XRP Up 400% In 3 Months: Investment Opportunities And Risks.

Table of Contents

Factors Contributing to XRP's Recent Price Surge

Several intertwined factors have contributed to XRP's impressive price appreciation. Understanding these elements is crucial for assessing its future trajectory.

Positive Ripple Legal Developments

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has been a major driver of XRP's price fluctuations. Recent court decisions and legal progress have significantly impacted investor sentiment.

- Partial Victory in SEC Lawsuit: The court's rulings on certain aspects of the case have been interpreted favorably by the market, reducing some of the regulatory uncertainty surrounding XRP.

- Positive Judgements: Several key rulings have favored Ripple's arguments, leading to increased confidence amongst investors.

- Expert Opinions: Many market analysts believe that a favorable outcome in the Ripple vs. SEC case could propel XRP's price significantly higher. This positive outlook contributes to the buying pressure fueling the recent surge. The legal uncertainty surrounding XRP is, however, still a significant factor to consider.

Increased Institutional Adoption

Beyond the legal developments, growing institutional adoption is another significant factor. Large financial firms are increasingly recognizing the potential of XRP and its underlying technology.

- Strategic Partnerships: Ripple has forged several strategic partnerships with major financial institutions, demonstrating confidence in the platform's capabilities and further boosting investor sentiment.

- Increased Trading Volume: A notable rise in trading volume across major cryptocurrency exchanges indicates growing institutional interest and participation in the XRP market. This suggests a shift towards wider acceptance and integration within the financial system.

- Market Capitalization Growth: The increase in market capitalization reflects a greater overall valuation of XRP, suggesting a growing belief in its long-term potential.

Growing Ecosystem and Utility

The expanding utility of XRP within the RippleNet ecosystem and beyond is further driving its price increase.

- Cross-Border Payments: XRP facilitates faster and cheaper cross-border payments, a significant advantage over traditional financial systems. This practical application increases the demand for XRP.

- Remittances: The use of XRP in remittance services is growing, offering a more efficient and cost-effective solution for sending money across borders.

- Blockchain Technology Integration: XRP's integration with various blockchain technologies expands its potential applications and strengthens its position in the broader cryptocurrency market.

Investment Opportunities in XRP

The surge in XRP's price presents both short-term and long-term investment opportunities, but these come with inherent risks.

Strategic Long-Term Investing

For those with a long-term perspective, XRP's potential remains significant, contingent upon positive legal outcomes and continued adoption.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals mitigates the risk associated with market volatility. This strategy allows investors to accumulate XRP over time, regardless of short-term price fluctuations.

- Thorough Research: Before investing in XRP or any other cryptocurrency, thorough research is essential. Understanding the technology, the market dynamics, and the associated risks is paramount.

- Diversification: Diversifying your investment portfolio is a crucial risk management strategy. Never invest more than you can afford to lose.

Short-Term Trading Strategies

Short-term trading strategies, such as day trading or swing trading, offer the potential for higher returns but also significantly amplified risk.

- Technical Analysis: Short-term trading relies heavily on technical analysis to identify potential entry and exit points. This requires significant expertise and experience.

- High Risk, High Reward: The potential for rapid gains is balanced by the risk of substantial losses. Market volatility in the short term can lead to unpredictable price swings.

- Risk Tolerance: Only engage in short-term trading if you have a high risk tolerance and a deep understanding of market mechanics.

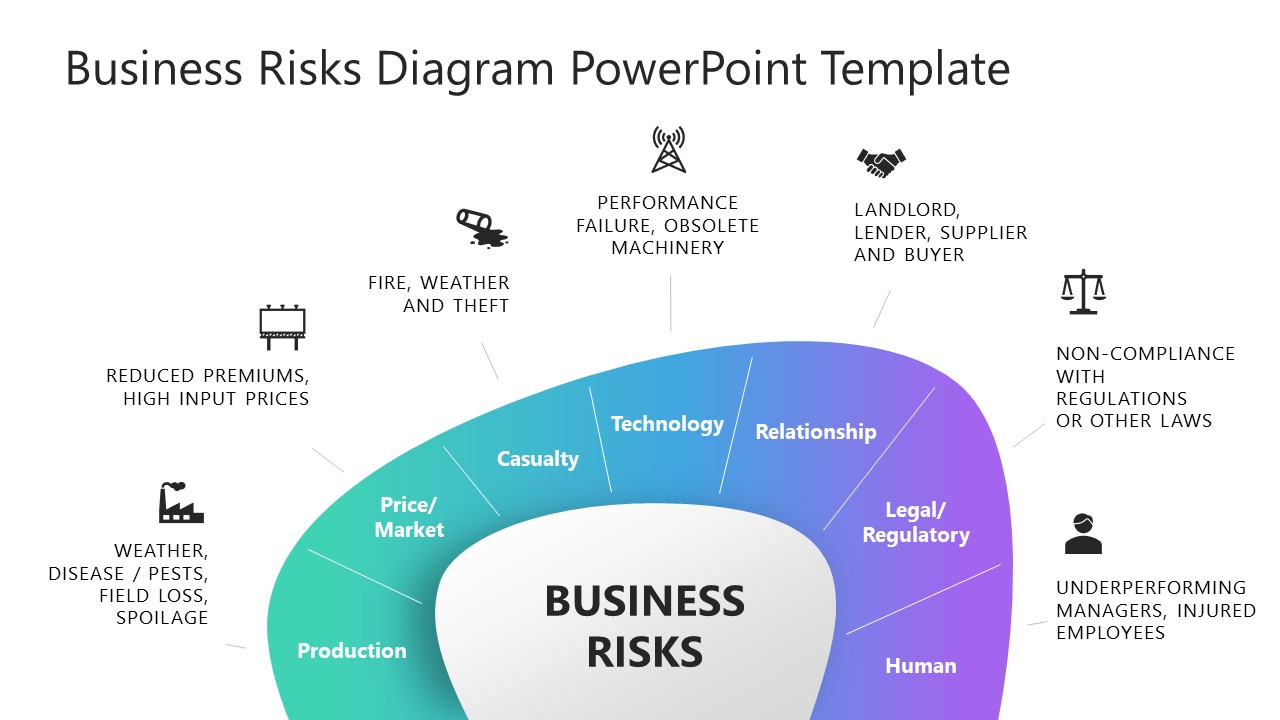

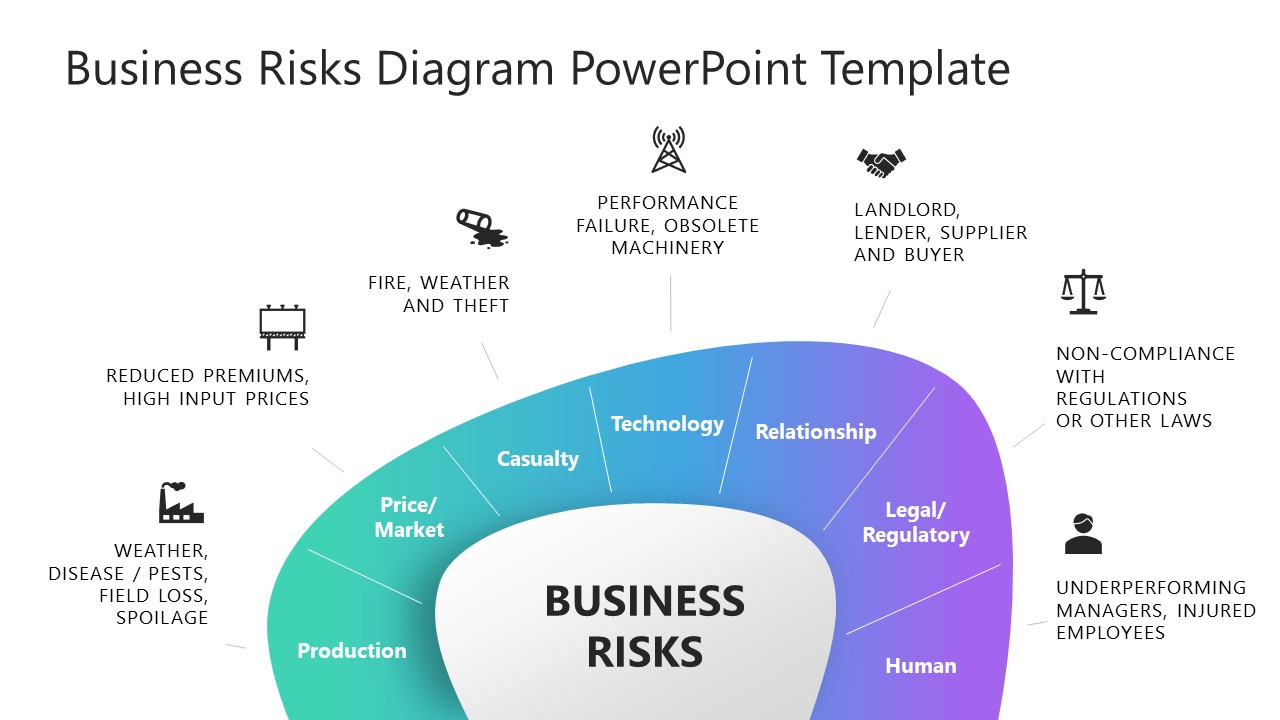

Risks Associated with Investing in XRP

Despite the recent price surge, significant risks are associated with investing in XRP.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain. The outcome of the Ripple vs. SEC case will have a profound impact on XRP's future.

- Future Regulatory Actions: Unfavorable regulatory decisions could severely impact XRP's price and liquidity.

- Legal Risks: Investing in an asset with uncertain regulatory status carries inherent legal risks.

- SEC Regulations: The ongoing regulatory scrutiny by the SEC highlights the volatility inherent in the cryptocurrency market.

Market Volatility

The cryptocurrency market is inherently volatile. XRP's price can experience significant swings in short periods, leading to substantial losses.

- Price Fluctuation: Sudden price drops are commonplace in the crypto market, and XRP is no exception.

- Risk Management: Effective risk management strategies are crucial to mitigate potential losses.

- Investment Limits: Only invest an amount you can comfortably afford to lose.

Scams and Fraud

The cryptocurrency market is susceptible to scams and fraudulent activities. Protecting yourself from these threats is crucial.

- Reputable Exchanges: Use only reputable and secure cryptocurrency exchanges.

- Wallet Security: Implement robust security measures to protect your cryptocurrency wallets.

- Fraud Prevention: Be wary of suspicious investment opportunities and conduct thorough due diligence before investing.

Conclusion

XRP's recent 400% price increase underscores both its immense potential and its considerable risks. While positive legal developments, institutional adoption, and expanding utility have fueled this surge, regulatory uncertainty, market volatility, and the ever-present threat of scams remain significant concerns. Before investing in XRP, conduct thorough research, understand your risk tolerance, and consider diversifying your portfolio. Learn more about XRP investment strategies and carefully consider the risks and rewards before making any investment decisions. Remember, investing in XRP requires a balanced understanding of both its potential and its inherent volatility.

Featured Posts

-

Xrp News Sbi Holdings Distributes Xrp To Shareholders A Ripple Update

May 01, 2025

Xrp News Sbi Holdings Distributes Xrp To Shareholders A Ripple Update

May 01, 2025 -

Auto Opladen In Noord Nederland De Enexis Gids Voor Buiten Piektijden

May 01, 2025

Auto Opladen In Noord Nederland De Enexis Gids Voor Buiten Piektijden

May 01, 2025 -

Protecting Yourself From Fake Steven Bartlett Investment Videos A Comprehensive Guide

May 01, 2025

Protecting Yourself From Fake Steven Bartlett Investment Videos A Comprehensive Guide

May 01, 2025 -

Shrimp Ramen Stir Fry A Quick And Easy Recipe

May 01, 2025

Shrimp Ramen Stir Fry A Quick And Easy Recipe

May 01, 2025 -

Bhart Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Rdeml

May 01, 2025

Bhart Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Rdeml

May 01, 2025

Latest Posts

-

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025 -

The Death Of A Dallas And 80s Soap Star

May 01, 2025

The Death Of A Dallas And 80s Soap Star

May 01, 2025 -

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025 -

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025