XRP Price Surge: Ripple SEC Case Update And ETF Possibilities

Table of Contents

Ripple vs. SEC Lawsuit Update

The legal battle between Ripple and the Securities and Exchange Commission (SEC) has been a major driver of XRP's price fluctuations. Understanding the case's progression is crucial to predicting future XRP price movements.

Recent Court Decisions and Their Impact on XRP Price

Several key rulings have significantly impacted market sentiment and the XRP price surge.

- Summary Judgment Ruling: The partial summary judgment ruling in July 2023, which stated that programmatic sales of XRP did not constitute securities, led to a significant increase in XRP's price. This positive development boosted investor confidence.

- Judge's Statements on Institutional Sales: Judge Analisa Torres's statements regarding the nature of XRP sales to institutional investors also influenced market perception, contributing to the XRP price surge.

- Impact on Investor Confidence: Positive rulings generally translate to increased investor confidence, leading to higher demand and a subsequent price increase. Conversely, negative rulings can trigger sell-offs and price drops. For example, following less favorable rulings, XRP saw price corrections of [insert percentage]% within [insert timeframe].

Legal experts, such as [mention relevant legal expert and their opinion], suggest that [quote their opinion on the impact of the rulings]. The ongoing legal process remains a significant factor affecting the XRP price surge.

Potential Outcomes and Their Implications for XRP

The Ripple vs. SEC case could conclude in several ways:

- Ripple Win: A complete victory for Ripple would likely trigger a substantial XRP price surge, potentially leading to wider adoption and increased institutional investment. Regulatory clarity would be a major catalyst.

- SEC Win: An SEC victory could result in a significant price drop and potential delisting from major exchanges, severely impacting XRP's value and accessibility.

- Settlement: A negotiated settlement could lead to a less dramatic price movement, depending on the terms of the agreement. This outcome might offer some regulatory clarity but could still lead to uncertainty.

The potential for delisting from exchanges is a significant risk. If the SEC prevails and labels XRP a security, many exchanges may be forced to delist it, reducing liquidity and potentially causing a sharp price decline.

The Growing Interest in XRP ETFs

The possibility of XRP ETFs is another significant factor influencing the XRP price surge.

What are XRP ETFs and Why are they Important?

XRP ETFs (Exchange-Traded Funds) are investment vehicles that would allow investors to trade XRP shares on major stock exchanges, just like they trade stocks.

- Benefits: ETFs offer diversification benefits, increased liquidity, and easier access for investors compared to directly purchasing XRP on cryptocurrency exchanges.

- Regulatory Hurdles: The SEC's approval is crucial for XRP ETFs. The ongoing regulatory uncertainty around cryptocurrencies presents significant hurdles.

- Comparison with other Crypto ETFs: The success or failure of other crypto ETFs, such as Bitcoin ETFs, will serve as a precedent and indicator for the potential approval of XRP ETFs. The regulatory landscape is evolving rapidly.

The Impact of SEC Decisions on ETF Applications

The outcome of the Ripple lawsuit will heavily influence the SEC's decision on XRP ETF applications.

- Influence on SEC's Decision: A Ripple victory would significantly increase the chances of XRP ETF approval, potentially accelerating the XRP price surge.

- Potential Timeline: An optimistic scenario suggests approval within [timeframe], while a pessimistic view anticipates a longer delay or potential rejection.

- Existing ETF Applications: [Mention any existing XRP ETF applications and their current status].

Potential Investors and Market Impact of XRP ETFs

The approval of XRP ETFs would attract a wider range of investors.

- Investor Types: Institutional investors, seeking diversification and regulatory compliance, are likely to invest heavily. Retail investors will also find it easier to access XRP.

- Increased Trading Volume and Market Capitalization: ETF approval would drastically increase trading volume and market capitalization, potentially driving a substantial XRP price surge.

- Impact on Volatility: While increased liquidity could reduce volatility in the long run, the initial impact could be highly volatile depending on market sentiment.

Technical Analysis and Price Prediction (Optional)

While technical analysis can provide insights, it's crucial to remember its limitations and avoid viewing it as definitive.

Chart Patterns and Support/Resistance Levels

Analyzing XRP price charts reveals key support and resistance levels, which can indicate potential price movements.

- Support/Resistance Levels: [Analyze recent price charts and identify key support and resistance levels. Include a chart if possible.]

- Technical Indicators: [Mention relevant technical indicators like moving averages and RSI, explaining how they inform the analysis.]

Short-Term and Long-Term Price Predictions (with caveats)

Based on the aforementioned analysis, [offer cautious and well-supported predictions for short-term and long-term price movements. Clearly state assumptions and limitations]. These are not financial advice.

Conclusion

The XRP price surge is intricately linked to the ongoing Ripple vs. SEC lawsuit and the potential for XRP ETF approvals. Positive developments in the lawsuit and increased regulatory clarity greatly enhance the likelihood of XRP ETF approval, potentially leading to a sustained price increase. However, the inherent volatility of the cryptocurrency market necessitates careful consideration and risk assessment.

Call to Action: Stay informed about the ongoing Ripple vs. SEC lawsuit and the potential for XRP ETF approvals. Monitor the XRP price surge closely and make informed decisions based on your own risk tolerance. Further research into XRP and the evolving regulatory landscape is highly recommended before investing in this volatile market. Learn more about the XRP price surge and its potential future.

Featured Posts

-

Six Nations Review Frances Win And The Emerging Lions Squad

May 02, 2025

Six Nations Review Frances Win And The Emerging Lions Squad

May 02, 2025 -

Frances Rugby Dominance A Masterclass By Dupont

May 02, 2025

Frances Rugby Dominance A Masterclass By Dupont

May 02, 2025 -

Lotto Plus Results Winning Numbers For Lotto Lotto Plus 1 And 2

May 02, 2025

Lotto Plus Results Winning Numbers For Lotto Lotto Plus 1 And 2

May 02, 2025 -

Michael Sheen Donates 100 000 To Clear 1 Million Debt For 900 People

May 02, 2025

Michael Sheen Donates 100 000 To Clear 1 Million Debt For 900 People

May 02, 2025 -

Play Station Beta Program Eligibility And How To Register With Sony

May 02, 2025

Play Station Beta Program Eligibility And How To Register With Sony

May 02, 2025

Latest Posts

-

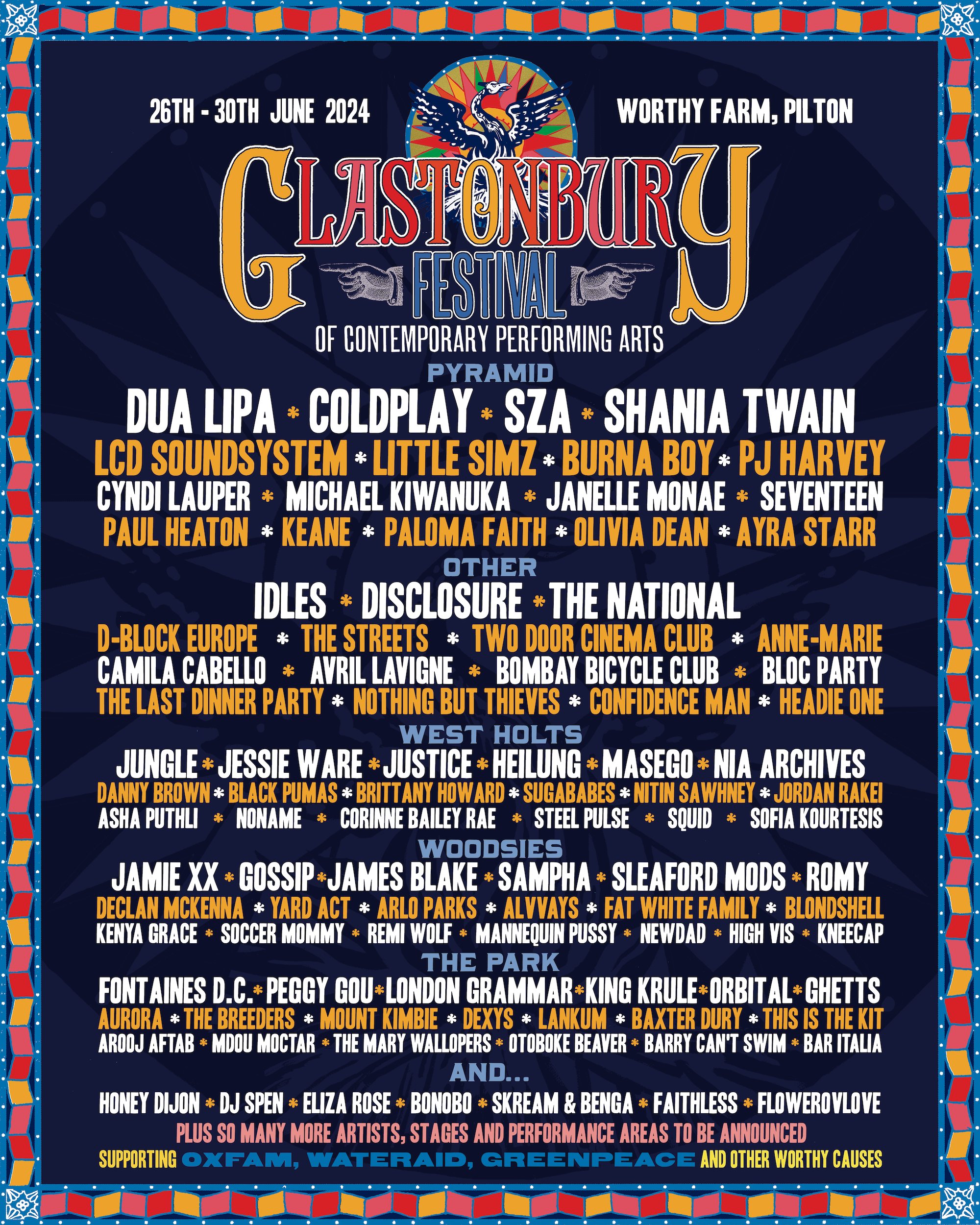

Glastonbury Headliners 2024 Potential Lineup Featuring The 1975 And Olivia Rodrigo

May 02, 2025

Glastonbury Headliners 2024 Potential Lineup Featuring The 1975 And Olivia Rodrigo

May 02, 2025 -

The 1975 And Olivia Rodrigo Glastonbury 2024 Headliner Speculation

May 02, 2025

The 1975 And Olivia Rodrigo Glastonbury 2024 Headliner Speculation

May 02, 2025 -

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025 -

Last Chance For Glastonbury 2025 Tickets Resale Tickets On Sale

May 02, 2025

Last Chance For Glastonbury 2025 Tickets Resale Tickets On Sale

May 02, 2025 -

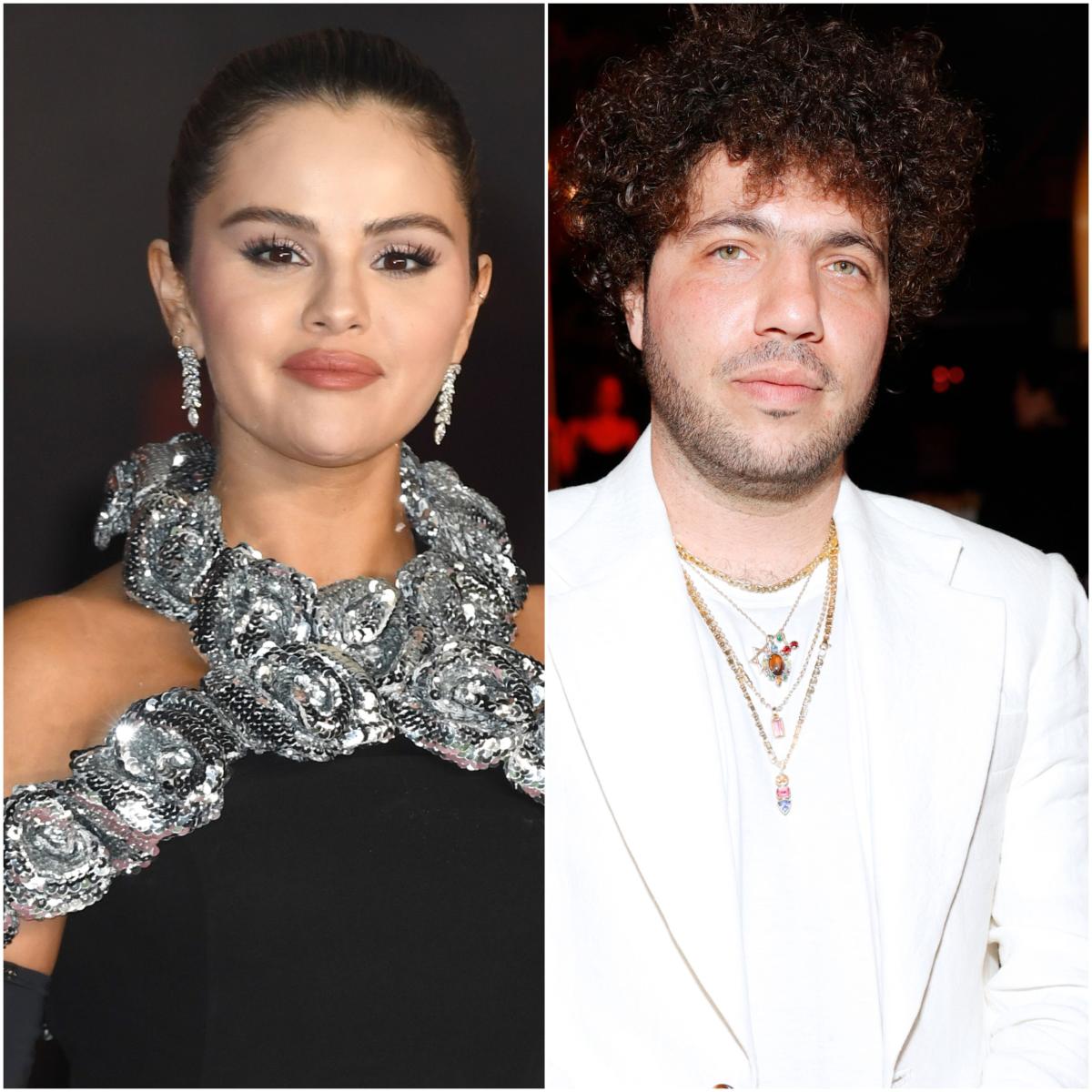

Selena Gomezs Sophisticated High Waisted Suit A Retro Workplace Inspiration

May 02, 2025

Selena Gomezs Sophisticated High Waisted Suit A Retro Workplace Inspiration

May 02, 2025