XRP Regulatory Uncertainty: What The SEC Ruling Means For Investors

Table of Contents

Understanding the SEC v. Ripple Case and its Outcome

The SEC's lawsuit against Ripple alleged that XRP was an unregistered security, violating federal securities laws. Ripple countered, arguing that XRP is a decentralized digital asset and not subject to SEC regulation. The court's decision was a mixed bag, significantly impacting the perception of XRP regulatory uncertainty.

- Summary of the judge's findings: The court ruled that institutional sales of XRP constituted unregistered securities offerings. However, programmatic sales of XRP on public exchanges were not deemed securities. This distinction is crucial in understanding the varying degrees of XRP regulatory uncertainty affecting different parties.

- Clarification on XRP sales: The ruling created a nuanced situation. While some XRP transactions are now clearly defined as securities, others are not. This legal distinction creates complexities for exchanges and investors alike, fueling further XRP regulatory uncertainty.

- Ongoing appeals: Both the SEC and Ripple have indicated potential appeals, meaning the legal battle may continue, prolonging the XRP regulatory uncertainty and leaving investors in a state of limbo. This ongoing litigation adds another layer of complexity to the situation.

How the Ruling Impacts Different Categories of XRP Holders

The SEC v. Ripple ruling has had differing impacts on various XRP holders, further highlighting the challenges of XRP regulatory uncertainty.

Impact on Institutional Investors

Large-scale holders and trading platforms face significant challenges.

- Legal ramifications for exchanges: Exchanges that continued to list XRP after the initial SEC allegations now face potential legal exposure and increased scrutiny. This uncertainty is a significant factor in the overall XRP regulatory uncertainty.

- Compliance challenges: Institutional investors struggle to navigate compliance requirements in the face of this ambiguous regulatory environment. The complexities surrounding XRP regulatory uncertainty necessitate careful legal counsel and robust compliance strategies.

- Impact on future investments: The ruling casts a shadow over future investments in similar cryptocurrencies, creating a chilling effect on innovation within the crypto space. This uncertainty could impact the entire sector beyond just XRP.

Impact on Retail Investors

Individual XRP holders are also impacted by the XRP regulatory uncertainty.

- Price volatility: The ongoing legal battles create significant price volatility for XRP, making it a highly risky asset. This volatility is a direct consequence of the lingering XRP regulatory uncertainty.

- Challenges in selling or transferring XRP: Selling or transferring XRP can be challenging due to delisting from some exchanges and concerns about regulatory compliance. Navigating these complexities increases the burden of XRP regulatory uncertainty on retail investors.

- Need for increased financial literacy: Retail investors need to improve their understanding of regulatory compliance and the risks associated with investing in cryptocurrencies during periods of high XRP regulatory uncertainty.

Navigating the Future of XRP Investment: Risk Assessment and Strategies

Investing in XRP remains risky due to the persistent XRP regulatory uncertainty.

- Inherent risks: The ongoing legal proceedings and potential future regulatory changes introduce significant risks to XRP investments. Understanding these risks is crucial for mitigating the impact of XRP regulatory uncertainty.

- Risk management strategies: Diversification of investment portfolios and thorough due diligence are essential strategies for mitigating these risks. This proactive approach is crucial in the face of XRP regulatory uncertainty.

- Staying informed: Keeping abreast of ongoing legal developments and potential regulatory changes is paramount. Staying informed about all aspects of XRP regulatory uncertainty is a key element of responsible investment.

- Alternative opportunities: Exploring alternative investment opportunities within the wider cryptocurrency market can provide diversification and reduce reliance on a single, uncertain asset like XRP.

The Broader Implications for the Crypto Market

The SEC v. Ripple case has broader implications for the entire cryptocurrency market.

- Increased scrutiny: The ruling has intensified regulatory scrutiny of other crypto projects, raising concerns about potential future legal challenges. This increased scrutiny is a widespread consequence of the XRP regulatory uncertainty.

- Potential for further legal battles: The case sets a precedent that could lead to more legal battles and regulatory actions targeting other digital assets. This potential for further legal action is a significant aspect of the ongoing XRP regulatory uncertainty.

- Need for clear regulatory frameworks: The case underscores the urgent need for clear and consistent regulatory frameworks for the cryptocurrency industry globally. This need for clarity is a direct response to the issues raised by XRP regulatory uncertainty.

Conclusion: Addressing XRP Regulatory Uncertainty for Informed Decision-Making

The SEC v. Ripple case has created significant XRP regulatory uncertainty, impacting investors differently. Understanding the risks associated with XRP investments is crucial for making informed decisions. Conduct thorough research and seek professional financial advice before investing in any cryptocurrency, particularly during times of high XRP regulatory uncertainty. Stay informed about XRP regulatory uncertainty and XRP investment strategies to navigate this evolving landscape effectively and make well-informed choices regarding your XRP holdings.

Featured Posts

-

China Urges Drug Makers And Hospitals To Replace Us Imports

May 01, 2025

China Urges Drug Makers And Hospitals To Replace Us Imports

May 01, 2025 -

Death Of A Dallas Star 80s Soap Opera Icon Passes Away

May 01, 2025

Death Of A Dallas Star 80s Soap Opera Icon Passes Away

May 01, 2025 -

Is Xrp A Good Investment A Detailed Analysis

May 01, 2025

Is Xrp A Good Investment A Detailed Analysis

May 01, 2025 -

Understanding Rare Seabirds The Work Of Te Ipukarea Society

May 01, 2025

Understanding Rare Seabirds The Work Of Te Ipukarea Society

May 01, 2025 -

Mqbwdh Kshmyr Agha Syd Rwh Allh Mhdy Ka Bhart Ke Khlaf Shdyd Ahtjaj

May 01, 2025

Mqbwdh Kshmyr Agha Syd Rwh Allh Mhdy Ka Bhart Ke Khlaf Shdyd Ahtjaj

May 01, 2025

Latest Posts

-

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

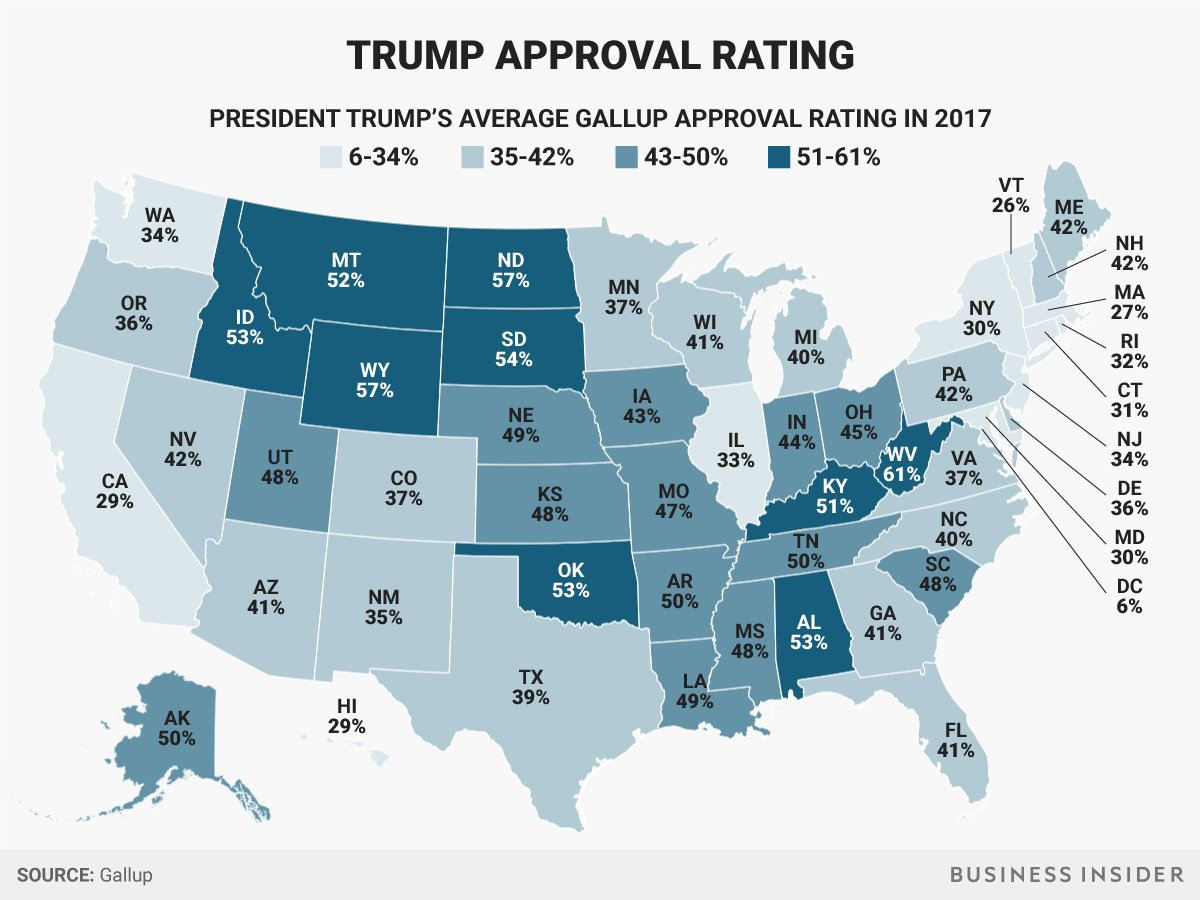

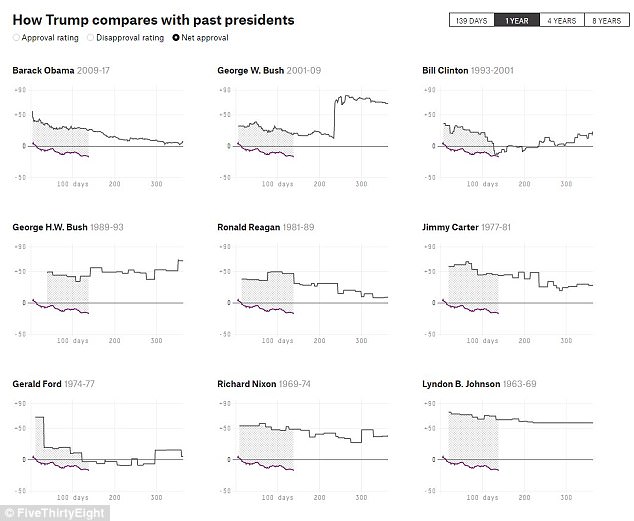

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025 -

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025