XRP Price Prediction: Analyzing The Post-SEC Lawsuit Market Outlook

Table of Contents

The Impact of the SEC Lawsuit on XRP's Price

The SEC lawsuit against Ripple, filed in December 2020, sent shockwaves through the XRP market. The initial announcement triggered a significant price drop, wiping out a considerable portion of XRP's value. The subsequent period was characterized by intense price fluctuations, reflecting the ever-changing market sentiment surrounding the legal battle.

- Key Events Affecting Price: The lawsuit's various stages, including court filings, expert testimony, and procedural rulings, all significantly impacted XRP's price. Positive developments often led to price rallies, while setbacks resulted in dips.

- Media Coverage and Investor Sentiment: Negative media portrayals exacerbated the price declines, while positive news and legal victories fueled price increases. Investor confidence played a crucial role, with fear and uncertainty driving sell-offs and hope driving buying pressure.

- Impact on Trading Volume and Liquidity: The lawsuit period saw significant fluctuations in trading volume. During periods of high uncertainty, volume often increased as investors reacted to news and court developments. Liquidity also experienced variations, sometimes becoming less accessible due to increased volatility.

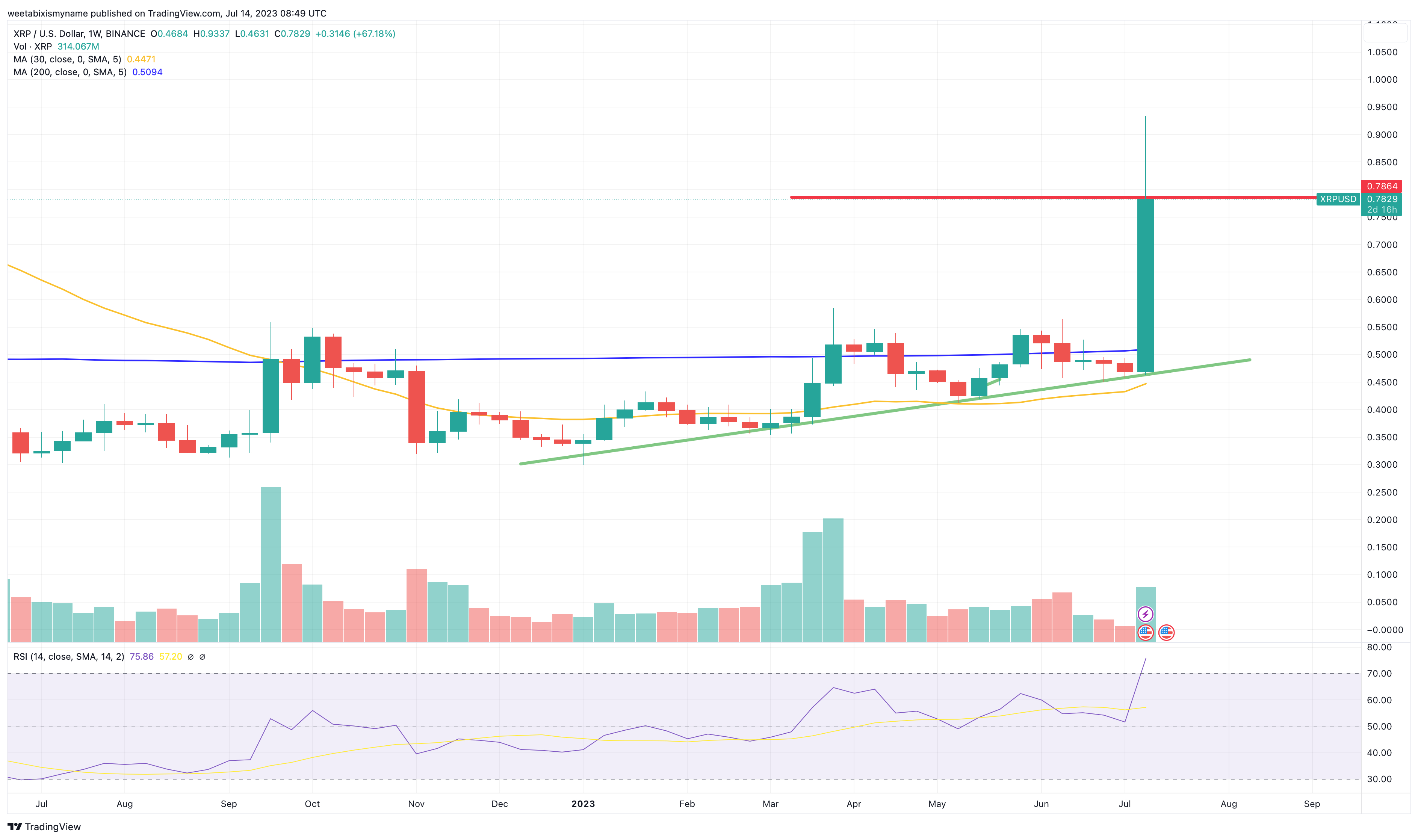

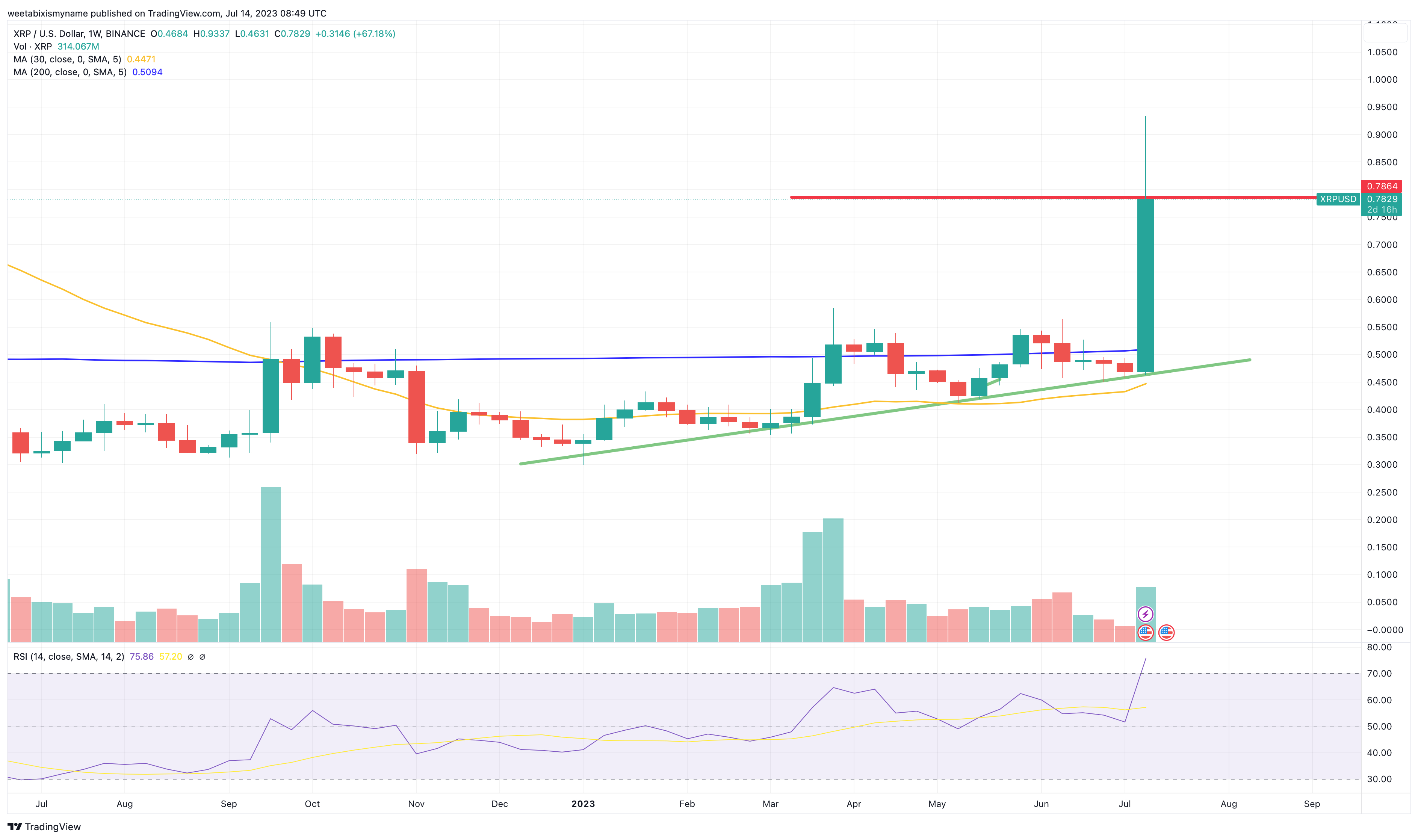

Technical Analysis of XRP's Chart

Technical analysis provides valuable insights into potential future price movements by studying historical price data and chart patterns. This approach is crucial for forming an informed XRP price prediction. Analyzing indicators like moving averages, support and resistance levels, and chart patterns can reveal potential trends and predict future price action.

- Key Indicators: Moving averages (e.g., 50-day, 200-day) help identify trends. Support and resistance levels indicate price zones where buying and selling pressure are expected to be strong. Chart patterns (e.g., head and shoulders, triangles) can signal potential price reversals or breakouts.

- Chart Examples: (Ideally, this section would include relevant charts illustrating key technical indicators and patterns. Due to the limitations of this text-based format, visual examples are omitted. However, readers are encouraged to conduct their own chart analysis using reputable trading platforms.)

- Potential Breakout Points and Price Targets: Based on technical analysis, certain price points can be identified as potential breakout points. Reaching these levels could indicate significant price movements, either upward or downward. Technical analysis can offer potential price targets based on these breakouts.

Fundamental Analysis of XRP and Ripple

Fundamental analysis focuses on the underlying value of an asset, which is crucial for forming a long-term XRP price prediction. This involves examining Ripple's business model, partnerships, technology advancements, and overall adoption rate.

- Key Partnerships: Ripple's partnerships with financial institutions worldwide are a significant driver of XRP's value. Increased adoption by banks and payment processors boosts XRP's utility and potential for future growth.

- Technological Advancements: Ripple's continuous development of its technology, including its involvement in Central Bank Digital Currency (CBDC) projects, strengthens XRP's long-term prospects. Innovations improve efficiency and scalability, potentially attracting more users and institutions.

- Growth of the XRP Ecosystem: The expansion of the XRP ecosystem, including the development of new applications and services built on the XRP Ledger, signals a growing demand for XRP. This growth can positively impact XRP’s price.

Market Sentiment and Future Regulatory Clarity

The overall cryptocurrency market significantly influences XRP's price. A bullish Bitcoin market often leads to positive sentiment towards altcoins like XRP, while a bearish market can have the opposite effect. Furthermore, future regulatory decisions will significantly shape XRP's price outlook.

- Potential Regulatory Outcomes: Positive regulatory developments, such as clear guidelines on cryptocurrency classification, could boost investor confidence and lead to higher prices. Conversely, negative regulations could lead to price declines.

- Impact on Investor Confidence: Regulatory clarity is crucial for attracting institutional investors. A clear regulatory framework would likely reduce risk perception and attract significant capital inflow, potentially driving up XRP’s price.

- Increased Institutional Adoption: Increased regulatory clarity often paves the way for institutional adoption. Large financial institutions are more likely to invest in assets with clear regulatory frameworks, which could significantly impact XRP’s price.

Considering the Ripple vs. SEC Verdict

The outcome of the Ripple vs. SEC lawsuit was a landmark event. A favorable ruling significantly boosted investor confidence, leading to a substantial price increase. Conversely, an unfavorable ruling could have resulted in prolonged price depression.

- Different Possible Scenarios and Impacts: Analyzing different scenarios – a partial win, a complete win for Ripple, or a complete loss – helps understand the potential range of price reactions.

- Market Reaction to Each Scenario: Predicting the market's reaction requires considering various factors, including the overall market sentiment at the time of the ruling and how quickly investors react to the news.

- Importance of Informed Decision-Making: The Ripple vs. SEC verdict highlighted the importance of carefully considering the potential impacts of legal and regulatory developments before making investment decisions.

Conclusion

Analyzing XRP’s price requires considering technical and fundamental factors, as well as the impact of the SEC lawsuit and prevailing market sentiment. While predicting the future price of any cryptocurrency is inherently uncertain, a comprehensive analysis provides a more informed basis for investment decisions. Potential scenarios range from bullish to bearish, depending on various factors discussed above. Stay informed on the latest developments affecting the XRP price prediction and make smart, educated investment choices. Keep an eye on the XRP price outlook, the future of XRP, and ongoing XRP market analysis to stay ahead of the curve.

Featured Posts

-

8 000 Km A Velo L Aventure De Trois Jeunes Du Bocage Ornais

May 02, 2025

8 000 Km A Velo L Aventure De Trois Jeunes Du Bocage Ornais

May 02, 2025 -

The Impact Of Mental Health Policies On Employee Productivity

May 02, 2025

The Impact Of Mental Health Policies On Employee Productivity

May 02, 2025 -

Unexpectedly High Macau Gaming Revenue In Lead Up To Golden Week

May 02, 2025

Unexpectedly High Macau Gaming Revenue In Lead Up To Golden Week

May 02, 2025 -

Brtanwy Wzyr Aezm Kw Kshmyr Ke Bare Myn Ayk Drkhwast Mwswl Hwyy

May 02, 2025

Brtanwy Wzyr Aezm Kw Kshmyr Ke Bare Myn Ayk Drkhwast Mwswl Hwyy

May 02, 2025 -

Trump Supporter Ray Epps Defamation Case Against Fox News The January 6th Controversy

May 02, 2025

Trump Supporter Ray Epps Defamation Case Against Fox News The January 6th Controversy

May 02, 2025

Latest Posts

-

Fortnites Wwe Collaboration How To Obtain Cody Rhodes And The Undertaker Skins

May 02, 2025

Fortnites Wwe Collaboration How To Obtain Cody Rhodes And The Undertaker Skins

May 02, 2025 -

Get Cody Rhodes And The Undertaker Fortnite Skins A Complete Guide

May 02, 2025

Get Cody Rhodes And The Undertaker Fortnite Skins A Complete Guide

May 02, 2025 -

Fortnite Tmnt Skins How To Get Every Teenage Mutant Ninja Turtle Outfit

May 02, 2025

Fortnite Tmnt Skins How To Get Every Teenage Mutant Ninja Turtle Outfit

May 02, 2025 -

The Return Of Iconic Fortnite Skins A 1000 Day Item Shop Event

May 02, 2025

The Return Of Iconic Fortnite Skins A 1000 Day Item Shop Event

May 02, 2025 -

Fortnite Wwe Skins Unlocking Cody Rhodes And The Undertaker

May 02, 2025

Fortnite Wwe Skins Unlocking Cody Rhodes And The Undertaker

May 02, 2025