Personal Loan Rates Today: How To Secure The Lowest APR

Table of Contents

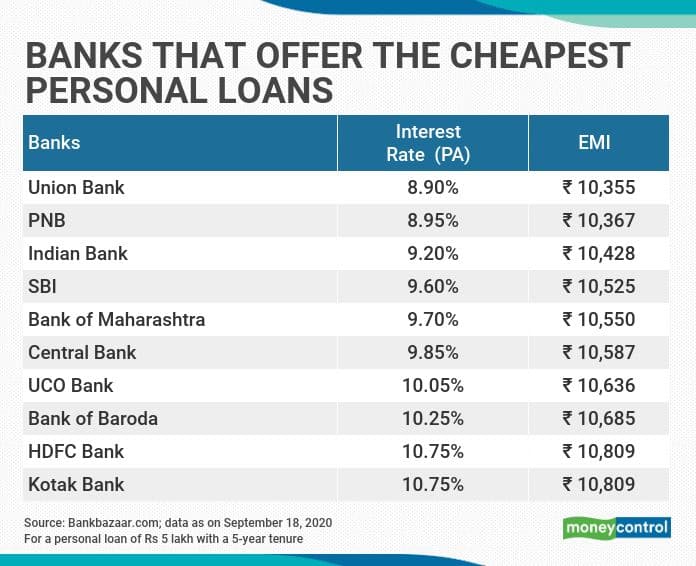

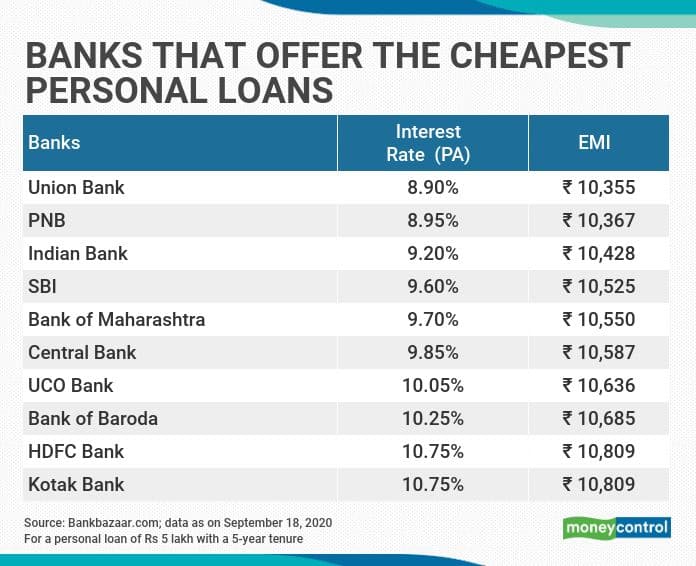

Understanding Personal Loan Rates and APR

Understanding APR (Annual Percentage Rate) is crucial when comparing personal loan offers. The APR represents the total cost of borrowing, encompassing the interest rate plus any fees associated with the loan. While the interest rate reflects the percentage charged on the principal loan amount, the APR provides a more comprehensive picture of the overall cost. Several factors influence your personal loan APR:

-

Credit Score: This is arguably the most significant factor. A higher credit score demonstrates creditworthiness, leading to lower APRs. Lenders perceive lower risk with borrowers who have consistently demonstrated responsible financial behavior.

-

Loan Amount: Generally, larger loan amounts might come with slightly higher APRs due to the increased risk for lenders.

-

Loan Term: Shorter loan terms mean higher monthly payments but lower overall interest paid because you're repaying the principal faster. Conversely, longer loan terms lead to lower monthly payments but higher total interest charges.

-

Lender Type: Different lenders—banks, credit unions, and online lenders—have varying lending criteria and rates. Credit unions often offer more competitive rates for their members.

-

Higher credit score = lower APR

-

Shorter loan terms = higher monthly payments but lower overall interest

-

Larger loan amounts may have slightly higher APRs.

-

Different lenders have different lending criteria and rates.

How to Improve Your Credit Score for Better Rates

A good credit score is paramount to securing low APR personal loans. Lenders use your credit score to assess your creditworthiness and risk. Improving your credit score can significantly reduce the interest rate you'll pay. Here’s how:

-

Pay bills on time: Consistent on-time payments are crucial for building a positive credit history. Even one late payment can negatively impact your score.

-

Keep credit utilization low: Your credit utilization ratio (the amount of credit you're using compared to your total available credit) significantly impacts your credit score. Aim to keep it below 30%.

-

Monitor your credit report regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors. Disputing any inaccuracies is crucial.

-

Consider a secured credit card: If you have limited or damaged credit, a secured credit card (requiring a security deposit) can help you build credit responsibly.

-

Dispute any errors on your credit report: Inaccuracies on your credit report can significantly affect your score. Actively monitor your reports and dispute any mistakes.

Comparing Personal Loan Offers from Different Lenders

Never settle for the first loan offer you receive. Comparing rates from multiple lenders is essential to securing the best personal loan rates. Explore various lender types:

-

Banks: Offer a wide range of loan products but may have stricter lending criteria and potentially higher rates than other options.

-

Credit Unions: Often provide more competitive rates and better customer service, especially to their members.

-

Online Lenders: Offer convenience and potentially faster approvals but thoroughly research their reputation and fees before applying.

When comparing, utilize these strategies:

-

Use online comparison tools: Many websites allow you to compare rates from multiple lenders simultaneously.

-

Read the fine print carefully: Pay close attention to all fees and charges beyond the APR, as these can significantly impact the overall cost.

-

Check customer reviews: See what other borrowers have experienced with different lenders. This can provide valuable insights into customer service and transparency.

Negotiating for a Lower APR

Don't be afraid to negotiate! While not always successful, negotiating a lower interest rate is worth exploring, especially if you have a strong financial profile.

-

Be polite but firm in your negotiations: Clearly state your reasons for seeking a lower rate, highlighting your positive financial history.

-

Highlight your positive financial history: Emphasize your consistent on-time payments and low credit utilization.

-

Present competing loan offers: Having offers from other lenders strengthens your negotiating position.

-

Inquire about any available discounts or promotions: Some lenders offer discounts for specific groups (e.g., military personnel, employees of certain companies).

Conclusion: Securing Your Ideal Personal Loan Rate

Securing the lowest possible APR on a personal loan involves a combination of factors. Improving your credit score, comparing offers from various lenders (banks, credit unions, and online lenders), and negotiating for a lower rate are key strategies. Remember that understanding the nuances of APR versus interest rates, and carefully reviewing loan terms and fees, is essential to finding the best personal loan APR for your needs. Start comparing personal loan rates today and secure the lowest APR possible to make your borrowing experience more manageable. Don't hesitate to use the tips outlined above to get the best deal on your personal loan.

Featured Posts

-

Nl West Standings Padres Dodgers Streaking Burnes Out

May 28, 2025

Nl West Standings Padres Dodgers Streaking Burnes Out

May 28, 2025 -

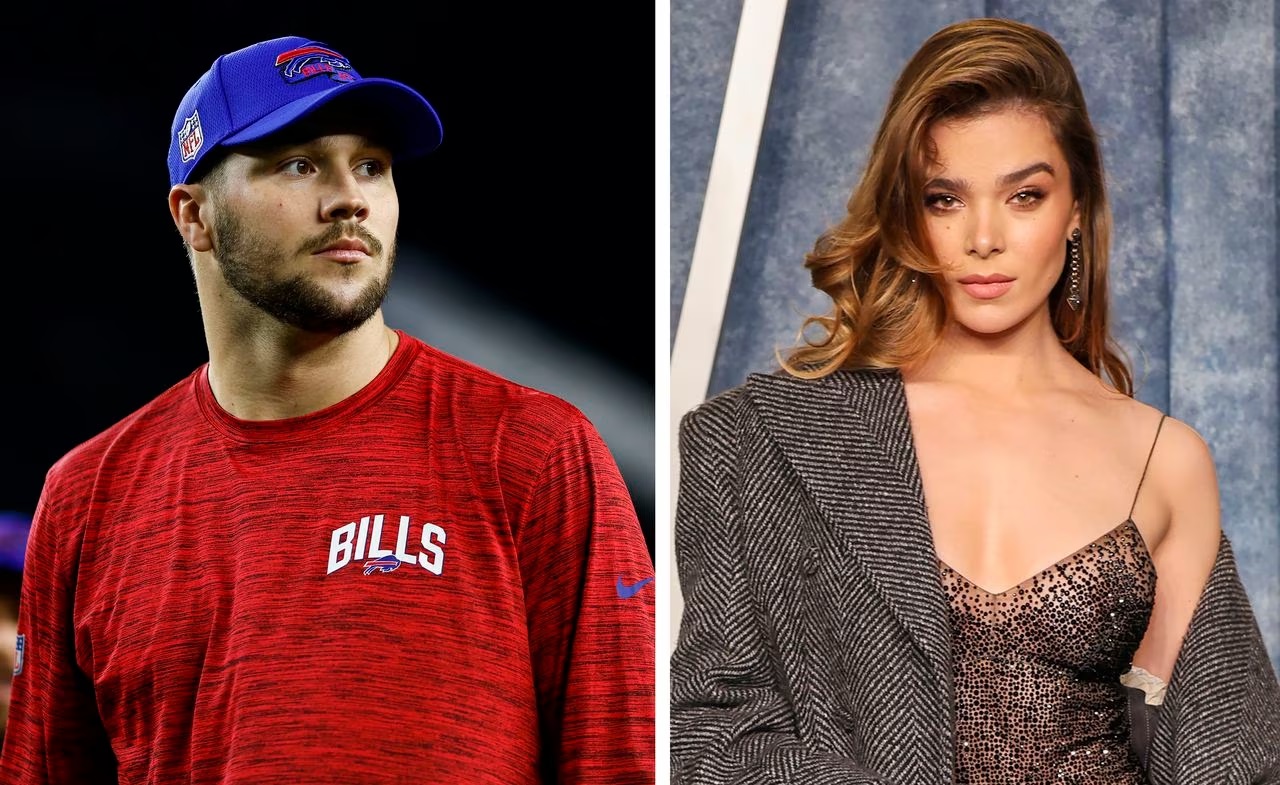

Josh Allen And Hailee Steinfeld A Look At The Upcoming Wedding And The Qbs Performance

May 28, 2025

Josh Allen And Hailee Steinfeld A Look At The Upcoming Wedding And The Qbs Performance

May 28, 2025 -

Padres On Deck Sweeping The Rockies

May 28, 2025

Padres On Deck Sweeping The Rockies

May 28, 2025 -

Winning Lotto Ticket Sold Here Claim Your Prize Now

May 28, 2025

Winning Lotto Ticket Sold Here Claim Your Prize Now

May 28, 2025 -

Pacers Beat Nets In Overtime Mathurins Stellar Performance

May 28, 2025

Pacers Beat Nets In Overtime Mathurins Stellar Performance

May 28, 2025