XRP (Ripple) Price Analysis: Should You Buy Now?

Table of Contents

Current Market Conditions and XRP Price Performance

Recent Price Trends and Volatility

XRP's price has shown considerable volatility in recent times. Analyzing the XRP price chart reveals a history of sharp increases and decreases. (Insert chart showing weekly, monthly, and yearly XRP price movements here. Alt text: "XRP Price Chart showing weekly, monthly, and yearly performance"). Several factors contribute to this volatility:

- Regulatory News: The ongoing SEC lawsuit against Ripple significantly impacts investor sentiment and XRP price. Positive developments could lead to a surge, while negative news might trigger a drop.

- Market Sentiment: The overall cryptocurrency market sentiment plays a crucial role. A bullish market generally benefits XRP, while a bearish trend can push its price down.

- Bitcoin Price: As the dominant cryptocurrency, Bitcoin's price movements often correlate with altcoins like XRP. A Bitcoin price surge can positively influence XRP, and vice versa.

Technical Analysis of XRP

Technical analysis uses various indicators to predict future price movements. Examining the XRP price history through this lens gives valuable insights.

- Moving Averages: Analyzing short-term (e.g., 50-day) and long-term (e.g., 200-day) moving averages can reveal potential support and resistance levels. (Insert chart showing moving averages here. Alt text: "XRP Technical Analysis Chart showing moving averages").

- RSI (Relative Strength Index): This indicator measures the momentum of price changes. High RSI values suggest overbought conditions, while low values indicate oversold conditions.

- MACD (Moving Average Convergence Divergence): The MACD helps identify potential trend reversals. Crossovers of the MACD lines can signal buying or selling opportunities.

Fundamental Analysis of Ripple

Fundamental analysis assesses the underlying value of Ripple and its potential for growth. Key factors include:

- Ripple Technology: Ripple's technology, specifically its blockchain and RippleNet, enables faster and cheaper cross-border payments. Its efficiency is a significant strength.

- XRP Adoption: The growing adoption of RippleNet by financial institutions worldwide is a positive sign for XRP's future. Increased usage translates to higher demand.

- Ripple Partnerships: Strategic partnerships with major financial players enhance Ripple's credibility and potential for expansion.

- SEC Lawsuit XRP: The ongoing SEC lawsuit is a major risk factor, impacting investor confidence and potentially affecting future price. A favorable resolution could significantly boost XRP's price.

Factors Influencing Future XRP Price

Regulatory Landscape and Legal Developments

The outcome of the SEC lawsuit against Ripple is arguably the most significant factor influencing XRP's future. A favorable ruling could lead to a substantial price increase, while an unfavorable decision could cause a sharp decline. Regulatory clarity in other jurisdictions is also crucial for XRP's long-term prospects. Understanding XRP regulation is vital for any investor.

Market Sentiment and Adoption

Investor sentiment plays a key role in price fluctuations. Positive news and growing adoption of Ripple's technology by financial institutions can boost investor confidence and drive the price upward. Conversely, negative news or a slowdown in adoption could dampen investor enthusiasm. Monitoring the XRP adoption rate is key.

Technological Advancements and RippleNet

Continued development and innovation within Ripple's technology, particularly improvements to RippleNet and the expansion of its network, are positive factors. New features and increased efficiency can enhance the platform's appeal and drive demand for XRP. The growth of RippleNet adoption directly influences XRP's value.

Should You Buy XRP Now? A Risk Assessment

Based on our analysis, the current situation presents both opportunities and risks. While XRP's technology and potential for adoption are compelling, the ongoing SEC lawsuit and inherent cryptocurrency volatility introduce significant uncertainty. Before deciding whether to buy XRP or not, carefully consider:

- High Volatility: XRP's price can fluctuate dramatically in short periods.

- Regulatory Uncertainty: The SEC lawsuit and potential future regulations pose substantial risks.

- Market Competition: The cryptocurrency market is highly competitive, with many alternative payment solutions.

Conclusion: Making Informed Decisions About XRP Investment

This XRP price analysis highlights the complex interplay of factors influencing XRP's price. While the potential rewards are significant, so are the risks. Whether the current market conditions suggest buying, holding, or selling XRP depends heavily on your risk tolerance and investment goals. Remember, thorough research is crucial before investing in XRP. Diversifying your investment portfolio is also highly recommended to mitigate risk. Before you buy XRP now, or at any time, always conduct your own in-depth research and consider consulting a financial advisor.

Featured Posts

-

Blay Styshn 6 Twqeat Thlylat Wakhr Alakhbar

May 02, 2025

Blay Styshn 6 Twqeat Thlylat Wakhr Alakhbar

May 02, 2025 -

England Womens Nations League Squad Kelly Included Following Injuries

May 02, 2025

England Womens Nations League Squad Kelly Included Following Injuries

May 02, 2025 -

Global Commission Insights Urgent Mental Health Needs Of Young People In Canada

May 02, 2025

Global Commission Insights Urgent Mental Health Needs Of Young People In Canada

May 02, 2025 -

Rare Earth Minerals A New Economic Partnership Between Ukraine And The U S

May 02, 2025

Rare Earth Minerals A New Economic Partnership Between Ukraine And The U S

May 02, 2025 -

Mini Camera Chaveiro A Pequena Camera Com Grande Impacto

May 02, 2025

Mini Camera Chaveiro A Pequena Camera Com Grande Impacto

May 02, 2025

Latest Posts

-

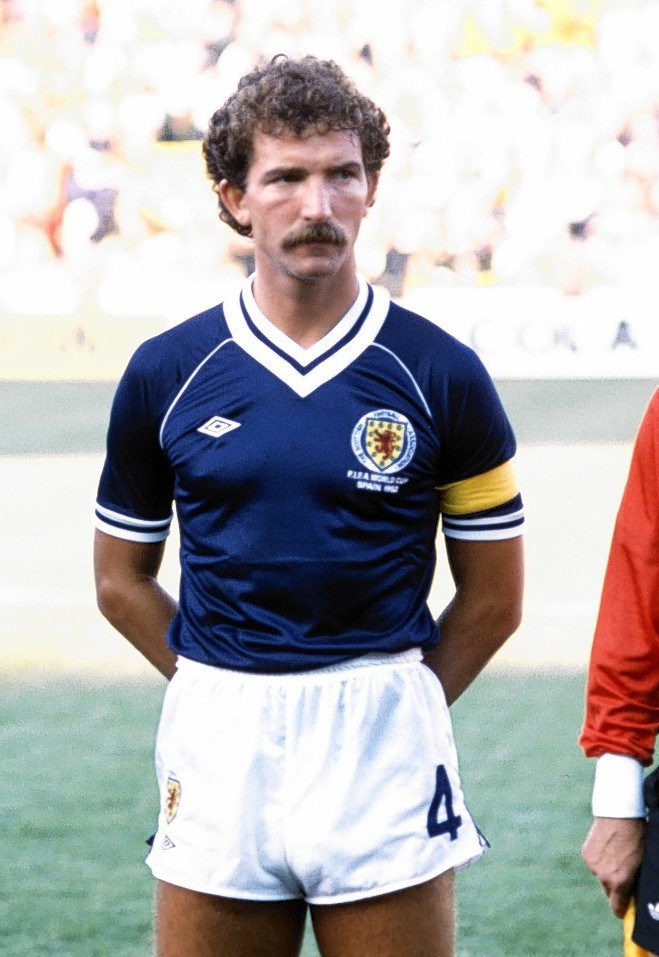

Graeme Sounesss Transfer Opinion Rashford And Aston Villa

May 02, 2025

Graeme Sounesss Transfer Opinion Rashford And Aston Villa

May 02, 2025 -

Mwqf Slah Alhrj Thdhyr Ham Mn Jw 24

May 02, 2025

Mwqf Slah Alhrj Thdhyr Ham Mn Jw 24

May 02, 2025 -

Graeme Souness On Aston Villa And Marcus Rashford Transfer Advice

May 02, 2025

Graeme Souness On Aston Villa And Marcus Rashford Transfer Advice

May 02, 2025 -

Is Mo Salahs Liverpool Future In Jeopardy Contract Update

May 02, 2025

Is Mo Salahs Liverpool Future In Jeopardy Contract Update

May 02, 2025 -

The Special Quality Graeme Souness Sees In Lewis Skelly His Attitude

May 02, 2025

The Special Quality Graeme Souness Sees In Lewis Skelly His Attitude

May 02, 2025