XRP Price Prediction: Will XRP Hold $2 Support? Reversal Or Fakeout?

Table of Contents

Current Market Analysis: Assessing XRP's Position

To accurately predict XRP's future price, we need to thoroughly analyze its current standing. This involves examining both technical indicators and fundamental factors, along with the impact of broader macroeconomic conditions.

H2: Technical Analysis of XRP's Chart:

Technical analysis provides valuable insights into price trends. Let's look at some key indicators:

-

Moving Averages: The 50-day and 200-day moving averages are crucial indicators. A bullish crossover (50-day crossing above the 200-day) could signal a potential uptrend. Conversely, a bearish crossover could suggest further downward pressure. Currently, [insert current status of moving averages and interpretation - e.g., "the 50-day MA is below the 200-day MA, indicating a bearish trend"]. Analyzing these trends in conjunction with the price action around the $2 support level is crucial for our XRP price prediction. Keywords: XRP technical analysis, XRP chart, moving averages, RSI, MACD, support resistance.

-

RSI (Relative Strength Index): The RSI helps determine whether XRP is overbought or oversold. An RSI above 70 often suggests overbought conditions, while below 30 indicates oversold conditions. [Insert current RSI value and interpretation – e.g., "The current RSI of [value] suggests [overbought/oversold/neutral] conditions."]

-

MACD (Moving Average Convergence Divergence): The MACD is a momentum indicator that can signal trend changes. A bullish crossover (MACD line crossing above the signal line) suggests bullish momentum, while a bearish crossover signals bearish momentum. [Insert current MACD status and interpretation].

-

Support and Resistance Levels: The $2 mark represents a significant support level for XRP. A break below this level could trigger a further price decline. However, a strong bounce off this level could signify a potential reversal. [Include a chart visualizing these levels and recent price action].

H2: Fundamental Analysis of Ripple and XRP:

Beyond technical indicators, the fundamentals of Ripple and XRP play a vital role.

-

Ripple News and Developments: Recent legal battles, partnerships, and technological advancements significantly impact investor sentiment and, consequently, XRP's price. Positive news, such as successful legal outcomes or strategic partnerships, could boost XRP's price. Conversely, negative news could lead to a price decline. [Discuss specific recent news and its potential impact – e.g., "The ongoing legal battle with the SEC continues to be a major factor influencing investor sentiment. A positive resolution could trigger a significant price surge."] Keywords: Ripple news, XRP fundamentals, Ripple lawsuit, XRP adoption, investor sentiment.

-

XRP Adoption: Increased adoption by businesses and institutions is crucial for long-term price appreciation. Monitoring the growth of XRP's use cases is essential for a comprehensive XRP price prediction.

H2: Macroeconomic Factors Affecting XRP:

The broader cryptocurrency market and global macroeconomic conditions also influence XRP's price.

-

Bitcoin Price: Bitcoin often acts as a bellwether for the entire crypto market. A significant Bitcoin price increase can positively influence altcoins like XRP, while a Bitcoin price decline can trigger a sell-off. [Mention the current Bitcoin price and correlation with XRP]. Keywords: Bitcoin price, cryptocurrency market, crypto regulation, market sentiment, altcoin market.

-

Regulatory Developments: Government regulations significantly impact the cryptocurrency market. Positive regulatory developments can boost investor confidence, while negative news can trigger uncertainty and price declines.

XRP Price Prediction Scenarios: Reversal or Fakeout?

Based on our analysis, several scenarios are possible regarding XRP's future price movement around the $2 support.

H2: Bullish Scenario: $2 Holds as Support, Price Reversal:

If the $2 support holds, and we see positive developments on the fundamental side (e.g., a favorable outcome in the Ripple lawsuit), a bullish reversal is possible.

- Conditions for Reversal: A strong bounce off the $2 support, coupled with a bullish crossover of moving averages and positive RSI/MACD signals, would suggest a potential reversal.

- Potential Price Targets: A successful reversal could see XRP reach [insert potential price targets, justifying them with technical analysis]. Keywords: XRP price reversal, bullish XRP, XRP price target.

H2: Bearish Scenario: $2 Support Breaks, Further Decline:

If the $2 support breaks, it could trigger a cascade of sell-offs, leading to a further price decline.

- Factors Leading to Breakdown: Negative news surrounding Ripple, a broader cryptocurrency market downturn, or continued bearish technical signals could contribute to a support break.

- Potential Price Targets: A breakdown below $2 could see XRP decline to [insert potential price targets and rationale]. Keywords: XRP price decline, bearish XRP, XRP support break.

H2: Neutral Scenario: Consolidation and Sideways Trading:

Before a clear trend emerges, XRP might experience a period of consolidation and sideways trading.

- Factors Contributing to Consolidation: Uncertainty surrounding the Ripple lawsuit, a lack of significant bullish or bearish catalysts, or simply a period of market indecision could lead to sideways movement.

- XRP Price Range: The price could fluctuate within a specific range before breaking out in either direction. Keywords: XRP price consolidation, sideways trading, XRP price range.

Conclusion: Will XRP Hold $2? Your Next Steps

Our analysis suggests that the fate of the $2 support level for XRP is uncertain. A bullish reversal is possible if the support holds, positive news emerges, and technical indicators turn bullish. Conversely, a break below $2 could trigger a further decline. A period of consolidation is also a distinct possibility. Remember that this is an analysis and not financial advice. Thorough research and understanding of your own risk tolerance are crucial before making any investment decisions. Share your own XRP price predictions in the comments below and continue following our updates for further analysis on the $2 support level and future XRP price predictions. Keywords: XRP price prediction, XRP analysis, Ripple, $2 support, cryptocurrency investment.

Featured Posts

-

Chicago United Center Fans New 5 Uber Shuttle Service Available

May 08, 2025

Chicago United Center Fans New 5 Uber Shuttle Service Available

May 08, 2025 -

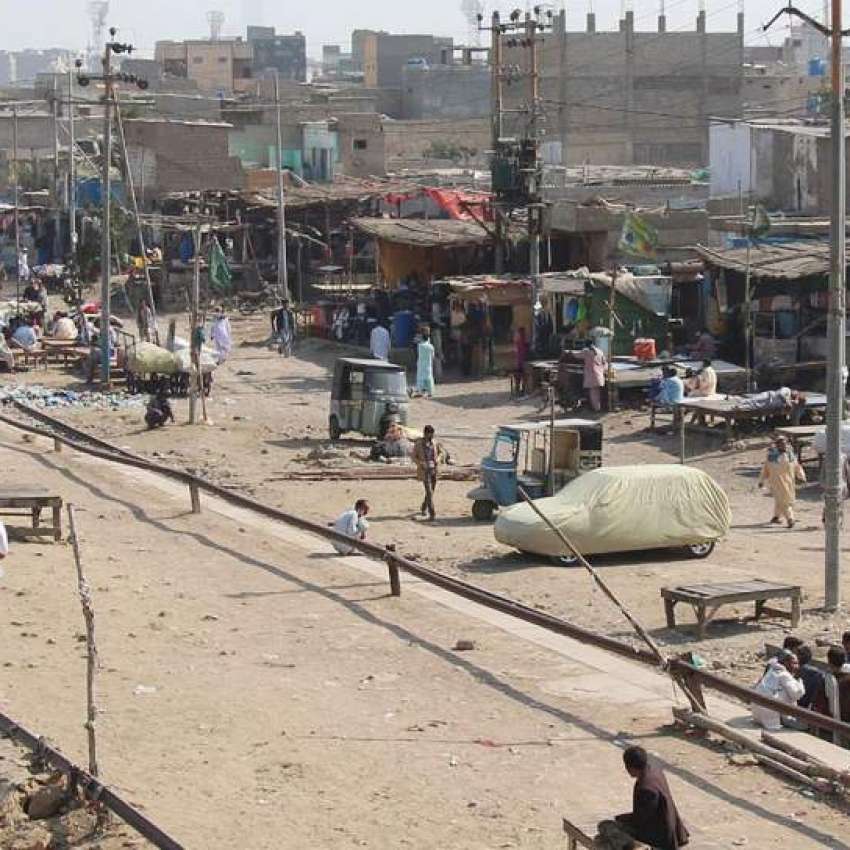

Krachy Ke Bed Lahwr Myn Bhy Py Ays Ayl Trafy Ka Dwrh

May 08, 2025

Krachy Ke Bed Lahwr Myn Bhy Py Ays Ayl Trafy Ka Dwrh

May 08, 2025 -

Liga De Quito Vs Flamengo Analisis Del Empate En La Libertadores

May 08, 2025

Liga De Quito Vs Flamengo Analisis Del Empate En La Libertadores

May 08, 2025 -

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025 -

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025