impact on smaller businesses and startups: Smaller companies and startups with limited budgets may be forced to abandon VMware, shifting to less feature-rich or more costly alternatives. This could limit their ability to compete with larger corporations.

-

Potential for increased cloud vendor lock-in: The drastic price increase could intensify vendor lock-in, making it extremely difficult and costly for organizations to switch virtualization platforms. This lack of choice could stifle innovation and potentially lead to unfair business practices.

-

Discussion of alternative virtualization solutions: The price hike is pushing many businesses to explore and evaluate alternative virtualization solutions, leading to increased competition and potentially better options for customers in the long run. The market may see a surge in adoption of competing technologies.

Antitrust Concerns and Regulatory Scrutiny

The proposed acquisition has drawn significant antitrust scrutiny from regulatory bodies worldwide. The potential for monopolistic practices and anti-competitive behavior due to the substantial VMware price hike is a primary concern.

-

Relevant regulatory bodies involved: Agencies like the Federal Trade Commission (FTC) in the United States and similar bodies in other countries are investigating the potential anti-competitive effects of the merger and the price hike implications.

-

Potential consequences if the acquisition is blocked: If the acquisition is blocked due to antitrust concerns, VMware would likely remain an independent company, potentially avoiding the drastic price increases. This would be a victory for many businesses and could lead to a more competitive market.

-

Potential for price fixing or anti-competitive behavior: Regulators are carefully examining whether the proposed price hikes constitute price fixing or anti-competitive behavior, as it could stifle innovation and reduce consumer choice.

Future Scenarios and Potential Outcomes

Several scenarios are possible regarding the Broadcom acquisition of VMware and the associated price hike.

-

Scenario 1: Acquisition approved, price hikes implemented. This scenario would dramatically reshape the enterprise cloud market, potentially leading to increased consolidation and decreased competition.

-

Scenario 2: Acquisition blocked, VMware remains independent. This would likely prevent the drastic price hikes and maintain a more competitive landscape. Innovation in the virtualization market could also flourish.

-

Scenario 3: Acquisition approved with conditions, mitigating price hikes. Regulatory bodies might approve the merger but impose conditions that limit the extent of price increases or mandate certain safeguards to prevent anti-competitive practices.

Conclusion

The potential 1050% VMware price hike stemming from Broadcom's proposed acquisition is a significant concern for businesses of all sizes. AT&T's opposition highlights the potential for crippling cost increases and reduced market competition. The ongoing regulatory scrutiny underscores the significant antitrust concerns surrounding this merger. The implications for the enterprise cloud market are profound, potentially driving businesses towards alternative virtualization solutions and impacting innovation.

Call to Action: Stay informed about the ongoing developments surrounding the Broadcom acquisition of VMware and the potential impact of the 1050% VMware price hike. Monitor regulatory announcements and consider exploring alternative virtualization solutions to protect your business from potentially crippling cost increases. Actively monitor the VMware price hike situation and its potential ramifications for your organization.

Featured Posts

-

Wynne Evans Go Compare Future Uncertain Following Strictly Incident

May 09, 2025

Wynne Evans Go Compare Future Uncertain Following Strictly Incident

May 09, 2025 -

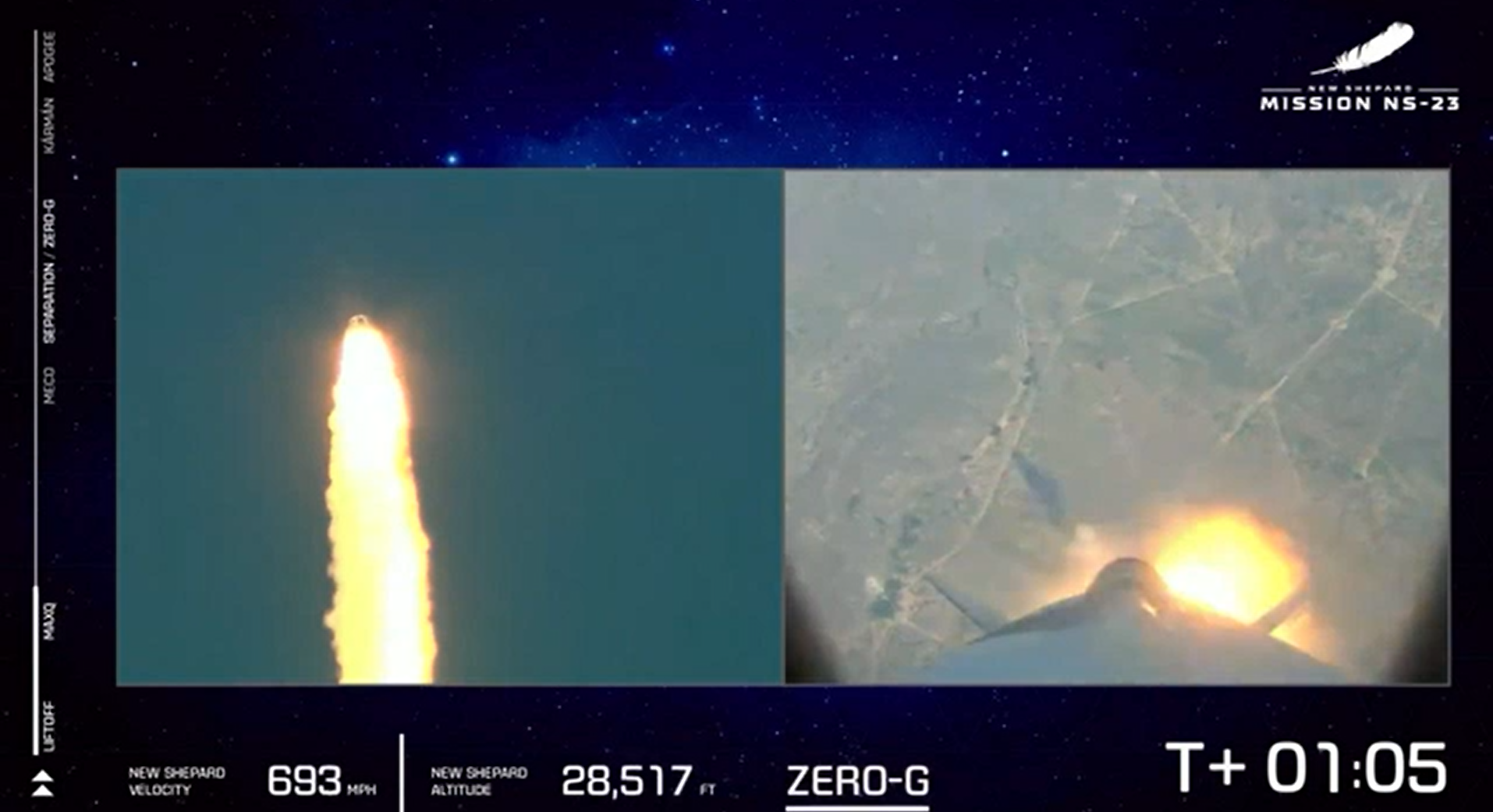

Rocket Launch Abort Blue Origin Cites Subsystem Problem

May 09, 2025

Rocket Launch Abort Blue Origin Cites Subsystem Problem

May 09, 2025 -

Vu Viec Tien Giang Thuc Day Cai Cach He Thong Cham Soc Tre Em

May 09, 2025

Vu Viec Tien Giang Thuc Day Cai Cach He Thong Cham Soc Tre Em

May 09, 2025 -

700 Point Sensex Rally Todays Stock Market News And Analysis

May 09, 2025

700 Point Sensex Rally Todays Stock Market News And Analysis

May 09, 2025 -

Report Jayson Tatum Suffers Bone Bruise Game 2 Appearance Unlikely

May 09, 2025

Report Jayson Tatum Suffers Bone Bruise Game 2 Appearance Unlikely

May 09, 2025